SUPPLY

CHAIN Ryan Kilcullen

24 September 2014

Exhibit 99.6 |

SUPPLY

CHAIN Ryan Kilcullen

24 September 2014

Exhibit 99.6 |

DISCLAIMER

2

This Management Presentation contains forward-looking statements. James Hardie may from time to

time make forward-looking statements in its periodic reports filed with or furnished to the

SEC, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written

materials and in oral statements made by the company’s officers, directors or employees to

analysts, institutional investors, existing and potential lenders, representatives of the media

and others. Statements that are not historical facts are forward-looking statements and such

forward-looking statements are statements made pursuant to the Safe Harbor Provisions of

the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include: •

statements about the company’s future performance; •

projections of the company’s results of operations or financial condition; •

statements regarding the company’s plans, objectives or goals, including those relating to

strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•

expectations concerning the costs associated with the suspension or closure of operations at any of

the company’s plants and future plans with respect to any such plants;

•

expectations concerning the costs associated with the significant capital expenditure projects at any

of the company’s plants and future plans with respect to any such projects; •

expectations regarding the extension or renewal of the company’s credit facilities including

changes to terms, covenants or ratios;

•

expectations concerning dividend payments and share buy-backs; •

statements concerning the company’s corporate and tax domiciles and structures and potential

changes to them, including potential tax charges;

•

statements regarding tax liabilities and related audits, reviews and proceedings; •

statements regarding the possible consequences and/or potential outcome of the legal proceedings

brought against two of the company’s subsidiaries by the New Zealand Ministry of Education

and the potential product liabilities, if any, associated with such proceedings;

•

expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund

(AICF), a special purpose fund for the compensation of proven Australian asbestos-related

personal injury and death claims;

•

expectations concerning indemnification obligations; •

expectations concerning the adequacy of the company’s warranty provisions and estimates for

future warranty-related costs;

•

statements regarding the company’s ability to manage legal and regulatory matters (including but

not limited to product liability, environmental, intellectual property and competition law

matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and

•

statements about economic conditions, such as changes in the US economic or housing recovery or

changes in the market conditions in the Asia Pacific region, the levels of new home

construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and

other financing, mortgage and other interest rates, housing affordability and supply, the levels of

foreclosures and home resales, currency exchange rates, and builder and consumer confidence. |

3

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,”

“may,” “objective,” “outlook” and similar expressions are

intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned

not to place undue reliance on these forward-looking statements and all such forward-looking

statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on the company’s current expectations, estimates and

assumptions and because forward-looking statements address future results, events and

conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are

unforeseeable and beyond the company’s control. Such known and unknown risks,

uncertainties and other factors may cause actual results, performance or other achievements to differ

materially from the anticipated results, performance or achievements expressed, projected or

implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and

Exchange Commission on 26 June 2014, include, but are not limited to: all matters relating to or

arising out of the prior manufacture of products that contained asbestos by current and former

James Hardie subsidiaries; required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the company’s

financial statements as an asbestos liability; governmental loan facility to AICF; compliance with and

changes in tax laws and treatments; competition and product pricing in the markets in which the

company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal

proceedings; general economic and market conditions; the supply and cost of raw materials; possible

increases in competition and the potential that competitors could copy the company’s

products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of

conducting business internationally; compliance with and changes in laws and regulations; the effect

of the transfer of the company’s corporate domicile from The Netherlands to Ireland,

including changes in corporate governance and any potential tax benefits related thereto; currency exchange risks; dependence on customer preference and the concentration

of the company’s customer base on large format retail customers, distributors and dealers;

dependence on residential and commercial construction markets; the effect of adverse changes in

climate or weather patterns; possible inability to renew credit facilities on terms favourable to the company, or at all; acquisition or sale of businesses and business

segments; changes in the company’s key management personnel; inherent limitations on internal

controls; use of accounting estimates; and all other risks identified in the company’s

reports filed with Australian, Irish and US securities agencies and exchanges (as appropriate). The

company cautions you that the foregoing list of factors is not exhaustive and that other risks

and uncertainties may cause actual results to differ materially from those referenced in the company’s forward-looking statements. Forward-looking statements speak only

as of the date they are made and are statements of the company’s current expectations concerning

future results, events and conditions. The company assumes no obligation to update any

forward-looking statements or information except as required by law. |

•

Supply Chain at JH

•

Network Expansion Impact

•

Customer Focus

•

Freight Market and JH Performance

AGENDA

4 |

JH

SUPPLY CHAIN OVERVIEW 5 |

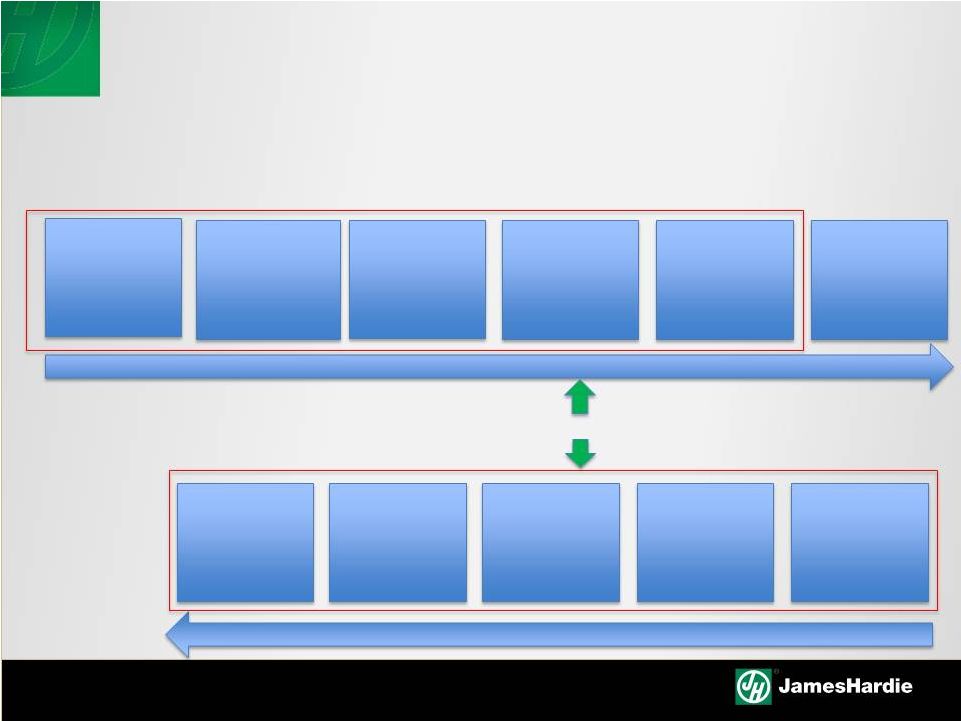

JH

SUPPLY CHAIN Raw Material

Suppliers

Manufacturing

Scheduling

Outbound

Freight

Channel

Management

Warehousing

Jobsite

Delivery

Raw Material

Requirements

Inventory

Strategy

Capacity

Planning

Production

Scheduling

Demand

Forecasting

Managing the three flows: Product, Information and Cash Flow

Product Flow

Information Flow

JH Supply Chain Organization

6 |

JH

SUPPLY CHAIN OBJECTIVES JH Supply Chain has two primary objectives

1.

Customer value creation

2.

Operational and financial efficiency

We accomplish by

•

Leveraging our network scope and operating capability

to enhance the profitability and experience of our

customers

•

Deploying optimization concepts and tactics to

maximize financial returns to JH

7 |

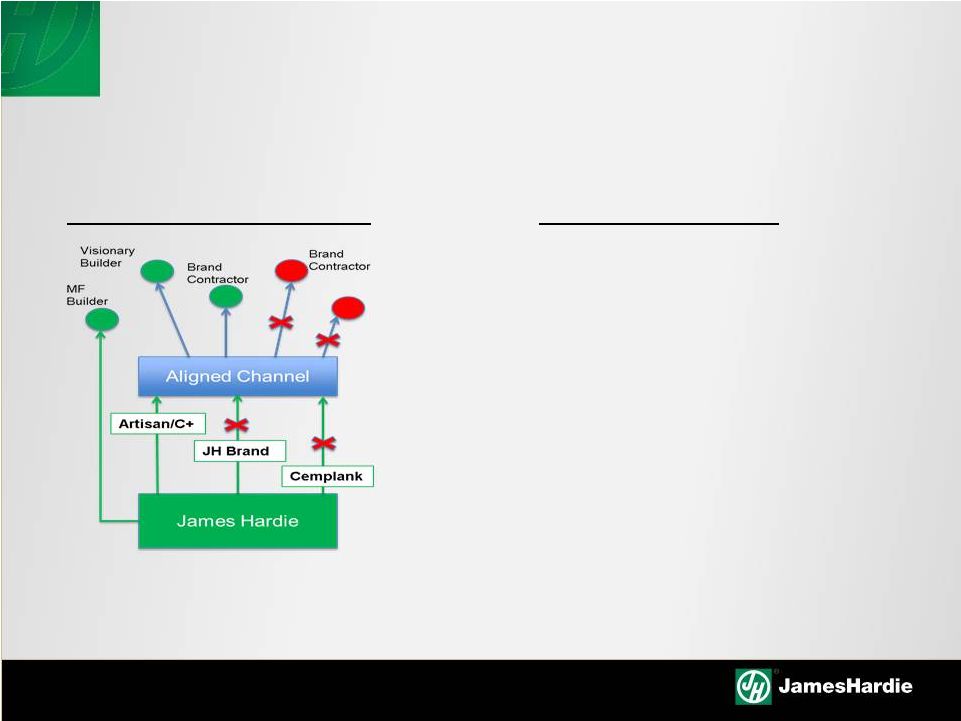

EXAMPLE 1: VMIS

VMIs increase the profitability of our channel partners

VMIs are a critical element of our overall business strategy

8

Optimizing JH Returns

Customer Value Creation

Lower freight costs

-

Weight max, ideal sourcing, lead time

Order volatility is greatly reduced

Increase in C+ penetration

Enables scale for jobpack LTLs

Significant reduction in working capital

Wider SKU offering

Reduced

order

processing

costs

–

JH

does

all replenishment activities

Ability to place LTL special orders |

EXAMPLE 2: JOBPACKS

Customer Value Creation

•

To-the-piece ordering capability reduces

jobsite waste and returns cost

•

Made-to-order at standard lead-times

eliminates the need for inventory

•

Access to the full JH line enables selling

the whole house

The efficiency of our jobpack supply chain enables a competitive

advantage by delivering “the tail”

at an unmatched cost-to-service

Jobpacks enable full wrap ColorPlus through an efficient supply chain

Optimizing JH Returns

•

HardieLink enables efficient order flow

•

APO scheduling creates efficient

manufacturing sequencing and changeovers

•

Manugistics

TMS optimizes multi-stop routing

& leverages VMI volume scale

9 |

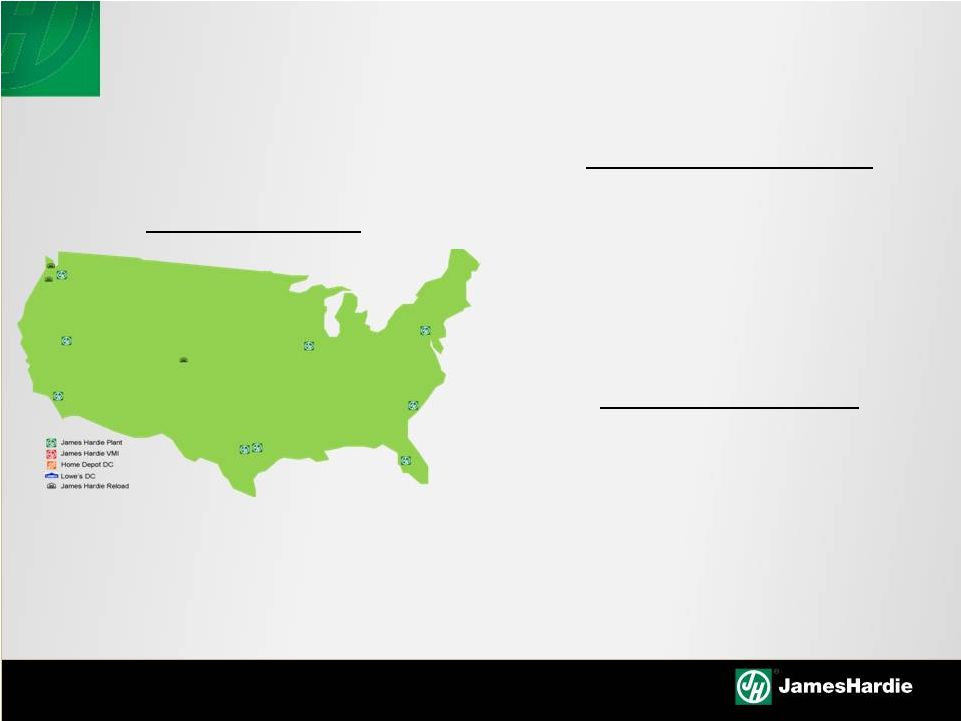

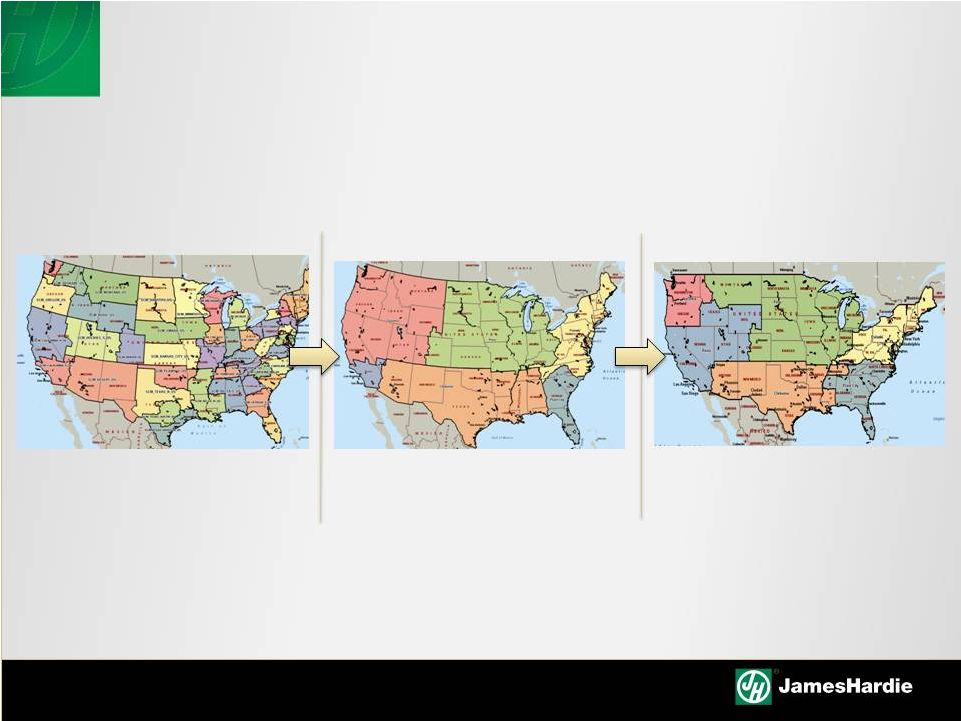

JH

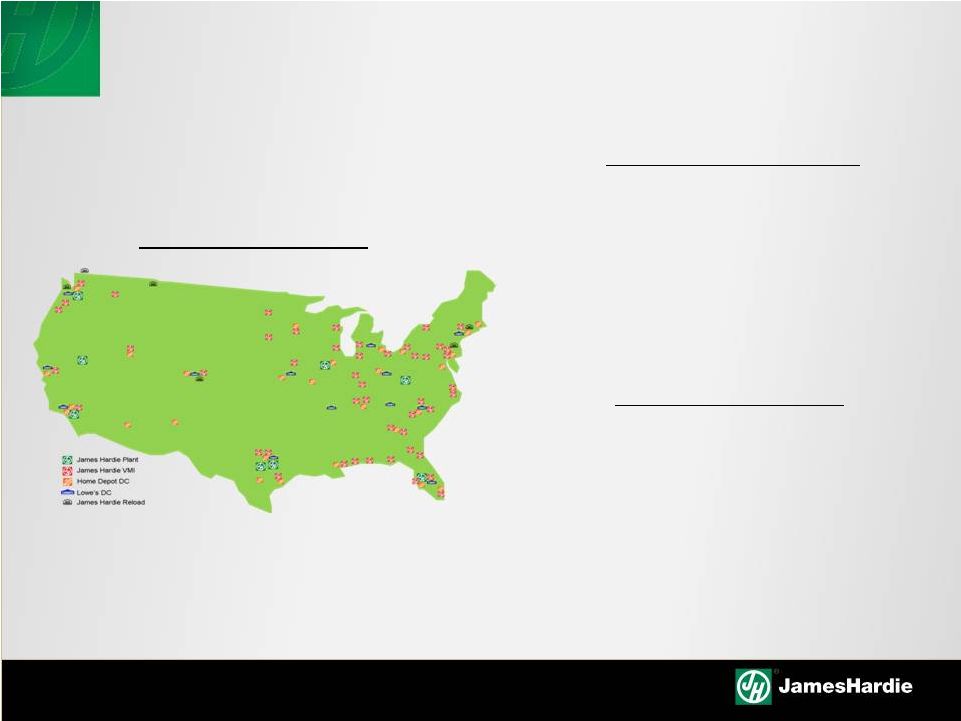

NETWORK EVOLUTION JH Network –

FY05

Customer Value Creation

Optimizing JH Returns

10

•

Limited non-product value creation in JH

supply Chain

•

Product mixing rules force complexity

onto our customer base

•

Production scheduling is focused on

enabling flat sheet PcI/PdI

•

Freight model is optimized for full

truckload purchasing performance |

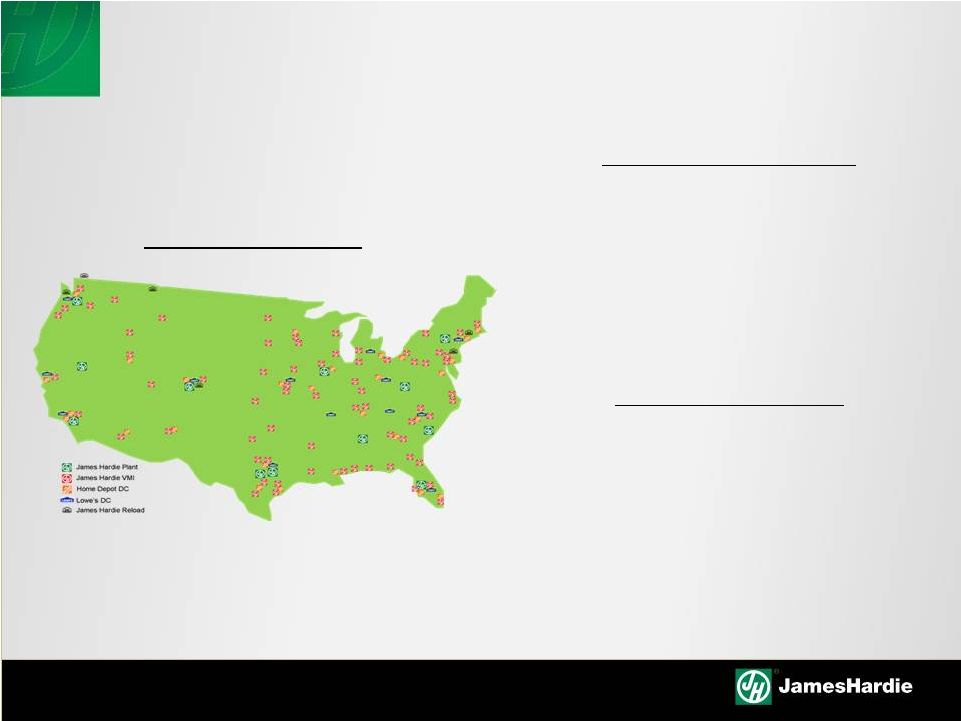

JH

NETWORK EVOLUTION JH Network –

Today

Optimizing JH Returns

Customer Value Creation

11

•

Network density enables flexible ordering

rules to mix full range of products

•

VMIs and jobpacks create profitable options

for servicing all builder types

•

Focus is on internal JH optimization of

production scheduling and freight routing

•

Expanded scope of JH network enables

significant reduction of average truck haul |

JH

NETWORK EVOLUTION JH Network –

35/90

Customer Value Creation

Optimizing JH Returns

12

•

Customer-focused value chain makes JH

an easy-to-work with Business Partner •

Deeper understanding of non-product value

enhances customer profitability

•

Integrated supply chain (raw materials to

market) enables true optimization

•

Efficiency focus is on inbound/outbound

opportunities and deep customer

partnerships

|

CHALLENGES OF INCREASING NETWORK SCALE

A growing network also brings supply chain challenges

Capturing the full benefit of scale requires:

1.

A step change in organizational capability

2.

Optimization logic in our daily supply chain operations

13 |

ORGANIZATIONAL CAPABILITY

5 Pillar Strategy

Recruit

Engage

Develop

Evaluate

Grow/Promote

Attract, develop and retain supply chain talent that

can manage the challenges of our 35/90 network

External

Technical

Expertise

Leverage the

Chicago MBA

Program

Customer

Operations as

a Pipeline

Quality

Performance

Management

In-Role Career

Progression

Mapping

Manufacturing

Experience

Assignment

Pilot

APICS

Technical

Development

Program

PG&D Goal

Setting and

Progress

Tracking

14

Connection to

the Business

Speaker Series

JHMT Lunch

events

Early-Career

“Next Steps”

Events |

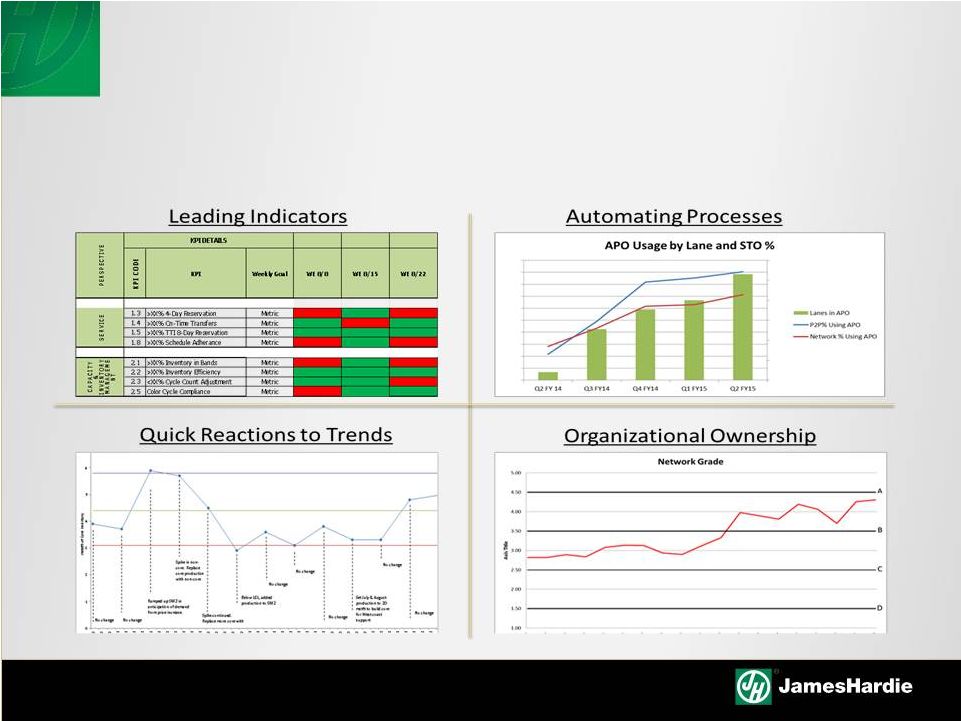

PROCESS CAPABILITY

Capturing the opportunities of a highly integrated network

requires enhanced operating capabilities

Order Flow

Planning Processes

Freight Management

•

Integration with

customer ERPs

•

HardieLink

•

VMI Transaction

Automation

•

Flat sheet

scheduling logic

•

APO deployment

•

Network landed

cost optimization

•

Multi-stop

optimization

•

Purchasing

model

enhancements

15 |

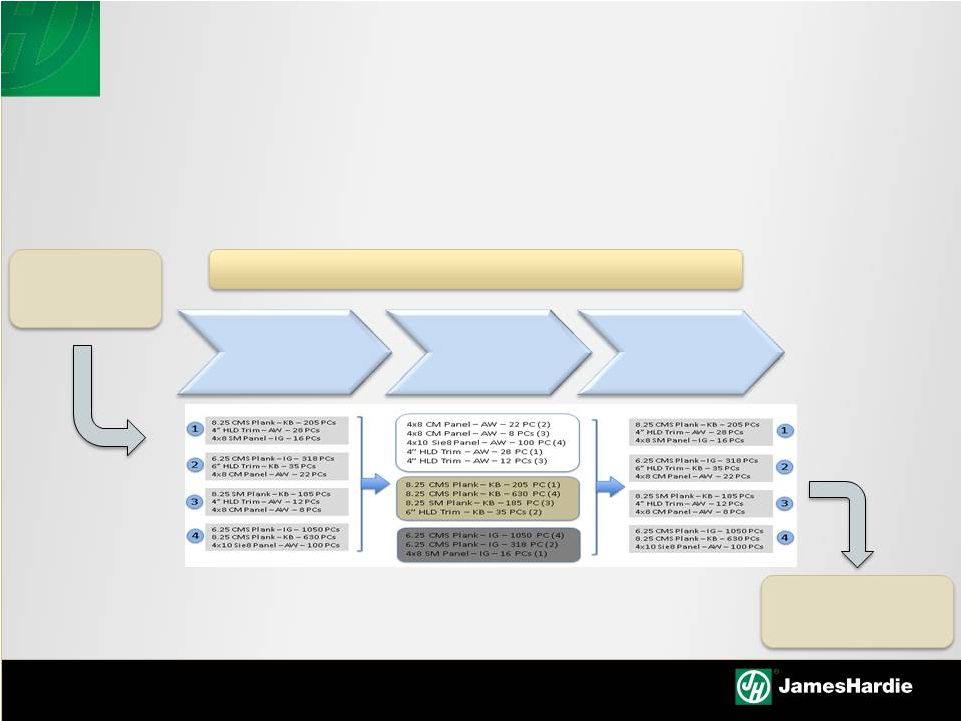

PROCESS ENHANCEMENT EXAMPLE

Automated order flow systems enable jobpack fulfillment with high

organizational, manufacturing and freight cost efficiency

Customer

orders with

multiple SKUs

& colors

Automated,

optimized

sequencing

Re-aggregated

orders, ready

for shipment

HardieLink

Order Entry

System

TMS Multi-Stop

Optimizer

APO Production Scheduling Optimization

16 |

CUSTOMER VALUE INITIATIVE:

ON-TIME SERVICE

17 |

THE

IMPORTANCE OF CONSISTENT SERVICE •

Secures market position

•

Enables us to capitalize on our sales force

investment

•

Maintains our brand

•

Reduces waste in our internal organization

–

allows us to invest in growth, rather than

maintenance of our existing base

Consistent on-time performance critical component of enabling 35/90

Importance to the Channel

Importance to Hardie

On-time service performance requires a systematic approach

to capacity management and day-to-day operational planning

18 |

ENSURING SUFFICIENT CAPACITY FOR DEMAND

Regional Sourcing Zones

Customer demand is grouped into

sourcing zones

Lowest Cost Sourcing

Manufacturing & freight costs

determine “ideal”

source plant

Introducing manufacturing

capacities shifts the model

Actual Network Sourcing

Constant network balancing ensures we have sufficient production

capacity to meet customer demand

Our objective is to fulfill every customer order at the lowest landed cost,

with a high level of on-time service

19 |

OPERATIONAL EXCELLENCE IN ORDER FULFILLMENT

A strong customer focus drives our daily replenishment activities

20 |

ON-TIME SERVICE SUMMARY

•

On-time service is an important component of JH Customer

Focus and has a direct link to 35/90

•

Our supply chain systems are designed for on-time service at

optimized total landed cost

•

Our recent performance has been strong –

the most recent 3

quarters are our highest service performance in the last 5 years

•

Consistent on-time service enables us to continue to pull buffers

out of our supply chain –

resulting in further cost reductions

21 |

MAXIMIZING JH RETURNS: MANAGING

THE RISING TRANSPORTATION MARKET

22 |

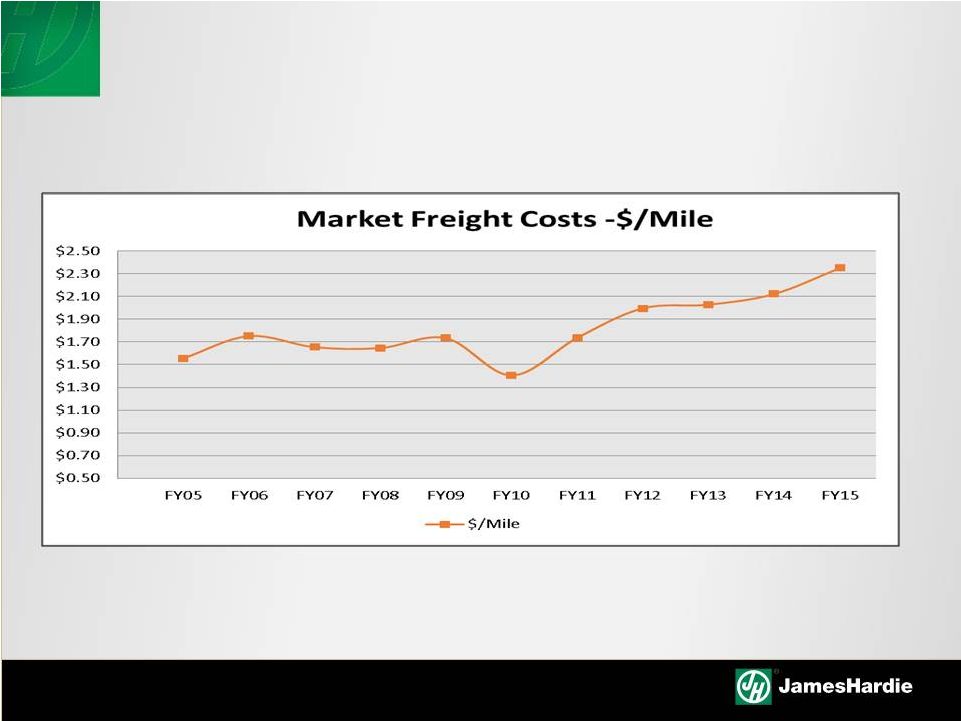

EXTERNAL TRANSPORTATION COST

Market rates* have rebounded dramatically from recession-levels

External factors are driving freight costs to historic highs

*Source: KeyBanc Capital Markets Truckload Spot Index

23 |

HEADWINDS IN THE FREIGHT MARKET

Fundamental shifts in the demand/supply equation driving cost

The result of this shift will be a higher cost market than historical reference

points –

We do not expect a return to pre-recession costs

Demand Drivers

Supply Constraints

Post-recession economic recovery

Increasingly congested rail system

Recent regulatory changes that

reduce driver capacity

Demographic shifts = an annual net

loss of drivers in the workforce

More difficult credit environment

limiting capacity investments

24

•

Aging infrastructure = less efficient

•

Growing US petro industry that is

becoming rail reliant |

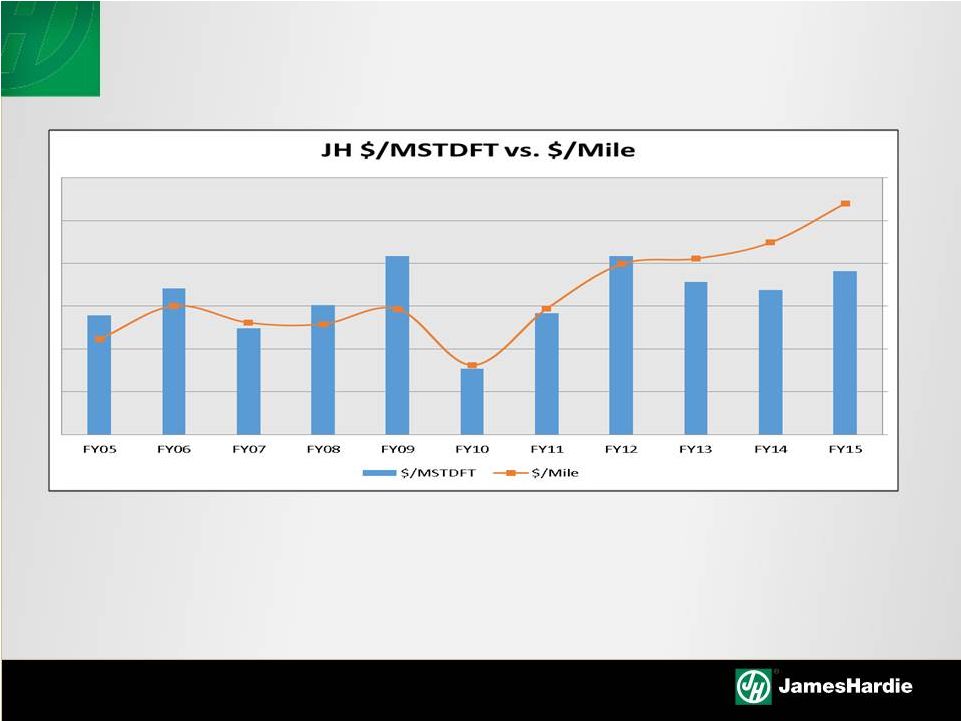

JH

NETWORK AND MARKET FREIGHT COSTS FY05

–

FY12

JH

freight

cost

trended

inline

with

market

rates

FY13

–

FY15

JH

freight

costs

separate

from

the

market

trend

as

a

result

of multiple initiatives to improve our network efficiency

25 |

PROGRESS DRIVING THE RECENT SEPARATION

Result

How

it

was

Achieved

14% reduction in average length

of truckload haul

5% more fiber cement on every

truckload shipped

7% improvement in purchasing

performance vs the market

•

Significantly higher utilization of rail

•

Plant-to-plant

and

ColorPlus®

product

network rail

•

VMI-enabled sourcing improvements

•

Automated LTL truckload building capability

•

VMI-enabled weight maximization program

•

Product weight logic optimization

•

26% increase in JHBP brokerage volume

•

Pick-up window increase by improved

planning

•

Targeted lane purchasing program

26 |

JH

TRANSPORTATION SUMMARY •

There are significant headwinds in the external freight

market

•

Network efficiencies have largely offset these costs

•

Our ability to continue to off-set this cost pressure will

become more reliant on closer partnerships with Customers

and Carriers

•

JH Supply Chain must continue its hard push to optimize

freight costs in our network

27 |

SUPPLY CHAIN SUMMARY

28 |

SUPPLY CHAIN SUMMARY

•

JH Supply Chain is focused on delivering customer value while

optimizing financial returns

•

Our expanding network enables us to maximize both of these

objectives –

while requiring improved organizational and process

capabilities

•

FY15 YTD we are delivering on our commitment of Customer

Focus

•

We expect strong headwinds in the freight market to continue,

and we are focused on offsetting the impact on JH financials

29 |

QUESTIONS |