NORTH AMERICA OVERVIEW STRATEGIC PILLARS LOUIS GRIES SEPTEMBER 2016 Exhibit 99.2

AGENDA STRATEGIC PILLARS PEOPLE BRAND PROMISE MARKET POSITION NON-FIBER CEMENT

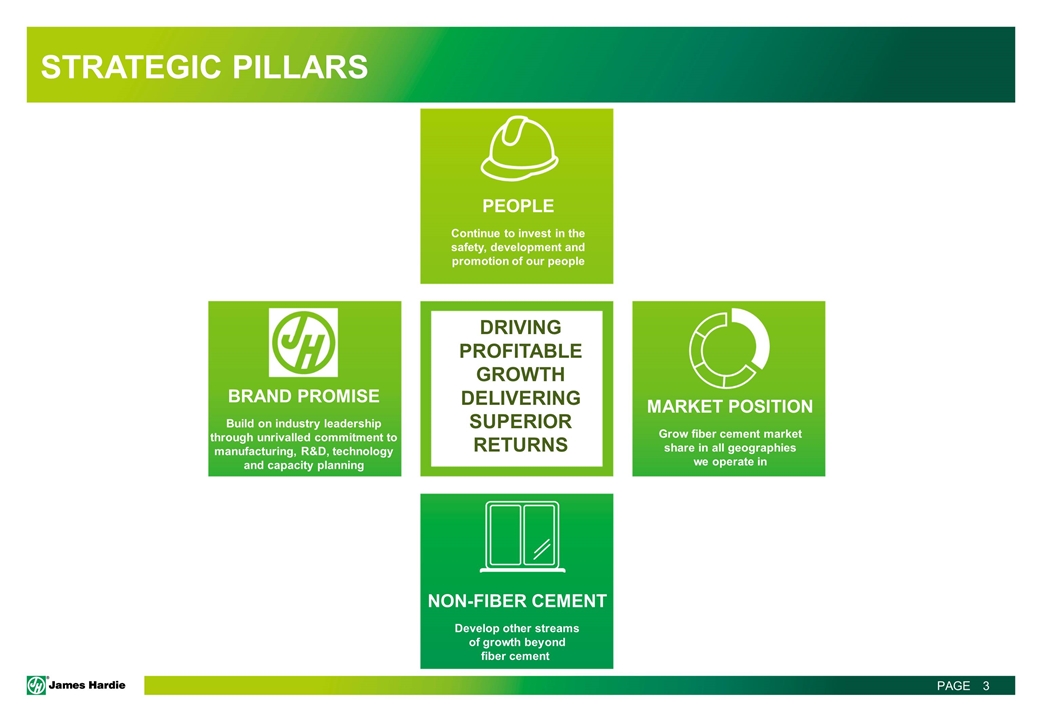

STRATEGIC PILLARS BRAND PROMISE Build on industry leadership through unrivalled commitment to manufacturing, R&D, technology and capacity planning PEOPLE Continue to invest in the safety, development and promotion of our people MARKET POSITION Grow fiber cement market share in all geographies we operate in NON-FIBER CEMENT Develop other streams of growth beyond fiber cement DRIVING PROFITABLE GROWTH DELIVERING SUPERIOR RETURNS

PEOPLE – INCREASING ORGANIZATIONAL CAPABILITY Smart, Driven, Respectful and Real We will refocus on optimizing our organizational capability by: Ensuring a safe work environment Developing and promoting our employees Attracting top external talent Creating a culture of engagement with our employees Delivering a better employee retention outcome PEOPLE Continue to invest in the development and promotion of our people

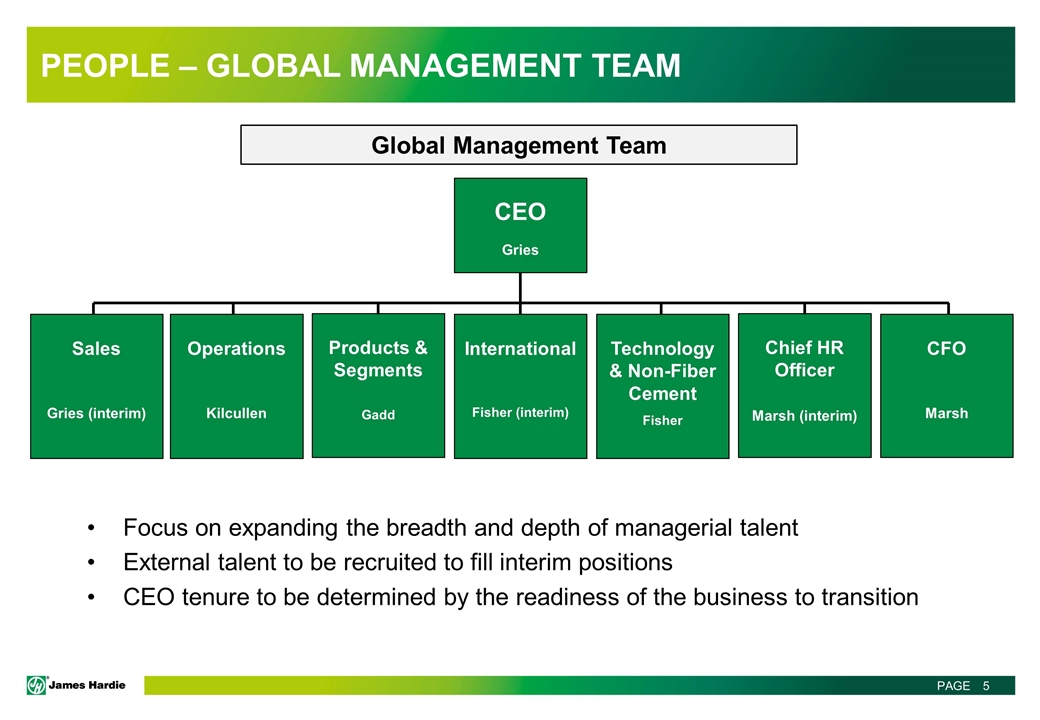

PEOPLE – GLOBAL MANAGEMENT TEAM Focus on expanding the breadth and depth of managerial talent External talent to be recruited to fill interim positions CEO tenure to be determined by the readiness of the business to transition CEO Gries Operations Kilcullen Products & Segments Gadd International Fisher (interim) Technology & Non-Fiber Cement Fisher CFO Marsh Sales Gries (interim) Chief HR Officer Marsh (interim) Global Management Team

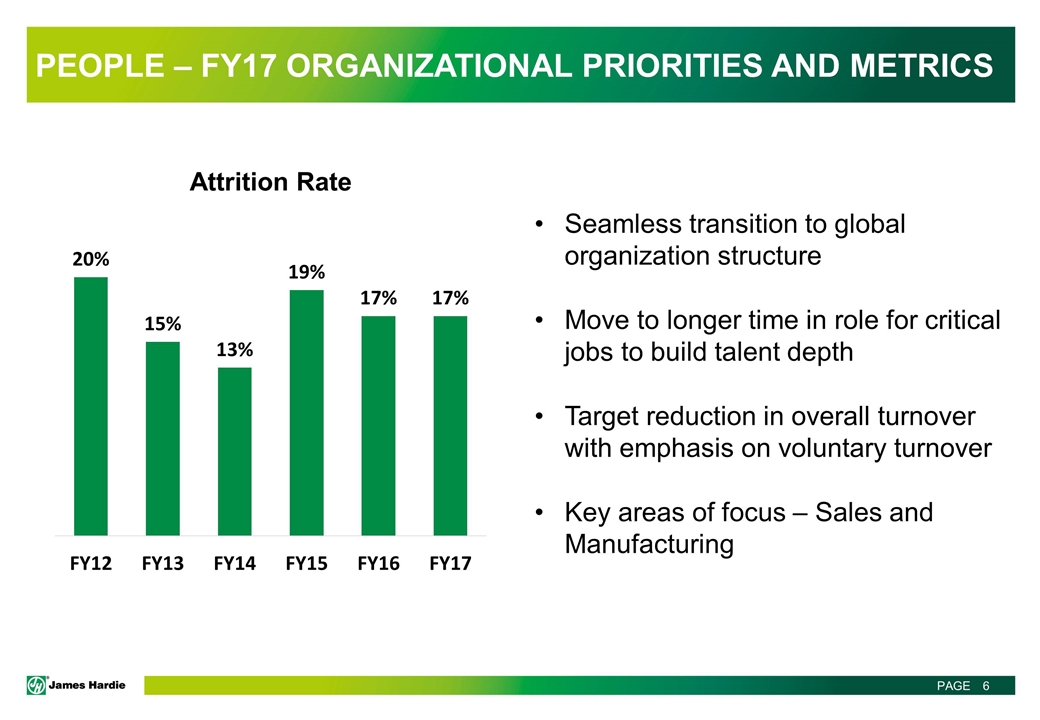

PEOPLE – FY17 ORGANIZATIONAL PRIORITIES AND METRICS Seamless transition to global organization structure Move to longer time in role for critical jobs to build talent depth Target reduction in overall turnover with emphasis on voluntary turnover Key areas of focus – Sales and Manufacturing

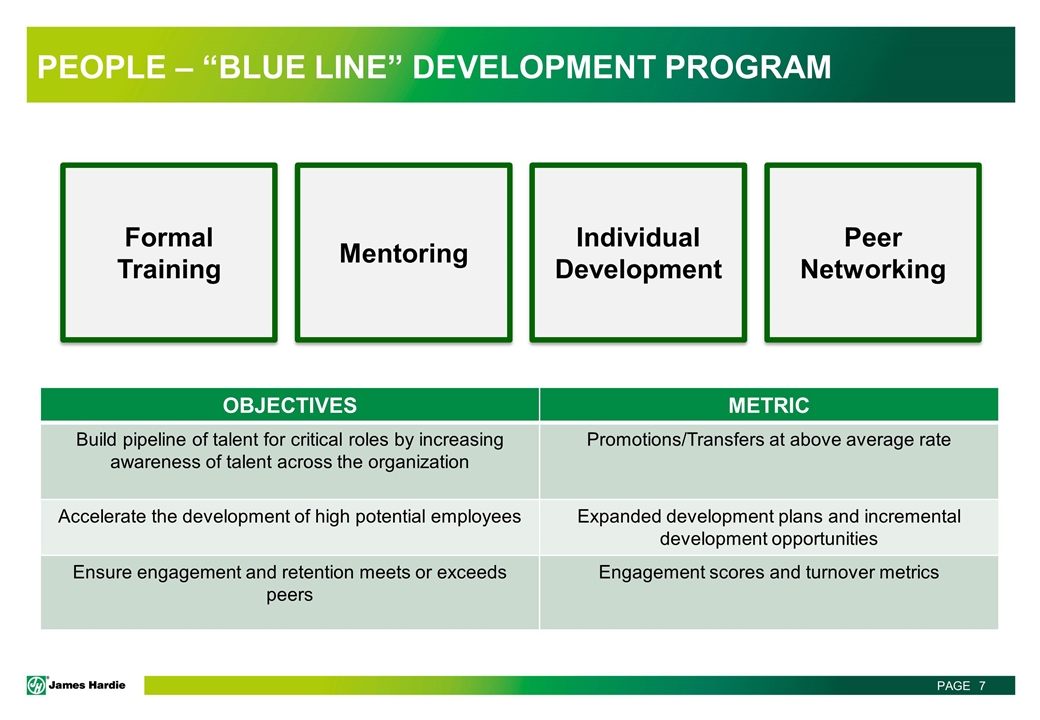

PEOPLE – “BLUE LINE” DEVELOPMENT PROGRAM Formal Training Mentoring Individual Development Peer Networking OBJECTIVES METRIC Build pipeline of talent for critical roles by increasing awareness of talent across the organization Promotions/Transfers at above average rate Accelerate the development of high potential employees Expanded development plans and incremental development opportunities Ensure engagement and retention meets or exceeds peers Engagement scores and turnover metrics

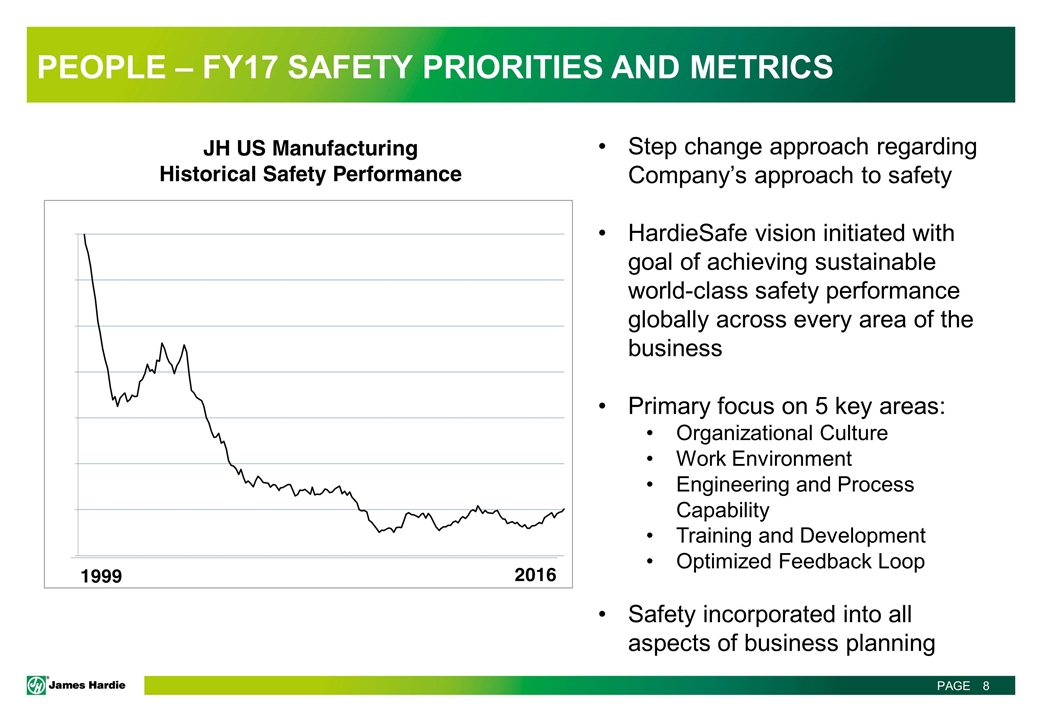

PEOPLE – FY17 SAFETY PRIORITIES AND METRICS Step change approach regarding Company’s approach to safety HardieSafe vision initiated with goal of achieving sustainable world-class safety performance globally across every area of the business Primary focus on 5 key areas: Organizational Culture Work Environment Engineering and Process Capability Training and Development Optimized Feedback Loop Safety incorporated into all aspects of business planning 1999 2016 JH US Manufacturing Historical Safety Performance

BRAND PROMISE – DIFFERENTIATED BY DESIGN Operational Excellence and Continuous Innovation We aim to deliver differentiated products and services by: An unrivalled commitment to research and development Maintaining our manufacturing cost advantage Delivering industry leading quality and service levels Investing in future manufacturing capability and capacity Utilizing technology to better improve our customers experiences with us Ensuring we meet our financial returns objectives BRAND PROMISE Build on industry leadership through unrivalled commitment to manufacturing, R&D, technology and capacity planning

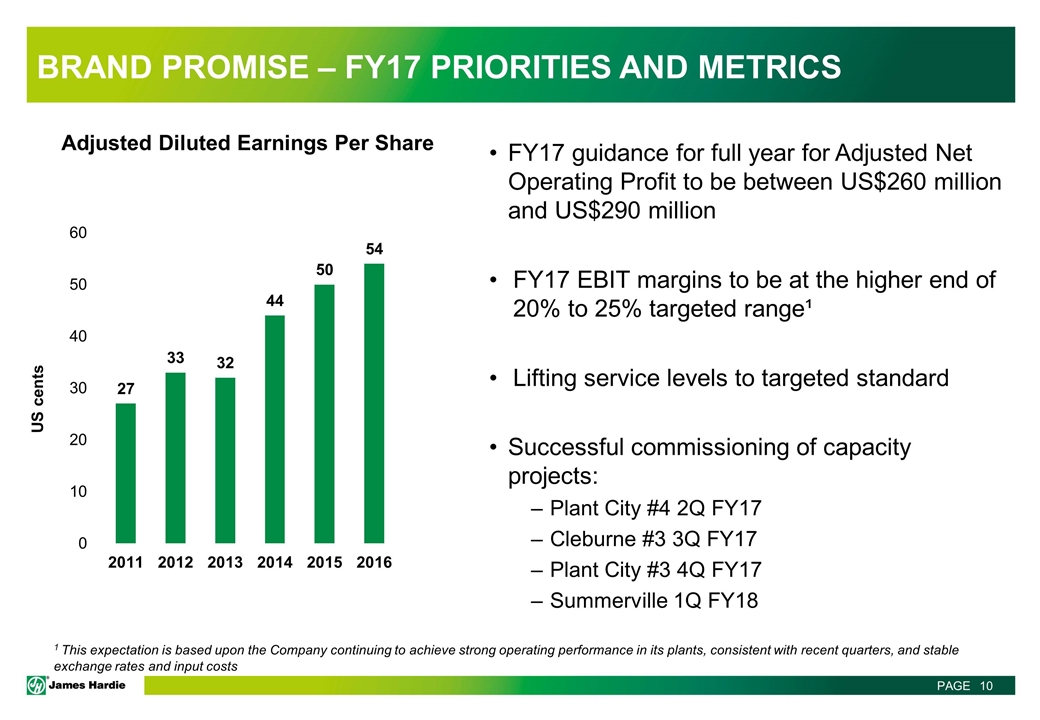

BRAND PROMISE – FY17 PRIORITIES AND METRICS FY17 guidance for full year for Adjusted Net Operating Profit to be between US$260 million and US$290 million FY17 EBIT margins to be at the higher end of 20% to 25% targeted range¹ Lifting service levels to targeted standard Successful commissioning of capacity projects: Plant City #4 2Q FY17 Cleburne #3 3Q FY17 Plant City #3 4Q FY17 Summerville 1Q FY18 Adjusted Diluted Earnings Per Share 1 This expectation is based upon the Company continuing to achieve strong operating performance in its plants, consistent with recent quarters, and stable exchange rates and input costs

MARKET POSITION – POSITIONED FOR GROWTH Growing Market Share in all our Businesses and Geographies We aim to grow our businesses by: Growing fiber cement by substituting for wood and vinyl siding and trim in the new construction, repair and remodel and multifamily segments (35%) Maintaining our fiber cement category position by delivering differentiated value from the supply chain through to the home owner (90%) Driving our share of the rigid backer board market to 50%, while extending our presence in the underlayment market to non-fiber cement categories and adjacent accessories Utilizing a segmented approach to brand positioning and strategic pricing MARKET POSITION Grow fiber cement market share in all geographies we operate in

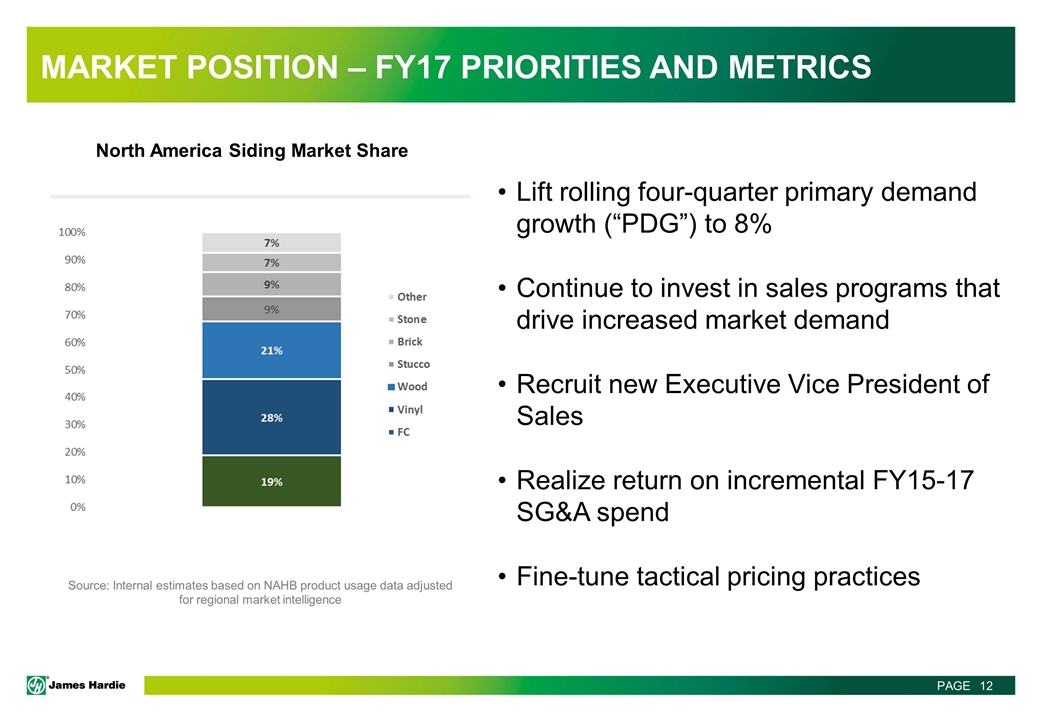

MARKET POSITION – FY17 PRIORITIES AND METRICS Lift rolling four-quarter primary demand growth (“PDG”) to 8% Continue to invest in sales programs that drive increased market demand Recruit new Executive Vice President of Sales Realize return on incremental FY15-17 SG&A spend Fine-tune tactical pricing practices North America Siding Market Share Source: Internal estimates based on NAHB product usage data adjusted for regional market intelligence

NON-FIBER CEMENT – DEVELOPING NEW STREAMS OF GROWTH Building the Foundations for Future Growth We will continue to explore opportunities for growth beyond our existing fiber cement business by: Continuing to invest in fiberglass protrusion technology and our existing fiberglass window frame business Identifying other non-fiber cement businesses within the North American building materials sector Prioritising early stage technology where our existing core competencies around product innovation, process improvement and market development can add value Giving consideration to fiber cement opportunities beyond existing geographies NON-FIBER CEMENT Develop other streams of growth beyond fiber cement

QUESTIONS