INVESTOR PRESENTATION

OCTOBER 2014

Exhibit 99.1 |

INVESTOR PRESENTATION

OCTOBER 2014

Exhibit 99.1 |

PAGE

DISCLAIMER

2

This Management Presentation contains forward-looking statements. James Hardie may from time to

time make forward-looking statements in its periodic reports filed with or furnished to the

SEC, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in

media releases and other written materials and in oral statements made by the company’s officers,

directors or employees to analysts, institutional investors, existing and potential lenders,

representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-

looking statements are statements made pursuant to the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•

statements about the company’s future performance; •

projections of the company’s results of operations or financial condition; •

statements regarding the company’s plans, objectives or goals, including those relating to

strategies, initiatives, competition, acquisitions, dispositions and/or its products; •

expectations concerning the costs associated with the suspension or closure of operations at any of

the company’s plants and future plans with respect to any such plants; •

expectations concerning the costs associated with the significant capital expenditure projects at any

of the company’s plants and future plans with respect to any such projects; •

expectations regarding the extension or renewal of the company’s credit facilities including

changes to terms, covenants or ratios;

•

expectations concerning dividend payments and share buy-backs; •

statements concerning the company’s corporate and tax domiciles and structures and potential

changes to them, including potential tax charges;

•

statements regarding tax liabilities and related audits, reviews and proceedings; •

statements regarding the possible consequences and/or potential outcome of the legal proceedings

brought against two of the company’s subsidiaries by the New Zealand Ministry of Education

and the potential product liabilities, if any, associated with such proceedings;

•

expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund

(AICF), a special purpose fund for the compensation of proven Australian asbestos-related

personal injury and death claims;

•

expectations concerning indemnification obligations; •

expectations concerning the adequacy of the company’s warranty provisions and estimates for

future warranty-related costs;

•

statements regarding the company’s ability to manage legal and regulatory matters (including but

not limited to product liability, environmental, intellectual property and competition law

matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain

third-party recoveries; and

•

statements about economic conditions, such as changes in the US economic or housing recovery or

changes in the market conditions in the Asia Pacific region, the levels of new home

construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing

values, the availability of mortgages and other financing, mortgage and other interest rates, housing

affordability and supply, the levels of foreclosures and home resales, currency exchange rates,

and builder and consumer confidence. |

PAGE

DISCLAIMER (continued)

3

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,”

“may,” “objective,” “outlook” and similar expressions are

intended to identify forward-looking statements but are not the exclusive means of identifying such

statements. Readers are cautioned not to place undue reliance on these forward-looking statements

and all such forward-looking statements are qualified in their entirety by reference to the

following cautionary statements. Forward-looking statements are based on the company’s current expectations, estimates and

assumptions and because forward-looking statements address future results, events and

conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the company’s control.

Such known and unknown risks, uncertainties and other factors may cause actual results, performance or

other achievements to differ materially from the anticipated results, performance or

achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk

Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on

26 June 2014, include, but are not limited to: all matters relating to or arising out of the

prior manufacture of products that contained asbestos by current and former James Hardie subsidiaries; required contributions to AICF, any shortfall

in AICF and the effect of currency exchange rate movements on the amount recorded in the

company’s financial statements as an asbestos liability; governmental loan facility to

AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the company operates; the

consequences of product failures or defects; exposure to environmental, asbestos, putative consumer

class action or other legal proceedings; general economic and market conditions; the supply and

cost of raw materials; possible increases in competition and the potential that competitors could copy the company’s products;

reliance on a small number of customers; a customer’s inability to pay; compliance with and

changes in environmental and health and safety laws; risks of conducting business

internationally; compliance with and changes in laws and regulations; the effect of the transfer of the company’s corporate domicile from The Netherlands to

Ireland, including changes in corporate governance and any potential tax benefits related thereto;

currency exchange risks; dependence on customer preference and the concentration of the

company’s customer base on large format retail customers, distributors and dealers; dependence on residential and commercial construction

markets; the effect of adverse changes in climate or weather patterns; possible inability to renew

credit facilities on terms favourable to the company, or at all; acquisition or sale of

businesses and business segments; changes in the company’s key management personnel; inherent limitations on internal controls; use of

accounting estimates; and all other risks identified in the company’s reports filed with

Australian, Irish and US securities agencies and exchanges (as appropriate). The company

cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from

those referenced in the company’s forward-looking statements. Forward-looking statements

speak only as of the date they are made and are statements of the company’s current

expectations concerning future results, events and conditions. The company assumes no obligation to update any forward-looking statements or

information except as required by law.

|

PAGE

AGENDA

•

Global Strategy and Business Overview

•

USA & Europe Fiber Cement

•

Asia Pacific Fiber Cement

•

Capital Management Framework

•

Group Outlook and Guidance

•

Appendix

4

In this Management Presentation, James Hardie may present financial measures, sales volume terms,

financial ratios, and Non-US GAAP financial measures included in the Definitions section of

this document. The company presents financial measures that it believes are customarily used by its

Australian investors. Specifically, these financial measures, which are equivalent to or derived from

certain US GAAP measures as explained in the definitions, include “EBIT”, “EBIT

margin”, “Operating profit before income taxes” and “Net operating profit”. The company may also present other

terms for measuring its sales volume (“million square feet” or “mmsf” and

“thousand square feet” or “msf”); financial ratios (“Gearing ratio”, “Net

interest expense cover”, “Net interest paid cover”, “Net debt payback”,

“Net debt (cash)”); and Non-US GAAP financial measures (“Adjusted EBIT”,

“Adjusted EBIT margin”, “Adjusted net operating profit”, “Adjusted diluted

earnings per share”, “Adjusted operating profit before income taxes”,

“Adjusted effective tax rate on earnings”, “Adjusted EBITDA”, and “Adjusted

selling, general and administrative expenses”. Unless otherwise stated, results and

comparisons are of the first quarter of the current fiscal year versus the first quarter of the prior fiscal year. |

PAGE

Industry Leadership and Profitable Growth

•

Introduce differentiated

products to deliver a

sustainable competitive

advantage

•

Aggressively grow demand

for our products in targeted

market segments

5

GLOBAL STRATEGY |

PAGE

•

Annual net sales US$1.6+b

•

Total assets US$2.0b

•

Strong cash generation

•

Operations in North America, Asia Pacific and Europe

•

3,100 employees

•

Market cap US$6b

•

S&P/ASX 100 company

•

NYSE ADR listing

Market

capitalization

as

at

20

August

2014.

Total

assets

and

net

cash

as

at

30

June

2014.

Annual

net

sales

equal

1QFY15

net

sales

annualised.

Total assets exclude asbestos compensation

A GROWTH FOCUSED COMPANY

6 |

PAGE

Q1

Q1

%

FY 2015

FY 2014

Change

Adjusted net operating profit

² 50.1

52.0

(4)

Adjusted diluted earnings per share (US cents)

11

12

US$ Millions

Net operating profit reflects:

•

Higher sales volumes and average net sales prices in both the USA and Europe Fiber

Cement and Asia Pacific Fiber Cement Segments

•

USA and Europe Fiber Cement EBIT margin of 21.2%

•

Asia Pacific Fiber Cement Segment EBIT margin of 21.7%³

•

Increase in adjusted effective tax rate, changes in the fair value of interest rate

swaps, and foreign currency losses

²

Adjusted net operating profit excludes asbestos adjustments, New Zealand weathertightness

claims and tax adjustments ³

Asia Pacific EBIT margin excludes New Zealand weathertightness claims

Q1 FY15 GROUP NET OPERATING PROFIT

1

7

1

Comparisons

are

of

the

1

st

quarter

of

the

current

fiscal

year

versus

the

1

st

quarter

of

the

prior

fiscal

year |

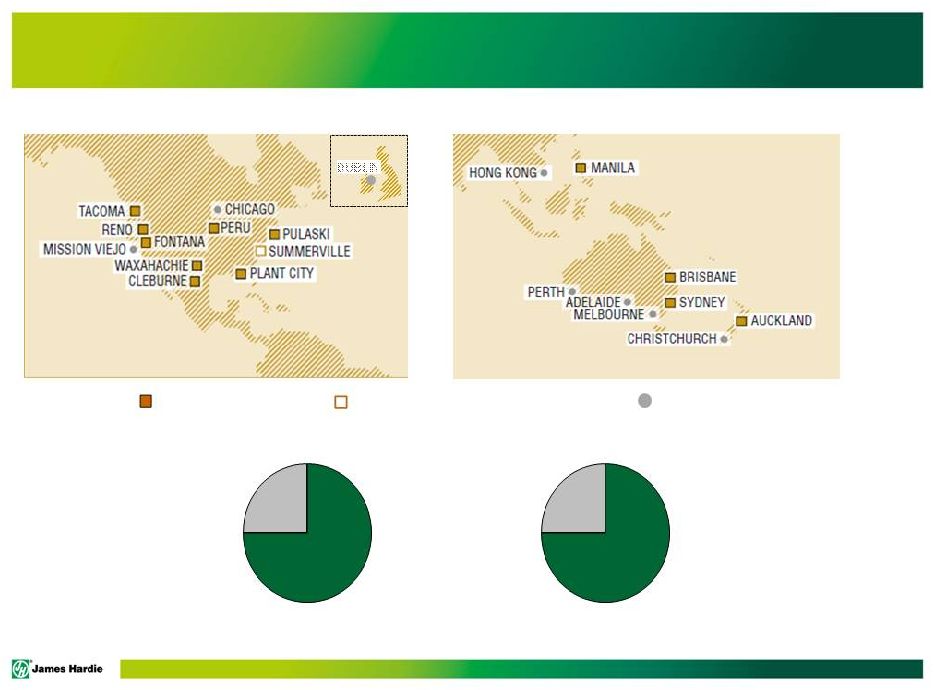

PAGE

USA and Europe

77%

Asia Pacific

23%

USA and Europe

77%

Asia Pacific

23%

8

WORLD LEADER IN FIBER CEMENT

USA & Europe

Asia Pacific

JHX Sales Office

JHX Manufacturing Operations

Geographic Mix¹

Net Sales

EBIT ²

DUBLIN

1

All

percentages

are

for

the

1

ST

quarter

ended

30

June

2014

²

EBIT –

excludes research and development, asset impairments, asbestos-related items,

New Zealand weathertightness claims and general corporate costs JHX Manufacturing Operations

– Production Suspended |

PAGE

Research

&

Development:

Significant

and

consistent

investment

9

CREATING A SUSTAINABLE AND DIFFERENTIATED

ADVANTAGE

History of Fiber Cement Substrate Development

James Hardie

Siding Products

•

US$33.1m spent on Research & Development in FY14

•

US$363.1m spent on Research & Development since 2000

|

PAGE

Fiber cement is more durable than wood and engineered wood, looks and

performs better than vinyl, and is more cost effective and quicker to build with

than brick

Fiber

Cement

Vinyl

Engineered

Wood

Fire resistant

Hail resistant

Resists warping

Resists buckling

Lasting color

Dimensional stability

Can be repainted

?

?

?

?

?

?

?

?

?

?

?

?

?

?

10

DELIVERING SUPERIOR PRODUCT PERFORMANCE |

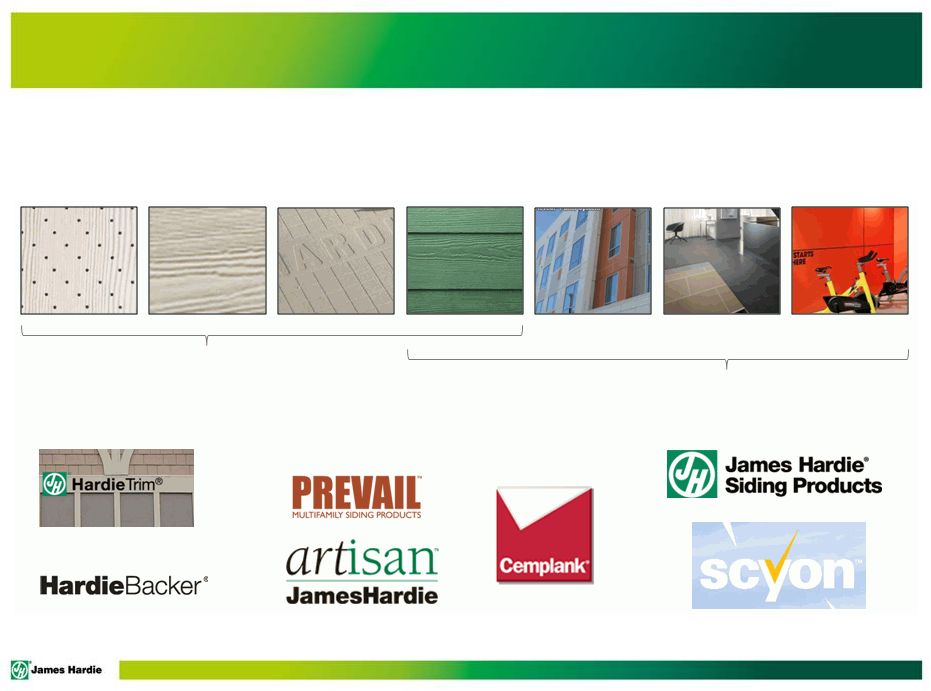

PAGE

Siding

Primary Products

Soffit

Trim /

Fascia

Backerboard

Commercial

Exteriors

Flooring

Interior Walls

/ Ceilings

Brand Portfolio

U.S. & Europe

Asia Pacific

BUILDING A PORTFOLIO OF PRODUCTS AND BRANDS

11 |

PAGE

¹

Production was suspended at the Summerville plant in November 2008

USA Plant Locations

USA AND EUROPE FIBER CEMENT SEGMENT

Tacoma, WA

Reno, NV

Fontana, CA

Waxahachie,

TX

Cleburne, TX

Summerville,

SC

Plant City, FL

Pulaski, VA

Peru, IL

12

•

Largest fiber cement

producer in North America

•

2,100 employees

•

9 manufacturing plants¹

•

2 research and development

facilities

1Q FY15

1Q FY14

Net Sales

US$321.5m

US$278.1

m

EBIT

US$68.0m

US$59.4m

EBIT Margin

21.2%

21.4% |

PAGE

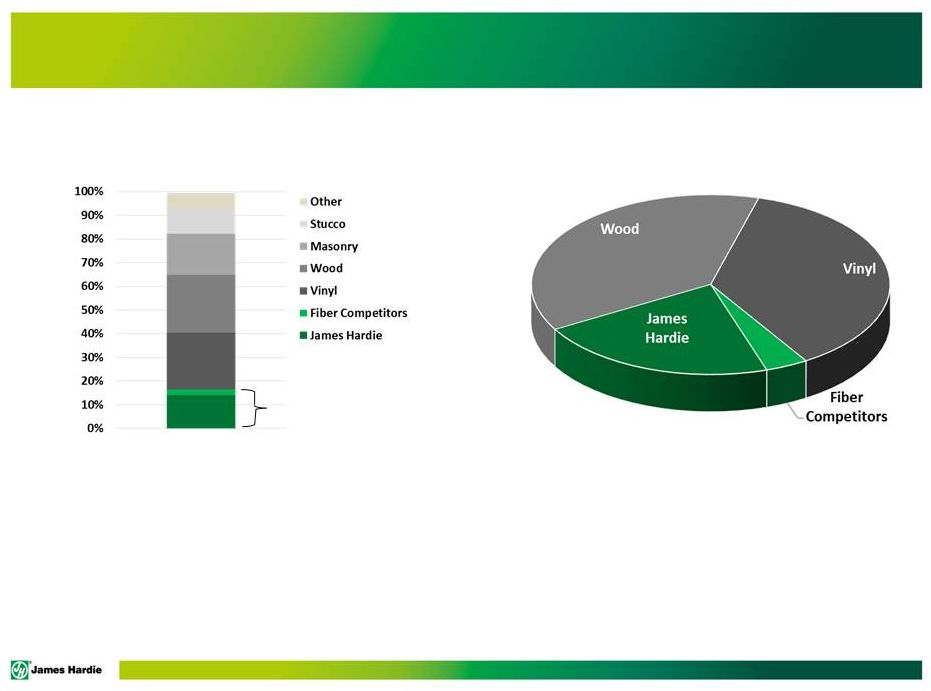

Fiber Cement Share: 17%

North America External Cladding Market Share

North America Wood-Look Market Size

Source: Internal estimates based on NAHB product usage data adjusted

for regional market intelligence

Source: Internal estimates based on NAHB product usage data adjusted

for regional market intelligence

4.7BSF

DRIVING CATEGORY AND MARKET SHARE GAINS

13

35/90 Plan

Currently:

•

Grow fiber cement share to 35% of the exterior cladding market against other

wood-looking siding alternatives

•

Maintain JHX’s category share at 90%

•

JHX wins ~90% of the fiber cement category, while fiber cement used in ~17% of the

total market •

Current estimate is wood-look siding (Wood, Vinyl and Fiber Cement) is

60-65% of total market. |

PAGE

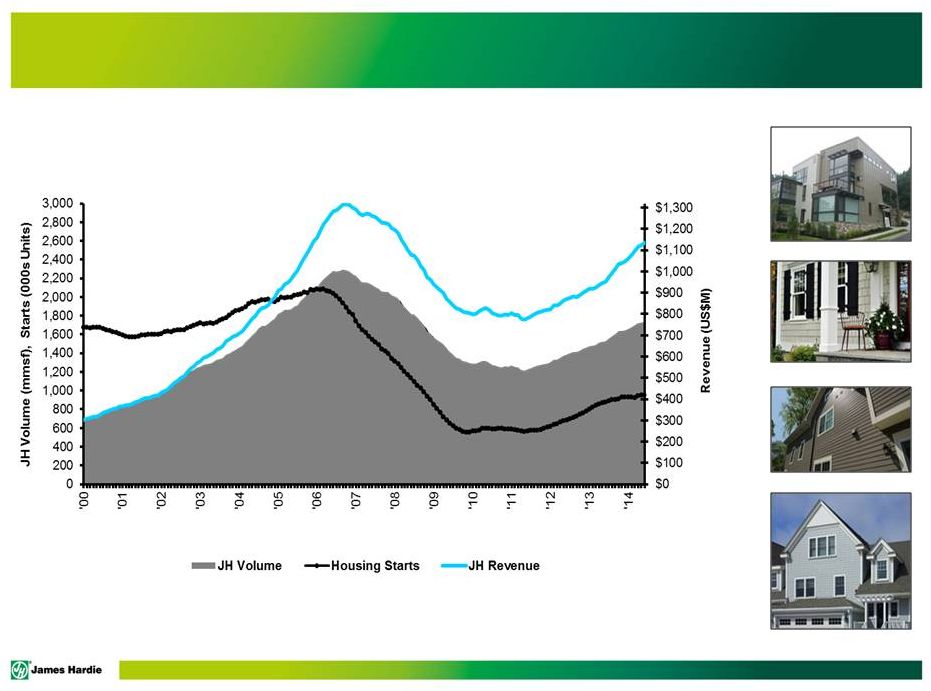

Rolling 12 month average of seasonally adjusted estimate of housing starts by US

Census Bureau AGGRESSIVELY GROWING DEMAND FOR OUR PRODUCTS

14

USA Fiber Cement Top Line Growth |

PAGE

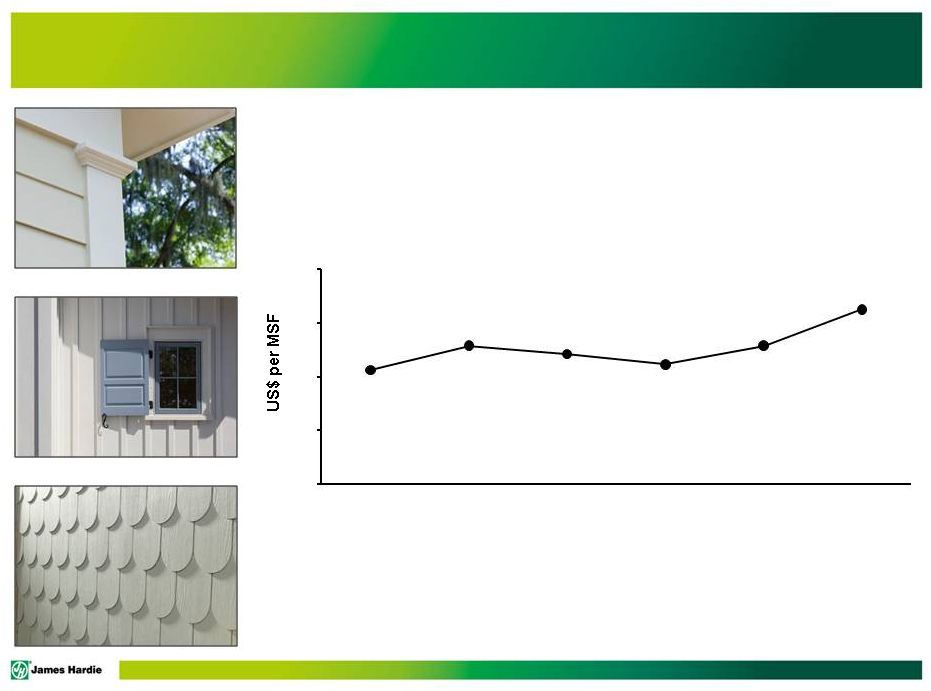

USA and Europe Fiber Cement

Average Net Sales Price

US$680

ACHIEVING THE RIGHT VALUE FOR OUR PRODUCTS

15

550

590

630

670

710

FY10

FY11

FY12

FY13

FY14

Q1 FY15 |

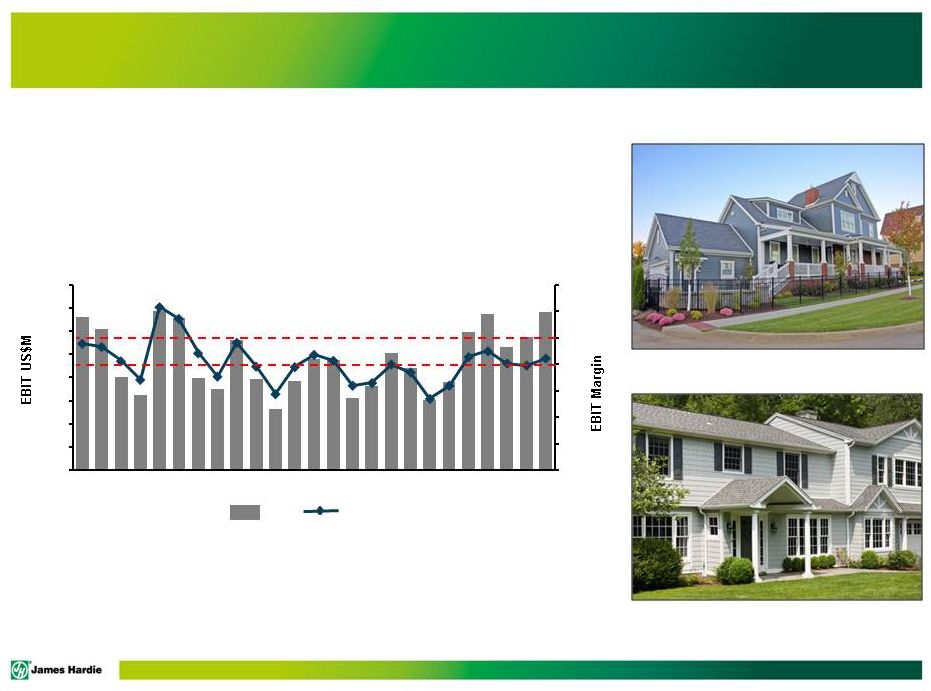

PAGE

USA and Europe Fiber Cement

Quarterly EBIT and EBIT Margin

1

USA AND EUROPE: DELIVERING STRONG RETURNS

16

EBIT

EBIT Margin

0

5

10

15

20

25

30

35

0

10

20

30

40

50

60

70

80

FY09

FY10

FY11

FY12

FY13

FY14

FY15

1

Excludes

asset

impairment

charges

of

US$14.3

million

in

4

th

quarter

FY12,

US$5.8

million

in

3

rd

quarter

FY13

and

US$11.1

million

in

4

th

quarter

FY13 |

PAGE

•

985 employees

•

5 manufacturing plants across

Australia, New Zealand and the

Philippines

•

1 research and development facility

EBIT and EBIT margin excludes New Zealand weathertightness claims

17

ASIA PACIFIC FIBER CEMENT SEGMENT

1Q FY15

1Q FY14

Net Sales

US$95.3m

US$94.1m

EBIT

US$20.7m

US$21.1m

EBIT Margin

21.7%

22.4%

Asia Pacific Plant Locations |

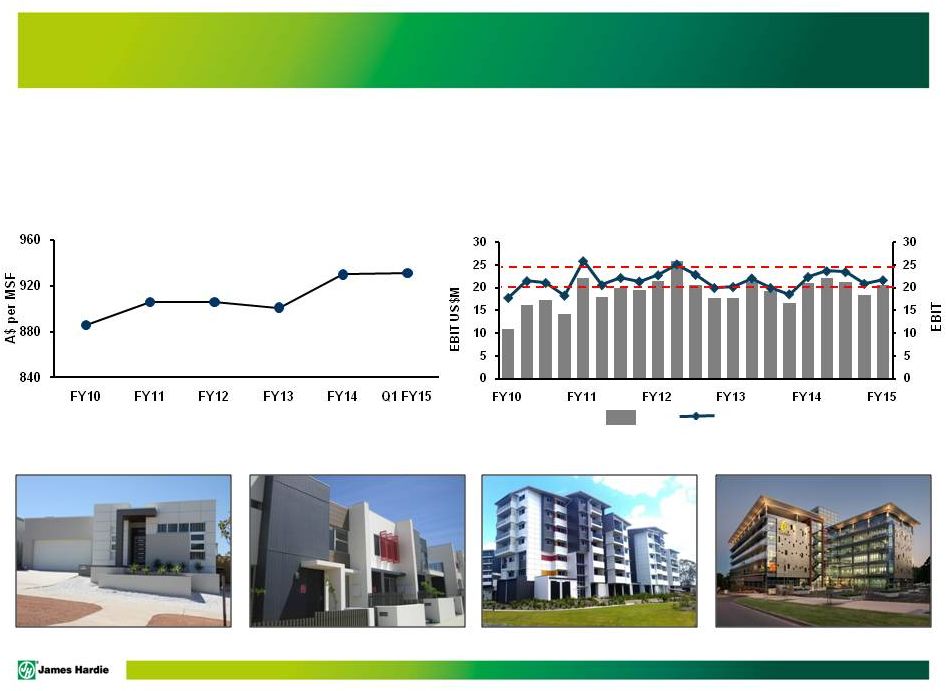

PAGE

1

EBIT and EBIT margin excludes New Zealand weathertightness claims

EBIT

EBIT Margin

ASIA PACIFIC: DELIVERING STRONG RETURNS

18

Asia Pacific Fiber Cement Segment

A$931

Average Net Sales Price

Quarterly

EBIT

and

EBIT

Margin

1 |

PAGE

Ceilings and partitions

Philippines

Exterior cladding

Australia

General purpose flooring

Australia

New Zealand

Interior walls

19

TARGETTING THE RIGHT PRODUCT INTO THE RIGHT MARKET

Asia Pacific Core Markets |

PAGE

JHX APPROACH TO CAPITAL MANAGEMENT

20

Objectives

•

To optimize our capital structure with a view towards a target net debt position in

the range of 1-2 times EBITDA excluding asbestos

Strategy

•

While reinvesting in R&D and capacity expansion required for growth;

•

Provide consistent dividend payments within the payout ratio of 50-70% of

Adjusted Net Operating Profit; and

•

A continued commitment to share buy back program together with possible use of

special dividends. Framework

•

Manage capital efficiency within a prudent and rigorous financial policy

-

Ensure sufficient liquidity to support financial obligations and execute

strategy -

Minimize cost of capital while taking into consideration current and future

industry, market and economic risks and conditions

-

Fund CAPEX and reinvestment in our capacity and capability

-

Maintain flexibility to capitalize on market and strategic opportunities

•

Strong cash flow generation expected to continue and grow

|

PAGE

JHX FY15 LIQUIDITY AND CAPITAL ALLOCATION

Liquidity

21

•

An ordinary dividend of US32.0 cents per security and a special dividend of US20.0

cents per security, totaling US$230.3 million, was paid on 08 August 2014

from FY14 earnings Dividends

•

During the quarter, we repurchased and cancelled 715,000 shares of our common stock

under the May

2013

program,

at

a

total

cost

A$9.8

million

(US$9.1

million)

and

an

average

market

price

of

A$13.69 (US$12.73)

•

In

May

2014,

we

announced

a

new

share

buyback

program

to

acquire

up

to

5%

of

our

issued

capital

during the following 12 months

Buybacks

•

With the addition of this facility, we have US$505.0 million of combined credit

facilities available to us with a combined average tenor of 3.0 years

•

In May 2014, we added US$150.0 million of credit facilities intended to replace and

augment an existing US$50.0 million credit facility which expired on 14

February 2014 |

PAGE

USA and Europe Fiber Cement

•

The

US

operating

environment

continues

to

recover,

but

at

a

more

modest

pace

than

expected

earlier this

year

•

The recent flattening in housing activity has created some uncertainty about the

pace of the recovery in the short-term

•

Our medium-term view on the recovery is unchanged. To capitalize on the growing

market demand and anticipated market penetration, we continue to invest in

additional manufacturing capacity across the US •

EBIT

to

revenue

margin

is

expected

to

remain

within

our

target

range

of

20%

-

25%

for

fiscal

2015, absent

any major external factors

Asia Pacific Fiber Cement

•

In Australia, net sales from the Australian business are expected to improve,

tracking in line with expected growth in the detached housing market and an

expected positive movement in the repair and remodel market

•

The

New

Zealand

business

is

expected

to

deliver

improved

results

supported

by

a

stronger

local

housing

market,

particularly

in

Auckland

and

Christchurch,

although

at

a

more

moderate

rate

of

growth

than

prior

year

•

The Philippines business is expected to grow, driven by increased penetration in to

a relatively flat repair and

remodel

market,

together

with

increased

penetration

into

the

growing

residential

high

rise

market

JHX FY15 GROUP OUTLOOK

22 |

PAGE

•

Management

expects

full

year

Adjusted

net

operating

profit

to

be

between

US$205

million

and

US$235 million assuming, among other things, housing industry conditions in the

United States continue to improve at a more moderate level than originally

assumed at the beginning of

the

year,

and

that

an

exchange

rate

at

or

near

current

levels

is

applicable

for

the

remainder

of the fiscal year

•

Management cautions that although the US market is recovering, uncertainties about

the pace of the recovery in the short term remain. Further the market

price for input costs remain volatile and continue to impact earnings

•

Management is unable to forecast the comparable US GAAP financial measure due to

uncertainty regarding the impact of actuarial estimates on

asbestos-related assets and liabilities in future periods

JHX FY15 GUIDANCE

23 |

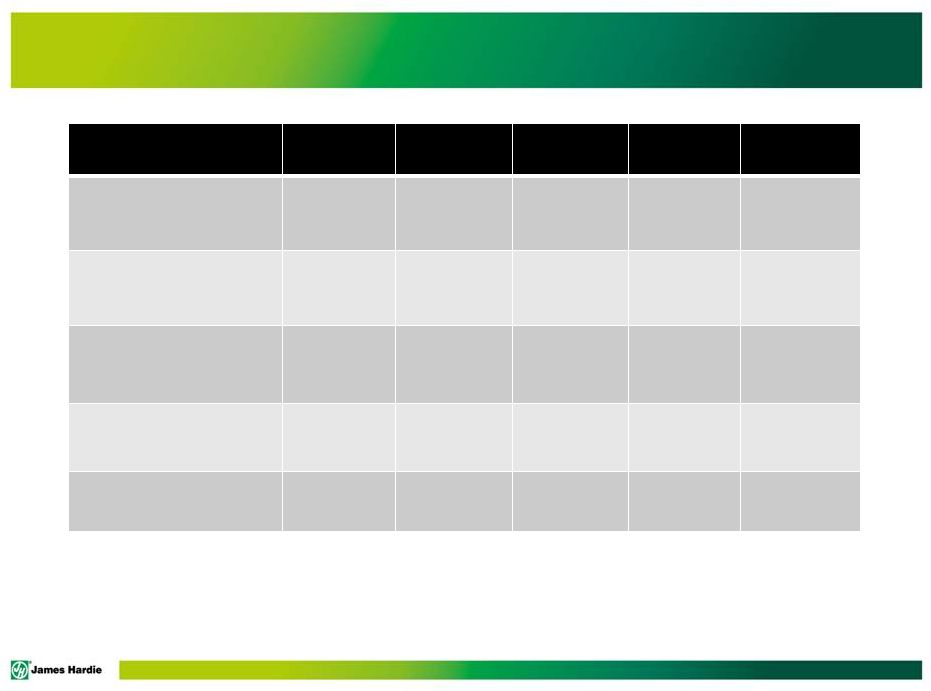

APPENDIX |

PAGE

1

Excludes asbestos adjustments, AICF SG&A expenses,

AICF

interest

income,

New

Zealand weathertightness claims and tax adjustments

2

Excludes asbestos adjustments, AICF SG&A expenses, and New Zealand

weathertightness claims JHX KEY RATIOS

25

3 Months

FY2015

3 Months

FY2014

3 Months

FY2013

11c

12c

10c

EBIT/ Sales (EBIT margin)

17.1%

18.1%

17.0%

Gearing Ratio

(3.3)%

(16.5)%

(32.1)%

Net Interest Expense Cover

79.1x

84.4x

57.7x

Net Interest Paid Cover

89.0x

67.5x

115.4x

EPS (Diluted) (US Cents)

1

1

2

2

2 |

PAGE

FY10

FY11

FY12

FY13

FY14

Net Sales

US$m

828

814

862

951

1,128

Sales Volume

mmsf

1,304

1,248

1,332

1,489

1,697

Average Price

US$ per msf ²

632

648

642

626

652

EBIT US$m¹

209

160

163

163

237

EBIT Margin %¹

25

20

19

17

21

26

1

2

During the second quarter of FY14, the company refined its methodology for

calculating average net sales price in both the USA and Europe and Asia Pacific Fiber

Cement segments to exclude ancillary products that have no impact on fiber cement

sales volume, which is measured and reported in million square feet (“mmsf”).

As the revenue contribution of these ancillary products been increasing, the

company believes the refined methodology provides an improved disclosure of average

net sales price, in line with the company’s primary fibre cement business,

which is a key segment performance indicator. The company has restated average net

sales price in the prior periods to conform with the current calculation of average

net sales price. USA AND EUROPE FIBER CEMENT –

5 YEAR RESULTS

OVERVIEW

Excludes asset impairment charges of US$14.3 million and US$16.9 million in FY12 and FY13,

respectively |

PAGE

1

Excludes New Zealand product liability expenses of US$5.4 million , US$13.2 million

and US$1.8 million in FY12, FY13 and FY14, respectively 2

During the second quarter of FY14, the company refined its methodology for

calculating average net sales price in both the USA and Europe and Asia Pacific Fiber

Cement segments to exclude ancillary products that have no impact on fiber cement

sales volume, which is measured and reported in million square feet (“mmsf”). As

the revenue contribution of these ancillary products has been increasing, the

company believes the refined methodology provides an improved disclosure of average

net sales price, in line with the company’s primary fiber cement business,

which is a key segment performance indicator. The company has restated average net

sales price in the prior periods to conform with the current calculation of average

net sales price. FY10

FY11

FY12

FY13

FY14

Net Sales

US$m

297

353

376

370

366

Sales Volume

mmsf

390

408

392

394

417

Average Price

A$ per msf ²

886

906

906

901

930

EBIT US$m¹

59

79

86

75

83

EBIT Margin %¹

20

23

23

20

23

27

ASIA

PACIFIC

FIBER

CEMENT

–

5

YEAR

RESULTS

OVERVIEW |

PAGE

JHX 1

QUARTER FY15 GROUP RESULTS

•

Earnings impacted by:

•

Higher sales volumes and average sales prices across all business units;

•

Higher production costs, primarily due to higher market prices for input costs and

plant inefficiencies; and

•

Higher organizational spend, primarily due to an increase in stock compensation

expense and an increase in discretionary spend

28

ST

•

Continued capital expenditure on key production capacity projects across our

business units

•

Decrease in cash generated by trading activities to US$83.6 million for the current

three month period compared to US$87.9 million in the prior corresponding

period •

During the quarter we repurchased and cancelled 715,000 shares of our common stock,

at a total cost A$9.8 million (US$9.1 million) and an average market price

of A$13.69 (US$12.73)

•

An ordinary dividend of US32.0 cents per security and a special dividend of US20.0

cents per security, totaling US$230.3 million, was paid on 08 August 2014

from FY14 earnings |

PAGE

Highlights

•

Higher sales volumes; and

•

Higher average net sales prices in local

currencies

•

Higher production costs; primarily higher market

prices of input costs and plant inefficiencies

•

Higher stock compensation expenses caused by

a 47% appreciation in our stock price versus

prior year

•

Higher discretionary spend related to product

and market development activities

•

Interest expense increased due to changes in

the net debt position of AICF

•

Other expense increased largely as a result of

realized and unrealized foreign exchange losses

•

Income tax expense increased 12% due to a

higher effective tax rate

JHX

1

QUARTER

FY15

RESULTS

29

US$ Millions

Q1 '15

Q1 '14

% Change

Net sales

416.8

372.2

12

Gross profit

140.2

126.3

11

SG&A expenses

(59.9)

(54.9)

(9)

R&D expense

(8.4)

(9.0)

7

Asbestos adjustments

(21.5)

94.5

EBIT

50.4

156.9

(68)

Net interest (expense) income

(1.1)

0.1

Other (expense) income

(3.7)

0.1

Income tax expense

(16.7)

(14.9)

(12)

Net operating profit

28.9

142.2

(80)

ST

•

Net sales increased 12% favorably impacted by:

•

Gross profit margin decreased 30 bps impacted by:

•

SG&A expenses increased:

•

Between EBIT and net operating profit: |

PAGE

1

Includes AICF SG&A expenses and AICF interest expense, net

Summary

•

5% increases in operating segment

EBIT

•

Higher general corporate costs, net

interest and other income, and tax

expenses

JHX 1

QUARTER FY15 RESULTS (continued)

30

US$ Millions

Q1 '15

Q1 '14

% Change

Net operating profit

28.9

142.2

(80)

Asbestos:

Asbestos adjustments

21.5

(94.5)

Other asbestos

1

0.8

(0.6)

New Zealand weathertightness claims

(benefit) expense

(1.3)

4.6

Asbestos and other tax adjustments

0.2

0.3

(33)

Adjusted net operating profit

50.1

52.0

(4)

ST

•

Asbestos adjustments were favorable due

to a 2% favorable change in the Australian

dollar spot exchange rate against the US

dollar from the beginning balance sheet

date to the ending balance sheet date for

the period. In the prior corresponding

quarter the change in spot rates was 11%

unfavorable.

•

The New Zealand weathertightness liability

decreased as a result of higher rate of

claim resolution, fewer open claims at the

end of the quarter and continued reduction

in the number of new claims received

•

Adjusted net operating profit decreased

4% due to: |

PAGE

1

Asia

Pacific

Fiber

Cement

EBIT

excludes

New

Zealand

weathertightness

claims

of

US$1.3

million

benefit

and

US$4.6

million

expense

in

Q1’FY15

and Q1’FY14, respectively

2

Research and development expenses include costs associated with core research

projects that are designed to benefit all business units. These costs are

recorded in the Research and Development segment rather than attributed to individual business units

Summary

An increase in stock

compensation expenses due

to a 40% appreciation in our

stock price versus the prior

year

An increase in discretionary

spend related to product and

market development activities

JHX 1

QUARTER FY15 -

SEGMENT EBIT

31

US and Europe FC EBIT +14% driven

by volume and price, partially offset by

higher input costs and SG&A

APAC Fiber Cement EBIT in local

currency up 4% versus the prior year

General corporate costs excluding

asbestos higher primarily due to:

US$ Millions

Q1 ’15

Q1 ’14

% Change

USA and Europe Fiber Cement

68.0

59.4

14

Asia Pacific Fiber Cement

1

20.7

21.1

(2)

Research & Development

2

(6.8)

(6.1)

(11)

General corporate costs excluding asbestos

(10.7)

(6.9)

(55)

Adjusted EBIT

71.2

67.5

5

Asbestos adjustments

(21.5)

94.5

AICF SG&A expenses

(0.6)

(0.5)

(20)

New

Zealand

weathertightness

claims

benefit

(expense)

1.3

(4.6)

Total EBIT

50.4

156.9

(68)

Net interest (expense) income

(1.1)

0.1

Other (expense) income

(3.7)

0.1

Income tax expense

(16.7)

(14.9)

(12)

Net operating profit

28.9

142.2

(80)

ST |

PAGE

US$ Millions

Q1 ’15

Q1 ’14

Operating profit before income taxes

45.6

157.1

Asbestos:

Asbestos adjustments

21.5

(94.5)

Other asbestos

1

0.8

(0.6)

NZ weathertightness claims (benefit) expense

(1.3)

4.6

Adjusted operating profit before income taxes

66.6

66.6

Income tax expense

(16.7)

(14.9)

Asbestos and other tax adjustments

0.2

0.3

Income tax expense excluding tax adjustments

(16.5)

(14.6)

Adjusted effective tax rate

24.8%

21.9%

1

Includes AICF SG&A expenses and AICF interest expense, net

Summary

JHX 1

QUARTER FY15 -

INCOME TAX EXPENSE

32

Adjusted effective tax rate increased

compared to the prior corresponding

quarter due to a shift in the geographic

mix of earnings.

Income tax expense excluding tax

adjustments increased compared to the

prior corresponding quarter due to the

higher adjusted effective tax rate applied

to flat adjusted operating profit before

income taxes

ST |

PAGE

1

JHX

1

ST

QUARTER

FY15

-

CASHFLOW

33

US$ Millions

Q1 ’15

Q1 ’14

EBIT

50.4

156.9

Non-cash items:

Asbestos adjustments

21.5

(94.5)

Other non-cash items

18.4

16.0

Net working capital movements

(6.7)

9.5

Cash Generated By Trading Activities

83.6

87.9

Tax payments, net

(1.9)

(1.7)

Change in other non-trading assets and liabilities

(39.5)

(16.7)

Change in asbestos-related assets & liabilities

(0.5)

(0.9)

Interest paid

0.8

(1.0)

Net Operating Cash Flow

42.5

67.6

Purchases of property, plant & equipment

(48.6)

(26.1)

Proceeds from sale of property, plant & equipment

-

0.4

Common stock repurchased and retired

(9.1)

-

Dividends paid

(124.6)

-

Proceeds from issuance of shares

2.2

2.5

Tax benefit from stock options exercised

0.3

0.2

Effect of exchange rate on cash

1.9

(0.2)

Movement In Net Cash

(135.4)

44.4

Beginning Net Cash

167.5

153.7

Ending Net Cash

32.1

198.1 |

PAGE

•

We continued to spend on previously announced capital expansion projects at our

Plant City, Florida, Cleburne, Texas and Carole Park, Queensland

facilities •

We continue to assess greenfield and brownfield projects across the US

•

In Q1 FY14, we completed the purchase of the previously-leased land and

buildings at Carole Park, Brisbane plant and commenced investments to

increase the plant’s production capacity •

We are tracking in line with our plans to invest approximately US$200 million per

year in capital expenditure over the next three years

US$ Millions

Q1 ’15

Q1 ’14

% Change

USA and Europe Fiber Cement (including

Research and Development)

38.5

11.6

Asia Pacific Fiber Cement

10.1

14.5

(30)

Total

48.6

26.1

86

JHX 1

ST

QUARTER FY15 -

CAPITAL EXPENDITURE

34 |

PAGE

The following major capacity expansion projects in the USA and Europe

and Asia Pacific Fiber Cement businesses are in progress:

JHX MANUFACTURING CAPACITY EXPANSION

35

US$65.0 million

Approximate

Investment

Project

Description

Estimated

Commission

Date

First half of fiscal 2016

First half of fiscal 2016

First half of fiscal 2016

Plant City, Florida –

4

th

sheet machine and

ancillary facilities

Cleburne, Texas –

3

rd

sheet machine and

ancillary facilities

Carole Park, Queensland –

capacity

expansion project

US$37.0 million

A$89.0 million |

PAGE

JHX NET DEBT/CASH

At 30 June 2014:

US$ Millions

Total facilities

505.0

Gross debt

-

Cash

32.1

Net cash

32.1

Unutilised facilities and cash

537.1

36

•

Weighted

average

remaining

term

of

debt

facilities

was

3.0

years

at

30

June

2014,

up

from

2.4

years at 31 March 2014

•

We remain well within our financial debt covenants

•

Net cash of US$32.1 million compared to net cash of US$167.5 million at 31 March

2014 •

Net cash position at 30 June 2014 was reduced to the extent of the May 2014

dividend payment of US$124.6 million

•

Subsequent to 30 June 2014, we moved into a net debt position, drawing US$320.0

million from our debt facilities to fund capital expenditures, dividend

payments and the AICF contribution payment |

PAGE

•

Year to date claims experience of liable entities were 2% above the 31 March 2014

actuarial forecast for FY2015 and 3% lower than the prior corresponding

period •

Readers are referred to Note 7 of our 30 June 2014 Condensed Consolidated Financial

Statements for further information on asbestos claims experience

37

ASBESTOS

FUND

–

PROFORMA

(unaudited)

A$ millions

AICF

cash

and

investments

-

31

March

2014

65.5

Insurance recoveries

18.8

Interest expense, net

(0.2)

Claims paid

(32.7)

Operating costs

(1.1)

Other

1.6

AICF

cash

and

investments

-

30

June

2014

51.9 |

PAGE

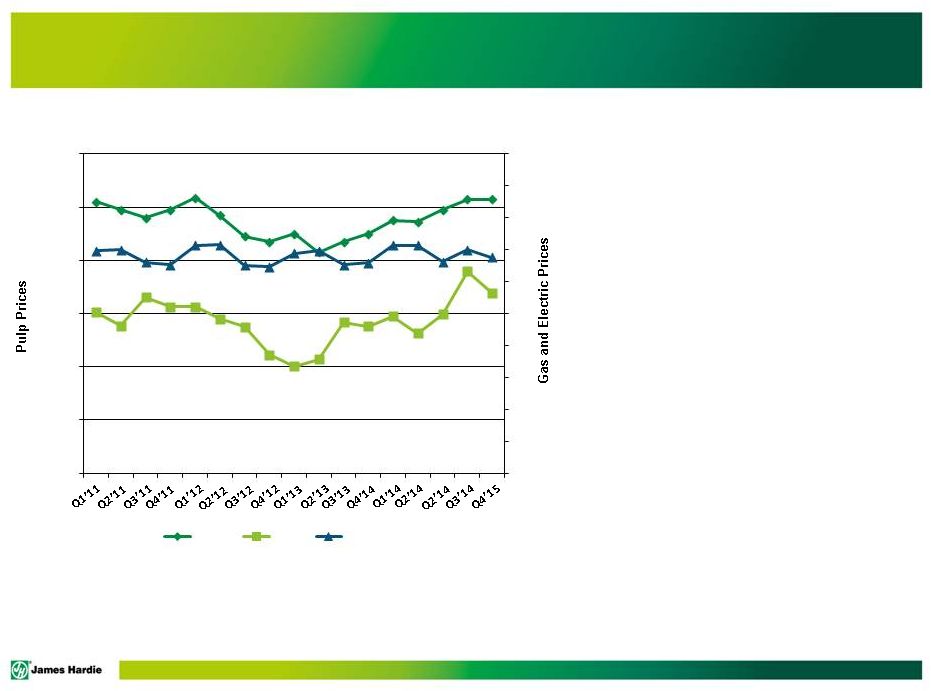

USA AND EUROPE INPUT COSTS

Discussion

38

The information underlying the table above is sourced as follows:

Quarterly US Input Costs

0

1

2

3

4

5

6

7

8

9

10

0

200

400

600

800

1,000

1,200

PULP

GAS

ELECTRIC

•

We are engaged in effective sourcing

strategies to reduce the impact of

increasing market prices

•

The cost of gas for industrial users has

nearly doubled over the last 2 years

•

The price of NBSK pulp is at a three-

year peak

•

Many of our input costs fluctuate in-line

with commodity prices tracked by

external indices; the chart to the left

trends some of these external sources

•

Input costs are significantly up over

the prior year, primarily driven by

pulp, silica and cement

•

Electric –

Cost per hundred kilowatt hour for industrial users

–

from US Energy Information Administration (May 2014 monthly data)

•

Gas –

Cost per thousand cubic feet for industrial users –

from US Energy Information Administration (May 2014 monthly data)

•

Pulp –

Cost per ton –

from RISI |

PAGE

¹

Production was suspended at the Summerville plant in November 2008, it is

anticipated the plant will be re-commissioned during the current cycle.

It is not anticipated that the Blandon site (not shown) will be

re-commissioned Flat Sheet Plant

Capacity (mmsf)

Plants operating

Cleburne, Texas

466

Additional capacity by mid calendar year 2015

200

Peru, Illinois

560

Plant City, Florida

300

Additional capacity by mid calendar year 2015

300

Pulaski, Virginia

600

Reno, Nevada

300

Tacoma, Washington

200

Waxahachie, Texas

360

Fontana, California

1

250

Plant suspended

Summerville, South Carolina

1

190

Flat Sheet Total

3,726

Plant Capacity

USA

AND

EUROPE

FIBER

CEMENT

–

PLANT

CAPACITY

39 |

PAGE

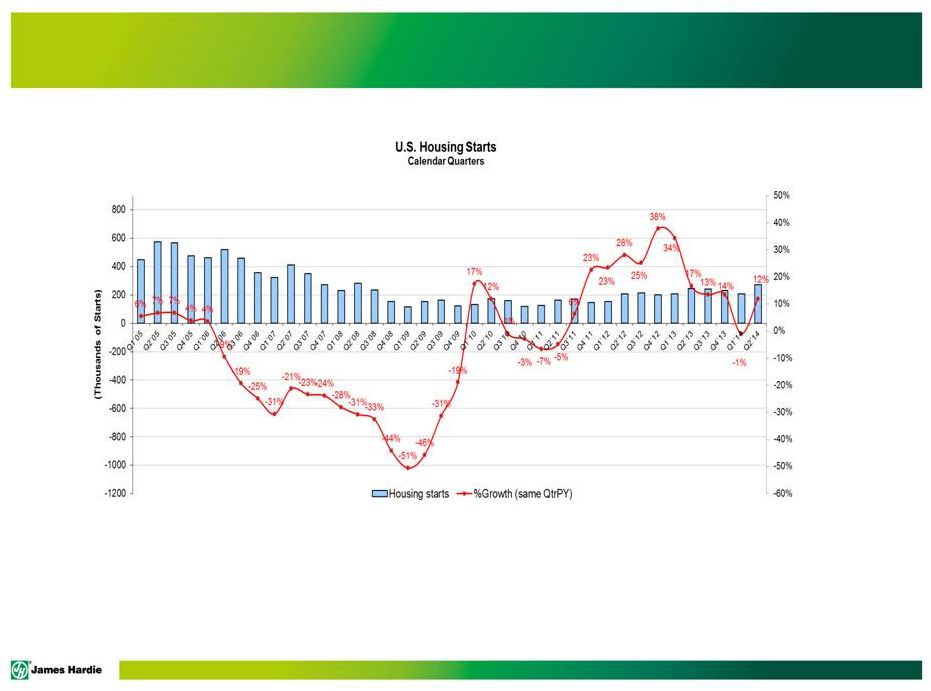

TOTAL US HOUSING STARTS

40 |

PAGE

DEFINITIONS AND OTHER TERMS

Financial Measures –

US GAAP equivalents

Management's Analysis of Results and

Consolidated Statements of Operations

Media Release

and Other Comprehensive Income (Loss)

(US GAAP)

Net sales

Net sales

Cost of goods sold

Cost of goods sold

Gross profit

Gross profit

Selling, general and administrative expenses

Selling, general and administrative expenses

Research and development expenses

Research and development expenses

Asbestos adjustments

Asbestos adjustments

EBIT

*

Operating income (loss)

Net interest income (expense)*

Sum of interest expense and interest income

Other income (expense)

Other income (expense)

Operating profit (loss) before income taxes*

Income (loss) before income taxes

Income tax (expense) benefit

Income tax (expense) benefit

Net operating profit (loss)*

Net income (loss)

*- Represents non-U.S. GAAP descriptions used by Australian companies.

41

This document contains financial statement line item descriptions that are considered to be non-US

GAAP, but are consistent with those used by Australian companies. Because the company prepares

its Condensed Consolidated Financial Statements under US GAAP, the following table

cross-references each non-US GAAP line item description, as used in Management’s

Analysis of Results and Media Release, to the equivalent US GAAP financial statement line item

description used in the company’s Condensed Consolidated Financial Statements: |

PAGE

DEFINITIONS AND OTHER TERMS

EBIT

margin

–

EBIT

margin

is

defined

as

EBIT

as

a

percentage

of

net

sales.

Sales Volumes

mmsf

–

million

square

feet,

where

a

square

foot

is

defined

as

a

standard

square

foot

of

5/16”

thickness

msf

–

thousand

square

feet,

where

a

square

foot

is

defined

as

a

standard

square

foot

of

5/16”

thickness

Financial Ratios

Gearing Ratio

–

Net

debt

(cash)

divided

by

net

debt

(cash)

plus

shareholders’

equity

Net interest expense cover

–

EBIT divided by net interest expense (excluding loan establishment fees)

Net interest paid cover

–

EBIT

divided

by

cash

paid

during

the

period

for

interest,

net

of

amounts

capitalised

Net debt payback

–

Net debt (cash) divided by cash flow from operations

Net debt (cash)

–

Short-term and long-term debt less cash and cash equivalents

Return on capital employed

–

EBIT divided by gross capital employed

42 |

INVESTOR PRESENTATION

OCTOBER 2014 |