Exhibit 99.5

KPMG

cutting through complexity

Valuation of Asbestos-Related

Disease Liabilities of former James

Hardie entities (“the Liable Entities”)

to be met by the AICF Trust

Prepared for Asbestos Injuries

Compensation Fund Limited

(“AICFL”)

As at 31 March 2015

21 May 2015

|

||||||||

| KPMG Actuarial Pty Ltd | ABN: 91 144 686 046 | |||||||

| Australian Financial Services Licence No. 392050 | Telephone: +61 2 9335 7000 | |||||||

| 10 Shelley Street | Facsimile: +61 2 9335 7001 | |||||||

| Sydney NSW 2000 | DX: 1056 Sydney | |||||||

| www.kpmg.com.au | ||||||||

| PO Box H67 | ||||||||

| Australia Square NSW 1215 | ||||||||

| Australia | ||||||||

21 May 2015

Narreda Grimley

General Manager

Asbestos Injuries Compensation Fund Limited

Suite 1, Level 6, 56 Clarence Street

Sydney NSW 2000

| Cc | Matthew Marsh, Chief Financial Officer, James Hardie Industries plc |

Paul Miller, General Counsel, Department of Premier and Cabinet, The State of New South Wales

The Board of Directors, Asbestos Injuries Compensation Fund Limited

Dear Narreda

VALUATION OF ASBESTOS-RELATED DISEASE LIABILITIES OF FORMER JAMES HARDIE ENTITIES (“THE LIABLE ENTITIES”) TO BE MET BY THE AICF TRUST

We are pleased to provide you with our Annual Actuarial Report relating to the asbestos-related disease liabilities of the Liable Entities which are to be met by the AICF Trust.

The report is effective as at 31 March 2015 and has taken into account claims data and information provided to us by AICFL as at 31 March 2015.

If you have any questions with respect to the contents of this report, please do not hesitate to contact us.

Yours sincerely

|

|

| |

| Neil Donlevy MA FIA FIAA | Jefferson Gibbs BSc FIA FIAA | |

| Executive, KPMG Actuarial Pty Ltd | Executive, KPMG Actuarial Pty Ltd | |

| Fellow of the Institute of Actuaries (London) Fellow of the Institute of Actuaries of Australia |

Fellow of the Institute of Actuaries (London) Fellow of the Institute of Actuaries of Australia |

© 2015 KPMG, an Australian partnership and a member firm of the KPMG network of

independent member firms affiliated with KPMG International Cooperative (“KPMG

International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the

KPMG logo are registered trademarks of KPMG International.

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Table of Contents

| Executive Summary |

i | |||||||

| 1 | Scope and Purpose |

1 | ||||||

| 1.1 | Introduction |

1 | ||||||

| 1.2 | Scope of report |

2 | ||||||

| 1.3 | Areas of potential exposure |

6 | ||||||

| 1.4 | Data reliances and limitations |

8 | ||||||

| 1.5 | Uncertainty |

8 | ||||||

| 1.6 | Distribution and use |

9 | ||||||

| 1.7 | Date labelling convention used in this Report |

10 | ||||||

| 1.8 | Author of the report |

10 | ||||||

| 1.9 | Professional standards and compliance |

10 | ||||||

| 1.10 | Control processes and review |

11 | ||||||

| 1.11 | Funding position of the AICF Trust |

11 | ||||||

| 1.12 | Basis of preparation of Report |

11 | ||||||

| 2 | Data |

12 | ||||||

| 2.1 | Data provided to KPMG Actuarial |

12 | ||||||

| 2.2 | Data limitations |

12 | ||||||

| 2.3 | Data reconciliation and testing |

12 | ||||||

| 2.4 | Data conclusion |

15 | ||||||

| 3 | Valuation Methodology and Approach |

16 | ||||||

| 3.1 | Previous valuation work and methodology changes |

16 | ||||||

| 3.2 | Overview of current methodology |

16 | ||||||

| 3.3 | Disease type and class subdivision |

18 | ||||||

| 3.4 | Numbers of future claims notifications |

20 | ||||||

| 3.5 | Incidence of claim settlements from future claim notifications |

25 | ||||||

| 3.6 | Average claim costs of IBNR claims |

25 | ||||||

| 3.7 | Proportion of claims settled for nil amounts |

26 | ||||||

| 3.8 | Pending claims |

27 | ||||||

| 3.9 | Insurance Recoveries |

28 | ||||||

| 3.10 | Cross-claim recoveries |

32 | ||||||

| 3.11 | Discounting cashflows |

33 | ||||||

| 4 | Claims Experience – Mesothelioma Claim Numbers |

34 | ||||||

| 4.1 | Overview |

34 | ||||||

| 4.2 | Profile of mesothelioma claims |

37 | ||||||

| 4.3 | External statistics on mesothelioma claims incidence |

42 | ||||||

| 4.4 | Base valuation assumption for number of mesothelioma claims |

44 | ||||||

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 5 | Claims Experience – Claim numbers (non-mesothelioma diseases) |

45 | ||||||

| 5.1 | Overview |

45 | ||||||

| 5.2 | Asbestosis claims |

45 | ||||||

| 5.3 | Lung cancer claims |

45 | ||||||

| 5.4 | ARPD & Other claims |

46 | ||||||

| 5.5 | Workers Compensation and Wharf claims |

46 | ||||||

| 5.6 | Summary of base claims numbers assumptions (including mesothelioma) |

47 | ||||||

| 5.7 | Baryulgil |

47 | ||||||

| 6 | Exposure and Latency Experience and Incidence Pattern Assumptions |

48 | ||||||

| 6.1 | Exposure information |

48 | ||||||

| 6.2 | Latency period of reported claims |

50 | ||||||

| 6.3 | Modelled peak year of claims |

54 | ||||||

| 6.4 | Pattern of future claim notifications assumed |

56 | ||||||

| 7 | Claims Experience – Average Claims Costs and Average Legal Costs |

58 | ||||||

| 7.1 | Overview |

58 | ||||||

| 7.2 | Mesothelioma claims |

59 | ||||||

| 7.3 | Asbestosis claims |

61 | ||||||

| 7.4 | Lung cancer claims |

62 | ||||||

| 7.5 | ARPD & Other claims |

63 | ||||||

| 7.6 | Workers Compensation claims |

64 | ||||||

| 7.7 | Wharf claims |

65 | ||||||

| 7.8 | Mesothelioma large claim size and incidence rates |

66 | ||||||

| 7.9 | Summary average claim cost assumptions |

68 | ||||||

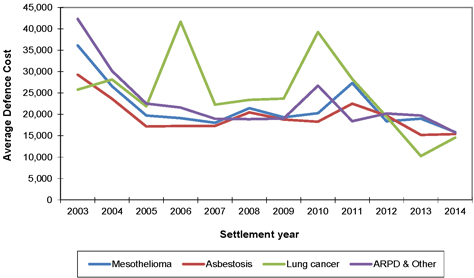

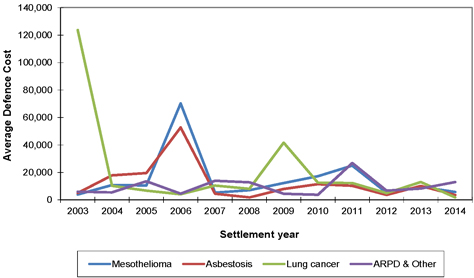

| 7.10 | Defence legal costs |

69 | ||||||

| 7.11 | Summary average defendant legal costs assumptions |

71 | ||||||

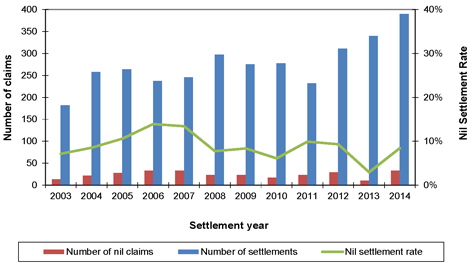

| 8 | Claims Experience – Nil Settlement Rates |

72 | ||||||

| 8.1 | Overview |

72 | ||||||

| 8.2 | Mesothelioma claims |

73 | ||||||

| 8.3 | Asbestosis claims |

74 | ||||||

| 8.4 | Lung cancer claims |

75 | ||||||

| 8.5 | ARPD & Other claims |

76 | ||||||

| 8.6 | Workers Compensation claims |

77 | ||||||

| 8.7 | Wharf claims |

78 | ||||||

| 8.8 | Summary assumptions |

79 | ||||||

| 9 | Economic and Other Assumptions |

80 | ||||||

| 9.1 | Overview |

80 | ||||||

| 9.2 | Claims inflation |

80 | ||||||

| 9.3 | Superimposed inflation |

85 | ||||||

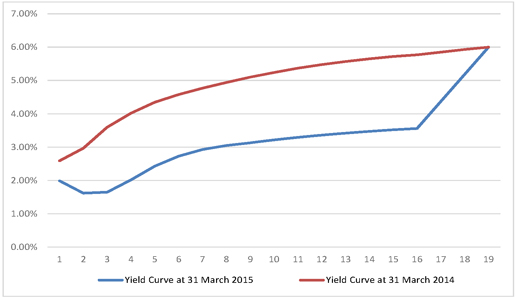

| 9.4 | Discount rates: Commonwealth bond zero coupon yields |

89 | ||||||

| 9.5 | Cross-claim recovery rates |

90 | ||||||

| 9.6 | Settlement Patterns |

91 |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 10 | Valuation Results |

93 | ||||||

| 10.1 | Central estimate liability |

93 | ||||||

| 10.2 | Comparison with previous valuation |

94 | ||||||

| 10.3 | Comparison of valuation results since 30 September 2006 |

97 | ||||||

| 10.4 | Cashflow projections |

98 | ||||||

| 10.5 | Amended Final Funding Agreement calculations |

100 | ||||||

| 10.6 | Insurance Recoveries |

101 | ||||||

| 11 | Uncertainty |

102 | ||||||

| 11.1 | Overview |

102 | ||||||

| 11.2 | Sensitivity testing |

103 | ||||||

| 11.3 | Results of sensitivity testing |

105 |

Tables

| Table 2.1: Grouping of financial data from claims and accounting databases |

14 | |||

| Table 2.2: Comparison of amounts from claims and accounting databases ($m) |

14 | |||

| Table 3.1: Change in cost of claims during 2014/15 financial year ($m) – claim award component only |

28 | |||

| Table 5.1: Number of claims by disease type |

45 | |||

| Table 5.2: Claim numbers experience and assumptions for 2015/16 |

47 | |||

| Table 6.1: Assumed underlying latency distribution parameters from average date of exposure to date of notification |

54 | |||

| Table 6.2: Modelled peak year of claim notifications |

54 | |||

| Table 7.1: Average attritional non-nil claim award (inflated to mid 2014/15 money terms) |

58 | |||

| Table 7.2: Average mesothelioma claims assumptions |

59 | |||

| Table 7.3: Average asbestosis claims assumptions |

61 | |||

| Table 7.4: Average lung cancer claims assumptions |

62 | |||

| Table 7.5: Average ARPD & Other claims assumptions |

63 | |||

| Table 7.6: Average Workers Compensation claims assumptions |

64 | |||

| Table 7.7: Average wharf claims assumptions |

65 | |||

| Table 7.8: Summary average claim cost assumptions |

68 | |||

| Table 8.1: Nil settlement rates |

72 | |||

| Table 8.2: Summary nil settlement rate assumptions |

79 | |||

| Table 9.1: Base inflation assumptions |

85 | |||

| Table 9.2: Zero coupon yield curve by duration |

89 | |||

| Table 9.3: Settlement pattern of claims awards by delay from claim reporting |

92 | |||

| Table 10.1: Comparison of central estimate of liabilities |

93 | |||

| Table 10.2: Comparison of valuation results since 30 September 2006 |

97 | |||

| Table 10.3: Amended Final Funding Agreement calculations |

100 | |||

| Table 10.4: Insurance recoveries at 31 March 2015 |

101 | |||

| Table 11.1: Summary results of sensitivity analysis ($m) |

106 |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

|

Figures

|

| |||

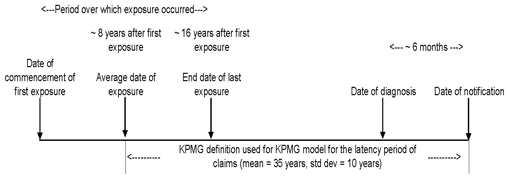

| Figure 3.1: Illustration of timeline of exposure, latency and claim reporting (example shown is for mesothelioma) |

21 | |||

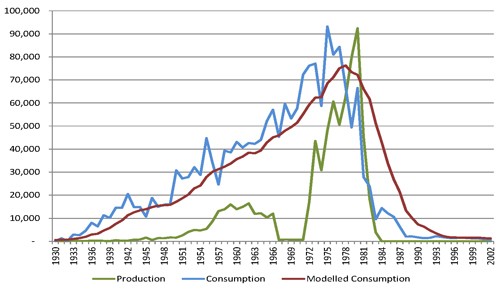

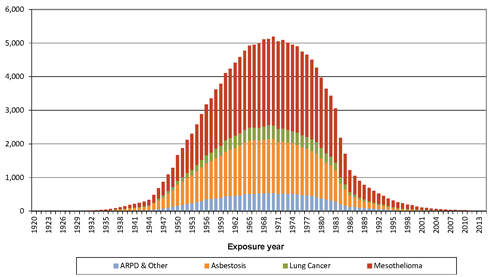

| Figure 3.2: Consumption and production indices – Australia 1930-2002 |

22 | |||

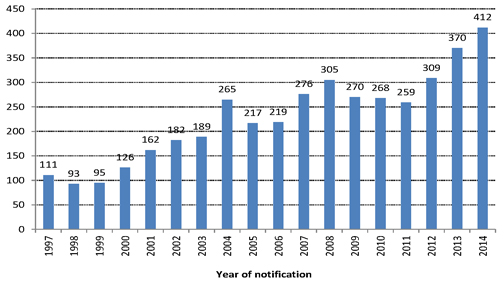

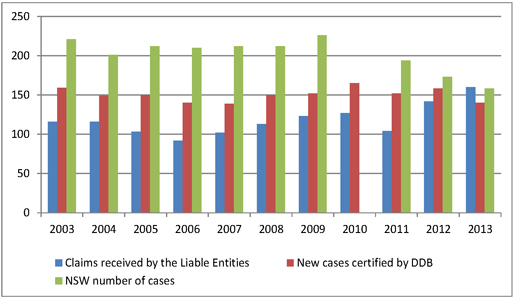

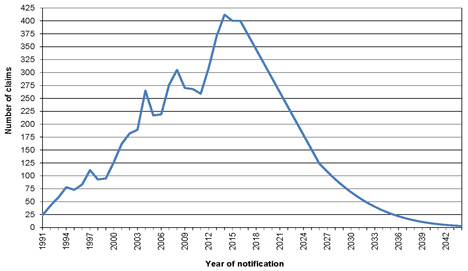

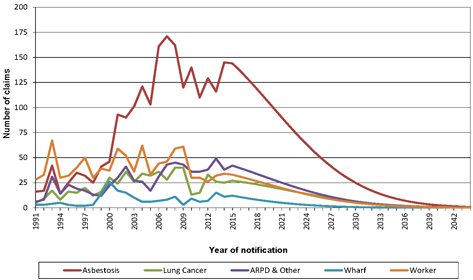

| Figure 4.1: Number of mesothelioma claims reported annually |

34 | |||

| Figure 4.2: Monthly notifications of mesothelioma claims |

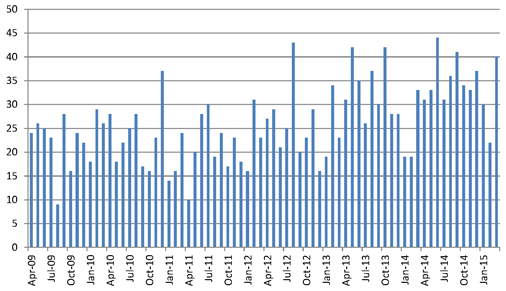

35 | |||

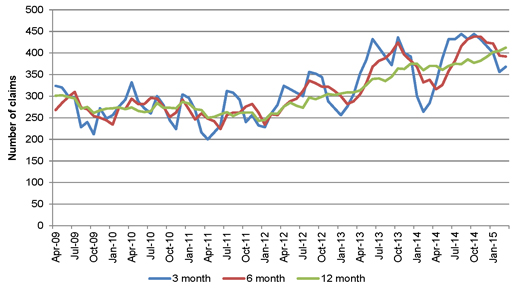

| Figure 4.3: Rolling annualised averages of mesothelioma claim notifications |

36 | |||

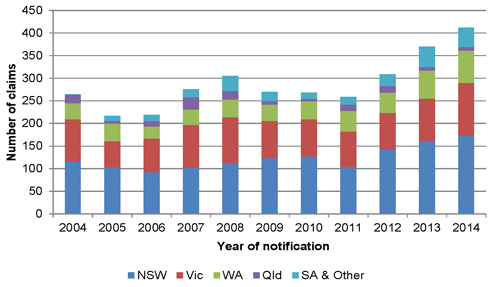

| Figure 4.4: Number of mesothelioma claims by State |

37 | |||

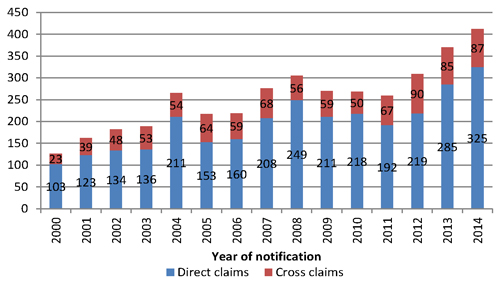

| Figure 4.5: Number of mesothelioma claims by type of claim |

38 | |||

| Figure 4.6: Number of mesothelioma claims by number of defendants (direct claims only) |

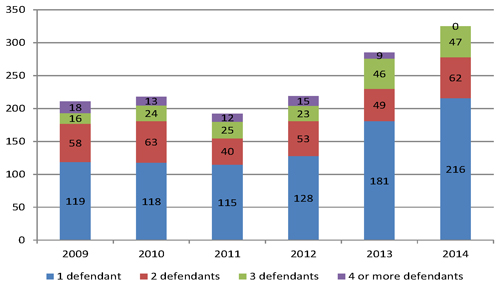

39 | |||

| Figure 4.7: Number of mesothelioma claims by age of claimant |

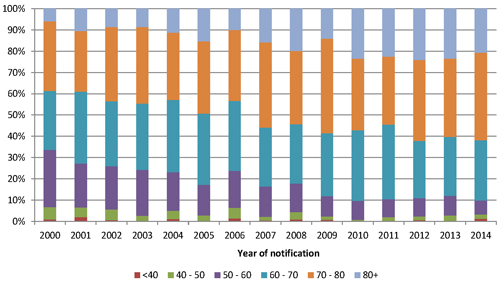

40 | |||

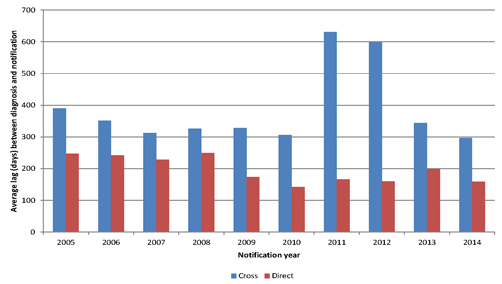

| Figure 4.8: Delay from diagnosis of mesothelioma to notification of claim against the Liable Entities |

41 | |||

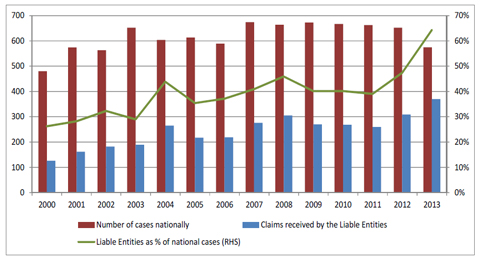

| Figure 4.9: Number of mesothelioma cases reported nationally compared to the number of claims received by the Liable Entities |

42 | |||

| Figure 4.10: Number of mesothelioma cases reported in NSW |

43 | |||

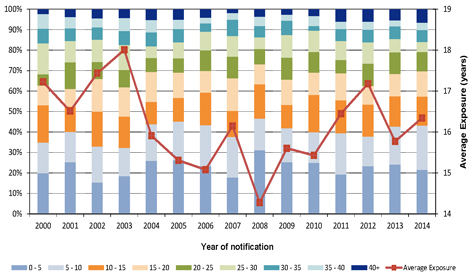

| Figure 6.1: Mix of claims by duration of exposure (years) |

48 | |||

| Figure 6.2: Exposure (person-years) of all Liable Entities’ claimants to date |

49 | |||

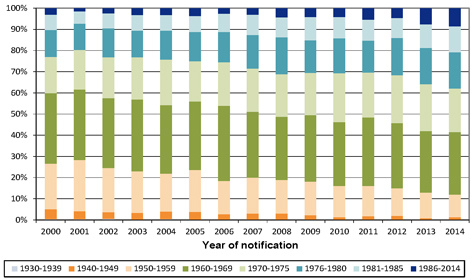

| Figure 6.3: Exposure (person years) of all claimants to date by report year and exposure period |

50 | |||

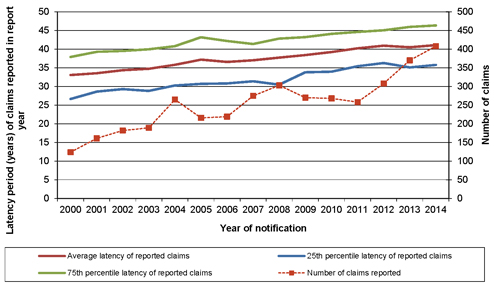

| Figure 6.4: Latency of mesothelioma claims |

51 | |||

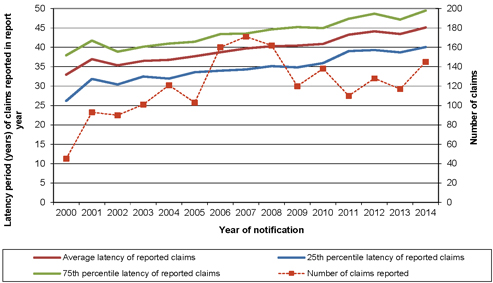

| Figure 6.5: Latency of asbestosis claims |

52 | |||

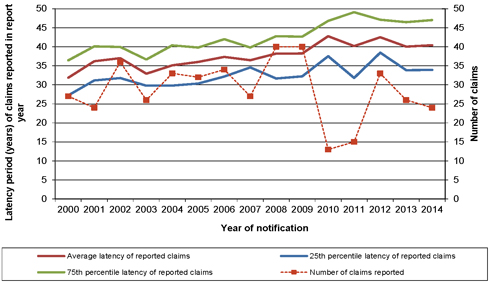

| Figure 6.6: Latency of lung cancer claims |

53 | |||

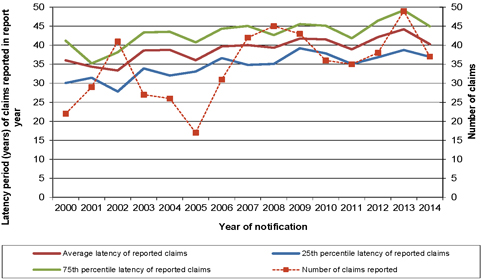

| Figure 6.7: Latency of ARPD & Other claims |

53 | |||

| Figure 6.8: Projected future claim notifications for mesothelioma |

56 | |||

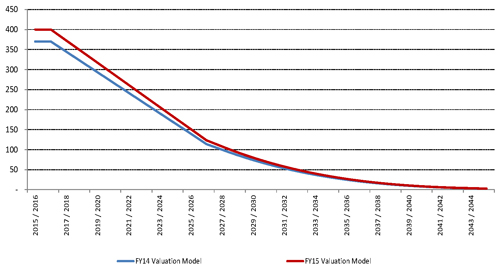

| Figure 6.9: Comparison with previous mesothelioma incidence curve assumptions |

56 | |||

| Figure 6.10: Projected future claim notifications for other disease types |

57 | |||

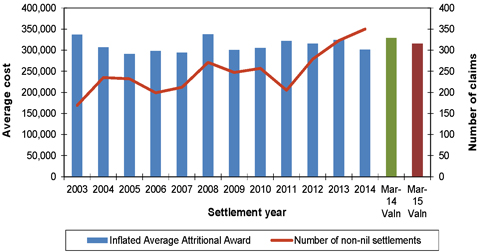

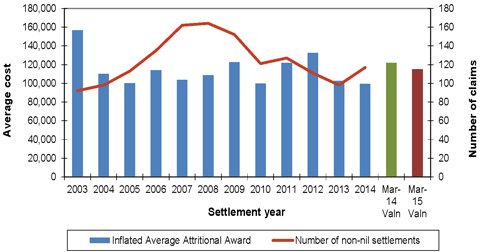

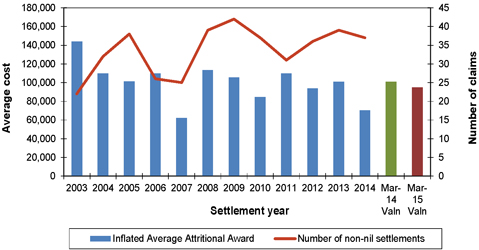

| Figure 7.1: Average attritional awards (inflated to mid 2014/15 money terms) and number of non-nil claims settlements for mesothelioma claims (excluding large claims) |

59 | |||

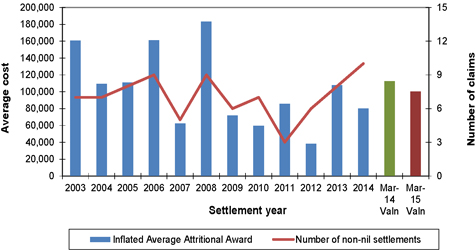

| Figure 7.2: Average awards (inflated to mid 2014/15 money terms) and number of non-nil claims settlements for asbestosis claims |

61 | |||

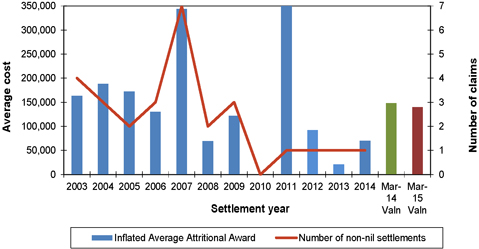

| Figure 7.3: Average awards (inflated to mid 2014/15 money terms) and number of non-nil claims settlements for lung cancer claims |

62 | |||

| Figure 7.4: Average awards (inflated to mid 2014/15 money terms) and number of non-nil claims settlements for ARPD & Other claims |

63 | |||

| Figure 7.5: Average awards (inflated to mid 2014/15 money terms) and number of non-nil claims settlements for Workers Compensation claims |

64 | |||

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

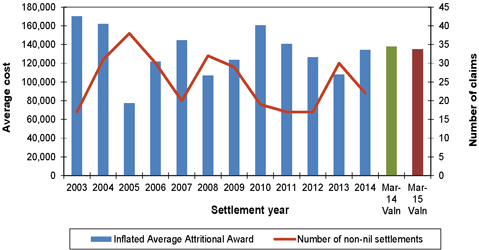

| Figure 7.6: Average awards (inflated to mid 2014/15 money terms) and number of non-nil claims settlements for wharf claims |

65 | |||

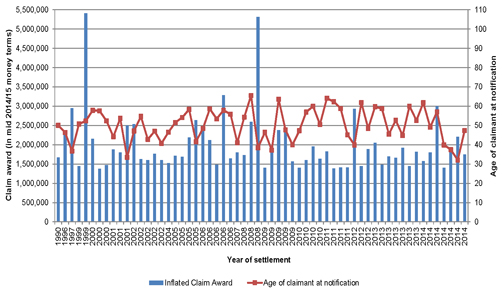

| Figure 7.7: Distribution of individual large claims by settlement year |

66 | |||

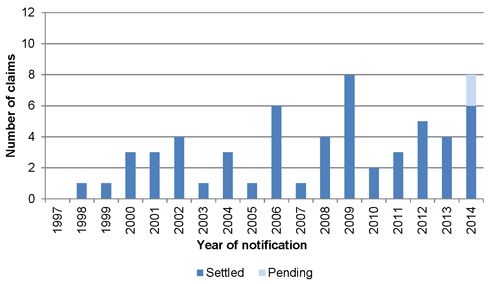

| Figure 7.8: Number of mesothelioma large claims by year of notification |

67 | |||

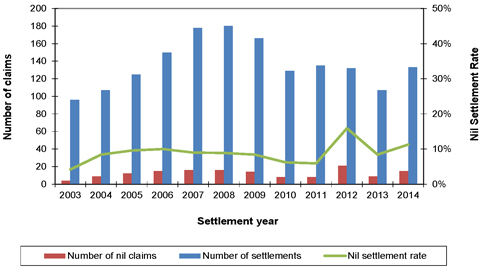

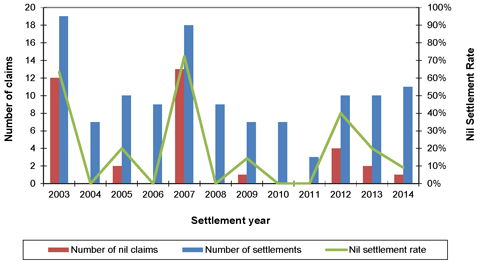

| Figure 8.1: Mesothelioma nil claims experience |

73 | |||

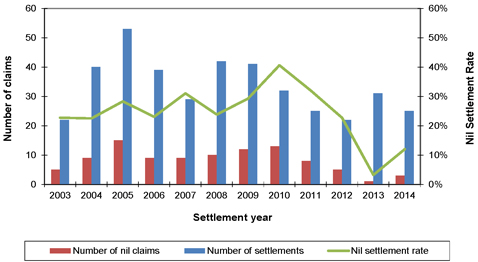

| Figure 8.2: Asbestosis nil claims experience |

74 | |||

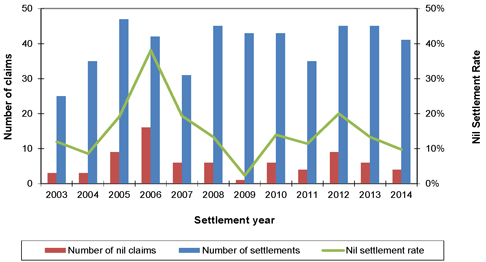

| Figure 8.3: Lung cancer nil claims experience |

75 | |||

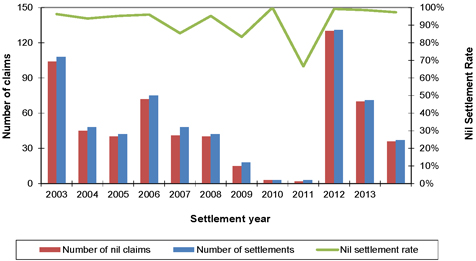

| Figure 8.4: ARPD & Other nil claims experience |

76 | |||

| Figure 8.5: Workers Compensation nil claims experience |

77 | |||

| Figure 8.6: Wharf nil claims experience |

78 | |||

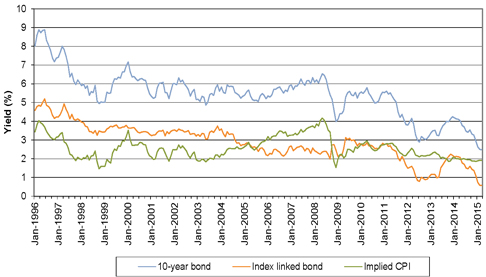

| Figure 9.1: Trends in Bond Yields |

81 | |||

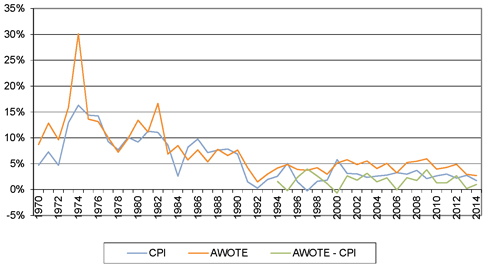

| Figure 9.2: Trends in CPI and AWOTE |

82 | |||

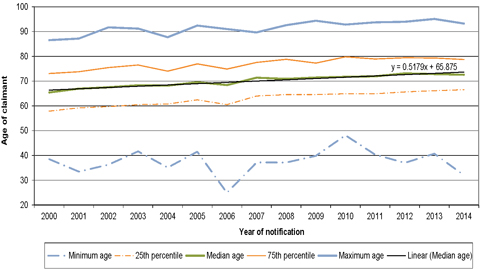

| Figure 9.3: Age profile of mesothelioma claimants by report year |

83 | |||

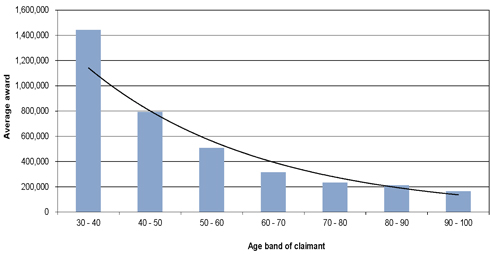

| Figure 9.4: Average mesothelioma claim settlement amounts by decade of age |

84 | |||

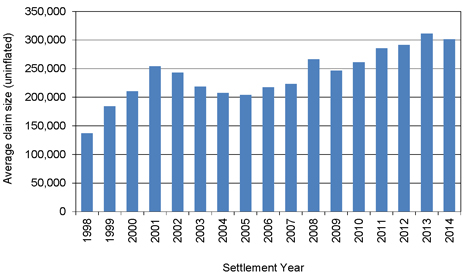

| Figure 9.5: Average mesothelioma awards of the Liable Entities (uninflated) |

87 | |||

| Figure 9.6: Zero coupon yield curve by duration |

90 | |||

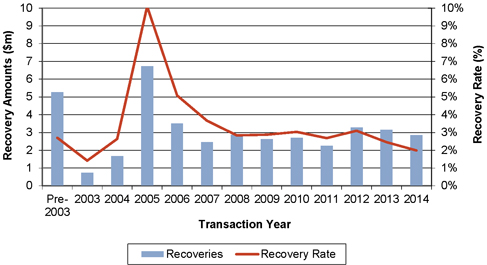

| Figure 9.7: Cross-claim recovery experience |

91 | |||

| Figure 9.8: Settlement pattern derivation for mesothelioma claims: paid as % of ultimate cost |

92 | |||

| Figure 9.9: Settlement pattern derivation for non-mesothelioma claims: paid as % of ultimate cost |

92 | |||

| Figure 10.1: Analysis of change in central estimate liability (discounted basis) |

95 | |||

| Figure 10.2: Analysis of change in central estimate liability (undiscounted basis) |

96 | |||

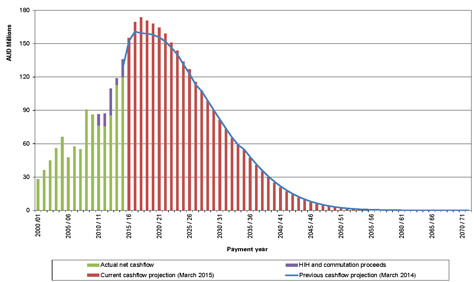

| Figure 10.3: Comparison of actual net cash outflows with projected net payments at the 30 September 2006 valuation |

98 | |||

| Figure 10.4: Historical claim-related expenditure of the Liable Entities |

98 | |||

| Figure 10.5: Annual cashflow projections – inflated and undiscounted ($m) |

99 | |||

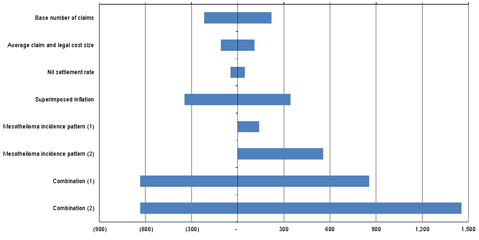

| Figure 11.1: Sensitivity testing results – Impact around the Discounted Central Estimate (in $m) |

105 | |||

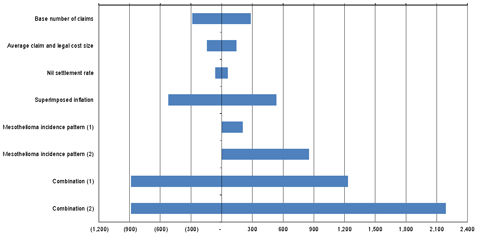

| Figure 11.2: Sensitivity testing results – Impact around the undiscounted central estimate (in $m) |

105 |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| Appendices

|

| |||||

| A |

Credit rating default rates by duration |

108 | ||||

| B |

Projected inflated and undiscounted cashflows ($m) |

109 | ||||

| C |

Projected inflated and discounted cashflows ($m) |

110 | ||||

| D |

Australian asbestos consumption and production data: 1930-2002 |

111 | ||||

| E |

Data provided by AICFL |

112 | ||||

| F |

Glossary of terms used in the Amended Final Funding Agreement |

114 | ||||

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

|

Valuation of the asbestos-related disease | |

|

liabilities of the Liable Entities to be met by the AICF Trust | ||

|

Effective as at 31 March 2015 | ||

|

21 May 2015

|

Executive Summary

Important Note: Basis of Report

This valuation report (“the Report”) has been prepared by KPMG Actuarial Pty Ltd (ABN 91 144 686 046) (“KPMG Actuarial”) in accordance with an “Amended and Restated Final Funding Agreement in respect of the provision of long-term funding for compensation arrangements for certain victims of Asbestos-related diseases in Australia” (hereafter referred to as the “the Amended Final Funding Agreement”) between James Hardie Industries NV (now known as James Hardie Industries plc) (hereafter referred to as “James Hardie”), James Hardie 117 Pty Limited, the State of New South Wales and Asbestos Injuries Compensation Fund Limited (“AICFL”) which was signed on 21 November 2006.

This Report is intended to meet the requirements of the Amended Final Funding Agreement and values the asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust.

This Report is not intended to be used for any other purpose and may not be suitable, and should not be used, for any other purpose. Opinions and estimates contained in the Report constitute our judgment as of the date of the Report.

The information contained in this Report is of a general nature and is not intended to address the objectives, financial situation or needs of any particular individual or entity. It is provided for information purposes only and does not constitute, nor should it be regarded in any manner whatsoever as, advice and is not intended to influence a person in making a decision in relation to any financial product or an interest in a financial product. No one should act on the information contained in this Report without obtaining appropriate professional advice after a thorough examination of the accuracy and appropriateness of the information contained in this Report having regard to their objectives, financial situation and needs.

In preparing the Report, KPMG Actuarial has relied on information supplied to it from various sources and has assumed that the information is accurate and complete in all material respects. KPMG Actuarial has not independently verified the accuracy or completeness of the data and information used for this Report.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

i |

|

Valuation of the asbestos-related disease | |

|

liabilities of the Liable Entities to be met by the AICF Trust | ||

|

Effective as at 31 March 2015 | ||

|

21 May 2015

|

Except insofar as liability under statute cannot be excluded, KPMG Actuarial, its executives, directors, employees and agents will not be held liable for any loss or damage of any kind arising as a consequence of any use of the Report or purported reliance on the Report including any errors in, or omissions from, the valuation models.

The Report must be read in its entirety. Individual sections of the Report, including the Executive Summary, could be misleading if considered in isolation. In particular, the opinions expressed in the Report are based on a number of assumptions and qualifications which are set out in the full Report.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

ii |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Introduction

The Amended Final Funding Agreement requires the completion of an Annual Actuarial Report evaluating the potential asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust. KPMG Actuarial has been retained by AICFL to provide this Annual Actuarial Report as required under the Amended Final Funding Agreement and this is detailed in our Engagement Letter dated 13 November 2014.

The Liable Entities are defined as being the following entities:

| ● | Amaca Pty Ltd (formerly James Hardie & Coy); |

| ● | Amaba Pty Ltd (formerly Jsekarb, James Hardie Brakes and Better Brakes); and |

| ● | ABN60 Pty Ltd (formerly James Hardie Industries Ltd). |

In addition, the liability for Baryulgil claims is deemed to be a liability of Amaca by virtue of the James Hardie (Civil Liability) Act 2005 (NSW). Under Part 4 of that Act, Amaca is liable for the “Marlew Asbestos Claims” or “Marlew Contribution Claims” as defined in that Act.

Our valuation is on a central estimate basis and is intended to be effective as at 31 March 2015. It has been based on claims data and information as at 31 March 2015 provided to us by AICFL.

Overview of Recent Claims Experience and comparison with previous valuation projections

In this section we compare the actual experience in 2014/15 (referred to in the following tables as “FY15 Actual”) with the projections for 2014/15 that were contained within our previous valuation report at 31 March 2014. We will refer to these projections for 2014/15 as “FY15 Expected” in the tables that follow.

Claim numbers

There have been 412 mesothelioma claims reported in 2014/15, an 11% increase on the 370 mesothelioma claims reported in 2013/14.

For non-mesothelioma claims (excluding workers compensation claims), there have been 219 claims reported in 2014/15 compared to 207 claims reported in 2013/14. There has been greater variation within the individual disease types.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

iii |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

The following table shows the comparison of actual experience with that which had been forecast at the previous valuation.

Table E.1. Comparison of claim numbers

| FY15 Actual | FY15 Expected |

Ratio of Actual to Expected (%) |

FY14 Actual | |||||

| Mesothelioma |

412 | 370 | 111% | 370 | ||||

| Asbestosis |

145 | 120 | 121% | 117 | ||||

| Lung Cancer |

25 | 30 | 83% | 26 | ||||

| ARPD & Other |

38 | 48 | 79% | 49 | ||||

| Wharf |

11 | 12 | 92% | 15 | ||||

| Workers |

34 | 30 | 113% | 31 | ||||

| Total |

665 | 610 | 109% | 608 |

Average Claim Awards

Average claims awards in 2014/15 have been lower than expectations across all disease types.

There have been seven large mesothelioma claim settlements (being claims in excess of $1m in 2006/07 money terms) in 2014/15, which is lower than our expectations. Total claims expenditure on large claims has been 29% below expectations, reflecting both a lower frequency and a lower average cost than expected.

The following table shows the comparison of actual experience with that which had been forecast at the previous valuation.

Table E.2. Comparison of average claim size of non-nil claims

| FY15 Actual | FY15 Expected |

Ratio of Actual to Expected |

FY14 Actual | |||||

| ($) | ($) | (%) | ($) | |||||

| Mesothelioma |

301,275 | 328,600 | 92% | 311,346 | ||||

| Asbestosis |

99,251 | 121,900 | 81% | 98,795 | ||||

| Lung Cancer |

134,262 | 137,800 | 97% | 103,720 | ||||

| ARPD & Other |

70,366 | 100,700 | 70% | 96,959 | ||||

| Wharf |

80,024 | 112,360 | 71% | 103,816 | ||||

| Workers |

70,000 | 148,400 | 47% | 20,000 | ||||

| Mesothelioma Large Claims (settled) | ||||||||

| Number |

7 | 9.25 | 76% | 7 | ||||

| Average claim size |

1,940,571 | 2,067,000 | 94% | 1,657,286 | ||||

| Total Cost |

13,584,000 | 19,119,750 | 71% | 11,601,000 |

Note: FY14 Actual values are expressed in 2013/14 money terms. FY15 Actual values and FY15 Expected values are expressed in 2014/15 money terms.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

iv |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

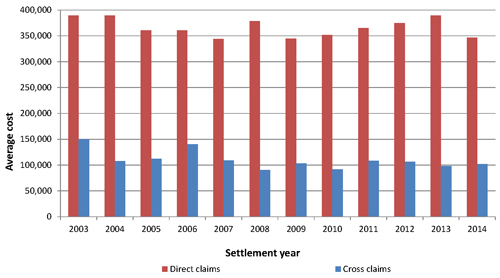

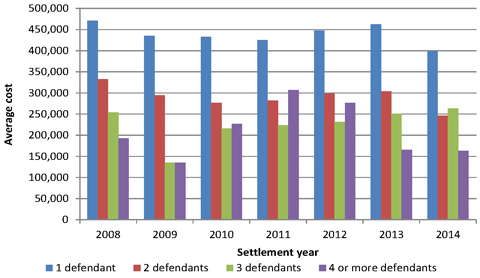

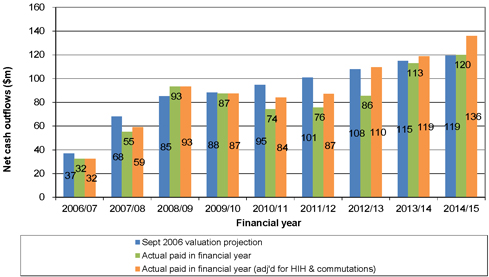

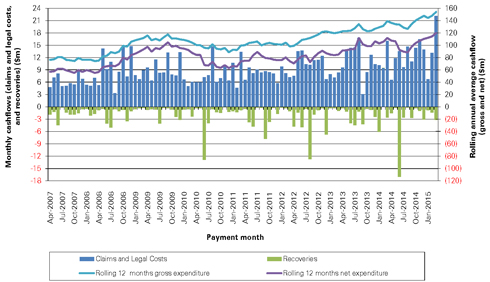

Cashflow expenditure: gross and net

Gross cashflow expenditure, at $154.3m, was 4% above expectations.

Net cashflow expenditure, at $121.1m, was 6% below expectations.

Table E.3. Comparison of cashflow

| FY15 Actual

($M) |

FY15 Expected

($M) |

Ratio of Actual to Expected (%) |

FY14 Actual

($M) | |||||

|

Gross Cashflow

|

154.3 | 148.9 | 104% | 140.4 | ||||

|

Insurance and Other Recoveries

|

(17.9) | (20.5) | 87% | (21.5) | ||||

|

Insurance recoveries from HIH / Commutations

|

(15.3) | 0.0 | n/a | (6.0) | ||||

|

Net Cashflow before HIH / Commutations

|

136.4 | 128.4 | 106% | 118.9 | ||||

|

Net Cashflow after HIH / Commutations

|

121.1 | 128.4 | 94% | 112.9 |

Insurance and Other Recoveries have been considerably higher than expected. However, this is entirely due to proceeds from insurance collections from HIH and associated entities as a result of successful applications of Section 562A(4).

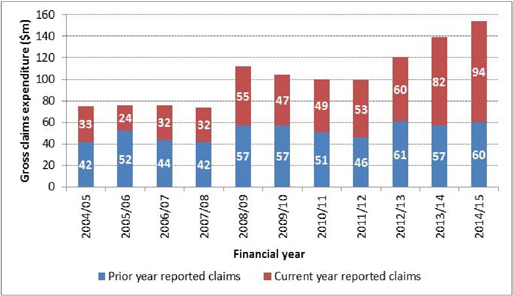

The following chart shows the composition of the gross cashflow between current and prior years’ reported claims.

Figure E.1. Composition of gross cashflow between current and prior years’ reported claims

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

v |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Payments in relation to claims reported in the financial year have shown a further increase compared with the previous year. This is predominantly due to the higher number of mesothelioma claims reported in the year and which have been settled in the year.

Payments in relation to prior years’ reported claims have been relatively stable in the most recent three years.

Liability Assessment

At 31 March 2015, our projected central estimate of the liabilities of the Liable Entities (the Discounted Central Estimate) to be met by the AICF Trust is $2,142.8m (March 2014: $1,870.2m).

We have not allowed for the future Operating Expenses of the AICF Trust or the Liable Entities in the liability assessment.

Table E.4. Comparison of central estimate of liabilities

| 31 March 2015 $m |

31 March 2014 $m | |||||||

| Gross of insurance recoveries |

Insurance recoveries |

Net of insurance recoveries |

Net of insurance

recoveries | |||||

|

Total uninflated and undiscounted cash-flows

|

1,795.2 | 229.3 | 1,565.9 | 1,546.6 | ||||

|

Inflation allowance

|

1,257.5 | 80.5 | 1,177.0 | 1,258.5 | ||||

|

Total inflated and undiscounted cash-flows

|

3,052.7 | 309.8 | 2,742.9 | 2,805.1 | ||||

|

Discounting allowance

|

(656.0) | (56.0) | (600.1) | (934.9) | ||||

|

Net present value liabilities

|

2,396.7 | 253.8 | 2,142.8 | 1,870.2 |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

vi |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

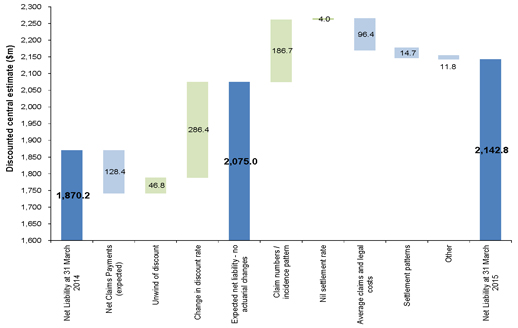

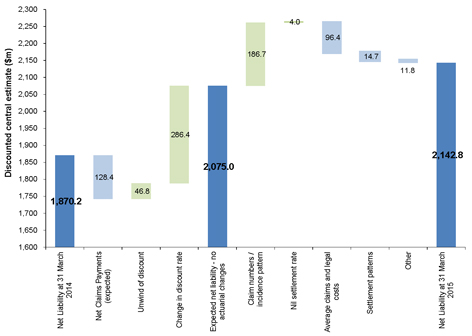

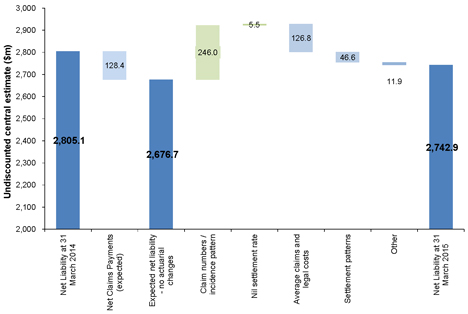

Comparison with previous valuation

In the absence of any change to the claim projection assumptions from our 31 March 2014 valuation, other than allowing for the changes in the discount rate, we would have projected a Discounted Central Estimate liability of $2,075.0m as at 31 March 2015, i.e. an increase of $204.8m from our 31 March 2014 valuation result.

This increase of $204.8m is due to:

| ● | A reduction of $81.6m, being the net impact of expected claims payments (which reduce the liability) and the “unwind of discount” (which increases the liability and reflects the fact that cashflows are now one year nearer and therefore are discounted by one year less). |

| ● | An increase of $286.4m resulting from the significantly lower discount rates prevailing at 31 March 2015 compared with those adopted at 31 March 2014. |

Our liability assessment at 31 March 2015 of $2,142.8m therefore represents an increase of $67.8m, which arises from changes to the claim projection assumptions.

The increase of $67.8m is principally a consequence of:

| ● | An increase in the projected future number of claims for mesothelioma and asbestosis; |

offset by

| ● | Lower average claims sizes and average defence legal cost assumptions for most disease types; |

| ● | Changes to assumed future patterns of claims settlement; and |

| ● | Favourable settlement experience for claims that were pending at 31 March 2014 relative to case estimates established at 31 March 2014. |

The following chart shows an analysis of the change in our liability assessments from 31 March 2014 to 31 March 2015.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

vii |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Figure E.2. Analysis of change in central estimate liability (discounted basis)

Note: Green bars signal that this factor has given rise to an increase in the liability whilst light blue bars signal that this factor has given rise to a reduction in the liability.

The undiscounted liability as of 31 March 2015 has increased from $2,677m (based on the 31 March 2014 valuation) to $2,743m. This represents an increase of $66m.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

viii |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Amended Final Funding Agreement calculations

The Amended Final Funding Agreement sets out the basis on which payments will be made to the AICF Trust.

Additionally, there are a number of other figures specified within the Amended Final Funding Agreement that we are required to calculate. These are:

| ● | Discounted Central Estimate; |

| ● | Term Central Estimate; and |

| ● | Period Actuarial Estimate. |

Table E.5. Amended Final Funding Agreement calculations

| $m | ||

|

Discounted Central Estimate (net of cross-claim recoveries, Insurance and Other Recoveries)

|

2,142.8 | |

| Period Actuarial Estimate (net of cross-claim recoveries, gross of Insurance and Other Recoveries) comprising: | 544.2 | |

|

Discounted value of cashflow in 2015/16

|

171.4 | |

|

Discounted value of cashflow in 2016/17

|

185.0 | |

|

Discounted value of cashflow in 2017/18

|

187.7 | |

| Term Central Estimate (net of cross-claim recoveries, Insurance and Other Recoveries)

|

2,135.3 |

The actual funding amount due at a particular date will depend upon a number of factors, including:

| ● | the net asset position of the AICF Trust at that time; |

| ● | the free cash flow amount of the James Hardie Group in the preceding financial year; and |

| ● | the Period Actuarial Estimate in the latest Annual Actuarial Report. |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

ix |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Uncertainty

Estimates of asbestos-related disease liabilities are subject to considerable uncertainty, significantly more than personal injury liabilities in relation to other causes, such as CTP or Workers Compensation claims.

It should therefore be expected that the actual emergence of the liabilities will vary from any estimate. As indicated in Figure E.3, depending on the actual out-turn of experience relative to that currently forecast, the variation could potentially be substantial.

Thus, no assurance can be given that the actual liabilities of the Liable Entities to be met by the AICF Trust will not ultimately exceed the estimates contained in this Report. Any such variation may be significant.

The uncertainties prevailing at this year-end (and at the previous year-end) are higher than historically observed. This is a consequence of the higher than expected level of mesothelioma claims reporting and the uncertainty this brings in relation to the projection of the future number of mesothelioma claims to be received.

We have performed sensitivity testing to identify the impact of different assumptions upon the size of the liabilities. The different scenarios selected are documented at Section 11.2 of this report.

We have not included a sensitivity test for the impact of changes in discount rates although, as noted in this Report, changes in discount rates can introduce significant volatility to the Discounted Central Estimate result reported at each year-end.

We note that these sensitivity test ranges are not intended to correspond to a specified probability of sufficiency, nor are they intended to indicate an upper bound or a lower bound of all possible outcomes.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

x |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

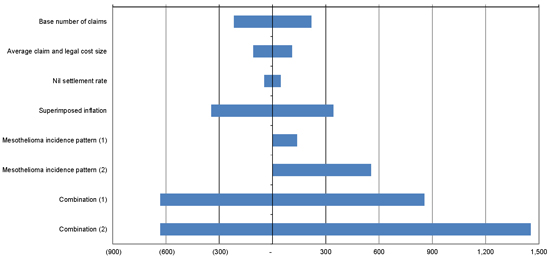

Figure E.3. Sensitivity testing results – Impact around the Discounted Central Estimate (in $m)

The single most sensitive assumption shown in the chart is the timing of the peak period of claims reporting against the Liable Entities. Shifting the assumed period of peak claims reporting by a further 2 years for mesothelioma (i.e. assuming that claim reporting begins to reduce after 2018/19) together with increased claims reporting from 2026/27 onwards could add a further $555m (26%) on a discounted basis (as shown in the above chart by the scenario labelled “mesothelioma incidence pattern (2)”).

Table E.6. Summary results of sensitivity analysis ($m)

| Undiscounted | Discounted | |||

|

Central estimate

|

2,742.9 | 2,142.8 | ||

|

Low Scenario

|

1,860.4 | 1,510.4 | ||

|

High Scenario

|

4,931.1 | 3,596.7 |

Whilst the table above indicates a range around the discounted central estimate of liabilities of -$632m to +$1,454m, the actual cost of liabilities could fall outside that range depending on the actual experience.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

xi |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Data, Reliances and Limitations

We have been provided with the following data by AICFL:

| ● | Claims dataset at 31 March 2015 with individual claims listings; |

| ● | Accounting transactions dataset at 31 March 2015 (which includes individual claims payment details); and |

| ● | Detailed insurance bordereaux information (being a listing of claims filed with the insurers of the Liable Entities) produced by Randall & Quilter Investment Holdings as at 31 March 2015. |

While we have tested the consistency of the various data sets provided, we have not otherwise verified the data nor have we undertaken any auditing of the data at source. We have relied on the data provided as being complete and accurate in all material respects. Consequently, should there be material errors or incompleteness in the data, our assessment could be affected materially.

Executive Summary Not Report

Please note that this executive summary is intended as a brief overview of our Report. To properly understand our analysis and the basis of our liability assessment requires examination of our Report in full.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

xii |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 1 | Scope and Purpose

| |||

| 1.1 | Introduction |

The Amended Final Funding Agreement requires the completion of an Annual Actuarial Report evaluating the potential asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust.

| 1.1.1 | Liable Entities |

The Liable Entities are defined as being the following entities:

| ● | Amaca Pty Ltd (formerly James Hardie & Coy); |

| ● | Amaba Pty Ltd (formerly Jsekarb, James Hardie Brakes and Better Brakes); and |

| ● | ABN60 Pty Ltd (formerly James Hardie Industries Ltd). |

In addition, the liability for Baryulgil claims is deemed to be a liability of Amaca by virtue of the James Hardie (Civil Liability) Act 2005 (NSW). Under Part 4 of that Act, Amaca is liable for “Marlew Asbestos Claims” or “Marlew Contribution Claims” as defined in that Act.

| 1.1.2 | Personal asbestos claims |

Under the Amended Final Funding Agreement, the liabilities to be met by the AICF Trust relate to personal asbestos-related disease liabilities of the Liable Entities.

Such claims must relate to exposure which took place in Australia and which have been brought in a Court in Australia.

The precise scope of the liabilities is documented in Section 1.2 and in Appendix F of this Report.

| 1.1.3 | Purpose of report |

KPMG Actuarial has been retained by AICFL to provide an Annual Actuarial Report as required under the Amended Final Funding Agreement and this is detailed in our Engagement Letter dated 13 November 2014.

The prior written consent of KPMG Actuarial is required for any other use of this Report or the information contained in it.

Our valuation is effective as at 31 March 2015 and has been based on claims data and information as at 31 March 2015 provided to us by AICFL.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

1 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 1.2 | Scope of report |

We have been requested to provide an actuarial assessment as at 31 March 2015 of the asbestos-related disease liabilities of the Liable Entities to be met by the AICF Trust, consistent with the terms of the Amended Final Funding Agreement.

The assessment is on a central estimate basis and is based on the claims experience as at 31 March 2015.

A “central estimate” liability assessment is an estimate of the expected value of the range of potential future liability outcomes. In other words, if all the possible values of the liabilities are expressed as a statistical distribution, the central estimate is an estimate of the mean of that distribution.

It is of note that our liability assessment:

| ● | Relates to the Liable Entities and Marlew (in relation to Marlew Claims arising from asbestos mining activities at Baryulgil). |

| ● | Is intended to cover: |

| - | The amount of settlements, judgments or awards for all Personal Asbestos Claims. |

| - | Claims Legal Costs incurred by the AICF Trust in connection with the settlement of Personal Asbestos Claims. |

| ● | Is not intended to cover: |

| - | Personal injury or death claims arising from exposure to asbestos which took place outside Australia. |

| - | Personal injury or death claims, arising from exposure to Asbestos, which are brought in Courts outside Australia. |

| - | Claims for economic loss, other than any economic loss forming part of an award for damages for personal injury and/or death. |

| - | Claims for loss of property, including those relating to land remediation. |

| - | The costs of asbestos or asbestos product removal relating to asbestos or asbestos products manufactured or used by or on behalf of the Liable Entities. |

| ● | Includes an allowance for: |

| - | Compensation to the NSW Dust Diseases Board or a Workers Compensation Scheme by way of a claim by such parties for contribution or reimbursement from the Liable Entities, but only to the extent that the cost of such claims is within the limits of funding for such claims as outlined within the Amended Final Funding Agreement. |

| - | Workers Compensation claims, being claims from former employees of the Liable Entities, but only to the extent that such liabilities are not met by a Workers Compensation Scheme or Policy (see section 1.2.1). |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

2 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| ● | Assumes that the product and public liability insurance policies of the Liable Entities will continue to respond to claims as and when they fall due. We have not made any allowance for the impact of any disputation concerning Insurance Recoveries, nor for any legal costs that may be incurred in resolving such disputes. |

| ● | Makes no allowance for: |

| - | potential Insurance Recoveries that could be made on product and public liability insurance policies placed from 1986 onwards which were placed on a “claims made” basis. |

| - | the future Operating Expenses of the Liable Entities or the AICF Trust. Separate allowance for future Operating Expenses should be considered by the management of AICFL. |

| - | the inherent uncertainty of the liability assessment. That is, no additional provision (or risk margin) has been included in excess of a central estimate. |

Readers of this Report may refer to our previous reports which are available at www.ir.jameshardie.com.au and www.aicf.org.au.

| 1.2.1 | Workers Compensation |

Workers Compensation claims are claims made by former employees of the Liable Entities. Such past, current and future reported claims were insured with, amongst others, Allianz Australia Limited, QBE and the various State-based Workers Compensation Schemes.

Under the Amended Final Funding Agreement, the part of a future Workers Compensation claim that is met by a Workers Compensation Scheme or Policy of the Liable Entities is outside of the AICF Trust. The AICF Trust is, however, to provide for any part of a claim not covered by a Workers Compensation Scheme or Policy (e.g. as a result of the existence of limits of indemnity and policy deductibles on those policies of insurance).

On this basis our liability assessment in relation to Workers Compensation claims and which relates to the AICF Trust, includes only the amount borne by the Liable Entities in excess of the anticipated recoveries due from a Workers Compensation Scheme or Policy.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

3 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

In making our assessment we have assumed that the Workers Compensation insurance programme will continue to respond to claims by former employees of the Liable Entities as and when they fall due. To the extent that they were not to respond owing to (say) insurer insolvency, Insurer Guarantee Funds may be available to meet such obligations.

| 1.2.2 | Dust Disease Board and Other Reimbursements |

There exists a right under Section 8E (Reimbursement Provisions) of the Dust Diseases Act 1942 for the NSW Dust Diseases Board (“DDB”) to recover certain costs from common law defendants, excluding the employer of the claimant.

This component of cost is implicitly included within our liability assessment as the claims awards made in recent periods and in recent settlements contain allowance for DDB reimbursement where applicable. Furthermore, currently reported open claims have an allowance within their case estimates for the costs of DDB reimbursement where relevant and applicable.

The Amended Final Funding Agreement indicates that the AICF Trust is intended to meet Personal Asbestos Claims and that claims by the DDB or a Workers Compensation Scheme for reimbursement will only be met up to a certain specified limit (aggregated across the DDB and Workers Compensation Schemes), being:

| ● | In the first financial year (2006/07) a limit of $750,000 applied; |

| ● | In respect of each financial year thereafter, that limit is indexed annually in line with the Consumer Price Index. At 31 March 2015, the annual limit is $938,974; |

| ● | There is an overall unindexed aggregate cap of $30m; |

| ● | At 31 March 2015, AICF has paid out $6,648,481 to the DDB. |

The cashflow and liability figures contained within this Report have already removed that component of any reimbursements that will not be met by the AICF Trust owing to the application of these limits and caps.

| 1.2.3 | Baryulgil (“Marlew Claims”) |

“Marlew Asbestos Claims” and “Marlew Contribution Claims” are deemed to be liabilities of Amaca. These claims specifically include:

| ● | Claims made against Amaca Pty Ltd or ABN60 resulting from their past ownership of the mine; and, in the case of Amaca, includes claims made in relation to the joint venture (Asbestos Mines Pty Ltd) established with Wunderlich in 1944 to begin mining at Baryulgil. |

| ● | Claims made against the subsequent owner of the mine (following its sale by James Hardie Industries to Woodsreef in 1976), being Marlew Mining Pty Ltd (“Marlew”) which is in liquidation, are to be met by the AICF Trust except where such claims are Excluded Marlew Claims, which are recoverable by the Claimant from other sources. |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

4 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

These claims are discussed further in Section 5.7.

| 1.2.4 | Risk Margins |

Australian-licensed insurance companies are required to hold, and many non-insurance companies elect to hold, insurance and self-insurance claims provisions at a level above the central estimate basis to reflect the uncertainty attaching to the liability assessment and to include an allowance in respect of that uncertainty.

A risk margin is an additional amount held, above the central estimate, so as to increase the likelihood of adequacy of the provisions to meet the ultimate cost of settlement of those liabilities.

We note that the Amended Final Funding Agreement envisages the ongoing financing of the AICF Trust is to be based on a “central estimate” approach and that the Annual Actuarial Report should provide a Discounted Central Estimate valuation.

Accordingly, we have made no allowance for any risk margins within this Report.

| 1.2.5 | Discounting |

We have determined a Discounted Central Estimate in this Report by discounting (to 31 March 2015) the projected future cashflows using yields on Commonwealth Government Bonds.

Conceptually, the Discounted Central Estimate at 31 March 2015 would normally represent an amount of money which, if fully provided in advance (i.e. as of 31 March 2015) and invested in risk-free assets (such as Commonwealth Government Bonds) of term and currency appropriate to the liabilities, would generate the necessary investment income such that (together with the capital value of those assets) it would be expected to be sufficient to pay for the liabilities as they fall due.

To the extent that the actual investments are:

| ● | of different terms; and/or |

| ● | in different currencies; and/or |

| ● | provide different expected rates of return |

investment profits or losses would emerge.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

5 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

One of the uncertainties in our valuation is the fact that fixed interest Commonwealth Government Bonds do not exist at most of the durations of our cashflow projection.

At 31 March 2015, there were 21 fixed interest Commonwealth Government Bonds on issue (with a face value of approximately $330bn), with 7 of them having maturity dates after 31 March 2025 (with a face value of $77bn). At 31 March 2015, the longest-dated maturity was April 2037.

This means we need to take a long-term view on bond yields that is not measured by market-observable rates of return.

We continue to note that the actual funding mechanism under the Amended Final Funding Agreement only provides for up to three years’ worth of projected Claims and Claims Legal Costs expenditure and one year’s worth of Operating Expenses at any one time.

| 1.3 | Areas of potential exposure |

As identified in Section 1.2, there are other potential sources of claims exposure beyond those directly considered within this Report. However, in a number of cases they are unquantifiable even if they have the potential to generate claims. This is especially the case for those sources of future claim where there has been no evidence of claims to date.

| 1.3.1 | General areas of potential exposure |

Areas of potential changes in claims exposure we have not explicitly allowed for in our valuation include, but are not limited to:

| ● | Future significant individual landmark and precedent-setting judicial decisions; |

| ● | Significant medical advancements; |

| ● | Unimpaired claims, i.e. claims for fear, stress, pure nervous shock or psychological illness. In this regard, we note the 2010/11 decisions by the Supreme Court (in relation to two cases: Tamaresis v Amaca and Galea v Amaca) which indicated that the AICF Trust was not required to meet the cost of nervous shock claims brought by individuals who have not been exposed to asbestos; |

| ● | A change in the basis of compensation for asymptomatic pleural plaques for which no associated physical impairment is exhibited; |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

6 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| ● | A proliferation (compared to past and current levels of activity) of “third-wave” claims, i.e. claims arising as a result of indirect exposure such as home renovation, washing clothes of family members that worked with asbestos, or from workers involved in the removal of asbestos or the demolition of buildings containing asbestos; |

| ● | Changes in legislation, especially those relating to tort reform for asbestos sufferers; |

| ● | Introduction of new, or elimination of existing, heads of damage; |

| ● | Exemplary and aggravated or punitive damages (being damages awarded for personal injuries caused as a result of negligence or reckless conduct); |

| ● | Changes in the basis of apportionment of awards for asbestos-related diseases for claimants who have smoked (we note the decisions in Amaca v Ellis [2010] HCA 5 and Evans v Queanbeyan City Council [2010] NSWDDT 7 which we understand are consistent with the previous decision in Judd v Amaca [2002] NSWDDT 25); |

| ● | Changes to taxation; and |

| ● | Future bankruptcies of other asbestos claim defendants (i.e. other liable manufacturers or distributors). |

Nonetheless, implicit allowance is made in respect of some of these items in the allowance for superimposed inflation included in our liability assessment. Furthermore, to the extent that some of these have emerged in past claims experience, they are reflected in our projections.

| 1.3.2 | New Zealand and other overseas exposures |

We have made no allowance for the risk of further development in relation to New Zealand exposures and the rights of claims from New Zealand claimants in Australian courts (as per Frost vs. Amaca Pty Ltd (2005), NSWDDT 36 although this decision was successfully appealed by Amaca in August 2006) nor for the risk of additional exposures from overseas. This is because, as noted in Section 1.2, the AICF Trust is not required to meet the cost of these claims as they are Excluded Claims.

In relation to claimants where exposures have involved more than one country (e.g. UK and Australia), we have assumed that the AICF Trust will only meet that part of the cost which is attributable to the Australian-related exposure.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

7 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 1.3.3 | Third-wave claims |

We have made allowance for so-called “third-wave” claims. These are defined as claims for personal injury and / or death arising from asbestos exposure during home renovations by individuals or to builders involved in such renovations. Such claims are allowed for within the projections to the extent to which they have arisen to date and to the extent our exposure model factors in these exposures in its projection.

We have not allowed for a significant additional surge in third-wave claims (over and above current levels of activity) in the future arising from renovations, but conversely we have not allowed for a tempering of those third-wave claims already included within our projection as a result of improved education of individuals as to the risks of such home renovations, or of any local Councils or State Governments passing laws in this regard.

It should be noted that claims for the cost of asbestos or asbestos product removal from homes and properties or any claims for economic loss arising from asbestos or asbestos products being within such homes and properties is not required to be met by the AICF Trust.

| 1.4 | Data reliances and limitations |

KPMG Actuarial has relied upon the accuracy and completeness of the data with which it has been provided. KPMG Actuarial has not verified the accuracy or completeness of the data, although we have undertaken steps to test its consistency with data previously received. However, KPMG Actuarial has placed reliance on the data previously received, and currently provided, as being accurate and complete in all material respects.

| 1.5 | Uncertainty |

It must be understood that estimates of asbestos-related disease liabilities are subject to considerable uncertainty.

This is due to the fact that the ultimate disposition of future claims will be subject to the outcome of events that have not yet occurred. Examples of these events, as noted in Section 1.3, include jury decisions, court interpretations, legislative changes, epidemiological developments, medical advancements, public attitudes, potential additional third-wave exposures and social and economic conditions such as inflation.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

8 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Therefore, it should be expected that the actual emergence of the liabilities will vary, perhaps materially, from any estimate. Thus, no assurance can be given that the actual liabilities of the Liable Entities to be met by the AICF Trust will not ultimately exceed the estimates contained herein. Any such variation may be significant.

| 1.6 | Distribution and use |

The purpose of this Report is as stated in Section 1.1.

This Report should not be used for any purpose other than those specified.

This Report will be provided to the Board and management of AICFL. This Report will also be provided to the Board and management of James Hardie, the NSW Government and to Ernst & Young in their capacity as auditors to both James Hardie and AICFL.

We understand that this Report will be filed with the ASX and placed on James Hardie’s website in its entirety.

We understand that this Report will also be placed on AICFL’s website in its entirety.

KPMG Actuarial consents to this Report being made available to the above-mentioned parties and for the Report to be distributed in the manner described above.

To the extent permitted by law, neither KPMG Actuarial nor its Executives, directors or employees will be responsible to any third parties for the consequences of any actions they take based upon the opinions expressed with this Report, including any use of or purported reliance upon this Report not contemplated in Section 1.2. Any reliance placed is that party’s sole responsibility.

Where distribution of this Report is permitted by KPMG Actuarial, the Report may only be distributed in its entirety and judgements about the conclusions and comments drawn from this Report should only be made after considering the Report in its entirety and with necessary consultation with KPMG Actuarial.

Readers are also advised to refer to the “Important Note: Basis of Report” section at the front of the Executive Summary of this Report.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

9 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 1.7 | Date labelling convention used in this Report |

In our analyses throughout this Report (unless otherwise stated), the “year” we refer to aligns with the financial year of AICFL and James Hardie and runs from 1 April to 31 March.

A “2008” notified claim would be a claim notified in the period 1 April 2008 to 31 March 2009. This might also be referred to as “2008/09” or “FY09”.

Similarly, a “2014” claim settlement would be a claim settled in the period 1 April 2014 to 31 March 2015. This might also be referred to as “2014/15” or “FY15”.

| 1.8 | Author of the report |

This Report is authored by Neil Donlevy, an Executive of KPMG Actuarial Pty Ltd, a Fellow of the Institute of Actuaries (London) and a Fellow of the Institute of Actuaries of Australia.

This Report is co-authored by Jefferson Gibbs, an Executive of KPMG Actuarial Pty Ltd, a Fellow of the Institute of Actuaries (London) and a Fellow of the Institute of Actuaries of Australia.

In relation to this Report, the primary regulator for both Neil Donlevy and Jefferson Gibbs is the Institute of Actuaries of Australia.

| 1.9 | Professional standards and compliance |

This Report details a valuation of the outstanding claims liabilities of entities which hold liabilities with features similar to general insurance liabilities as self-insured entities, and which have purchased related insurance protection.

In preparing this Report, we have complied with the Professional Standard 300 of the Institute of Actuaries of Australia (“PS300”), “Valuation of General Insurance Claims”.

However, as we note in Section 1.2, this Report does not include an allowance for the future Operating Expenses of the AICF Trust (which are estimated by AICFL) and nor does it include any allowance for a risk margin to reflect the inherent uncertainty in the liability assessment.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

10 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 1.10 | Control processes and review |

This valuation report and the underlying analyses have been subject to technical review and internal peer review.

The technical review focuses on ensuring that the valuation models and supporting claims experience analyses that are carried out are performed correctly and that the calculations are being correctly applied. The technical review also focuses on ensuring that the data that is being used has been reconciled insofar as possible.

Internal peer review involves a review of the approach, the methods, the assumptions selected and the professional judgments applied.

Both the technical review and internal peer review processes are applied to the Report as well as the valuation models.

| 1.11 | Funding position of the AICF Trust |

This Report does not analyse nor provide any opinion on the current, or prospective, funding position of the AICF Trust, nor of its likely funding needs and its potential use of the loan facility provided by the NSW Government.

This is because to do so within this Report would require consideration, estimation and documentation of the future financial performance of James Hardie.

This Report only provides analysis and opinion on the estimates of the future expenditure to be met by the AICF Trust.

The cashflow estimates contained in this Report assume that all claims against the Liable Entities will continue to be paid in full as and when they fall due.

| 1.12 | Basis of preparation of Report |

We have been advised by the management of AICFL to prepare the Report on a “going concern” basis (i.e. we should assume that AICFL will be able to meet the cost of the liabilities of the Liable Entities as they fall due).

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

11 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| 2 | Data

| |||

| 2.1 | Data provided to KPMG Actuarial |

We have been provided with the following data by AICFL:

| ● | Claims dataset at 31 March 2015 with individual claims listings; |

| ● | Accounting transactions dataset at 31 March 2015 (which includes individual claims payment details); and |

| ● | Detailed insurance bordereaux information (being a listing of claims filed with the insurers of the Liable Entities) produced by Randall & Quilter Investment Holdings as at 31 March 2015. |

We have allowed for the benefits of the product and public liability insurance policies of the Liable Entities based on information provided to us by AICFL relating to the insurance programme’s structure, coverage and layers.

We have also considered the claims data listings which formed the basis of our previous valuation assessments.

The data structures for the claims and accounting databases provided to us by AICFL as of 31 March 2015 are detailed in Appendix E.

| 2.2 | Data limitations |

We have tested the consistency of the various data sets provided to us at different valuation dates. Section 2.3 outlines the nature of the testing undertaken.

However, we have not otherwise verified the data and have instead relied on the data provided as being complete and accurate in all material respects.

We have relied upon the robustness of AICFL’s internal administration and systems as to the completeness of the data provided.

Consequently, should there be material errors or incompleteness in the data, our assessment could also be affected materially.

| 2.3 | Data reconciliation and testing |

We have performed a reconciliation of the data provided at 31 March 2015 with the data provided at 31 March 2014.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

12 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

We have undertaken a number of tests and reconciliations to test the accuracy of the data to the extent possible, noting the limitations outlined above.

| 2.3.1 | Reconciliation with previous valuation’s data |

We have performed a reconciliation of the claims database as at 31 March 2015 with that provided at 31 March 2014. Our findings are:

| ● | Claims notifications: There were no late notifications (claims with a report date prior to 31 March 2014 that were not present in the database at 31 March 2014). In addition, no claims changed notification date between the two databases. |

| ● | Portfolio Category: Four claims changed category. Of these, 3 related to claims reported in 2013/14 and 1 related to 2012/13. |

| ● | Settlement date: No claims changed their settlement date. |

Changing and developing data is not unexpected or to be considered as adverse. Indeed, changing data is common to all claims administration systems. We do not consider the number or extent of the changes noted above to be unreasonable.

| 2.3.2 | Reconciliation of claims settlement amounts between claims and accounting databases |

The accounting database extract contains the following fields:

| ● | Damages – which are gross of cross-claim recoveries; |

| ● | Costs; |

| ● | DDB reimbursements; |

| ● | Other costs; |

| ● | Payments to Medicare; and |

| ● | Defence legal costs. |

The claims database extract contains the following fields:

| ● | Damages – which in some cases are net of cross-claim recoveries, and which in others are gross of cross-claim recoveries. We are able to identify which records are gross of cross-claims recoveries and which records are net of cross-claim recoveries. We have then restated all damages data to be gross of cross-claim recoveries; |

| ● | Costs; |

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

13 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

| ● | DDB reimbursements; |

| ● | Other costs (Consulting costs and payments to Medicare); and |

| ● | Defence legal costs. |

We then mapped the financial data between the two databases into standardised groupings as follows:

Table 2.1: Grouping of financial data from claims and accounting databases

| CLAIMS DATABASE | ACCOUNTING DATABASE | |||||

| Award | Damages (gross of cross-claims) plus DDB reimbursement plus Medicare (from Accounting Database) | Damages plus DDB reimbursements plus Medicare | ||||

| Costs / Other |

Costs plus Other less Medicare (from accounting database) |

Costs plus Consulting |

||||

|

Defence legal costs |

Defence legal costs |

Defence legal costs |

Note: Recovery amounts are available from the accounting database

We have compared the payment records between the claims database and the accounting database from the earliest date to the current file position. Table 2.2 shows the results of this reconciliation for all claim transactions to date.

Table 2.2: Comparison of amounts from claims and accounting databases ($m)

| CLAIMS DATABASE | ACCOUNTING DATABASE | |||||||||

| Damages (gross of recoveries, excluding medicare) | 1,226.6 | Damages (gross of recoveries) | 1,234.0 | |||||||

| Costs |

35.0 | Costs | 35.7 | |||||||

| DDB |

11.3 | DDB | 11.5 | |||||||

| Other (inc Medicare) |

5.8 | Consulting | 2.3 | |||||||

| Medicare | 3.2 | |||||||||

| Defence legal costs |

157.2 | Defence legal costs | 157.5 | |||||||

| Total Value |

1,435.9 | Total Value | 1,444.2 | |||||||

| Standardisation |

||||||||||

| Award plus Medicare plus DDB |

1,241.1 | Award plus Medicare plus DDB | 1,248.7 | |||||||

| Costs / Other |

37.6 | Costs / Other | 38.0 | |||||||

| Defence legal costs |

157.2 | Defence legal costs | 157.5 | |||||||

| Total Value |

1,435.9 | Total Value | 1,444.2 | |||||||

The standardisation is the most relevant comparison because, as noted earlier, the two database extracts allocate the information (particularly in relation to Medicare) in slightly different ways.

| © 2015 KPMG, an Australian partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Printed in Australia. KPMG and the KPMG logo are registered trademarks of KPMG International. |

14 |

|

Valuation of the asbestos-related disease

liabilities of the Liable Entities to be met by the AICF Trust

Effective as at 31 March 2015

21 May 2015

|

Once the standardisation has been undertaken, the two datasets reconcile closely – with reconciliation differences totalling approximately $8.3m or 0.6% (31 March 2014: $7.3m).