Exhibit 99.2

JAMES HARDIE INDUSTRIES PLC NOTICE OF 2016 ANNUAL GENERAL MEETING

NOTICE OF 2016 ANNUAL GENERAL MEETING Notice is given that the Annual General Meeting (AGM) of James Hardie Industries plc (James Hardie or the Company) will be held on Thursday, 11 August 2016 in James Hardie’s Corporate Headquarters, The Cork Room, Europa House, 2nd Floor, Harcourt Centre (Block 9), Harcourt Street, Dublin 2, Ireland at 7:00am (Dublin time). ATTENDANCE AT AGM Persons registered as shareholders as at 7:00pm (Sydney time) / 10:00am (Dublin time) on Tuesday, 9 August 2016 may attend the AGM in person in Dublin. Shareholders wishing to participate in the AGM can also participate remotely via teleconference, during which they will have the same opportunities to ask questions as people attending the AGM in person. Shareholders or proxies will all be able to ask questions of the Board of Directors of James Hardie (Board) and the Company’s external auditor, Ernst & Young LLP. To enable more questions to be answered, enclosed is a form that you can use to submit questions in advance of the AGM, whether or not you will be attending. Shareholders or proxies not present at the AGM wishing to ask questions can do so in the manner described on page 4 of this booklet. CONTENTS OF THIS BOOKLET This booklet contains: § the Agenda for the AGM setting out the resolutions proposed to be put to the meeting; § Explanatory Notes describing the business to be conducted at the meeting; § information about who may vote at the AGM and how they may cast their vote; § details of how shareholders can attend the meeting in person in Dublin; and § details of how shareholders can participate in the meeting remotely by teleconference. NOTICE AVAILABILITY Additional copies of this booklet can be downloaded from James Hardie’s Investor Relations website (http://www.ir.jameshardie. com.au/jh/shareholder_meetings.jsp) or they can be obtained by contacting the Company’s registrar, Computershare Investor Services Pty Limited (Computershare), by calling: § 1300 855 080 from within Australia; or § +61 3 9415 4000 from outside Australia. THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you should immediately consult your investment or other professional advisor. James Hardie Industries plc ARBN 097 829 895, with registered of?ce at Second Floor, Europa House, Harcourt Centre, Harcourt Street, Dublin 2, Ireland and registered in Ireland under company number 485719. The liability of its members is limited.

AGENDA AND BUSINESS OF THE ANNUAL GENERAL MEETING Explanations of the background, rationale and further information for each proposed resolution are set out in the Explanatory Notes on pages 6 to 10 of this Notice of Meeting. The following are items of ordinary business: 1. Financial statements and reports for ?scal year 2016 To review James Hardie’s affairs and to consider and, if thought ?t, pass the following resolution as an ordinary resolution: To receive and consider the ?nancial statements and the reports of the Board and external auditor for the ?scal year ended 31 March 2016. The vote on this resolution is advisory only. 2. Remuneration Report for ?scal year 2016 To consider and, if thought ?t, pass the following resolution as a non-binding ordinary resolution: To receive and consider the Remuneration Report of the Company for the ?scal year ended 31 March 2016. The vote on this resolution is advisory only. 3. Re-election of Directors To consider and, if thought ?t, pass each of the following resolutions as separate ordinary resolutions: (a) That Michael Hammes, who retires by rotation in accordance with the Company’s Constitution, be re-elected as a director. (b) That David Harrison, who retires by rotation in accordance with the Company’s Constitution, be re-elected as a director. 4. Authority to fix the External Auditor’s RemunerationTo consider and, if thought ?t, pass the following resolution as an ordinary resolution: That the Board be authorised to ?x the remuneration of the external auditor for the ?scal year ended 31 March 2017. The following are items of special business: 5. Grant of Return on Capital Employed Restricted Stock Units To consider and, if thought fit, pass the following resolution as an ordinary resolution: That the award to Louis Gries, James Hardie’s Chief Executive Officer, of up to a maximum of 336,470 return on capital employed (ROCE) restricted stock units (ROCE RSUs), and his acquisition of ROCE RSUs and ordinary shares of James Hardie (Shares) issuable thereunder, up to that number, be approved for all purposes in accordance with the terms of the 2006 Long Term Incentive Plan (as amended) (2006 LTIP) and on the basis set out in the Explanatory Notes. 6. Grant of Relative Total Shareholder Return Restricted Stock Units To consider and, if thought ?t, pass the following resolution as an ordinary resolution: That the award to Louis Gries of up to a maximum of 380,079 relative total shareholder return (TSR) restricted stock units (Relative TSR RSUs), and his acquisition of Relative TSR RSUs and Shares issuable thereunder, up to that number, be approved for all purposes in accordance with the terms of the 2006 LTIP and on the basis set out in the Explanatory Notes. VOTING EXCLUSION STATEMENT In accordance with the ASX Listing Rules, James Hardie will disregard any votes cast on Resolutions 5 and 6 of this Notice of Meeting if they are cast by Louis Gries (who is eligible to participate in the employee incentive schemes which are the subject of Resolutions 5 and 6) or his associates. Mr Gries and his associates will not have their votes disregarded if: (i) they are acting as a proxy for a person who is entitled to vote, in accordance with the directions on a Voting Instruction Form; or (ii) they are chairing the meeting as proxy for a person who is entitled to vote, in accordance with a direction on a Voting Instruction Form to vote as the proxy decides. Notes on voting and Explanatory Notes follow, and a Voting Instruction Form and Question Form are enclosed. By order of the Board. Natasha Mercer Company Secretary 8 July 2016 JAMES HARDIE NOTICE OF MEETING 2016

VOTING AND PARTICIPATION IN THE ANNUAL GENERAL MEETING If you are a registered shareholder as at 7:00pm (Sydney time) / 10:00am (Dublin time) on Tuesday, 9 August 2016, you may attend, speak and vote, in person or appoint a proxy (who need not be a shareholder) to attend, speak and vote on your behalf, at the AGM in Dublin, Ireland or participate and ask questions while participating via the AGM teleconference. See VOTING ON THE RESOLUTIONS below for information on how you can vote. AGM DETAILS The AGM will be held at James Hardie’s Corporate Headquarters, The Cork Room, Europa House, 2nd Floor, Harcourt Centre (Block 9), Harcourt Street, Dublin 2, Ireland, starting at 7:00am (Dublin time) on Thursday, 11 August 2016. OPTIONS FOR SHAREHOLDERS UNABLE TO ATTEND AGM The AGM will be accessible by teleconference at 4:00pm (Sydney time) / 7:00am (Dublin time) on Thursday, 11 August 2016. Shareholders participating in the AGM teleconference will be able to ask questions of the Board and the Company’s external auditor, Ernst & Young LLP. You will need to have your Security Holder Reference Number (SRN) or the Holder Identification Number (HIN) (included on your Voting Instruction Form or most recent holding statement) as well as the name of your holding if you intend to ask a question via the teleconference. The following details are also set out on the Shareholder Meetings page on James Hardie’s Investor Relations website (http://www.ir.jameshardie.com.au/jh/shareholder_meetings.jsp). PARTICIPATION IN AGM TELECONFERENCE To participate in the AGM teleconference, please: § dial into the AGM using one of the following numbers: Australia toll free 1800 558 698 / USA toll free 0855 881 1339 or 1855 881 1339 from outside the USA; § Passcode: 926905; and § provide the operator with your name and SRN / HIN. If you have any questions during the teleconference follow the prompts from the teleconference operator. APPOINTING A PROXY To instruct the appointment of: § a proxy to attend the AGM in person on your behalf (Nominated Proxy); and § the Company Secretary in the event your Nominated Proxy does not attend the AGM, please complete the relevant section of the Voting Instruction Form, and return it to Computershare no later than 7:00pm (Sydney time) / 10:00am (Dublin time) on Tuesday, 9 August 2016 using the “Lodgement Instructions” set out on page 5. If you hold more than one share carrying voting rights, you may instruct the appointment of more than one proxy to attend, speak and vote at the meeting on your behalf provided each proxy is appointed to exercise rights attached to different Shares held by you. VOTING ON THE RESOLUTIONS How you can vote will depend on whether you are: § a shareholder; § a holder of American Depositary Shares, which trade on the New York Stock Exchange (NYSE) in the form of American Depositary Receipts (ADRs); or § a Nominated Proxy. Voting if you are a shareholder: If you are a shareholder and want to vote on the resolutions to be considered at the AGM, you have the following two options: Option A – If you are not attending the AGM or appointing a Nominated Proxy Follow this option if you do not intend to attend the AGM in person or appoint a Nominated Proxy.You may lodge a Voting Instruction Form directing CHESS Depository Nominees Pty Limited (CDN) (the legal holder of Shares for the purposes of the ASX Settlement Operating Rules) to nominate the Chairman of the AGM as its proxy to vote the Shares underlying your holding of CHESS Units of Foreign Securities (CUFS) that it holds on your behalf. You can submit your Voting Instruction Form as follows: 1. Complete the hard-copy Voting Instruction Form accompanying this Notice of Meeting and lodge it using the “Lodgement Instructions” set out on page 5. 2. Complete a Voting Instruction Form using the internet: Go to www.investorvote.com.au You will need: § your Control Number (located on your Voting Instruction Form); and § your SRN or HIN for your holding; and § your postcode as recorded in the Company’s register. If you lodge the Voting Instruction Form in accordance with these instructions, you will be taken to have signed it. For your vote to count, your completed Voting Instruction Form must be received by Computershare no later than

7:00pm (Sydney time) / 10:00am (Dublin time) on Tuesday, 9 August 2016. You will not be able to vote your Shares by way of teleconference. Option B – If you are (or your Nominated Proxy is) attending the AGM If you would like to attend the AGM or appoint a Nominated Proxy to attend the AGM on your behalf, and vote in person, you may use a Voting Instruction Form to direct CDN to nominate: (a) you or another person nominated by you (who does not need to be a shareholder) as a Nominated Proxy; and (b) the Company Secretary in the event the Nominated Proxy does not attend the AGM, as proxy to vote the Shares underlying your holding of CUFS on behalf of CDN in person at the AGM in Dublin. If the Nominated Proxy does not attend the AGM, the Company Secretary will vote the Shares in accordance with the instructions on the Voting Instruction Form or, for undirected proxies, in accordance with the Nominated Proxy’s written instructions. If the Nominated Proxy does not provide written instructions to the Company Secretary care of Computershare by facsimile to 1300 534 987 from inside Australia, or +61 3 9473 2408 from outside Australia, or by email to [email protected] by the earlier of (i) the time of commencement of voting on the resolutions at the AGM and (ii) 7:30am (Dublin time) / 4:30pm (Sydney time) on Thursday, 11 August 2016, then the Company Secretary intends voting in favour of all of the resolutions. For your proxy appointment to count, your completed Voting Instruction Form must be received by Computershare no later than 7:00pm (Sydney time) / 10:00am (Dublin time) on Tuesday, 9 August 2016. To obtain a free copy of CDN’s Financial Services Guide, or any Supplementary Financial Services Guide, go to http://www.asx. com.au/documents/settlement/CHESS_Depositary_Interests.pdf or phone 131279 from within Australia or +61 2 9338 0000 from outside Australia to ask to have one sent to you. If you submit a completed Voting Instruction Form to Computershare, but fail to select either of Option A or Option B, you are deemed to have selected Option A. Voting if you hold American Depositary Shares (ADSs): The depositary for ADSs held in James Hardie’s ADR program is Deutsche Bank Trust Company Americas (Deutsche Bank). Deutsche Bank will send this Notice of Meeting to ADS holders on or about 11 July 2016 and advise ADS holders how to give their voting instructions. To be eligible to vote, ADS holders must be the registered or bene?cial owner as at 5:00pm US Eastern Daylight Time (US EDT) on 5 July 2016 (the ADS record date). Deutsche Bank must receive any voting instructions, in the form required by Deutsche Bank, no later than 5:00pm (US EDT) on 1 August 2016. Deutsche Bank will endeavour, as far as is practicable, and permitted under applicable law, to instruct that the Shares ultimately underlying the CUFS represented by ADSs are voted in accordance with theinstructions received from ADS holders. If an ADS holder does not submit any voting instructions, the Shares ultimately underlying the CUFS represented by the ADSs held by that holder will not be voted. If you do not provide voting instructions, the Shares ultimately underlying your ADSs will not be voted on any resolution for which a broker does not have discretionary authority to vote. Under NYSE rules, brokers that are NYSE member organisations are prohibited from directing the voting of the Shares underlying ADSs held in customer accounts on non-routine matters (such as executive compensation and director elections) if they have not received voting instructions from the beneficial holders. Accordingly, if you are the beneficial owner of Shares underlying ADSs, and your broker holds your ADSs in its name, then you must instruct your broker as to how to vote your Shares. Otherwise, your broker may not vote your Shares. If you do not give your broker voting instructions and the broker does not vote your Shares, this is a “broker non-vote” which is treated as an abstention and does not count toward determining the votes for / against the resolution. Voting if you are a Nominated Proxy: If you are a Nominated Proxy and you do not attend and vote at the AGM, the Company Secretary will vote the Shares in accordance with the instructions on the Voting Instruction Form or, for undirected proxies, in accordance with your written instructions. If you wish to direct the Company Secretary how to vote any undirected proxies, you must submit your written instructions to the Company Secretary by no later than the earlier of (i) the time of commencement of voting on the resolutions at the AGM and (ii) 7:30am (Dublin time) / 4:30pm (Sydney time) on Thursday, 11 August 2016, otherwise, if you have not provided written instructions to the Company Secretary by such time, then the Company Secretary intends voting in favour of all of the resolutions. LODGEMENT INSTRUCTIONS Completed Voting Instruction Forms may be lodged with Computershare using one of the following methods: (a) by post to GPO Box 242, Melbourne, Victoria 3001, Australia; or (b) by delivery to Computershare at Level 5, 115 Grenfell Street, Adelaide SA 5000, Australia; or (c) online at www.investorvote.com.au; or (d) for Intermediary Online subscribers only (custodians), online at www.intermediaryonline.com; or (e) by facsimile to 1800 783 447 from inside Australia or +61 3 9473 2555 from outside Australia. Written instructions to the Company Secretary (if required) may be lodged by the Nominated Proxy with Computershare using one of the following methods: (a) by facsimile to 1300 534 987 from inside Australia, or +61 3 9473 2408 from outside Australia; or (b) by email to [email protected]. If the Nominated Proxy is a corporate and the written instructions will be submitted by a representative of the corporate, the appropriate ‘Certificate of Appointment of Corporate Representative’ form will need to be provided along with the written instructions.A form of certificate may be obtained from Computershare or online at www.investorcentre.com under the help tab and then click on ‘Need a Printable Form’. NO VOTING AVAILABLE IN AGM TELECONFERENCE You will not be able to vote by way of teleconference. If you wish for your vote to count, you must follow the instructions set out above. JAMES HARDIE NOTICE OF MEETING 2016

EXPLANATORY NOTES TERMINOLOGY References to shareholders in this Notice of Meeting, including these Explanatory Notes, include references to all the shareholders of James Hardie acting together, and include holders of CUFS, holders of ADSs, holders of Shares and members of the Company within the meaning of the Irish Companies Act 2014, except where describing how each group of shareholders may cast their votes. RESOLUTION 1 – FINANCIAL STATEMENTS AND REPORTS FOR FISCAL YEAR 2016 Resolution 1 asks shareholders to receive and consider the ?nancial statements and the reports of the Board and the Company’s external auditor, Ernst & Young LLP, for the year ended 31 March 2016. This resolution will also involve the review by the members of James Hardie’s affairs. The financial statements which are the subject of Resolution 1 are those prepared in accordance with Irish law, US Generally Accepted Accounting Principles (US GAAP) (to the extent that the use of those principles in the preparation of the ?nancial statements does not contravene any provision of Irish law) and Accounting Standards issued by the Accounting Standards Board and promulgated by the Institute of Chartered Accountants in Ireland (Generally Accepted Accounting Practice in Ireland), as distinct from the US GAAP consolidated ?nancial statements of the James Hardie Group as set out in the Company’s 2016 Annual Report. A brief overview of the financial and operating performance of the James Hardie Group during the year ended 31 March 2016 will be provided during the AGM. Copies of the James Hardie Group’s consolidated Irish financial statements are available free of charge either: (a) at the AGM in Dublin, Ireland; (b) at the Company’s registered Irish office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, Ireland; (c) at the Company’s registered Australian office at Level 3, 22 Pitt Street, Sydney NSW; or (d) on the Company’s Investor Relations website, http://www.ir.jameshardie.com.au/. Recommendation The Board believes it is in the interests of shareholders that the ?nancial statements and the reports of the Board and external auditor for the year ended 31 March 2016 be received and considered, and recommends that you vote in favour of Resolution 1.RESOLUTION 2 – REMUNERATION REPORT FOR FISCAL YEAR 2016 Resolution 2 asks shareholders to receive and consider the Remuneration Report for the year ended 31 March 2016. The Company is not required to produce a remuneration report or to submit it to shareholders under Irish, Australian or US law or regulations. However, taking into consideration James Hardie’s Australian and US shareholder base and ASX listing, the Company has voluntarily produced a remuneration report for non-binding shareholder approval for some years and currently intends to continue to do so. This report provides information on James Hardie’s remuneration practices in fiscal year 2016 and also voluntarily includes an outline of the Company’s proposed remuneration framework for fiscal year 2017. James Hardie’s Remuneration Report is set out on pages 29 to 68 of the 2016 Annual Report and can also be found on the Company’s Investor Relations website http://www.ir.jameshardie. com.au/. Although this vote does not bind the Company, the Board intends to take the outcome of the vote into consideration when considering the Company’s future remuneration policy. Recommendation The Board believes it is in the interests of shareholders that the Company’s Remuneration Report for the year ended 31 March 2016 be received and considered, and recommends that you vote in favour of Resolution 2. RESOLUTION 3 – RE-ELECTION OF DIRECTORS As part of their review of the composition of the Board, the Board and the Nominating and Governance Committee considered the desired pro?le of the Board, including the right number, mix of skills, quali?cations, experience, expertise, diversity and geographic location of its directors, to maximise the effectiveness of the Board. The Board and Nominating and Governance Committee work together to ensure James Hardie puts in place appropriate mechanisms for Board renewal. Resolutions 3(a) and 3(b) ask shareholders to separately consider the re-election of Michael Hammes and David Harrison to the Board. James Hardie’s Constitution requires that one-third of the directors subject to re-election (other than any directors appointed by the Board during the year) will retire at each AGM, with re-election possible after each term. Michael Hammes and David Harrison will retire at the 2016 AGM and each offers himself for re-election. As indicated in the 2013 AGM Notice of Meeting, Donald McGauchie AO, who also retires at this AGM, will not be standing for re-election.

Pro?les of the candidates follow: Michael Hammes BS, MBA Age 74 Michael Hammes was elected as an independent Non-Executive Director of James Hardie in February 2007. He was appointed Chairman of the Board in January 2008 and is a member of the Audit Committee, the Remuneration Committee and the Nominating and Governance Committee. Experience: Mr Hammes has extensive commercial experience at a senior executive level. He has held a number of executive positions in the medical products, hardware and home improvement, and automobile sectors, including Chief Executive Of?cer and Chairman of Sunrise Medical, Inc. (2000-2007), Chairman and Chief Executive Of?cer of Guide Corporation (1998-2000), Chairman and Chief Executive Of?cer of Coleman Company, Inc. (1993-1997), Vice Chairman of Black & Decker Corporation (1992-1993) and various senior executive roles with Chrysler Corporation (1986-1990) and Ford Motor Company (1979-1986). Directorships of listed companies in the past ?ve years: Current – Director of Navistar International Corporation (since 1996) and Director of DynaVox Mayer-Johnson (listed in April 2010). Last elected: August 2014 David Harrison BA, MBA, CMA Age 69 David Harrison was appointed as an independent Non-Executive Director of James Hardie in May 2008. He is Chairman of the Remuneration Committee and a member of the Audit Committee. Experience: Mr Harrison is an experienced company director with a ?nance background, having served in corporate ?nance roles, international operations and information technology during 22 years with Borg Warner/General Electric Co. His previous experience includes 10 years at Pentair, Inc., as Executive Vice President and Chief Financial Of?cer (1994-1996 and 2000-2007) and Vice President and Chief Financial Of?cer roles at Scotts, Inc. and Coltec Industries, Inc. (1996-2000). Directorships of listed companies in the past ?ve years: Current – Director of National Oilwell Varco (since 2003); Former– Director of Navistar International Corporation (2007-2012). Last elected: August 2013 Recommendation The Board, having assessed the performance of Michael Hammes and David Harrison, and on the recommendation of the Nominating and Governance Committee, believes it is in the interests of shareholders that each of the individuals referred to above be re-elected as a director of James Hardie, and recommends (with Michael Hammes and David Harrison each abstaining from voting in respect of their own election) that you vote in favour of Resolutions 3(a) and 3(b). RESOLUTION 4 – AUTHORITY TO FIX THE EXTERNAL AUDITOR’S REMUNERATION Resolution 4 asks shareholders to give authority to the Board to fix the external auditor’s remuneration. Ernst & Young LLP were first appointed external auditors for the James Hardie Group for the year ended 31 March 2009. A summary of the external auditor’s remuneration during the fiscal year ended 31 March 2016, as well as non-audit fees paid to Ernst & Young LLP are set out on page 169 of the 2016 Annual Report. The Audit Committee periodically reviews Ernst & Young LLP’s performance and independence as external auditor and reports its results to the Board. A summary of Ernst & Young LLP’s interaction with James Hardie, the Board and the Board Committees is set out on pages 82 to 84 of the 2016 Annual Report. Recommendation The Board believes it is in the interests of shareholders that the Board be given authority to fix the external auditor’s remuneration for the fiscal year ended 31 March 2017 and recommends, on the recommendation of the Audit Committee, that you vote in favour of Resolution 4. RESOLUTION 5 – GRANT OF ROCE RSUs Resolution 5 asks shareholders to approve the grant of ROCE RSUs under the 2006 LTIP to James Hardie’s Chief Executive Officer, Louis Gries. A summary of the terms and conditions of the 2006 LTIP was included in the 2015 AGM Notice of Meeting. That document may be accessed from the Shareholder Meetings page on James Hardie’s Investor Relations website (http://www.ir.jameshardie. com.au/jh/shareholder_meetings.jsp). For ?scal year 2017, the Remuneration Committee has allocated the Long-Term Incentive (LTI) target of the Chief Executive Of?cer (and each senior executive) between three separate components to ensure that reward is based on a diverse range of factors which validly re?ect longer term performance: § 40% to ROCE RSUs – an indicator of James Hardie’s capital efficiency over time; § 30% to Relative TSR RSUs – an indicator of James Hardie’s performance relative to its US peers; and § 30% to Scorecard LTI – an indicator of each senior executive’s contribution to James Hardie achieving its long-term strategic goals. The Board and the Remuneration Committee believe that separating the LTI target between these three components provides an appropriate incentive to ensure senior executives focus on the key areas which will drive shareholder value creation over the medium and long-term. As the Board and Remuneration Committee believe the LTI program as designed is achieving the stated objectives, and that management understands the current program and continues to be motivated by it, the LTI components for ?scal year 2017 are materially consistent with the components for ?scal year 2016. Reasons for ROCE RSUs ROCE RSUs shall vest if James Hardie’s ROCE performance meets or exceeds ROCE performance hurdles over a three year period, subject to the exercise of negative discretion by the Remuneration Committee. James Hardie introduced ROCE RSUs in ?scal year 2013 once the US housing market had stabilised to an extent which permitted the setting of multi-year ?nancial metrics. As James Hardie funds capacity expansions and market initiatives in the US and Asia Paci?c, it is important that management focuses on ensuring that the Company continues to achieve strong ROCE results while pursuing growth. Upon vesting, ROCE RSUs shall be settled in CUFS on a 1-to-1 basis. JAMES HARDIE NOTICE OF MEETING 2016

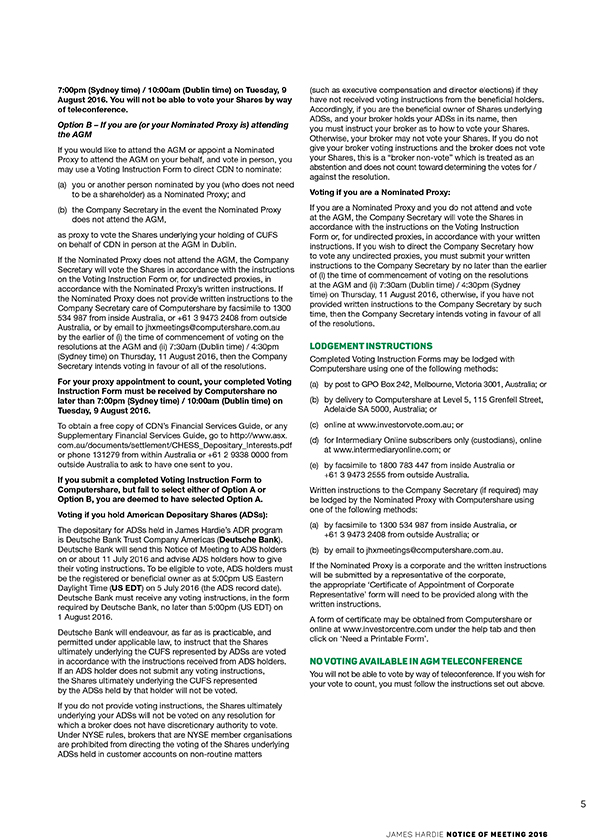

EXPLANATORY NOTES CONTINUED Changes for ?scal year 2017 The key aspects of the ROCE RSUs are largely unchanged from ?scal year 2016. The only change proposed for ?scal year 2017 is to increase the ROCE performance hurdles. Key aspects of ROCE RSUs Goal Setting: ROCE performance hurdles for the ROCE RSUs are based on historical results and take into account the forecasts for the US and Asia Paci?c housing markets. Achieving target vesting will require performance generally equivalent with the average of ROCE for ?scal years 2014 to 2016. By way of reference, the three-year average ROCE result for ?scal years 2014, 2015 and 2016 was 27.6%. ROCE De?nitions: The ROCE measure will be determined by dividing Adjusted Earnings Before Interest and Tax (Adjusted EBIT) by Adjusted Capital Employed each as further explained below. The Adjusted EBIT component of the ROCE measure will be determined as follows. Earnings before interest and taxation as reported in James Hardie’s financial results, adjusted by: § excluding the earnings impact of legacy issues (such as asbestos adjustments); and § adding back asset impairment charges in the relevant period, unless otherwise determined by the Remuneration Committee. Since management’s performance will be assessed on the pre-impairment value of James Hardie’s assets, the Remuneration Committee would not normally deduct the impact of any asset impairments from the Company’s EBIT for the purposes of measuring ROCE performance. The Adjusted Capital Employed component of the ROCE measure will be determined as follows. Total Assets minus Current Liabilities, as reported in James Hardie’s financial results, adjusted by: § excluding balance sheet items related to legacy issues (such as asbestos adjustments), dividends payable and deferred taxes; § adding back asset impairment charges in the relevant period, unless otherwise determined by the Remuneration Committee, in order to align the Adjusted Capital Employed with the determination of Adjusted EBIT; § adding back leasehold assets for manufacturing facilities and other material leased assets, which the Remuneration Committee believes give a more complete measure of the Company’s capital base employed in income generation; and § deducting all greenfield construction-in-progress, and any brownfield construction-in-progress projects involving capacity expansion that are individually greater than US$20 million, until such assets reach commercial production and are transferred to the ?xed asset register, in order to encourage management to invest in capital expenditure projects that are aligned with the long-term interests of the Company The ROCE performance hurdles will be indexed for changes to US and Asia Paci?c addressable housing starts. The resulting Adjusted Capital Employed for each quarter of any ?scal year will be averaged to better re?ect capital employed over the course of a year rather than at a certain point in time. The ROCE result to compare to the performance hurdles will be the average of James Hardie’s ROCE in fiscal years 2017, 2018 and 2019. These de?nitions have been framed to ensure management is rewarded and held accountable for the aspects over which they have direct in?uence and control, while not discouraging management from recommending that James Hardie undertake investments that will provide for future Company growth. Grant: The Chief Executive Officer will receive a grant equal to the maximum number of ROCE RSUs (200% of target). The number of ROCE RSUs which actually vest and the number of Shares ultimately received in 2019 will depend on James Hardie’s ROCE performance in fiscal years 2017 to 2019 together with the Remuneration Committee’s exercise of negative discretion. Performance Hurdle: The performance hurdles for ROCE RSUs granted in ?scal year 2017 (for performance in ?scal years 2017 to 2019) are: ROCE % OF ROCE RSUs VESTING < 24.0 % 0 % ? 24.0%, but < 26.0% 25 % ? 26.0%, but < 28.5% 50 % ? 28.5%, but < 29.5% 75 % ? 29.5 % 100 % The earnings component of ROCE performance targets is predicated on assumptions in market growth. Market growth in James Hardie’s primary markets has two main components – independent third party sourced data for new housing starts and an independent third party data sourced index for the repair and remodel market. These two main components are blended for an index of market growth. The above performance hurdles can be indexed up or down to the extent that actual US and Asia Pacific addressable housing starts over the performance period are higher or lower than those assumed in James Hardie’s fiscal years 2017-2019 business plan. Performance period: The overall performance period is three years. The ROCE RSUs vest three years after they are granted (which is expected to occur in September 2016), subject to the exercise of negative discretion by the Remuneration Committee. Conditions and negative discretion: In 2019, the Remuneration Committee will review James Hardie’s performance over the performance period and may exercise negative discretion to reduce the number of ROCE RSUs that would otherwise vest under the ROCE vesting scale above based on the quality of the ROCE returns balanced against management’s delivery of market share growth and performance against certain specified strategic goals and objectives (i.e., the Scorecard). The Remuneration Committee can only exercise negative discretion. It cannot be applied to enhance the reward that can be received. The potential to exercise negative discretion allows the Remuneration Committee to ensure that ROCE returns are not obtained at the expense of long-term sustainability. The Scorecard includes a number of longer-term measures which the Remuneration Committee believes are important contributors to long-term creation of shareholder value. Each year the Remuneration Committee approves a number of key objectives and the measures it expects to see achieved for each of these objectives. The ?scal year 2017 Scorecard applicable for the grants of ROCE RSUs (and Scorecard LTI) is set out in the 2016 Remuneration Report. The Remuneration Committee considers the goals to be reflective of James Hardie’s overall long-term goals. The Chief Executive Officer’s rating ultimately depends on the Remuneration Committee’s assessment (and the Board’s review) of his contribution to James Hardie in meeting the Scorecard objectives. Although most of the objectives in the Scorecard have quantitative targets, the Board has not allocated a specific weighting to any and the final Scorecard assessment and exercise of negative discretion (if any) will involve an element of judgment by the Remuneration Committee. A different amount of negative discretion is likely to be applied when assessing the Chief Executive Officer’s performance for the Scorecard LTI grants (which only include consideration of Scorecard measures) and ROCE RSUs grants (which involve a broader assessment of the quality of James Hardie’s results).

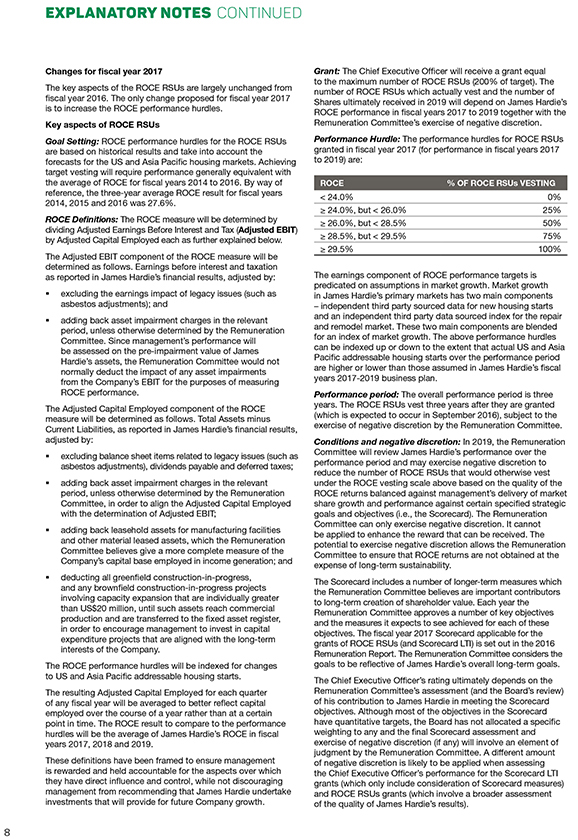

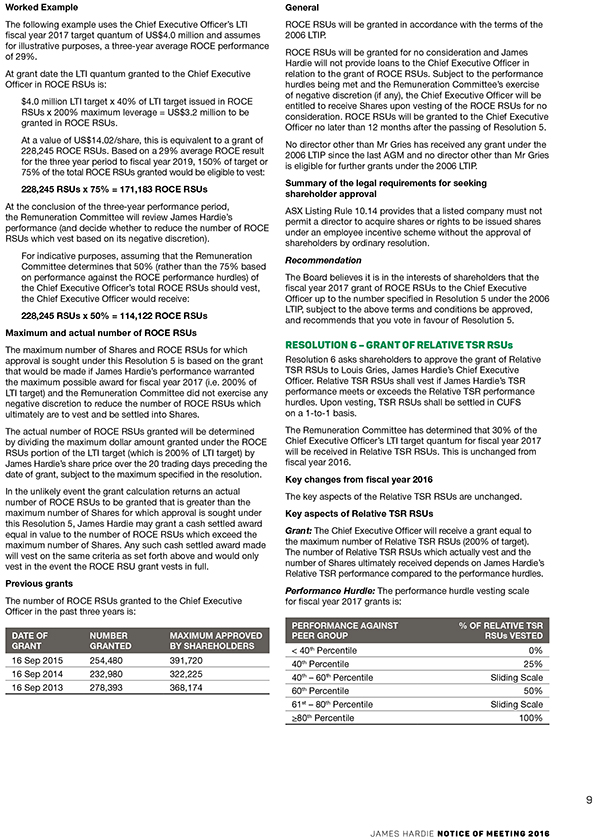

Worked Example The following example uses the Chief Executive Officer’s LTI fiscal year 2017 target quantum of US$4.0 million and assumes for illustrative purposes, a three-year average ROCE performance of 29%. At grant date the LTI quantum granted to the Chief Executive Officer in ROCE RSUs is: $4.0 million LTI target x 40% of LTI target issued in ROCE RSUs x 200% maximum leverage = US$3.2 million to be granted in ROCE RSUs. At a value of US$14.02/share, this is equivalent to a grant of 228,245 ROCE RSUs. Based on a 29% average ROCE result for the three year period to ?scal year 2019, 150% of target or 75% of the total ROCE RSUs granted would be eligible to vest: 228,245 RSUs x 75% = 171,183 ROCE RSUs At the conclusion of the three-year performance period, the Remuneration Committee will review James Hardie’s performance (and decide whether to reduce the number of ROCE RSUs which vest based on its negative discretion). For indicative purposes, assuming that the Remuneration Committee determines that 50% (rather than the 75% based on performance against the ROCE performance hurdles) of the Chief Executive Officer’s total ROCE RSUs should vest, the Chief Executive Officer would receive: 228,245 RSUs x 50% = 114,122 ROCE RSUs Maximum and actual number of ROCE RSUs The maximum number of Shares and ROCE RSUs for which approval is sought under this Resolution 5 is based on the grant that would be made if James Hardie’s performance warranted the maximum possible award for fiscal year 2017 (i.e. 200% of LTI target) and the Remuneration Committee did not exercise any negative discretion to reduce the number of ROCE RSUs which ultimately are to vest and be settled into Shares. The actual number of ROCE RSUs granted will be determined by dividing the maximum dollar amount granted under the ROCE RSUs portion of the LTI target (which is 200% of LTI target) by James Hardie’s share price over the 20 trading days preceding the date of grant, subject to the maximum speci?ed in the resolution. In the unlikely event the grant calculation returns an actual number of ROCE RSUs to be granted that is greater than the maximum number of Shares for which approval is sought under this Resolution 5, James Hardie may grant a cash settled award equal in value to the number of ROCE RSUs which exceed the maximum number of Shares. Any such cash settled award made will vest on the same criteria as set forth above and would only vest in the event the ROCE RSU grant vests in full. Previous grants The number of ROCE RSUs granted to the Chief Executive Of?cer in the past three years is: DATE OF NUMBER MAXIMUM APPROVED GRANT GRANTED BY SHAREHOLDERS 16 Sep 2015 254,480 391,720 16 Sep 2014 232,980 322,225 16 Sep 2013 278,393 368,174 General ROCE RSUs will be granted in accordance with the terms of the 2006 LTIP. ROCE RSUs will be granted for no consideration and James Hardie will not provide loans to the Chief Executive Officer in relation to the grant of ROCE RSUs. Subject to the performance hurdles being met and the Remuneration Committee’s exercise of negative discretion (if any), the Chief Executive Officer will be entitled to receive Shares upon vesting of the ROCE RSUs for no consideration. ROCE RSUs will be granted to the Chief Executive Officer no later than 12 months after the passing of Resolution 5. No director other than Mr Gries has received any grant under the 2006 LTIP since the last AGM and no director other than Mr Gries is eligible for further grants under the 2006 LTIP. Summary of the legal requirements for seeking shareholder approval ASX Listing Rule 10.14 provides that a listed company must not permit a director to acquire shares or rights to be issued shares under an employee incentive scheme without the approval of shareholders by ordinary resolution. Recommendation The Board believes it is in the interests of shareholders that the ?scal year 2017 grant of ROCE RSUs to the Chief Executive Of?cer up to the number speci?ed in Resolution 5 under the 2006 LTIP, subject to the above terms and conditions be approved, and recommends that you vote in favour of Resolution 5.RESOLUTION 6 – GRANT OF RELATIVE TSR RSUs Resolution 6 asks shareholders to approve the grant of Relative TSR RSUs to Louis Gries, James Hardie’s Chief Executive Officer. Relative TSR RSUs shall vest if James Hardie’s TSR performance meets or exceeds the Relative TSR performance hurdles. Upon vesting, TSR RSUs shall be settled in CUFS on a 1-to-1 basis. The Remuneration Committee has determined that 30% of the Chief Executive Officer’s LTI target quantum for fiscal year 2017 will be received in Relative TSR RSUs. This is unchanged from fiscal year 2016. Key changes from ?scal year 2016 The key aspects of the Relative TSR RSUs are unchanged. Key aspects of Relative TSR RSUs Grant: The Chief Executive Of?cer will receive a grant equal to the maximum number of Relative TSR RSUs (200% of target). The number of Relative TSR RSUs which actually vest and the number of Shares ultimately received depends on James Hardie’s Relative TSR performance compared to the performance hurdles. Performance Hurdle: The performance hurdle vesting scale for ?scal year 2017 grants is: PERFORMANCE AGAINST % OF RELATIVE TSR PEER GROUP RSUs VESTED < 40th Percentile 0 % 40th Percentile 25 % 40th – 60th Percentile Sliding Scale 60th Percentile 50 % 61st – 80th Percentile Sliding Scale ?80th Percentile 100 %

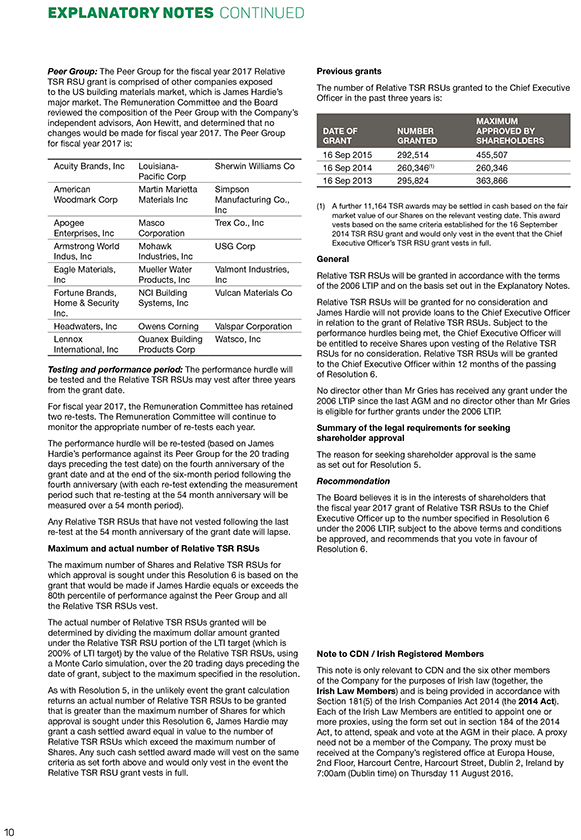

EXPLANATORY NOTES CONTINUED Peer Group: The Peer Group for the fiscal year 2017 Relative TSR RSU grant is comprised of other companies exposed to the US building materials market, which is James Hardie’s major market. The Remuneration Committee and the Board reviewed the composition of the Peer Group with the Company’s independent advisors, Aon Hewitt, and determined that no changes would be made for fiscal year 2017. The Peer Group for ?scal year 2017 is: Acuity Brands, Inc Louisiana- Sherwin Williams Co Paci?c Corp American Martin Marietta Simpson Woodmark Corp Materials Inc Manufacturing Co., Inc Apogee Masco Trex Co., Inc Enterprises, Inc Corporation Armstrong World Mohawk USG Corp Indus, Inc Industries, Inc Eagle Materials, Mueller Water Valmont Industries, Inc Products, Inc Inc Fortune Brands, NCI Building Vulcan Materials Co Home & Security Systems, Inc Inc. Headwaters, Inc Owens Corning Valspar Corporation Lennox Quanex Building Watsco, Inc International, Inc Products Corp Testing and performance period: The performance hurdle will be tested and the Relative TSR RSUs may vest after three years from the grant date. For ?scal year 2017, the Remuneration Committee has retained two re-tests. The Remuneration Committee will continue to monitor the appropriate number of re-tests each year. The performance hurdle will be re-tested (based on James Hardie’s performance against its Peer Group for the 20 trading days preceding the test date) on the fourth anniversary of the grant date and at the end of the six-month period following the fourth anniversary (with each re-test extending the measurement period such that re-testing at the 54 month anniversary will be measured over a 54 month period). Any Relative TSR RSUs that have not vested following the last re-test at the 54 month anniversary of the grant date will lapse. Maximum and actual number of Relative TSR RSUs The maximum number of Shares and Relative TSR RSUs for which approval is sought under this Resolution 6 is based on the grant that would be made if James Hardie equals or exceeds the 80th percentile of performance against the Peer Group and all the Relative TSR RSUs vest. The actual number of Relative TSR RSUs granted will be determined by dividing the maximum dollar amount granted under the Relative TSR RSU portion of the LTI target (which is 200% of LTI target) by the value of the Relative TSR RSUs, using a Monte Carlo simulation, over the 20 trading days preceding the date of grant, subject to the maximum speci?ed in the resolution. As with Resolution 5, in the unlikely event the grant calculation returns an actual number of Relative TSR RSUs to be granted that is greater than the maximum number of Shares for which approval is sought under this Resolution 6, James Hardie may grant a cash settled award equal in value to the number of Relative TSR RSUs which exceed the maximum number of Shares. Any such cash settled award made will vest on the same criteria as set forth above and would only vest in the event the Relative TSR RSU grant vests in full.Previous grants The number of Relative TSR RSUs granted to the Chief Executive Of?cer in the past three years is: MAXIMUM DATE OF NUMBER APPROVED BY GRANT GRANTED SHAREHOLDERS 16 Sep 2015 292,514 455,507 16 Sep 2014 260,346 (1) 260,346 16 Sep 2013 295,824 363,866 (1) A further 11,164 TSR awards may be settled in cash based on the fair market value of our Shares on the relevant vesting date. This award vests based on the same criteria established for the 16 September 2014 TSR RSU grant and would only vest in the event that the Chief Executive Officer’s TSR RSU grant vests in full. General Relative TSR RSUs will be granted in accordance with the terms of the 2006 LTIP and on the basis set out in the Explanatory Notes. Relative TSR RSUs will be granted for no consideration and James Hardie will not provide loans to the Chief Executive Of?cer in relation to the grant of Relative TSR RSUs. Subject to the performance hurdles being met, the Chief Executive Of?cer will be entitled to receive Shares upon vesting of the Relative TSR RSUs for no consideration. Relative TSR RSUs will be granted to the Chief Executive Of?cer within 12 months of the passing of Resolution 6. No director other than Mr Gries has received any grant under the 2006 LTIP since the last AGM and no director other than Mr Gries is eligible for further grants under the 2006 LTIP. Summary of the legal requirements for seeking shareholder approval The reason for seeking shareholder approval is the same as set out for Resolution 5. Recommendation The Board believes it is in the interests of shareholders that the ?scal year 2017 grant of Relative TSR RSUs to the Chief Executive Of?cer up to the number speci?ed in Resolution 6 under the 2006 LTIP, subject to the above terms and conditions be approved, and recommends that you vote in favour of Resolution 6. Note to CDN / Irish Registered Members This note is only relevant to CDN and the six other members of the Company for the purposes of Irish law (together, the Irish Law Members) and is being provided in accordance with Section 181(5) of the Irish Companies Act 2014 (the 2014 Act). Each of the Irish Law Members are entitled to appoint one or more proxies, using the form set out in section 184 of the 2014 Act, to attend, speak and vote at the AGM in their place. A proxy need not be a member of the Company. The proxy must be received at the Company’s registered office at Europa House, 2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, Ireland by 7:00am (Dublin time) on Thursday 11 August 2016.

Designed and produced by ArmstrongQ armstrongQ.com.au

James Hardie