Southern

Markets Update September 2015

Exhibit 99.7 |

Southern

Markets Update September 2015

Exhibit 99.7 |

PAGE DISCLAIMER FORWARD-LOOKING STATEMENTS This Investor Presentation contains forward-looking statements. James Hardie Industries plc (the “company”) may from time to time

make forward-looking statements in its periodic reports filed with or

furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or employees to

analysts, institutional investors, existing and potential lenders,

representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

• statements about the company’s future performance; • projections of the company’s results of operations or financial condition; • statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products; • expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans

with respect to any such plants; •

expectations concerning the costs associated with the significant capital expenditure projects at any of the company’s plants and future plans with respect to any such projects; • expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or

ratios; •

expectations concerning dividend payments and share buy-backs;

• statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax

charges; •

statements regarding tax liabilities and related audits, reviews and

proceedings; •

expectations about the timing and amount of contributions to Asbestos Injuries

Compensation Fund (AICF), a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims; • expectations concerning indemnification obligations; • expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs;

• statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability,

environmental, intellectual property and competition law matters) and to

resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and • statements about economic conditions, such as changes in the US economic or housing recovery or changes in the market conditions in the Asia Pacific region, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange

rates, and builder and consumer confidence.

|

PAGE DISCLAIMER (continued) Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,”

“estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,”

“outlook” and similar expressions are intended to identify

forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference

to the following cautionary statements. Forward-looking statements are

based on the company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results,

performance or achievements expressed, projected or implied by these

forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 21 May 2015, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products

that contained asbestos by current and former company subsidiaries;

required contributions to AICF, any shortfall in AICF and the effect of currency exchange rate movements on the amount recorded in the company’s financial statements as an asbestos liability; governmental loan facility to AICF; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other

legal proceedings; general economic and market conditions; the supply and

cost of raw materials; possible increases in competition and the potential that competitors could copy the company’s products; reliance on a small number of customers; a customer’s inability to pay; compliance with and changes in environmental and health and safety laws; risks of

conducting business internationally; compliance with and changes in laws

and regulations; the effect of the transfer of the company’s corporate domicile from the Netherlands to Ireland, including changes in corporate governance and any potential tax benefits related thereto; currency exchange risks; dependence on customer preference and the concentration of the company’s

customer base on large format retail customers, distributors and dealers;

dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; possible inability to renew credit facilities on terms favorable to the company, or at all; acquisition or sale of businesses and business segments; changes in the

company’s key management personnel; inherent limitations on internal

controls; use of accounting estimates; and all other risks identified in the company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The company cautions you that the foregoing list of factors is not exhaustive and that other risks and

uncertainties may cause actual results to differ materially from those

referenced in the company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the company’s current expectations concerning future results, events and conditions. The company assumes no obligation to update any forward-looking

statements or information except as required by law.

|

PAGE AGENDA • South Division Review • Growth / PDG Initiatives • Marketing & Customer Experience • Interiors 4 |

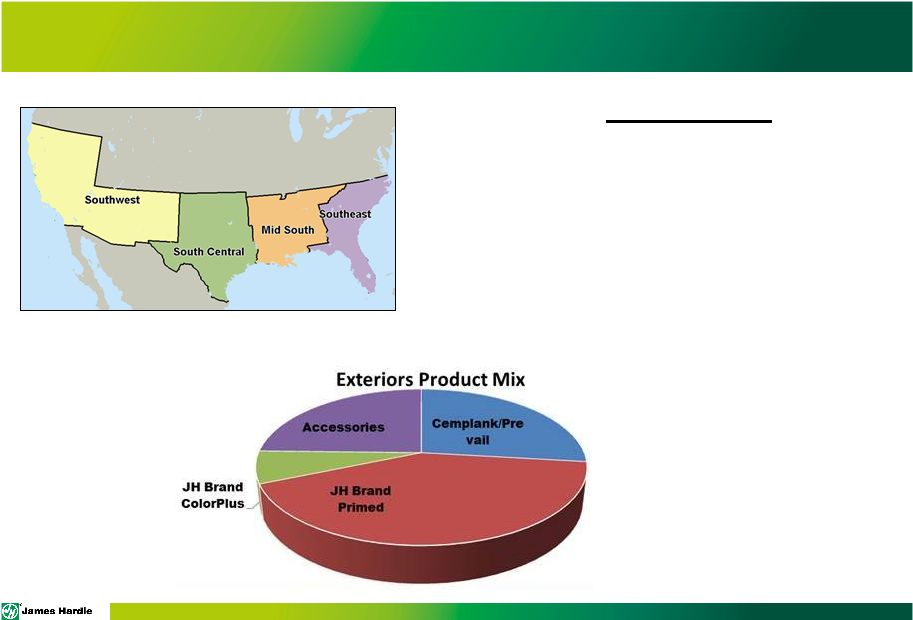

PAGE SOUTH DIVISION AT A GLANCE 5 Quick Facts Manufacturing Employees: ~640 Sales Employees: ~100 FY15 Volume: ~970 mmsf FY15 Revenue: $754M ~60% of North American Volume ~80% Exteriors vs Interiors ~85% Single Family vs Multi Family |

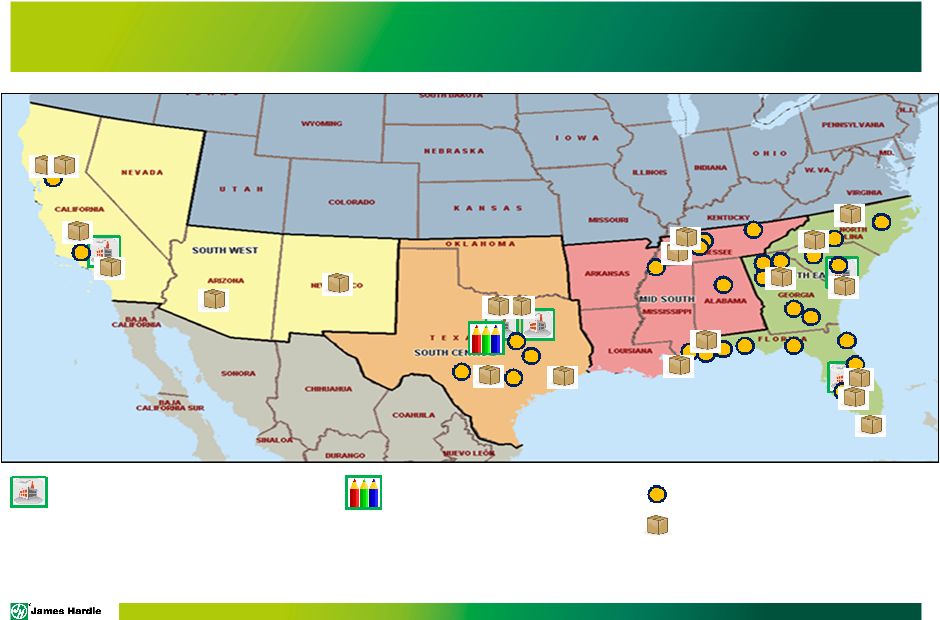

PAGE SOUTH MANUFACTURING & RELOAD NETWORK HZ10 Manufacturing Facility ColorPlus ® Products Facility VMI Distribution Center Big Box Distribution Center 6 |

PAGE KEYS TO OPERATIONAL STRATEGY • Safety • Customer service delivery • Capacity ahead of demand • Network redundancy • Labor efficiency and operational excellence SOUTH DIVISION MANUFACTURING PLANT KEY CAPABILITIES Fontana, CA Sheet Machines: 4’ wide, 5’ wide Low Density Production Primary products: Panel, Backer Key Imports: Trim, Heritage®, Artisan® and ColorPlus® Products Plant City, FL Sheet Machines: 4’ wide, 5’ wide Primary Products: Panel, Plank, Trim Key Imports: Backer, Heritage®, Artisan®, Vented Soffit and ColorPlus® Products Cleburne, TX Sheet Machines: 5’ wide Low Density Production Single Sourced Capacity: HLD Trim Primary products: Trim, Backer, Plank Key Imports: Heritage® & Artisan® Waxahachie, TX Sheet Machines: 4’ wide and 5’ wide Primary products: Panel, Plank, Soffit Key Imports: Backer, Heritage®, Artisan® 7 |

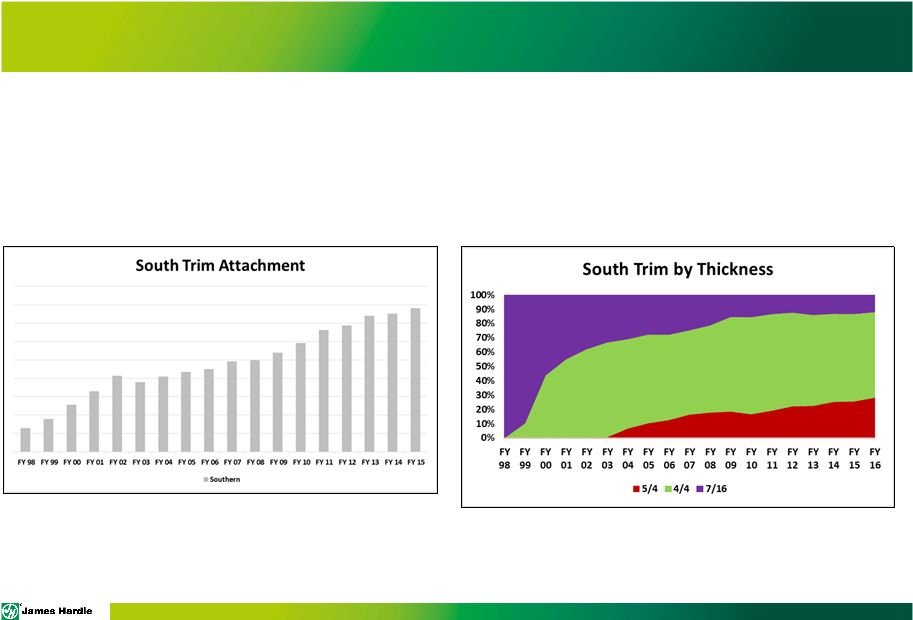

PAGE GROWTH AGAINST WOOD - TRIM TRIM ATTACHMENT TO SIDING CONTINUES TO BE A CORE FOCUS AND GROWTH DRIVER FOR THE SOUTH DIVISION 8 |

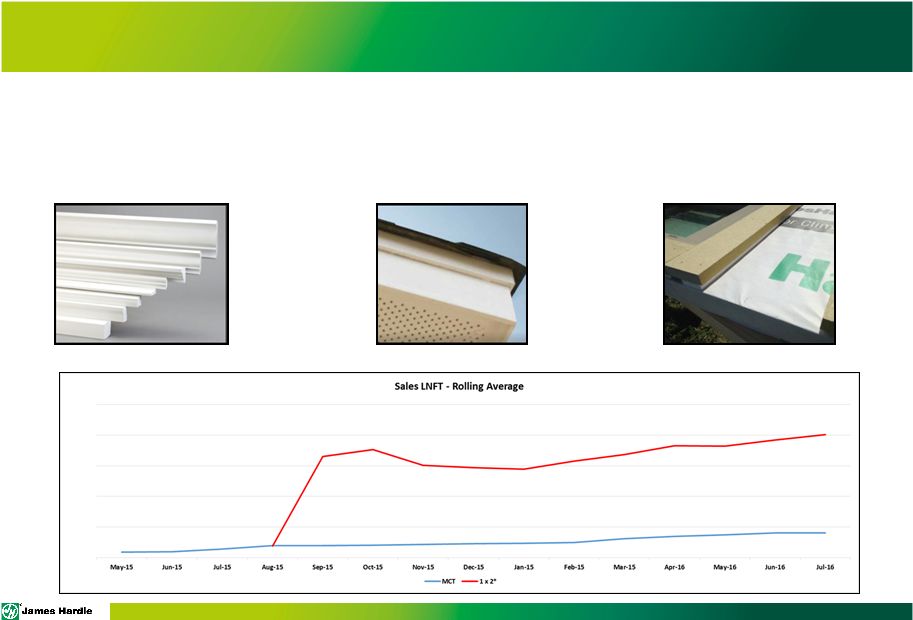

PAGE GROWTH AGAINST WOOD – NEW TRIM PRODUCTS We have expanded our new trim technologies across numerous markets to increase the size of the addressable market for trim. 9 Mouldings 1x2 Foam-Back Trim |

PAGE GROWTH AGAINST WOOD - CAROLINAS TRIM TRANSITION In Q3 FY16 the Carolinas market will transition to a new technology trim finished in our Plant City, FL facility, which enables: - Better Product - No Back-Grooves - Installs Easier - Improved Service Position - Better Capacity Utilization 10 |

PAGE GROWTH AGAINST WOOD – ARTISAN V RUSTIC 11 Artisan V Rustic was launched into the California market in 2014, providing key learning & development in manufacturing and in how to market to fragmented “Top of Market” customers. |

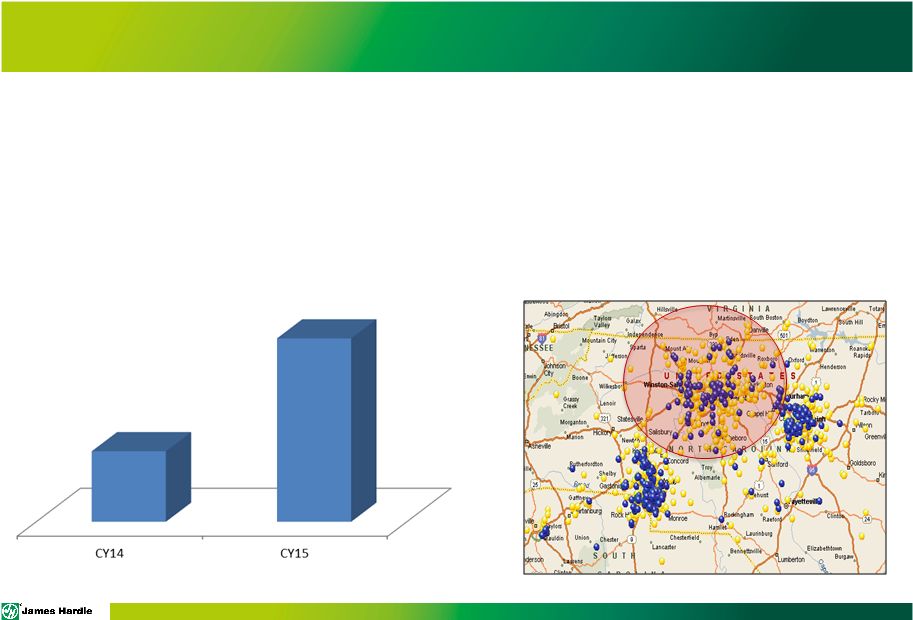

PAGE CONTRACTOR ALLIANCE PROGRAM A successful launch of the RR Contractor Alliance Program has resulted in more contractors, more sold jobs, and higher engagement in the program. 12 |

PAGE GROWTH AGAINST VINYL – AMBASSADOR PROGRAM The Ambassador Program has expanded into new geographies and we have leveraged our leads to acquire new contractor partners. 13 # Participating Contractors Ambassador Generated Leads |

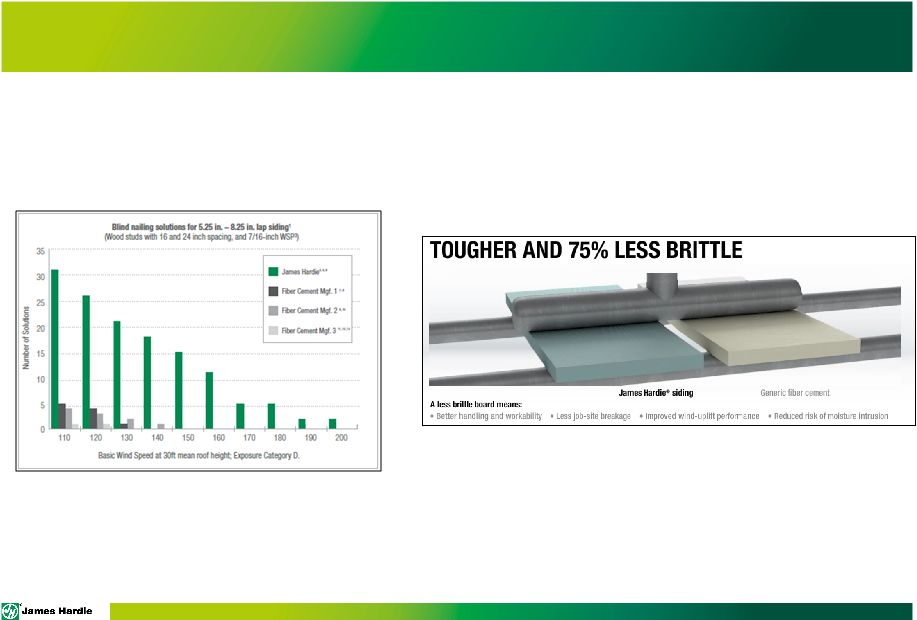

PAGE Growth Against Fiber Cement and Chip Board Our multi-brand strategy remains key to providing the right products to the right customers. 14 In FY15 we increased investments in promoting our product performance advantages over generic fiber cement and chip board. |

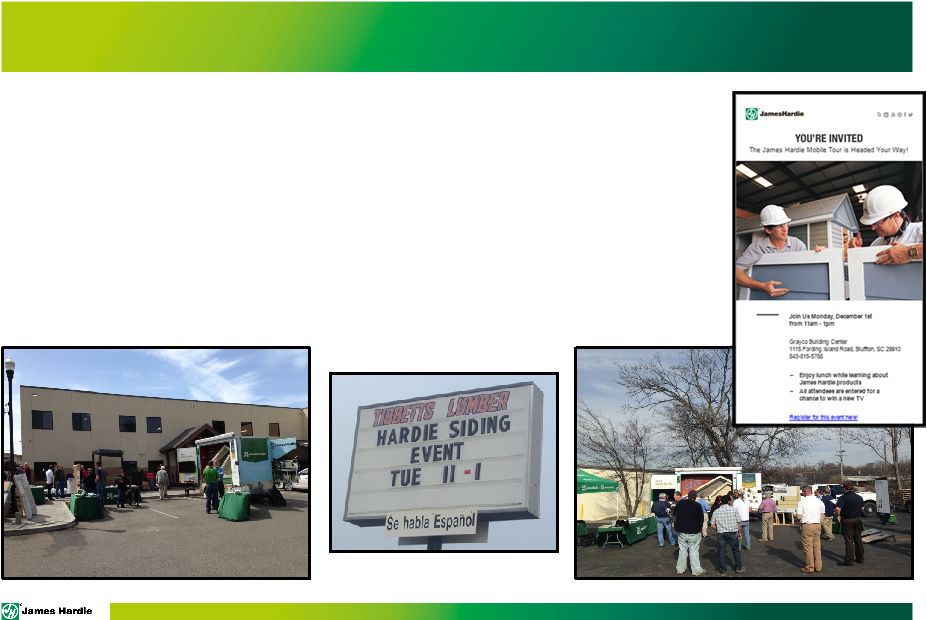

PAGE FRAGMENTED CUSTOMER MARKETING Investments in inside sales and customer aggregation events (mobile tours) have yielded: - Increased lead generation in fragmented markets - Improved customer experiences - Increased sales / conversions 15 |

PAGE 100% HARDIE The 100% Hardie Program offers concierge-style marketing services to builders who utilize a full-wrap product solution. 16 Services include: - Welcome kits - Co-branded model home marketing tools - PR Announcements - Advertising – Web / Print / Billboard - Parade of Homes support - Video Production - Customized Offerings |

PAGE CUSTOMER EXPERIENCE Our annual survey of customer experience across our distribution channel showed strong progress in almost all areas, especially in areas weighted most important by customers. 17 FY14 FY15 YOY FY14 FY15 YOY Product Quality 4.3 4.6 0.3 On Time & Complete Delivery 3.7 4.1 0.4 Financial Return 2.8 3.3 0.5 Product Quality 4.1 4.4 0.3 Trust-Based Relationship 3.2 3.6 0.4 Product Availability 3.5 4.1 0.7 On Time & Complete Delivery 3.2 3.8 0.7 Responsiveness 3.6 3.9 0.4 Product Availability 3.2 4.1 0.9 Trust-Based Relationship 3.4 3.7 0.4 Responsiveness 3.3 3.7 0.4 Ease of Doing Business 3.3 3.8 0.5 Ease of Doing Business 2.8 3.5 0.7 Financial Return 3.1 3.5 0.5 Cost of Doing Business 2.8 3.4 0.6 Lead Times 3.5 4.0 0.5 Growth 3.8 3.9 0.1 Cost of Doing Business 3.3 3.6 0.3 Dealer Distributor FY14 FY15 YOY FY14 FY15 YOY Product Quality 4.3 4.6 0.3 On Time & Complete Delivery 3.7 4.1 0.4 Financial Return 2.8 3.3 0.5 Product Quality 4.1 4.4 0.3 Trust-Based Relationship 3.2 3.6 0.4 Product Availability 3.5 4.1 0.7 On Time & Complete Delivery 3.2 3.8 0.7 Responsiveness 3.6 3.9 0.4 Product Availability 3.2 4.1 0.9 Trust-Based Relationship 3.4 3.7 0.4 Responsiveness 3.3 3.7 0.4 Ease of Doing Business 3.3 3.8 0.5 Ease of Doing Business 2.8 3.5 0.7 Financial Return 3.1 3.5 0.5 Cost of Doing Business 2.8 3.4 0.6 Lead Times 3.5 4.0 0.5 Growth 3.8 3.9 0.1 Cost of Doing Business 3.3 3.6 0.3 Dealer Distributor |

PAGE MARKETING Our new website (launched Nov 2014) and more aggressive digital marketing has driven improvement in our digital presence. 18 |

PAGE MARKETING 19 |

PAGE MARKETING – CAMPAIGN EXAMPLE To raise awareness of James Hardie’s performance advantage in high-wind markets, a multi-media marketing campaign was launched. 20 Tactics - Direct Sales Education & Promotion - TV – Ads & Consumer Interest Stories - Customer E-Communication - 3 rd Party Sponsorships - PR - Digital Advertising - Print Advertising |

PAGE INTERIORS • Market Overview • JH Value Proposition and Market Position • Execution and Results 21 |

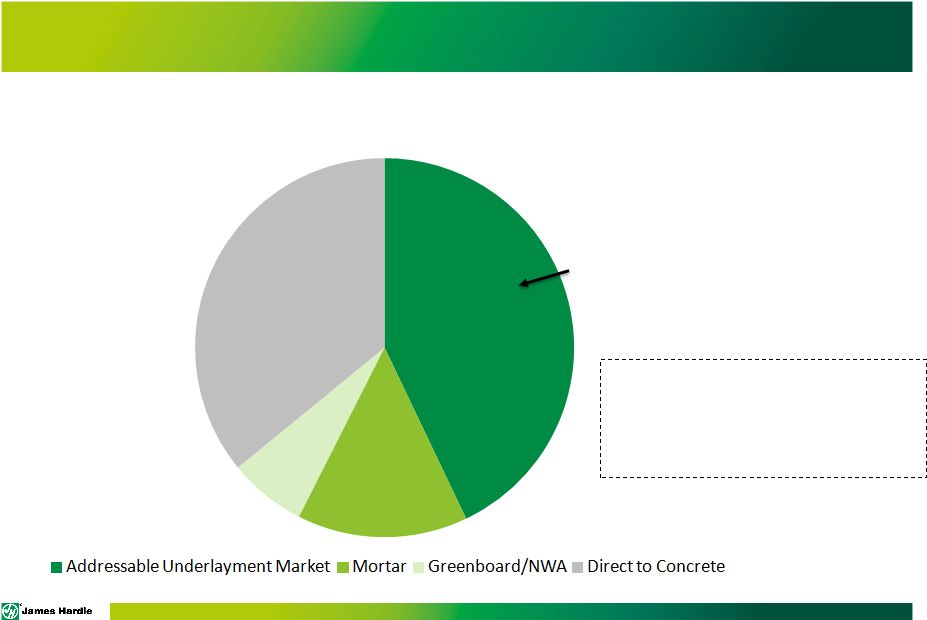

PAGE MARKET OVERVIEW 22 Total Tile Sales = 2,400 mmsf Total Performance Underlayment Opportunity Opportunity = Tile volume less applications that do not require an underlayment: • Direct to concrete • Greenboard/non-wet area walls • Mortar |

|

PAGE MESSAGING STRATEGY: THE THREE PILLARS 24 |

PAGE Made Better Formulation How It’s Made Benefits 25 |

PAGE INSTALLS BETTER Cutting Nails and Screws Floor vs. Wall 26 |

PAGE PERFORMS BETTER Moisture resistance Mold resistance Tile adhesion Protects the tile and the work 27 |

PAGE IMPROVED ORGANIZATIONAL EXECUTION The organization has been designed and staffed to deliver on our retail selling approach Relationship Education Position Inventory Conversion R E P I C 28 |

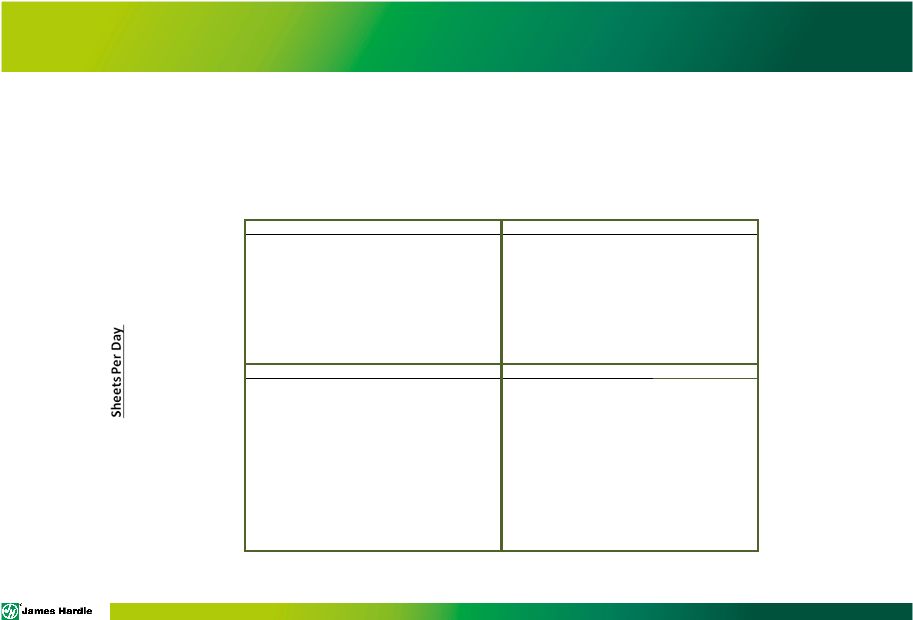

PAGE • Enhanced segmentation for rep direction “Where to go, What to do” • Focus on: – Conversions in “Contractor” stores – Retail fundamentals in “Retail” stores RETAIL STORE SEGMENTATION 29 High (200 spd) 1 2 3 4 Medium (32spd) Consolidated Fragmented 80 spd Conctractors Identify / Convert Conctractor Identify / Convert Positioning Gains / Optimize BM / Flooring positioning Gains / Optimize BM / Flooring Repeat Customers buying backerboard Positioning Gains / Optimize BM / Flooring Conctractors Aisle Converts positioning Gains / Optimize Flooring / BM contractors Identify / Convert |

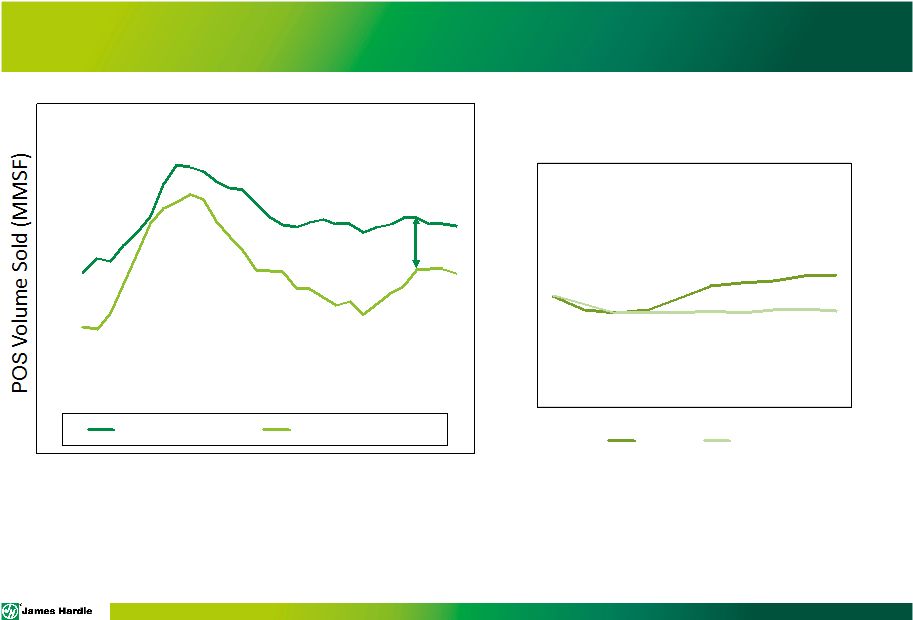

PAGE Conversions (MMSF) Average Rep Tenure (Years) Rep Tenure And Conversions FY16TD FY15TD • Creation of dedicated interiors career path driving tenure • Higher tenured reps delivering more conversions SALES ORGANIZATION +32% +28% 30 |

PAGE NATIONAL BACKER RETAIL POS RESULTS Current Year Previous Year +7% North Texas District Market Share FY 16 FY 15 31 |

PAGE SUMMARY • Manufacturing performing well and new capital investments starting to return value • Continue to invest in growth initiatives – Product line extensions to increase available market – Funding PDG projects and programs – Improvements in customer outreach and experience • Interiors positioning and performance improving 32 |

PAGE QUESTIONS 33 |