Exhibit 99.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended 31 March 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number 1-15240

JAMES HARDIE INDUSTRIES plc

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Ireland

(Jurisdiction of incorporation or organization)

Europa House, Second Floor

Harcourt Centre

Harcourt Street, Dublin 2, Ireland

(Address of principal executive offices)

Natasha Mercer

Corporate Secretary

(Contact name)

353 1411 6924 (Telephone) 353 1479 1128 (Facsimile)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class: |

Name of each exchange on which registered: | |

| Common stock, represented by CHESS Units of Foreign Securities CHESS Units of Foreign Securities American Depositary Shares, each representing five units of CHESS Units of Foreign Securities |

New York Stock Exchange* New York Stock Exchange* New York Stock Exchange |

| * | Listed, not for trading, but only in connection with the registered American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report:

445,680,673 shares of common stock at 31 March 2015

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Note — Checking the box will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | |

| Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP | x |

International Financial Reporting Standards as issued by the International Accounting

| Standards Board | ¨ | |

| Other | ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨ Item 17 ¨ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

2015

ANNUAL REPORT

ON FORM 20-F

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | i | |

|

|

TABLE OF CONTENTS

| Page(s) | |||||

| ii | |||||

| 1 | |||||

| 1 | |||||

| 1 | |||||

| 3 | |||||

| 3 | |||||

| 4 | |||||

| 11 | |||||

| 11 | |||||

| 14 | |||||

| 14 | |||||

| 18 | |||||

| 23 | |||||

| 37 | |||||

| 54 | |||||

| 54 | |||||

| 56 | |||||

| 81 | |||||

| 87 | |||||

| Remuneration of Independent Registered Public Accounting Firm |

126 | ||||

| 127 | |||||

| 127 | |||||

| 143 | |||||

| 145 | |||||

| 147 | |||||

| 147 | |||||

| Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

150 | ||||

| 151 | |||||

| 159 | |||||

| 159 | |||||

| 159 | |||||

| 168 | |||||

| 171 | |||||

| 171 | |||||

| 174 | |||||

| 178 | |||||

| 186 | |||||

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | ii | |

|

|

| Page(s) | |||||

| PART 1 |

|||||

| Item 1. Identity of Directors, Senior Management and Advisers |

Not applicable | ||||

| Item 2. Offer Statistics and Expected Timetable |

Not applicable | ||||

| Item 3. Key Information |

|||||

| A. Selected Financial Data |

1-2 | ||||

| B. Capitalization and Indebtness |

Not applicable | ||||

| C. Reasons for the Offer and Use of Proceeds |

Not applicable | ||||

| D. Risk Factors |

126-141 | ||||

| Item 4. Information on the Company |

|||||

| A. History and Development of the Company |

3-4; 12-13 | ||||

| B. Business Overview |

4-11 | ||||

| C. Organizational Structure |

4; 11 | ||||

| D. Property, Plants and Equipment |

11-14; 78 | ||||

| Item 4A. Unresolved Staff Comments |

None | ||||

| Item 5. Operating and Financial Review and Prospects |

|||||

| A. Operating Results |

61-74 | ||||

| B. Liquidity and Capital Resources |

74-78 | ||||

| C. Research and Development, Patents and Licenses, etc |

9 | ||||

| D. Trend Information |

79-80 | ||||

| E. Off-Balance-Sheet Arrangements |

79 | ||||

| F. Tabular Disclosure of Contractual Obligations |

79-80 | ||||

| G. Safe Harbor |

54-55 | ||||

| Item 6. Directors, Senior Management and Employees |

|||||

| A. Directors and Senior Management |

14-22 | ||||

| B. Compensation |

23-36 | ||||

| C. Board Practices |

37-53 | ||||

| D. Employees |

147 | ||||

| E. Share Ownership |

32-33 | ||||

| Item 7. Major Shareholders and Related Party Transactions |

|||||

| A. Major Shareholders |

171-173 | ||||

| B. Related Party Transactions |

43 | ||||

| C. Interests of Experts and Counsel |

None | ||||

| Item 8. Financial Information |

|||||

| A. Consolidated Statements and Other Financial Information |

81-124; 155-156 | ||||

| B. Significant Changes |

None | ||||

| Item 9. The Offer and Listing |

|||||

| A. Offer and Listing Details |

147-150 | ||||

| B. Plan of Distribution |

Not Applicable | ||||

| C. Markets |

148-149 | ||||

| D. Selling Shareholders |

Not Applicable | ||||

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | iii | |

|

|

FORM 20-F CROSS REFERENCE (continued)

| Page(s) | |||||

| PART 1 (continued) |

|||||

| E. Dilution |

Not Applicable | ||||

| F. Expenses of the Issue |

Not Applicable | ||||

| Item 10. Additional Information |

|||||

| A. Share Capital |

Not Applicable | ||||

| B. Memorandum and Articles of Association |

151-158 | ||||

| C. Material Contracts |

159 | ||||

| D. Exchange Controls |

159 | ||||

| E. Taxation |

159-166 | ||||

| F. Dividends and paying agents |

Not Applicable | ||||

| G. Statement by Experts |

Not Applicable | ||||

| H. Documents on Display |

167 | ||||

| I. Subsidiary Information |

Not Applicable | ||||

| Item 11. Quantitative and Qualitative Disclosures About Market Risk |

168-170 | ||||

| Item 12. Description of Securities Other Than Equity Securities |

|||||

| A. Debt Securities |

Not Applicable | ||||

| B. Warrants and Rights |

Not Applicable | ||||

| C. Other Securities |

Not Applicable | ||||

| D. American Depositary Shares |

149-159 | ||||

| PART II |

|||||

| Item 13. Defaults, Dividend Arrearages and Delinquencies |

None | ||||

| Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds |

None | ||||

| Item 15. Controls and Procedures |

145-146 | ||||

| Item 16A. Audit Committee Financial Expert |

49 | ||||

| Item 16B. Code of Business Conduct and Ethics |

44 | ||||

| Item 16C. Principal Accountant Fees and Services |

126 | ||||

| Item 16D. Exemptions from the Listing Standards for Audit Committees |

None | ||||

| Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

150 | ||||

| Item 16F. Change in Registrant’s Certifying Accountant |

None | ||||

| Item 16G. Corporate Governance |

37-53 | ||||

| Item 16H. Mine Safety Disclosures |

13 | ||||

| PART III |

|||||

| Item 17. Financial Statements |

Not Applicable | ||||

| Item 18. Financial Statements |

81-125 | ||||

| Item 19. Exhibits |

178-185 | ||||

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 1 | |

|

|

James Hardie Industries plc is a world leader in the manufacture of fiber cement siding and backerboard. Our products are used in a number of markets, including new residential construction (single and multi-family housing), manufactured housing, repair and remodeling and a variety of commercial and industrial applications. We manufacture numerous types of fiber cement products with a variety of patterned profiles and surface finishes for a range of applications, including external siding and soffit lining, internal linings, facades and floor and tile underlay. Our current primary geographic markets include the United States of America (“US”, “USA” or the “United States”), Canada, Australia, New Zealand, the Philippines and Europe.

James Hardie Industries plc is a “public limited company,” incorporated and existing under the laws of Ireland. Except as the context otherwise may require, references in this Annual Report on Form 20-F (this “Annual Report”) to “James Hardie,” the “James Hardie Group,” the “Company,” “JHI plc,” “we,” “our” or “us” refer to James Hardie Industries plc., together with its direct and indirect wholly owned subsidiaries as of the time relevant to the applicable reference.

This Annual Report contains statements that constitute “forward-looking statements.” For an explanation of forward-looking statements and the risks, uncertainties and assumptions to which they are subject, see “Section 2 – Reading this Report.” Further, a “Glossary of Abbreviations and Definitions” has also been included under Section 4 of this Annual Report.

The term “fiscal year” refers to our fiscal year ended 31 March of such year; the term “dollars,” “US$” or “$” refers to US dollars; and the term “A$” refers to Australian dollars. For the exchange rates used to convert Australian dollar denominated amounts into US dollars, see Note 2 to our consolidated financial statements in Section 2.

Information contained in or accessible through the websites mentioned in this Annual Report does not form part of this Annual Report unless we specifically state that it is incorporated by reference herein. All references in this report to websites are inactive textual references and are for information only.

We have included in this Annual Report the audited consolidated financial statements of the Company, consisting of our consolidated balance sheets as of 31 March 2015 and 2014, and our consolidated statements of operations and comprehensive income, changes in shareholders’ (deficit) equity and cash flows for each of the years ended 31 March 2015, 2014 and 2013, together with the related notes thereto. The consolidated financial statements included in this Annual Report have been prepared in accordance with accounting principles generally accepted in the US (“US GAAP”).

The selected consolidated financial information summarized below for the five most recent fiscal years has been derived in part from the Company’s financial statements. You should read the selected consolidated financial information in conjunction with the Company’s financial statements and related notes contained in “Section 2 – Consolidated Financial Statements” and with the information provided in “Section 2 – Management’s Discussion and Analysis.” Historic financial data is not necessarily indicative of our future results and you should not unduly rely on it.

| (Millions of US dollars) | ||||||||||||||||||||

| Consolidated Statement of Operations Data | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Net sales |

$ | 1,656.9 | $ | 1,493.8 | $ | 1,321.3 | $ | 1,237.5 | $ | 1,167.0 | ||||||||||

| Income (loss) from operations1 |

291.3 | 99.5 | 45.5 | 604.3 | (347.0 | ) | ||||||||||||||

| Net income (loss)1 |

$ | 291.3 | $ | 99.5 | $ | 45.5 | $ | 604.3 | $ | (347.0 | ) | |||||||||

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 2 | |

|

|

| (Millions of US dollars) | ||||||||||||||||||||

| Consolidated Balance Sheet Data | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Total assets |

$ | 2,044.5 | $ | 2,104.0 | $ | 2,113.2 | $ | 2,310.0 | $ | 1,960.6 | ||||||||||

| Net assets |

(202.6 | ) | (199.0 | ) | 18.2 | 126.4 | (454.5 | ) | ||||||||||||

| Common stock |

$ | 231.2 | $ | 230.6 | $ | 227.3 | $ | 224.0 | $ | 222.5 | ||||||||||

| (Number) | ||||||||||||||||||||

| Shares | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Basic weighted average number of common shares |

445.0 | 442.6 | 439.2 | 436.2 | 435.6 | |||||||||||||||

| Diluted weighted average number of common shares |

446.4 | 444.6 | 440.6 | 437.9 | 435.6 | |||||||||||||||

| (US dollar) | ||||||||||||||||||||

| Earnings Per Share | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Income (loss) from operations per common share — basic |

$ 0.65 | $ 0.22 | $ 0.10 | $ 1.39 | $ (0.80) | |||||||||||||||

| Net income (loss) per common share — basic |

0.65 | 0.22 | 0.10 | 1.39 | (0.80) | |||||||||||||||

| Income (loss) from operations per common share — diluted |

0.65 | 0.22 | 0.10 | 1.38 | (0.80) | |||||||||||||||

| Net income (loss) per common share — diluted |

0.65 | 0.22 | 0.10 | 1.38 | (0.80) | |||||||||||||||

| Dividends declared per share |

0.60 | 0.73 | 0.43 | 0.04 | - | |||||||||||||||

| Dividends paid per share |

$ 0.88 | $ 0.45 | $ 0.43 | $ 0.04 | $ - | |||||||||||||||

| Other Financial Data | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Net cash provided by operating activities |

$ | 179.5 | $ 322.8 | $ 109.3 | $ 387.2 | $ 147.2 | ||||||||||||||

| Net cash used in investing activities (Millions of US dollars) |

(277.9) | (118.8 | ) | (59.7 | ) | (49.9 | ) | (49.6 | ) | |||||||||||

| Net cash used in financing activities (Millions of US dollars) |

$ | (4.6) | $ (186.3 | ) | $ (158.7 | ) | $ (84.4 | ) | $ (89.7 | ) | ||||||||||

| Volume (million square feet) |

||||||||||||||||||||

| USA and Europe Fiber Cement |

1,849.7 | 1,696.9 | 1,488.5 | 1,331.8 | 1,248.0 | |||||||||||||||

| Asia Pacific Fiber Cement2 |

456.2 | 417.2 | 393.7 | 392.3 | 407.8 | |||||||||||||||

| Net Sales (Millions of US dollars) |

||||||||||||||||||||

| USA and Europe Fiber Cement |

$ | 1,276.5 | $1,127.6 | $ 951.4 | $ 862.0 | $ 814.0 | ||||||||||||||

| Asia Pacific Fiber Cement2 |

$ | 380.4 | $ 366.2 | $ 369.9 | $ 375.5 | $ 353.0 | ||||||||||||||

| Average sales price per unit (per thousand square feet) |

||||||||||||||||||||

| USA and Europe Fiber Cement |

US$ | 675 | US$ 652 | US$ 626 | US$ 642 | US$ 648 | ||||||||||||||

| Asia Pacific Fiber Cement2 |

A$ | 942 | A$ 930 | A$ 901 | A$ 906 | A$ 906 | ||||||||||||||

| 1 | Income (loss) from operations and net income (loss) include the following: asbestos adjustments, Asbestos Injuries Compensation Fund (“AICF”) selling, general and administrative (“SG&A”) expenses, Australian Securities and Investments Commission (“ASIC”) related (expenses) recoveries, asset impairment charges, non-recurring stamp duty and New Zealand weathertightness claims expenses. |

| (Millions of US dollars) | ||||||||||||||||||||

| Other Financial Data | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||

| Asbestos adjustments benefit (expense) |

33.4 | (195.8 | ) | (117.1 | ) | (15.8 | ) | (85.8 | ) | |||||||||||

| AICF SG&A expenses |

(2.5 | ) | (2.1 | ) | (1.7 | ) | (2.8 | ) | (2.2 | ) | ||||||||||

| ASIC related (expenses) recoveries |

- | - | (2.6 | ) | (1.1 | ) | 8.7 | |||||||||||||

| Asset impairments |

- | - | (16.9 | ) | (14.3 | ) | - | |||||||||||||

| Non-recurring stamp duty |

(4.2 | ) | - | - | - | - | ||||||||||||||

| New Zealand weathertightness claims3 |

4.3 | (1.8 | ) | (13.2 | ) | (5.4 | ) | - | ||||||||||||

For additional information on asbestos adjustments, AICF SG&A expenses, asset impairment charges, non-recurring stamp duty and New Zealand weathertightness, see “Section 2 – Management’s Discussion and Analysis” and Notes 7, 11 and 14 to our consolidated financial statements in Section 2.

| 2 | Asia Pacific Fiber Cement segment includes all fiber cement manufactured in Australia, New Zealand and the Philippines and sold in Australia, New Zealand, Asia, the Middle East and various Pacific Islands. |

| 3 | The Company began separately disclosing New Zealand weathertightness claims expense in fiscal year 2013 and did so for fiscal year 2012 for comparative purposes only. |

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 3 | |

|

|

History and Development of the Company

James Hardie was established in 1888 as an import business, listing on the Australian Securities Exchange (“ASX”) in 1951 to become a publicly owned company in Australia. After becoming a listed company, we built a diverse portfolio of building and industrial products. In the late-1970s, we pioneered the development of asbestos-free fiber cement technology and in the early-1980’s began designing and manufacturing a wide range of fiber cement building products that made use of the benefits that came from the products’ durability, versatility and strength. Using the technical and manufacturing expertise developed in Australia, we expanded into the United States, opening our first fiber-cement plant at Fontana, California in February 1990.

In September 2001, in order to maximize the benefit of our strong international growth and in order to generate higher returns for shareholders from the James Hardie Group’s continuing international expansion, the shareholders of James Hardie Industries Limited (“JHIL”), then the ultimate parent company of the James Hardie Group and the vehicle with which our shareholding was listed with the ASX, agreed to exchange their shares for shares in James Hardie Industries N.V. (“JHINV”), a Dutch public limited liability company. JHINV retained its primary listing on the ASX, and in October 2001, to reflect the new corporate structure, JHIL transferred all of its fiber cement businesses to JHINV.

In February 2010, our legal name was changed to James Hardie Industries SE when our legal form was converted from a Dutch public limited liability company to a Societas Europaea (“SE”), a European public limited liability company. This was the first stage of a two-stage re-domicile proposal to change our registered corporate domicile from the Netherlands to Ireland. On 17 June 2010, we implemented Stage 2 of the re-domicile and changed our registered corporate domicile to Ireland to become an Irish SE, becoming an Irish tax resident on 29 June 2010. On 15 October 2012, we converted from an Irish SE into our current corporate form, an Irish public limited company (“plc”).

We conduct our operations under legislation in various jurisdictions. As an Irish plc, we are governed by the Irish Companies Acts and we operate under the regulatory requirements of numerous jurisdictions and organizations, including the ASX, ASIC, the New York Stock Exchange (“NYSE”), the United States Securities and Exchange Commission (“SEC”), the Irish Takeover Panel and various other rulemaking bodies.

The address of our registered office in Ireland is Europa House, Second Floor, Harcourt Centre, Harcourt Street, Dublin 2, Ireland (the “Corporate Address”). The telephone number there is +353 1411 6924. Our agent in the United States is CT Corporation. Its office is located at 3 Winners Circle, 3rd Floor, Albany, New York 12205. The address of our registered office in Australia is Level 3, 22 Pitt Street, Sydney NSW 2000 and the telephone number there is +61 28845 3360. Our share registry is maintained by Computershare Registry Services Pty Ltd. All enquires and correspondence regarding holdings should be directed to: Computershare Investor Services Pty Ltd, Level 5, 115 Grenfell Street, Adelaide, SA 5000; telephone: (61 3) 9415 4000, toll free within Australia: 1 300 855 080 or toll free from the US 1855 298 3404.

Our Agreement with Asbestos Injuries Compensation Fund

Prior to 1987, ABN 60 Pty Limited (formerly JHIL) (“ABN 60”) and two of its former subsidiaries, Amaca Pty Limited (“Amaca”) and Amaba Pty Limited (“Amaba”) (together the “Former James Hardie Companies”), manufactured products in Australia that contained asbestos. These products have resulted in liabilities for the Former James Hardie Companies in Australia.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 4 | |

|

|

In February 2007, our shareholders approved the Amended and Restated Final Funding Agreement (“AFFA”) entered into on 21 November 2006 to provide long-term funding to AICF for the compensation of proven Australian-related personal injury claims for which the Former James Hardie Companies are found liable. AICF, an independent trust, subsequently assumed ownership of the Former James Hardie Companies. We do not own AICF, however, we are entitled to appoint three directors, including the Chairman, and the New South Wales (“NSW”) Government is entitled to appoint two directors.

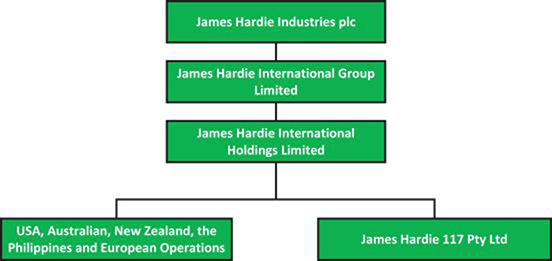

Under the terms of the AFFA, subject to the operation of an annual cash flow cap, James Hardie 117 Pty Ltd (the “Performing Subsidiary”) will make annual payments to AICF. The amount of these annual payments is dependent on several factors, including our free cash flow (as defined in the AFFA), actuarial estimations, actual claims paid, operating expenses of AICF, changes in the AUD/USD exchange rate and the annual cash flow cap. JHI plc owns 100% of the Performing Subsidiary and guarantees the Performing Subsidiary’s obligation. As a result, for purposes of US GAAP, we consider JHI plc to be the primary beneficiary of AICF.

Although we have no legal ownership in AICF, for financial reporting purposes, our interest in AICF is considered variable and we consolidate AICF due to our pecuniary and contractual interests in AICF as a result of the funding arrangements outlined in the AFFA. For additional information on our consolidation of AICF and asbestos-related assets and liabilities, see Note 2 to our consolidated financial statements.

Corporate Structure

The following diagram summarizes our current corporate structure:

General Overview of Our Business

Based on net sales, we believe we are the largest manufacturer of fiber cement products and systems for internal and external building construction applications in the United States, Australia, New Zealand, and the Philippines. We market our fiber cement products and systems under various Hardie brand names, such as HardieBacker® boards, and other brand names such as Artisan® Lap siding and Artisan® Accent Trim by James Hardie, Cemplank® and Prevail® siding and Scyon® advanced lightweight cement composite products such as Scyon® Stria® cladding.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 5 | |

|

|

The breakdown of our net sales by operating segment for each of our last three fiscal years is as follows:

| (Millions of US dollars) | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| USA and Europe Fiber Cement |

$ | 1,276.5 | $ | 1,127.6 | $ | 951.4 | ||||||

| Asia Pacific Fiber Cement |

380.4 | 366.2 | 369.9 | |||||||||

| Total Net sales |

$ | 1,656.9 | $ | 1,493.8 | $ | 1,321.3 | ||||||

Products

We manufacture a wide-range of fiber-cement building materials for both internal and external use across a broad range of applications, including: external siding, internal walls, floors, ceilings, soffits, roofing, lattice, decorative columns, fencing and facades. While there are some market specific products, our core product ranges, being planks, which are used for external siding and flat sheets, which are used for internal and external wall linings and floor underlayments, are sold across all of the markets in which we operate.

Products Used in External Applications

We developed a proprietary technology platform that enables us to produce thicker yet lighter-weight fiber cement products that are generally easier to handle than most traditional building products. Further, we believe that our products provide certain performance, design and cost advantages, while offering comparable aesthetics to competing products such as wood and vinyl siding.

Performance and design advantages:

| • | Our fiber cement products exhibit resistance to the damaging effects of moisture, fire, impact and termites compared to natural and engineered wood and wood-based products; |

| • | Competing products do not duplicate fiber cement aesthetics and the characteristics necessary for effectively accepting paint applications; |

| • | Our fiber cement products provide the ability to imprint designs that closely resemble the patterns and profiles of traditional building materials such as wood and stucco; |

| • | The surface properties of our products provide an effective paint-holding finish, especially when compared to natural and engineered wood products, allowing for greater periods of time between necessary maintenance and repainting; and |

| • | Compared to masonry construction, fiber cement is lightweight, physically flexible and can be cut using readily available tools, making our products more appealing across a broad range of architectural styles, be it of timber or steel-framed construction. |

We believe the benefits associated with our fiber cement products have enabled us to gain a competitive advantage over competing products.

Products Used in Internal Applications

Compared to natural and engineered wood and wood-based products, we believe our product range for internal applications provide the same general advantages provided by our products for external applications. In addition, our fiber cement products for internal applications exhibit less movement in response to exposure to moisture and impact damage than many competing products, providing a more consistent and durable substrate on which to install tiles. Further, we believe our ceramic tile underlayment products exhibit better handling and installation characteristics compared to fiberglass mesh cement boards.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 6 | |

|

|

Significant New Products

In the United States, new products released over the last three years include a new profile HZ10® HardiePlank® siding, HardieTrim® Mouldings, Artisan® V-Rustic premium exterior siding and an improved touch up accessory to support products using ColorPlus® technology.

In Australia and New Zealand, new products released over the last three years include the ARChitectural™ Prefinished panel range for commercial applications, including Invibe® panels with Chromashield® Technology and Inraw® panels.

In Australia only, the HardieBrace®, a new online calculator tool, offers a way to simplify structural bracing calculations. Modcem® modular flooring has provided an entry into commercial flooring applications. Additions to the range of building science offerings include HardieEdge® termite barrier, HardieWrap® weather barrier, HardieFire® Insulation, HardieBreak® Thermal Strip, as well as the HardieSmart® Boundary, Aged Care and ZeroLot Wall Systems. Due to an evolution of the market in Australia, the Scyon® range of products has been repositioned under the James Hardie brand as James Hardie® products including Scyon® technology.

In New Zealand only, over the same timeframe, Secura® Interior Flooring, Secura® Exterior Flooring, Axent™ Fascia, HomeRAB® 4.5mm Pre Cladding, HardieGlaze® Listello and Grande lining, Stria® Cladding, Axon® 400 and 133 Grain Cladding, Linea® Oblique™ Cladding and Easy Lap™ Panel have been launched under the repositioned James Hardie brand.

In the Philippines, new products released over the past three years include the extension of the established Hardieflex™ board range with the inclusion of Hardieflex™ Wet Area lining boards and Hardieflex™ Pro primarily for wet area application and HardieFlex® Flooring.

The European business has launched HardieFloor™ Structural Flooring, and has developed an innovative range of products focused on improving acoustic performance of buildings, including HardieFloor dB™ Structural Acoustic Flooring, and HardieQStrip™ Acoustic Batten.

Principal Markets for Our Products

United States, Canada and Europe

In the US and Canada, the largest application for fiber cement building products is in external siding for the residential building industry, which includes options such as vinyl, stucco, fiber cement, natural and engineered wood and brick, with vinyl having the largest share of the US and Canadian siding markets. External siding typically occupies a significant square footage component of the outside of every building. Selection of siding material is based on installed cost, durability, aesthetic appeal, strength, weather resistance, maintenance requirements and cost, insulating properties and other features. Different regions of the US and Canada show a decided preference amongst siding materials according to economic conditions, weather, materials availability and local preference.

Demand for siding in the US and Canada fluctuates based on the level of new residential housing starts and the repair and remodeling activity of existing homes. The level of activity is generally a function of interest rates and the availability of financing to homeowners to purchase a new home or make improvements to their existing homes, inflation, household income and wage growth, unemployment levels, demographic trends, gross domestic product growth and consumer confidence. The sale of fiber cement products in the US accounts for the largest portion of our net sales, accounting for 75%, 73% and 70% of our total net sales in fiscal years 2015, 2014 and 2013, respectively.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 7 | |

|

|

In the US and Canada, competition in the external siding market comes primarily from substitute products, such as natural or engineered wood, vinyl, stucco and brick. We believe we can continue to increase our market share from these competing products through targeted marketing programs designed to educate customers on our brand and the performance, design and cost advantages of our products.

In Europe, fiber cement building products are used in both residential and commercial building applications in external siding, internal walls, floors, soffits and roofing. We compete in most segments, except roofing, and promote the use of fiber cement products against traditional masonry, gypsum-based products and wood-based products. Since we commenced selling our products in Europe in fiscal year 2004, we have continued to work to grow demand for our products by building awareness among distributors, builders and contractors. Management believes that the growth outlook for fiber cement in Europe is favorable, in light of stricter insulation requirements driving demand for advanced exterior cladding systems, as well as better building practices increasing the use of fiber cement in interior applications.

Asia Pacific

In the Asia Pacific region, we principally sell into the Australian, New Zealand and Philippines markets, with the residential building industry representing the principal market for fiber cement products. The largest applications of fiber cement across our three primary markets are in external siding, internal walls, ceilings, floors, soffits, fences and facades. We believe the level of activity in this industry is generally a function of interest rates, inflation, household income and wage growth, unemployment levels, demographic trends, gross domestic product growth and consumer confidence. Demand for fiber cement building products is also affected by the level of new housing starts and renovation activity.

In Australia, we face competition from two primary competitors with domestic manufacturing facilities, along with increased competition from imports. Additionally, we continue to see competition from natural and engineered wood, wallboard, masonry and brick products.

In New Zealand, we continue to see competition intensifying as fiber cement imports have become more cost competitive and overseas manufacturers look to supplement their primary operating environments with additional markets.

In the Philippines, we have seen fiber cement gain acceptance across a broader range of product applications in the last decade, leading to additional fiber cement products entering the market, along with the increased use of gypsum in fiber cement applications. We see fiber cement having long-term growth potential not only in the Philippines, but across Asia and the Middle East, as the benefits of its light-weight and durability become more widely recognized.

Seasonality

Our earnings are seasonal and typically follow activity levels in the building and construction industry. In the United States, the calendar quarters ending in December and March generally reflect reduced levels of building activity depending on weather conditions. In Australia and New Zealand, the calendar quarter ending in March is usually the quarter most affected by a slowdown due to summer holidays. In the Philippines, construction activity diminishes during the wet season from June through September and during the last half of December due to the slowdown in business activity over the holiday period. Also, general industry patterns can be affected by weather, economic conditions, industrial disputes and other factors. See “Section 3 – Risk Factors.”

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 8 | |

|

|

Raw Materials

The principal raw materials used in the manufacture of our fiber cement products are cellulose fiber (wood-based pulp), silica (sand), Portland cement and water. We have established supplier relationships for all of our raw materials across the various markets in which we operate and we do not anticipate having difficulty in obtaining our required raw materials from these suppliers. The purchase price of these raw materials and other materials can fluctuate depending on the supply-demand situation at any given point in time.

We work hard to reduce the effect of both price fluctuations and supply interruptions by entering into contracts with qualified suppliers and through continuous internal improvements in both our products and manufacturing processes.

Cellulose Fiber

Reliable access to specialized, consistent quality, low cost pulp is critical to the production of fiber cement building materials. As a result of our many years of experience and expertise in the industry, we share our internal expertise with pulp producers in New Zealand, the United States, Canada, and Chile to ensure they are able to provide us with a highly specialized and proprietary formula crucial to the reinforcing cement matrix of our fiber cement products. We have confidentiality agreements with our pulp producers and we have obtained patents in the United States and in certain other countries covering certain unique aspects of our pulping formulas and processes that we believe cannot adequately be protected through confidentiality agreements. However, we cannot be assured that our intellectual property and other proprietary information will be protected in all cases. See “Section 3 – Risk Factors.”

Silica

High purity silica is sourced locally by the various production plants. In the majority of locations, we use silica sand as a silica source. In certain other locations, however, we process quartz rock and beneficiate silica sand to ensure the quality and consistency of this key raw material.

Cement

Cement is acquired in bulk from local suppliers. We continue to evaluate options on agreements with suppliers for the purchase of cement that can lock in our cement prices over longer periods of time.

Water

We use local water supplies and seek to process all wastewater to comply with environmental requirements.

Sales, Marketing and Distribution

The principal markets for our fiber cement products are the United States, Australia, New Zealand, the Philippines, Canada, and in parts of Europe, including the United Kingdom and France. In addition, we have sold fiber cement products in many other markets, including Belgium, China, Denmark, French Caribbean, Germany, Hong Kong, Hungary, India, Indonesia, Ireland, Italy, Malta, Mexico, the Middle East (Israel, Saudi Arabia, Lebanon, and the United Arab Emirates), the Netherlands, Norway, various Pacific Islands, Singapore, South Africa, South Korea, Spain, Sri Lanka, Switzerland, Taiwan, Turkey and Vietnam. Our brand name, customer education in comparative product advantages, differentiated product range and customer service, including technical advice and assistance, provide the basis for our marketing strategy.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 9 | |

|

|

We offer our customers support through a specialized fiber cement sales force and customer service infrastructure in the United States, Australia, New Zealand, the Philippines and Europe. The customer service infrastructure includes inbound customer service support coordinated nationally in each country, and is complemented by outbound telemarketing capability. Within each regional market, we provide sales and marketing support to building products dealers and lumber yards and also provide support directly to the customers of these distribution channels, principally homebuilders and building contractors.

We maintain dedicated regional sales management teams in our major sales territories, with our national sales managers and national account managers, together with regional sales managers and sales representatives, maintaining relationships with national and other major accounts. Our various sales forces, which in some instances manage specific product categories, include skilled trades people who provide on-site technical advice and assistance.

In the United States, we sell fiber cement products for new residential construction predominantly to distributors, which then sell these products to dealers or lumber yards. This two-step distribution process is supplemented with direct sales to dealers and lumber yards as a means of accelerating product penetration and sales. Repair and remodel products in the United States are typically sold through the large home center retailers and specialist distributors. Our products are distributed across the United States and Canada primarily by road and, to a lesser extent, by rail.

In Australia and New Zealand, both new construction and repair and remodel products are generally sold directly to distributor/hardware stores and lumber yards rather than through the two-step distribution process. In the Philippines, a network of thousands of small to medium size dealer outlets sell our fiber cement products to consumers, builders and real estate developers, although in recent years, do-it-yourself type stores have started to enter the Philippines market. The physical distribution of our product in each country is primarily by road or sea transport. Products manufactured in Australia, New Zealand and the Philippines are also exported to a number of markets in Asia, various Pacific Islands, and the Middle East by sea transport.

Despite the fact that distributors and dealers are generally our direct customers, we also aim to increase primary demand for our products by marketing our products directly to homeowners, architects and builders. We encourage them to specify and install our products because of the quality and craftsmanship of our products. This “pull through” strategy, in turn, assists us in expanding sales for our distribution network as distributors benefit from the increasing demand for our products.

Geographic expansion of our fiber cement business has occurred in markets where framed construction is prevalent for residential applications or where there are opportunities to change building practices from masonry to framed construction. Expansion is also possible where there are direct substitution opportunities irrespective of the methods of construction. Our entry into the Philippines is an example of the ability to substitute fiber cement for an alternative product (in this case plywood). With the exception of our current major markets, as well as Japan and certain rural areas in Asia, Scandinavia, and Eastern Europe, most markets in the world principally utilize masonry construction for external walls in residential construction. Accordingly, further geographic expansion depends substantially on our ability to provide alternative construction solutions and for those solutions to be accepted in those markets.

Dependence on Trade Secrets and Research and Development (“R&D”)

We pioneered the successful development of cellulose reinforced fiber cement and, since the early-1980s, have progressively introduced products developed as a result of our proprietary product formulation and process technology. The introduction of differentiated products is one of the core components of our global business strategy. This product differentiation strategy is supported by our significant investment in research and development activities.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 10 | |

|

|

We view spending on research and development as the key to sustaining our existing product leadership position, by providing a continuous pipeline of innovative new products and technologies with sustainable performance and design advantages over our competitors. Further, through our investments in new process technology or by modifying existing process technology, we aim to keep reducing our capital and operating costs and to find new ways to make existing and new products. As such, we expect to continue allocating significant funding to these endeavors. For fiscal years 2015, 2014 and 2013, our expenses for R&D were US$31.7 million, US$33.1 million and US$37.2 million, respectively.

Our current patent portfolio is based mainly on fiber cement compositions, associated manufacturing processes and the resulting products. Our non-patented technical intellectual property consists primarily of our operating and manufacturing know-how and raw material and operating equipment specifications, all of which are maintained as trade secret information. We have enhanced our abilities to effectively create, manage and utilize our intellectual property and have implemented a strategy that increasingly uses patenting, licensing, trade secret protection and joint development to protect and increase our competitive advantage.

In addition, we own a variety of licenses; industrial, commercial and financial contracts; and manufacturing processes. While we are dependent on the competitive advantage that these items provide as a whole, we are not dependent on any one of them individually and does not consider any one of them individually to be material. We do not materially rely on intellectual property licensed from any outside third parties. However, we cannot assure that our intellectual property and other proprietary information will be protected in all cases. In addition, if our research and development efforts fail to generate new, innovative products or processes, our overall profit margins may decrease and demand for our products may fall. See “Section 3 – Risk Factors.”

Governmental Regulation

As an Irish plc, we are governed by the Irish Companies Acts and are also subject to all applicable European Union level legislation. We also operate under the regulatory requirements of numerous jurisdictions and organizations, including the ASX, ASIC, the NYSE, the SEC, the Irish Takeover Panel and various other federal, state, local and foreign rulemaking bodies. See “Section 3 – Memorandum and Articles of Association” for information regarding Irish Companies Acts and regulations to which we are subject.

Environmental, Health and Safety Regulation

Our operations and properties are subject to extensive federal, state, local and foreign environmental protection, health and safety laws, regulations and ordinances governing activities and operations that may have adverse environmental effects. As it relates to our operations, our manufacturing plants produce regulated materials, including waste water and air emissions. The waste water produced from our manufacturing plants is internally recycled and reused before eventually being discharged to publicly owned treatment works, a process which is monitored by us, as well as by regulators. In addition, we actively monitor air emissions and other regulated materials produced by our plants so as to ensure compliance with the various environmental regulations under which we operate.

Some environmental laws provide that a current or previous owner or operator of real property may be liable for the costs of investigation, removal or remediation of certain regulated materials on, under, or in that property or other impacted properties. In addition, persons who arrange, or are deemed to have arranged, for the disposal or treatment of certain regulated materials may also be liable for the costs of investigation, removal or remediation of the regulated materials at the disposal or treatment site, regardless of whether the affected site is owned or operated by such person. Environmental laws often impose liability whether or not the owner, operator, transporter or arranger knew of, or was responsible for, the presence of such regulated materials. Also, third parties may make claims against owners or operators of properties for personal injuries, property damage and/or for clean-up associated with releases of certain regulated materials pursuant to applicable environmental laws and common law tort theories, including strict liability.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 11 | |

|

|

In the past, from time to time, we have received notices of alleged discharges in excess of our water and air permit limits. In each case, and in compliance with our Environmental Policy, we have addressed the concerns raised in those notices, in part, through capital expenditures intended to prevent future discharges in excess of permitted levels and, on occasion, the payment of associated minor fines.

Environmental compliance costs in the future will depend, in part, on continued oversight of operations, expansion of operations and manufacturing activities, regulatory developments and future requirements that cannot presently be predicted.

JHI plc is incorporated and domiciled in Ireland and the table below sets forth our significant subsidiaries, all of which are wholly-owned by JHI plc, either directly or indirectly, as of 30 April 2015.

| Name of Company | Jurisdiction of Establishment |

Jurisdiction of

Tax Residence | ||

| James Hardie 117 Pty Ltd |

Australia | Australia | ||

| James Hardie Aust. Holdings Pty Ltd |

Australia | Ireland | ||

| James Hardie Austgroup Pty Ltd |

Australia | Ireland | ||

| James Hardie Australia Management Pty Ltd |

Australia | Ireland | ||

| James Hardie Australia Pty Ltd |

Australia | Australia | ||

| James Hardie Building Products Inc. |

United States | United States | ||

| James Hardie Europe B.V. |

Netherlands | Netherlands | ||

| James Hardie Finance Holdings 1 Ltd |

Bermuda | Ireland | ||

| James Hardie Finance Holdings 3 Ltd |

Bermuda | Ireland | ||

| James Hardie Holdings Ltd |

Ireland | Ireland | ||

| James Hardie International Finance Ltd |

Ireland | Ireland | ||

| James Hardie International Group Ltd |

Ireland | Ireland | ||

| James Hardie International Holdings Ltd |

Ireland | Ireland | ||

| James Hardie New Zealand |

New Zealand | New Zealand | ||

| James Hardie NZ Holdings |

New Zealand | New Zealand | ||

| James Hardie North America Inc. |

United States | United States | ||

| James Hardie Philippines Inc. |

Philippines | Philippines | ||

| James Hardie Technology Ltd |

Bermuda | Ireland | ||

| James Hardie U.S. Investments Sierra LLC |

United States | United States | ||

| RCI Holdings Pty Ltd |

Australia | Australia |

Property, Plants and Equipment

We believe we have some of the largest and lowest cost fiber cement manufacturing plants across the United States, Australia and New Zealand, with our plants servicing both domestic and export markets. Our plants are ideally located to take advantage of established transportation networks, allowing us to distribute our products into key markets, while also providing easy access to key raw materials.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 12 | |

|

|

Manufacturing Capacity

At 31 March 2015, we had manufacturing facilities at the following locations:

| 1 | The calculated annual design capacity is based on management’s historical experience with our production process and is calculated assuming continuous operation, 24 hours per day, seven days per week, producing 5/16” medium density product at a targeted operating speed. No accepted industry standard exists for the calculation of our fiber cement manufacturing facility design and utilization capacities. |

| 2 | Estimated commission in fiscal year 2017. |

| 3 | The lease for our Waxahachie location expires on 31 March 2020, at which time we have an option to purchase the facility. |

| 4 | We suspended production at our Blandon, Pennsylvania and Summerville, South Carolina locations in November 2007 and November 2008, respectively. In the fourth quarter of fiscal year 2015, we began actively marketing the Blandon location for sale, and at the time of this Annual Report, we anticipate completing a sale and disposition of the property during the first half of fiscal year 2016. At the time of this Annual Report, no decision has been made on the future of the Summerville location. |

| 5 | In December 2014, we completed the purchase of the land and buildings previously leased at our Rosehill, New South Wales facility. |

| 6 | The Auckland leases expire on 22 March 2016, at which time we have an option to renew the leases for two further terms of 10 years expiring in March 2036. There is no option to purchase at the expiration of the lease. |

| 7 | The land on which our Philippines fiber cement plant is located is owned by Ajempa Holding Inc. (“Ajempa”), a related party. Ajempa is 40% owned by our operating entity, James Hardie Philippines Inc., and 60% owned by the James Hardie Philippines Retirement Fund. James Hardie Philippines Inc. owns 100% of the fixed assets on the land owned by Ajempa |

| 8 | The Meeandah lease expires on 23 March 2019, and contains options to renew for two further terms of 10 years expiring in March 2039. The current annual design capacity for the Meeandah facility is 50 thousand tons of reinforced concrete pipes per year. On 6 May 2015, we entered into a conditional sale agreement to sell our Australian concrete pipes business. At the date of this Annual Report, the sale is still subject to the satisfactory completion of various contract conditions, but is expected to close in the first half of fiscal year 2016. |

Based on the design capacities of our various fiber cement manufacturing facilities, for the year ended 31 March 2015, we had an annual flat sheet design capacity of 3,230 mmsf and 520 mmsf in the United States and Asia Pacific, respectively. It is important to note that annual design capacity does not necessarily reflect the actual capacity utilization rates of our manufacturing facilities, with actual utilization affected by factors such as demand, product mix, batch size, plant availability and production speeds. For fiscal 2015, actual capacity utilization across our plants was an average of 65% and 84% in the United States and Asia Pacific, respectively.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 13 | |

|

|

Mines

We lease silica quartz mine sites in Tacoma, Washington, Reno, Nevada and Victorville, California. The lease for our quartz mine in Tacoma, Washington expires in February 2018 (with options to renew). The lease for our silica quartz mine site in Reno, Nevada expires in January 2019. The lease for our silica mine site in Victorville, California expires in June, 2015. Further, we own rights to an additional property in Victorville, California, however, as of 30 April 2015, we have not begun to mine this site.

As a mine operator, we are required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), and rules promulgated by the SEC implementing that section of the Dodd-Frank Act, to provide certain information concerning mine safety violations and other regulatory matters concerning the operation of our mines. During fiscal year 2015, we did not receive any notices, citations, orders, legal action or other communication from the US Department of Labor’s Mine Safety and Health Administration that would necessitate additional disclosure under Section 1503(a) of the Dodd-Frank Act.

Capital Expenditures

We utilize a mix of operating cash flow and debt facilities to fund our capital expenditure projects and investments, and expect to incur significant capital expenditures through fiscal year 2017 with a focus on capacity expansion projects at existing plants, the refurbishment and re-commissioning of idled production assets and the development of new locations in anticipation of a continued improvement in our operating environment. Additionally, we continuously invest in equipment maintenance and upgrades to ensure continued environmental compliance and operating effectiveness of our plants. The following table sets forth our capital expenditures for the three most recent fiscal years:

| (Millions of US dollars) | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| USA and Europe Fiber Cement |

$ | 165.3 | $ | 72.4 | $ | 43.2 | ||||||

| Asia Pacific Fiber Cement |

94.4 | 40.7 | 10.7 | |||||||||

| R&D and Corporate |

16.5 | 2.3 | 7.2 | |||||||||

| Total Capital Expenditure |

$ | 276.2 | $ | 115.4 | $ | 61.1 | ||||||

Significant active capital expenditures

At 31 March 2015, the following significant capital expenditure projects remain in progress:

| Project Description | Approximate Investment (US millions) |

Investment to date (US millions) |

Project Start Date |

Expected Commission Date |

Expected Capacity Increase1 | |||||||||

| Plant City - 4th sheet machine |

$ | 70.5 | $ | 62.0 | Q4 FY14 | FY17 | 9% | |||||||

| Cleburne - 3rd sheet machine |

$ | 37.0 | $ | 31.1 | Q4 FY14 | FY17 | 6% | |||||||

| Carole Park - Capacity expansion |

$ | 80.1 | $ | 76.9 | Q1 FY14 | First Half FY16 | 40% | |||||||

| 1 | The expected capacity increase is based on management’s historical experience with our production process and is calculated assuming continuous operation, 24 hours per day, seven days per week, producing 5/16” medium density product at a targeted operating speed. It does not take into account factors such as product mix with varying thickness and density, batch size, plant availability and production speeds. |

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 14 | |

|

|

Significant completed capital expenditure projects

Following is a list of significant capital expenditure projects we have invested in over the three most recent fiscal years:

| Project Description | Total Investment (US Millions) |

Fiscal Year

of Expenditure | ||||

| Carol Park land and building purchase and capacity expansion |

$ | 76.9 | FY14 / FY15 | |||

| Plant City sheet machine #4 |

$ | 62.0 | FY14 / FY15 | |||

| Fontana Plant re-commisioning |

$ | 49.0 | FY13 - FY15 | |||

| Rosehill land and buildings |

$ | 37.5 | FY15 | |||

| Cleburne sheet machine #3 |

$ | 31.1 | FY14 / FY15 | |||

| Tacoma land and buildings |

$ | 28.3 | FY15 | |||

Capital Divestitures

During the three most recent fiscal years, we did not make any material capital divestitures. However, on 6 May 2015, we entered into a conditional sale agreement to sell our Australian concrete pipes business. At the date of this Annual Report, the sale is still subject to the satisfactory completion of various contract conditions, but is expected to close in the first half of fiscal year 2016. We do not consider the disposition of the pipes business a material divestiture or a strategic shift in the nature of our operations. Additionally, in the fourth quarter of fiscal year 2015, we executed a conditional sale agreement to sell our Blandon, Pennsylvania location, where production was suspended in November 2007. We expect to complete the sale of this property in the first half of fiscal year 2016.

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

Our management is overseen by our executive team, whose members cover the key areas of fiber cement research and development, production, manufacturing, investor relations, finance and legal.

Members of our executive team at 30 April 2015 (in alphabetical order) are:

Joe Blasko BSFS, JD

General Counsel

Age 48

|

Joe Blasko joined James Hardie as General Counsel in June 2011. Mr Blasko reports to the Company’s Chief Executive Officer (“CEO”).

Before joining James Hardie, Mr Blasko was Assistant General Counsel, and later, the General Counsel at Liebert Corporation, an Emerson Network Power Systems company and wholly-owned subsidiary of Emerson Electric Co. In his four years with Liebert/Emerson, Mr Blasko was responsible for establishing the legal department in Columbus, Ohio, managing and overseeing all legal matters and working closely with the executive management team. | |

| In this role, Mr Blasko also had global responsibilities which required expertise across multiple jurisdictions. | ||

From 2004 to 2006, Mr Blasko was Associate General Counsel at The Scotts Miracle-Gro Company, serving as the effective “general counsel” to numerous corporate divisions within the organization. From 1997 to 2004, Mr Blasko gained considerable regulatory and litigation expertise working at Vorys, Sater, Seymour and Pease LLP in Ohio.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 15 | |

|

|

Mr Blasko has a Juris Doctor from Case Western Reserve University in Cleveland, Ohio, USA and a Bachelor of Science in Foreign Service from Georgetown University, USA, with a specialty in International Relations, Law and Organizations.

Mark Fisher BSc, MBA

Executive General Manager – International

Age 44

|

Mark Fisher joined James Hardie in 1993 as a Production Engineer. Since then, he has worked for the Company as Finishing Manager, Production Manager and Product Manager at various locations; Sales and Marketing Manager; and as General Manager of our Europe Fiber Cement business. Mr Fisher was appointed Vice President — Specialty Products in November 2004, then Vice President — Research & Development in December 2005. In February 2008, his role was expanded to cover Engineering & Process Development. |

In January 2010, he was appointed Executive General Manager – International, responsible for the Company’s non-US businesses in Australia, New Zealand, Philippines and Europe and the Company’s windows business.

Mr Fisher has a Bachelor of Science in Mechanical Engineering and an MBA from University of Southern California, USA.

Sean Gadd BEng, MBA

Executive General Manager – Northern Division

Age 42

|

Sean Gadd joined James Hardie in 2004 as a Regional Engineering Manager for the Asia Pacific business, and progressed to Plant Manager for both the Carole Park and Rosehill facilities in Australia. Mr Gadd then moved to the US in 2006 to take the role of Manufacturing Manager for Trim and various manufacturing facilities across the US.

In 2009 he ran the US trim business for James Hardie with responsibility for both Manufacturing and Sales, followed by a brief assignment leading Supply Chain. In 2011, Mr Gadd was promoted to the role of Vice President of Sales for the Western USA and Canada. |

Over the next year, his role was expanded to include the Midwest and Northeast of the USA.

Mr Gadd was appointed Executive General Manager in September 2013 with full P&L responsibility for the Northern Division.

Mr Gadd has a Bachelor of Engineering in Manufacturing Management and an Executive MBA from the Australian Graduate School of Management, Australia.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 16 | |

|

|

Louis Gries BSc, MBA

Chief Executive Officer

Age 61

|

Louis Gries joined James Hardie as Manager of the Fontana fiber cement plant in California in February 1991 and was appointed President of James Hardie Building Products, Inc. in December 1993. Mr Gries became Executive Vice President — Operations in January 2003, responsible for operations, sales and marketing in our businesses in the Americas, Asia Pacific and Europe.

He was appointed Interim CEO in October 2004 and became CEO in February 2005. In April 2012, the Company announced that effective June 2012, Mr Gries would again assume responsibility for managing the US business. |

Before he joined James Hardie, Mr Gries worked for 13 years for USG Corp, including a variety of roles in research, plant quality and production, and product and plant management.

Mr Gries has a Bachelor of Science in Mathematics from the University of Illinois, USA and an MBA from California State University, Long Beach, USA.

Matthew Marsh BA, MBA

Chief Financial Officer

Age 40

|

Matthew Marsh joined James Hardie as Chief Financial Officer (“CFO”) in June 2013. As CFO he oversees the company’s overall financial activities, including accounting, tax, treasury, performance and competitor analysis, internal audit and financial operations. Mr Marsh is also responsible for the company’s technology and information systems.

After a 16-year career at General Electric Company (“GE”), Mr Marsh brings a strong background in financial management. Before joining James Hardie, Mr Marsh most recently served as CFO of GE Healthcare’s IT business. Prior to being named CFO of GE Healthcare IT, Mr Marsh oversaw | |

| the finance operations for GE Healthcare’s US Healthcare Systems and US Diagnostic Imaging businesses. | ||

Prior to those appointments Mr Marsh travelled globally with the GE Internal Audit Staff gaining extensive experience in several industries including appliances, information services, distribution and supply, aviation, plastics, financial services, capital markets and health care, across more than twenty countries. Mr Marsh has graduated from GE’s Financial Management Program (FMP).

Mr Marsh has a Bachelor of Arts in Economics and Public Affairs from Syracuse University, USA and an MBA from University of Chicago’s Booth School of Business, USA.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 17 | |

|

|

Sean O’Sullivan BA, MBA

Vice President — Investor & Media Relations

Age 49

|

Sean O’Sullivan joined James Hardie as Vice President — Investor & Media Relations in December 2008. For the eight years prior to joining James Hardie, Mr O’Sullivan was Head of Investor Relations at St. George Bank, where he established and led the investor relations function.

Mr O’Sullivan’s background includes thirteen years as a fund manager for GIO Asset Management, responsible for domestic and global investments. During this period, he spent time on secondment with a McKinsey and Co. taskforce that completed a major study into the Australian financial services industry. Mr O’Sullivan’s final position at GIO was General Manager | |

| of Diversified Investments where his responsibilities included determining the asset allocation for over A$10 billion in funds under management. After leaving GIO, Mr O’Sullivan worked for Westpac Banking Corporation in funds management sales. | ||

Mr O’Sullivan has a Bachelor of Arts in Economics from Sydney University, Australia and an MBA from Macquarie Graduate School of Management, Australia.

Ryan Sullivan BSc, MS, MBA

Executive General Manager – Southern Division

Age 41

|

Ryan Sullivan joined James Hardie in 2004 as the ColorPlus Manufacturing Manager. Since then, he has worked for the Company as Director of Global R&D and Engineering Services and Director of North America Supply Chain. In 2012, he became Director of the ColorPlus Business Unit, with product line responsibility for the North American ColorPlus business. In 2013, he was appointed to the James Hardie Management Team as Executive General Manager of the Southern Division with full P&L responsibility. |

Before joining James Hardie, Mr Sullivan was a senior manager at Marconi Communications where he held numerous positions and had global responsibility. He has also worked in the fields of nuclear power and advanced robotics.

Mr Sullivan has a Bachelor of Science in Mechanical Engineering with a minor in Engineering Design from Carnegie Mellon University, USA, a Masters of Science in Electrical Engineering from the University of Pittsburgh, USA and an MBA from the University of Pittsburgh Katz School, USA.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 18 | |

|

|

James Hardie’s directors have widespread experience, spanning general management, finance, law, marketing and accounting. Each director also brings valuable international experience that assists with James Hardie’s growth.

Members of the Board of Directors as at 31 March 2015 are:

Michael Hammes BS, MBA

Age 73

|

Michael Hammes was elected as an independent non-executive director of James Hardie in February 2007. He was appointed Chairman of the Board in January 2008 and is a member of the Audit Committee, the Remuneration Committee and the Nominating and Governance Committee.

Experience: Mr Hammes has extensive commercial experience at a senior executive level. He has held a number of executive positions in the medical products, hardware and home improvement, and automobile sectors, including CEO and Chairman of Sunrise Medical, Inc. (2000-2007), Chairman and CEO of Guide Corporation (1998-2000), Chairman and CEO of Coleman Company, Inc. (1993-1997), Vice Chairman of Black & Decker Corporation (1992-1993) and | |

| various senior executive roles with Chrysler Corporation (1986-1990) and Ford Motor Company (1979-1986). | ||

Directorships of listed companies in the past five years: Current – Director of Navistar International Corporation (since 1996); Director of DynaVox Mayer-Johnson (listed in April 2010).

Other: Resident of the United States.

Last elected: August 2014

Term expires: August 2017

Donald McGauchie AO

Age 65

|

Donald McGauchie joined James Hardie as an independent non-executive director in August 2003 and was appointed Acting Deputy Chairman in February 2007 and Deputy Chairman in April 2007. He is Chairman of the Nominating and Governance Committee.

Experience: Mr McGauchie has wide commercial experience within the food processing, commodity trading, finance and telecommunication sectors. He also has extensive public policy experience, having previously held several high-level advisory positions to the Australian Government. |

Directorships of listed companies in the past five years: Current – Chairman (since 2010) and Director (since 2010) of Australian Agricultural Company Limited; Chairman (since 2010) and Director (since 2003) of Nufarm Limited; Director of GrainCorp Limited (since 2009); Former – Chairman of Telstra Corporation Limited (2004-2009).

Other: Chairman of Australian Wool Testing Authority (since 2005) and Director since 1999; Former Director of The Reserve Bank of Australia (2001-2011); resident of Australia.

Last elected: August 2013

Term expires: August 2016

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 19 | |

|

|

Brian Anderson BS, MBA, CPA

Age 64

|

Brian Anderson was appointed as an independent non-executive director of James Hardie in December 2006. He is Chairman of the Audit Committee and a member of the Remuneration Committee.

Experience: Mr Anderson has extensive financial and business experience at both executive and board levels. He has held a variety of senior positions, with thirteen years at Baxter International, Inc., including Corporate Vice President of Finance, Senior Vice President and Chief Financial Officer (1997-2004) and, more recently, Executive Vice President and Chief Financial Officer of | |

| OfficeMax, Inc. (2004-2005). Earlier in his career, Mr Anderson was an Audit Partner of Deloitte & Touche LLP (1986-1991). | ||

Directorships of listed companies in the past five years: Current – Chairman (since 2010) and Director (since 2005) of A.M. Castle & Co.; Director of PulteGroup (since 2005); Director of W.W. Grainger, Inc. (since 1999); Former Lead Director of W.W. Grainger, Inc. (2011-2014).

Other: Resident of the United States.

Last elected: August 2012

Term expires: August 2015

Russell Chenu BCom, MBA

Age 65

|

Russell Chenu was appointed as a non-executive director of James Hardie in August 2014. He is a member of the Remuneration Committee.

Experience: Russell Chenu joined James Hardie as Interim CFO in October 2004 and was appointed CFO in February 2005. He was elected to the Company’s Managing Board at the 2005 Annual General Meeting (“AGM”), re-elected in 2008 and continued as a member of the Managing Board until it was dissolved in June 2010. As CFO, he was responsible for accounting, treasury, taxation, corporate finance, information technology and systems, and procurement. Mr Chenu | |

| retired as CFO in November 2013. | ||

Mr Chenu is an experienced corporate and finance executive who held senior finance and management positions with a number of Australian publicly-listed companies. In a number of these senior roles, he was engaged in significant strategic business planning and business change, including several turnarounds, new market expansions and management leadership initiatives.

Mr Chenu has a Bachelor of Commerce from the University of Melbourne and an MBA from Macquarie Graduate School of Management, Australia.

Directorships of listed companies in the past five years: Current – Director of Leighton Holdings Limited (since 2014); Director of Metro Performance Glass Limited (since 2014).

Other: Resident of Australia

Last elected: August 2014

Term expires: August 2017

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 20 | |

|

|

David D. Harrison BA, MBA, CMA

Age 68

|

David Harrison was appointed as an independent non-executive director of James Hardie in May 2008. He is Chairman of the Remuneration Committee and a member of the Audit Committee.

Experience: Mr Harrison is an experienced company director with a finance background, having served in corporate finance roles, international operations and information technology during 22 years with Borg Warner/General Electric Co. His previous experience includes ten years at Pentair, Inc., as Executive Vice President and Chief Financial Officer (1994-1996 and 2000-2007) and Vice President and Chief Financial Officer roles at Scotts, Inc. and Coltec Industries, Inc. (1996-2000). | |

Directorships of listed companies in the past five years: Current – Director of National Oilwell Varco (since 2003); Former – Director of Navistar International Corporation (2007-2012).

Other: Resident of the United States.

Last elected: August 2013

Term expires: August 2016

Andrea Gisle Joosen MSc, BSc

Age 51

|

Andrea Gisle Joosen was appointed as an independent non-executive director of James Hardie in March 2015. She is a member of the Audit Committee.

Experience: Ms Gisle Joosen is an experienced former executive with extensive experience in marketing, brand management and business development across a range of different consumer businesses. Her former roles include chief executive of Boxer TV Access AB in Sweden and managing director (Nordic region) of Panasonic, Chantelle AB and Twentieth Century Fox. Her early career involved several senior marketing roles with Procter & Gamble and Johnson & Johnson. |

Directorships of listed companies in the past five years: Current – Director of BillerudKorsnas AB (since 2015); Director of Dixons Carphone plc (since 2014); Director of ICA Gruppen AB (since 2010); Former – Director of Dixons Retail plc (2012-2013).

Other: Director of Mr Green AB (since 2015); Director of Neopitch AB (since 2004) and Lighthouse Group AB (since 2015); resident of Sweden.

Last elected: Ms Gisle Joosen will be standing for election at the August 2015 AGM.

|

|

||

| James Hardie 2015 Annual Report on Form 20-F | 21 | |

|

|

Alison Littley BA, FCIPS

Age 52

|

Alison Littley was appointed as an independent non-executive director of James Hardie in February 2012. She is a member of the Audit Committee and the Remuneration Committee.

Experience: Ms Littley has substantial experience in multinational manufacturing and supply chain operations, and she brings a strong international leadership background building effective management teams and third party relationships. She has held a variety of positions, most recently as Chief Executive of Buying Solutions, a UK Government Agency responsible for procurement of goods and services on behalf of UK government and public sector bodies (2006-2011). She has previously held senior management roles in Diageo plc (1999-2006) and Mars, |

Inc. (1981-1999). She serves on the Board of Weightmans LLP, a UK law firm and TG Eakin Ltd, a medical device company.

Directorships of listed companies in the past five years: None.

Other: Resident of the United Kingdom.

Last elected: August 2012

Term expires: August 2015

James Osborne BA Hons, LLB

Age 66

|

James Osborne was appointed as an independent non-executive director of James Hardie in March 2009. He is a member of the Nominating and Governance Committee.

Experience: Mr Osborne is an experienced company director with a strong legal background and a considerable knowledge of international business operations in North America and Europe. His career includes 35 years with the leading Irish law firm, A&L Goodbody, in roles which included opening the firm’s New York office in 1979 and serving as the firm’s managing partner (1982-1994). He has served as a consultant to the firm since 1994. Mr Osborne also contributed to the |

listing of Ryanair in London, New York and Dublin and continues to serve on Ryanair’s board.

Directorships of listed companies in the past five years: Current – Director of Ryanair Holdings plc (since 1996); Former – Chairman of Independent News & Media (2011-2012), Chairman of Newcourt Group plc (2004-2009).