INVESTOR

PRESENTATION Australian Investor Day

19 JUNE 2015 Exhibit 99.2 |

INVESTOR

PRESENTATION Australian Investor Day

19 JUNE 2015 Exhibit 99.2 |

PAGE DISCLAIMER 2 FORWARD-LOOKING STATEMENTS This Investor Presentation contains forward-looking statements. James Hardie Industries plc (the “company”) may from time to time

make forward-looking statements in its periodic reports filed with or

furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or

employees to analysts, institutional investors, existing and potential

lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include: • statements about the company’s future performance;

•

projections of the company’s results of operations or financial condition; • statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition,

acquisitions, dispositions and/or its products; •

expectations concerning the costs associated with the suspension or closure of

operations at any of the company’s plants and future plans with respect to any such plants; • expectations concerning the costs associated with the significant capital expenditure projects at any of the company’s plants and future

plans with respect to any such

projects;

• expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or ratios;

• expectations concerning dividend payments and share buy-backs; • statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax

charges; •

statements regarding tax liabilities and related audits, reviews and proceedings;

• expectations about the timing and amount of contributions to Asbestos Injuries Compensation Fund (AICF), a special purpose fund for the

compensation of proven Australian

asbestos-related

personal injury and death claims; •

expectations concerning indemnification obligations;

• expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs;

• statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability,

environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory

matters within current estimates and in anticipation of certain third-party recoveries; and • statements about economic conditions, such as changes in the US economic or housing recovery or changes in the market conditions in the

Asia Pacific region, the levels of

new home construction and

home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and

supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence. |

PAGE DISCLAIMER (continued) 3 Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,”

“estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,”

“continue,” “may,” “objective,” “outlook” and

similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking

statements are qualified in their entirety by reference to the following

cautionary statements. Forward-looking statements are based on the company’s current expectations,

estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and

beyond the company’s control. Such known and unknown risks,

uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements.

These factors, some of which are discussed under “Risk Factors”

in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 21 May 2015, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former company

subsidiaries; required contributions to AICF, any shortfall in AICF and

the effect of currency exchange rate movements on the amount recorded in the company’s financial statements as an asbestos liability; governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product

pricing in the markets in which the company operates; the consequences of

product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential

that competitors could copy the company’s products; reliance on a

small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; the effect of the

transfer of the company’s corporate domicile from the Netherlands to

Ireland, including changes in corporate governance and any potential tax benefits related thereto; currency exchange risks; dependence on customer preference and the concentration of the company’s customer base on large format retail customers,

distributors and dealers; dependence on residential and commercial

construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favorable to the company, or at all; acquisition or sale of businesses and business segments; changes in the

company’s key management personnel; inherent limitations on internal

controls; use of accounting estimates; and all other risks identified in the company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The company cautions you that the foregoing list of factors is not

exhaustive and that other risks and uncertainties may cause actual results

to differ materially from those referenced in the company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results,

events and conditions. The company assumes no obligation to update any

forward-looking statements or information except as required by law. NON-GAAP FINANCIAL INFORMATION This Investor Presentation contains financial measures that are not considered a measure of financial performance under generally accepted

accounting practices in the United States (“US GAAP”) and

should not be considered to be more meaningful than the equivalent US GAAP measure. Management has included such measures to provide investors with an alternative method for assessing its operating results in a manner that is focused on the performance of

its ongoing operations. Additionally, management uses such

non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not prepared in accordance with US GAAP, may not be reported by all of the company’s competitors and may not be directly comparable to similarly

titled measures of competitors due to potential differences in the exact

method of calculation. For additional information regarding the non-GAAP financial measures presented in this Investor Presentation, including a reconciliation of each non-GAAP financial measure to the equivalent US GAAP measure, see the sections

titled “Definition and Other Terms” and “Non-US GAAP

Financial Measures” included in the company’s Management’s Analysis of Results for the fourth quarter and twelve months ended 31 March 2015. |

PAGE AGENDA 4 James Hardie - Australian context Australian market overview Our performance Our focus Growth investment |

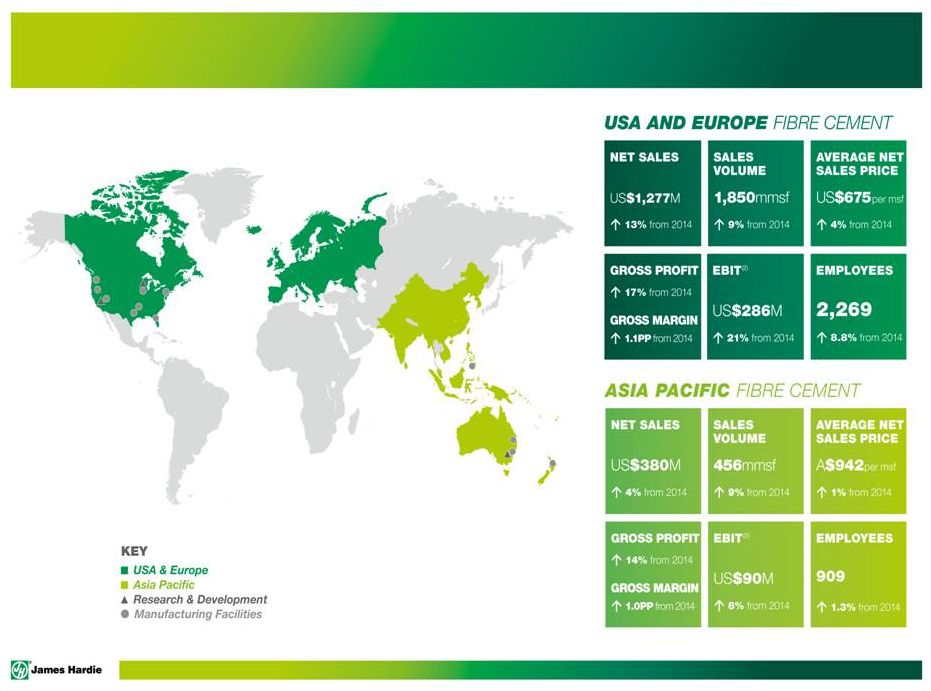

PAGE The Australian business in context 5 5 ² EBIT excludes asbestos,non-recurring stamp duty and New Zealand weathertightness claims |

PAGE We operate in the Australian building and construction market, with focus on buildings where people live and work 6 Renovation Mixed Commercial Attached Medium density Detached |

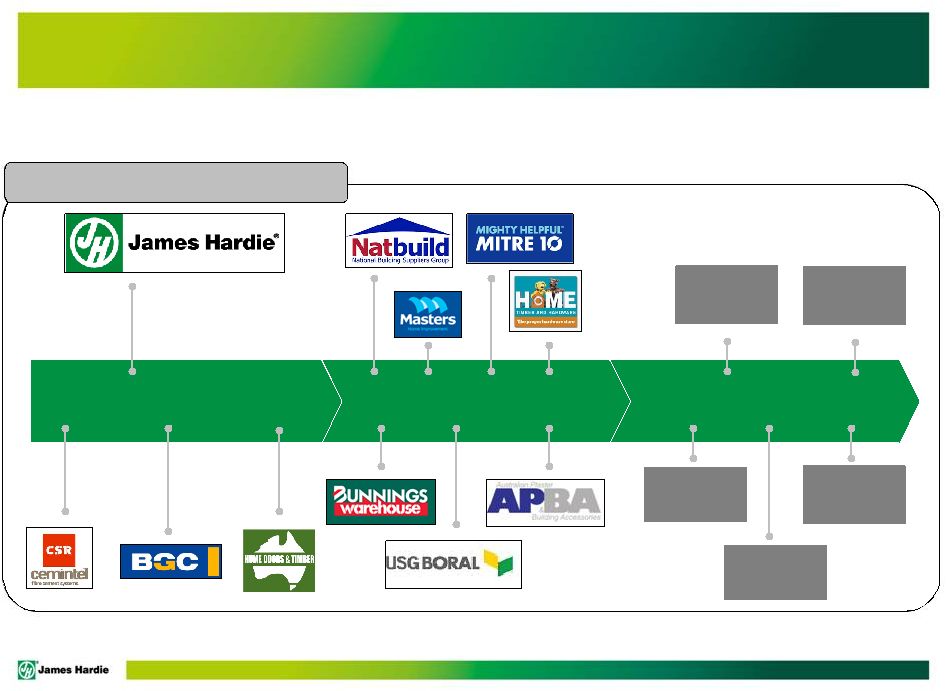

End user

segments Channel

Suppliers & major players Australian Fibre Cement Market We have broad market access through our distribution channel, with propositions targeted to key end user segments Volume builders Medium density Small- medium builder Commercial builder A&A 7 PAGE |

The

Australian building and construction market is in a favourable phase of the

cycle from a James Hardie perspective 8

FY15 relative to FY14 (YOY change) addressable market

Our product portfolio is currently biased to new detached residential

dwellings, medium density and A&A. We are looking for opportunities

to increase our participation in high density.

Detached residential

+17% starts Medium density residential +6% starts High density residential +33% starts A&A - 0.3% by dollars (work done) Commercial (addressable) - 4% by dollars (forecast) - 8 PAGE |

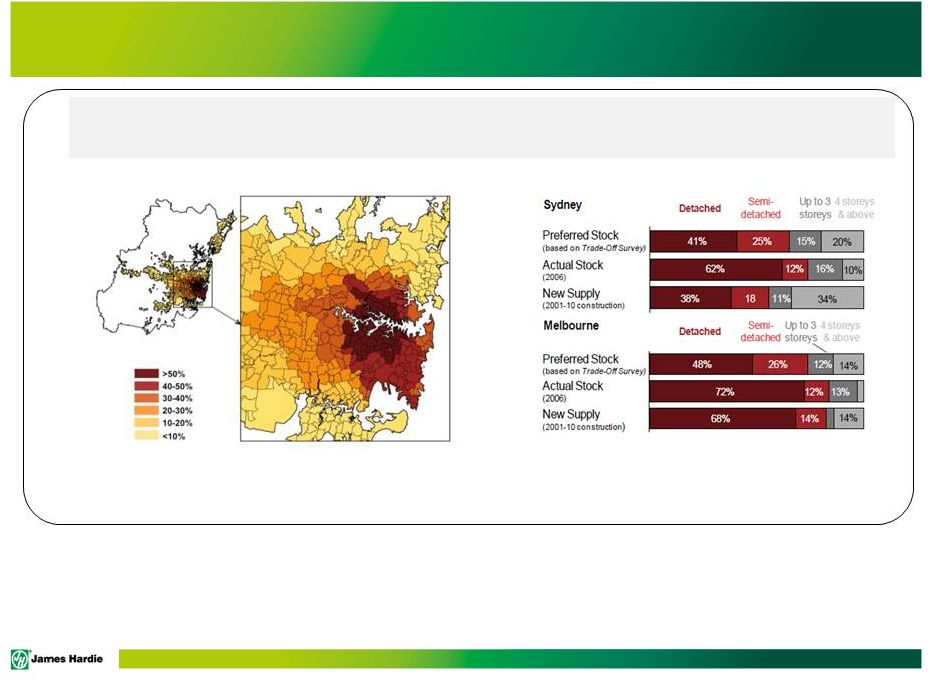

PAGE These two trends are creating the structural change to increased demand for higher density

living. Structural change is occurring in the built form, driven by employment opportunity and lifestyle choices “Cities are shaped by where people live, where they work, and how they get around.”

Jane-Frances Kelly and Peter Mares, Grattan Institute

Percentage of jobs that can be reached in a

45 minute car trip. Sydney, 2011.

Source: Grattan Institute

Discrepancy between available housing stock

and desired housing stock.

Source: Grattan Institute.

9 |

PAGE A range of urban design and built form solutions are emerging to create good quality higher density living An increasing range of housing solutions is being delivered to the market to enable the

living, working and transport preferences.

100 people per hectare

250 people per hectare

300 people per hectare

Source: Urban Taskforce.

10 PAGE |

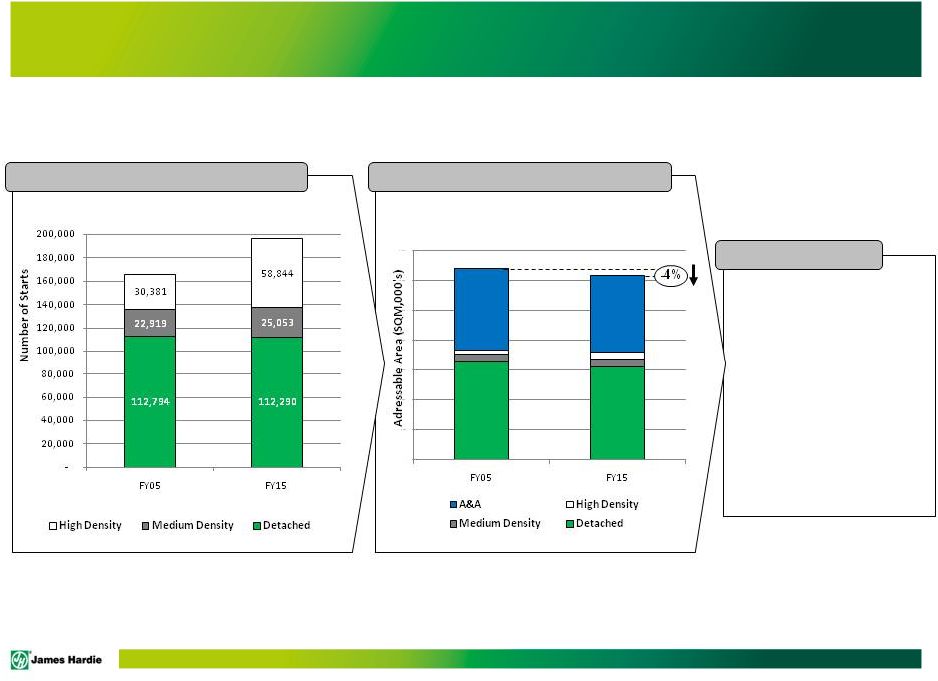

PAGE Increasing density leads to a change to the building material requirements 11 A change in construction starts… Impacts addressable external wall area Source: ABS Source: Abraham Akra – JH Market Analyst • Over the past decade, detached housing starts have been flat, whereas medium and high density have increased by ~ 57% • This trend towards higher density building is impacting the external addressable wall area • The external addressable wall area has decreased by ~4% Insights - - - - - - - |

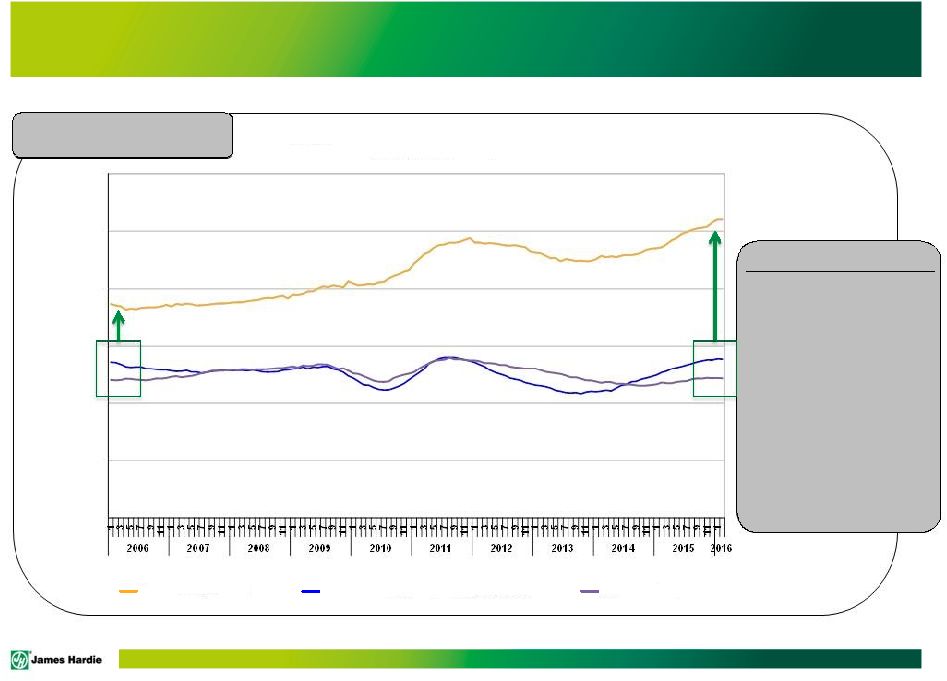

JH Top

Line Growth Top line growth

Insights House price improvements along the east coast is expected to lift A&A activity and JH revenue in FY16 and FY17 Over the past decade, we have grown the business: • Volume increased by 25% • Revenue increased by 40% Achieved in an environment where there has been little net volume change in market size Source: ABS, Abraham Akra. Our long run performance is well above market, in line with a structural shift in demand 12 Fiscal Month Local Top Line Growth, rolling 12 months JH Local Net Revenue Natl Resi Dwelling Approvals (ex High-Den) A&A Approvals PAGE |

PAGE James Hardie go to market Sustainable growth Increased OTW coverage Growth focused tools Targeting the right segments Differentiated products and systems Our demand generation model continues to be a key competitive advantage - James Hardie’s demand driven model has been progressively developed over the past 15 years. - Continuing to deliver above market returns. 13 PAGE |

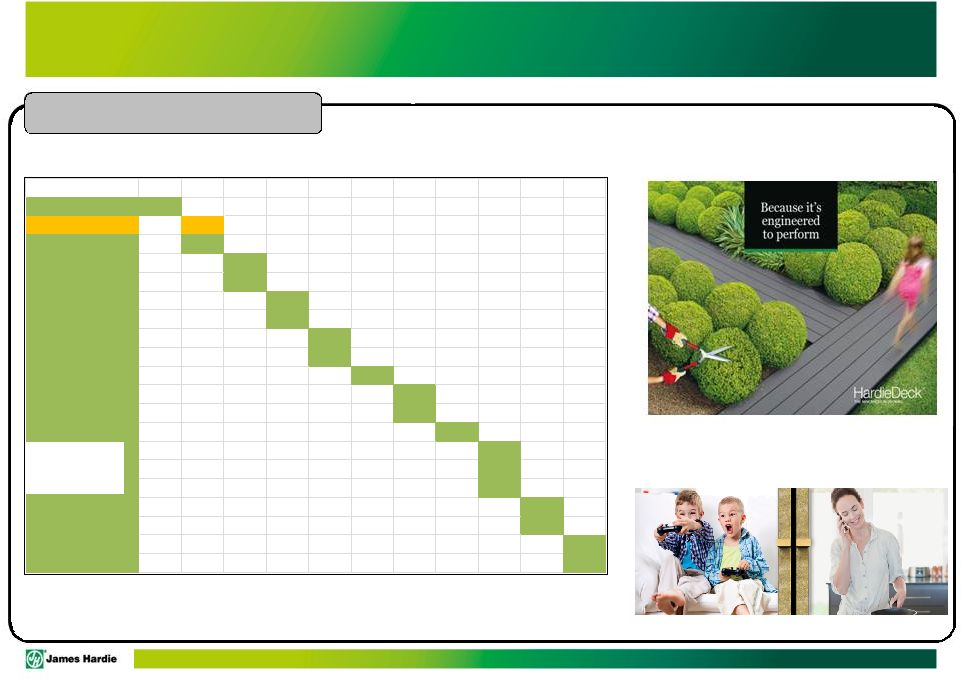

PAGE HardieSmart™ inter-tenancy Recent products launched Coupled with our go-to-market, our investment in product and system innovation continues to drive growth 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Linea™ Scyon™ Axon™ Stria™ Matrix™ Axent™ Trim Secura™ Exterior Secura™ Interior EasyLap™ express PVC joiners Axon™ 400 Stria™ Wide Hardiebreak™ ARChitectural™ Axon™ grained Stria™ splayed Hardiewrap™ Hardiefire™ Stone backer board HardieDeck™ HardieDeck™ 14 |

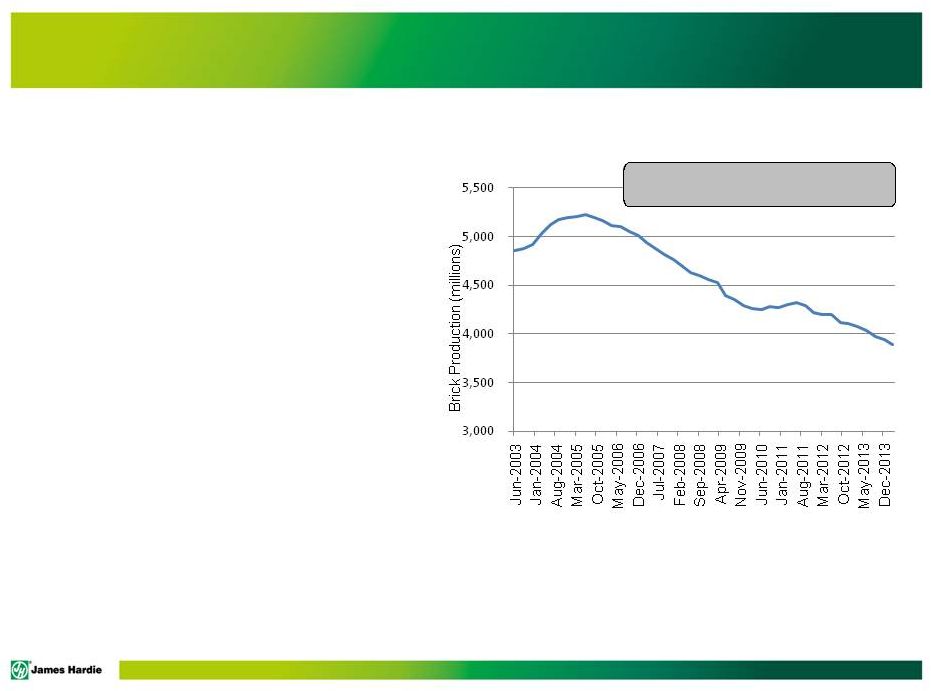

There is

a continued structural shift to modern methods of construction

15 Traditional methods of construction reducing in demand, driven by: – Growth in demand for lightweight solutions – Converting builders from double brick to frame construction – Shift away from detached dwellings to density Brick production: 10 year trend Source: ABS PAGE |

PAGE The Australian capacity utilisation in fibre cement is strong 16 JHX CSR BGC - JH estimate of total fibre cement capacity is 67M STM. - Market capacity utilisation in excess of 90%. - Structural rather than cyclical demand driving utilisation. |

17 We are investing in capacity to support continued market penetration • Phased capital investment of $89M. • Increasing capacity to align with market demand. • Commissioning in line with expectations. 17 PAGE |

Questions? |