Market and capacity update Matthew Marsh September 2016 Exhibit 99.3

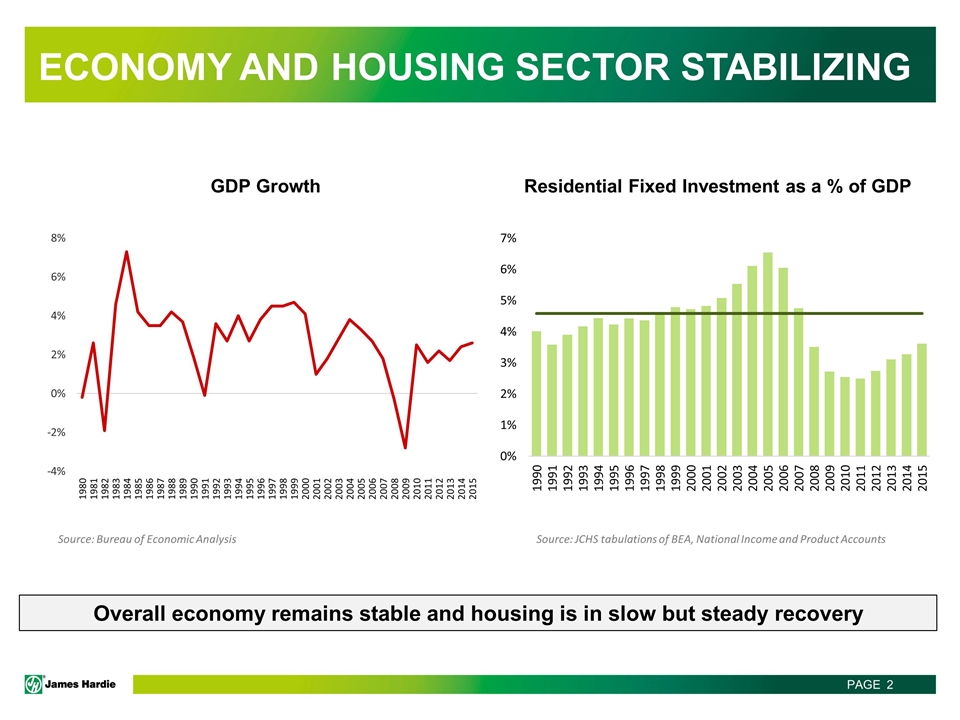

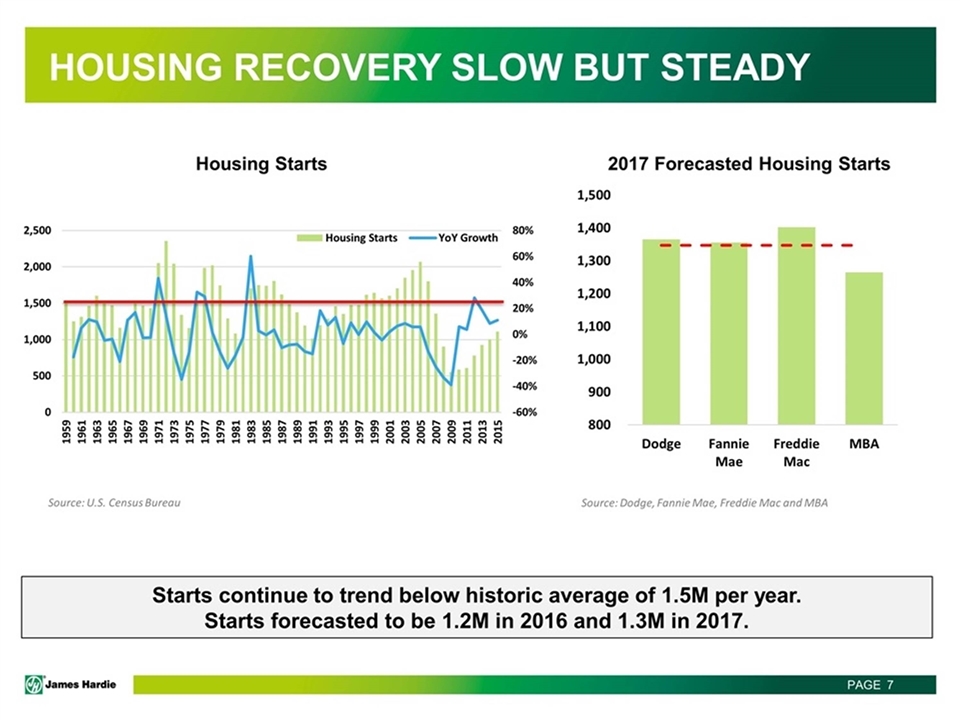

Economy and housing sector stabilizing Source: Bureau of Economic Analysis Residential Fixed Investment as a % of GDP Source: JCHS tabulations of BEA, National Income and Product Accounts GDP Growth Overall economy remains stable and housing is in slow but steady recovery

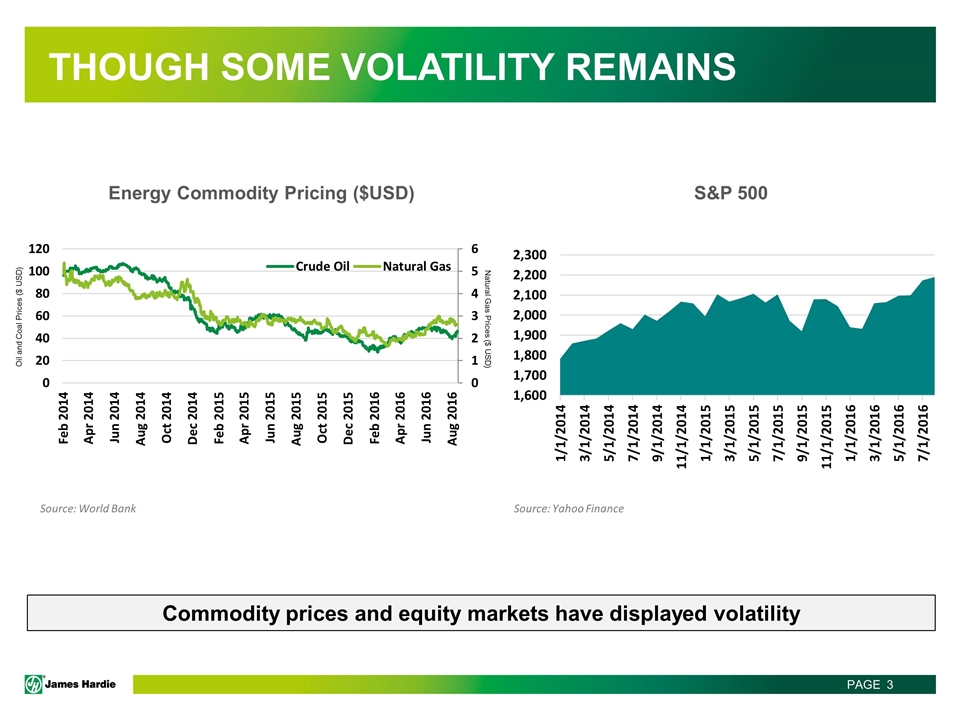

Though some volatility remains Commodity prices and equity markets have displayed volatility Source: World Bank S&P 500 Energy Commodity Pricing ($USD) Source: Yahoo Finance Oil and Coal Prices ($ USD) Natural Gas Prices ($ USD)

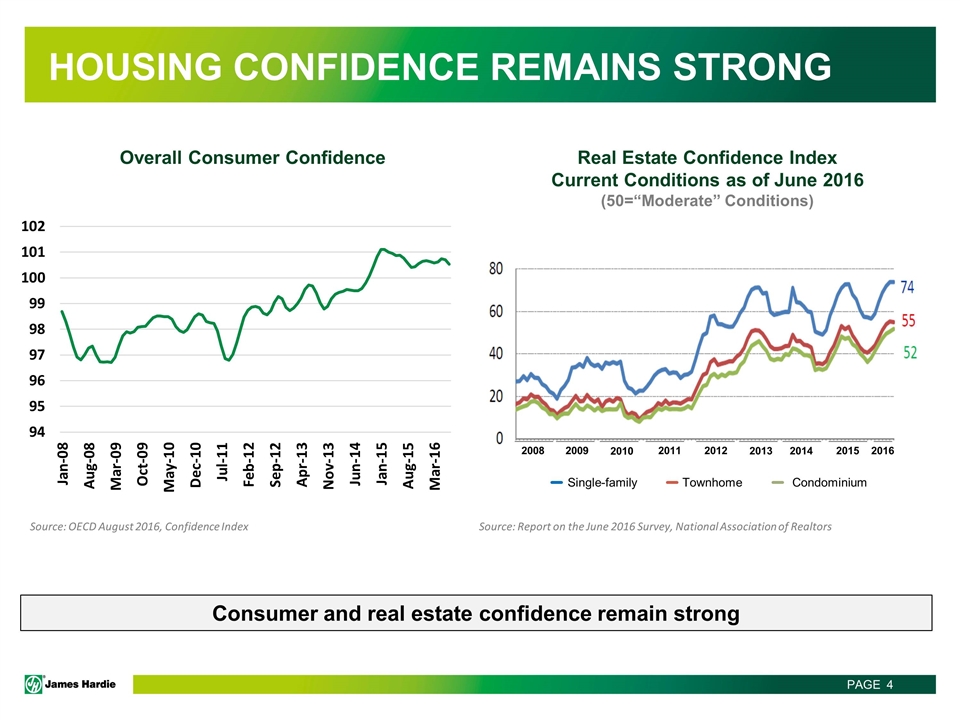

Housing confidence remains strong Consumer and real estate confidence remain strong Source: OECD August 2016, Confidence Index Overall Consumer Confidence Real Estate Confidence Index Current Conditions as of June 2016 (50=“Moderate” Conditions) Source: Report on the June 2016 Survey, National Association of Realtors Single-family Townhome Condominium 2008 2009 2010 2011 2012 2013 2014 2015 2016

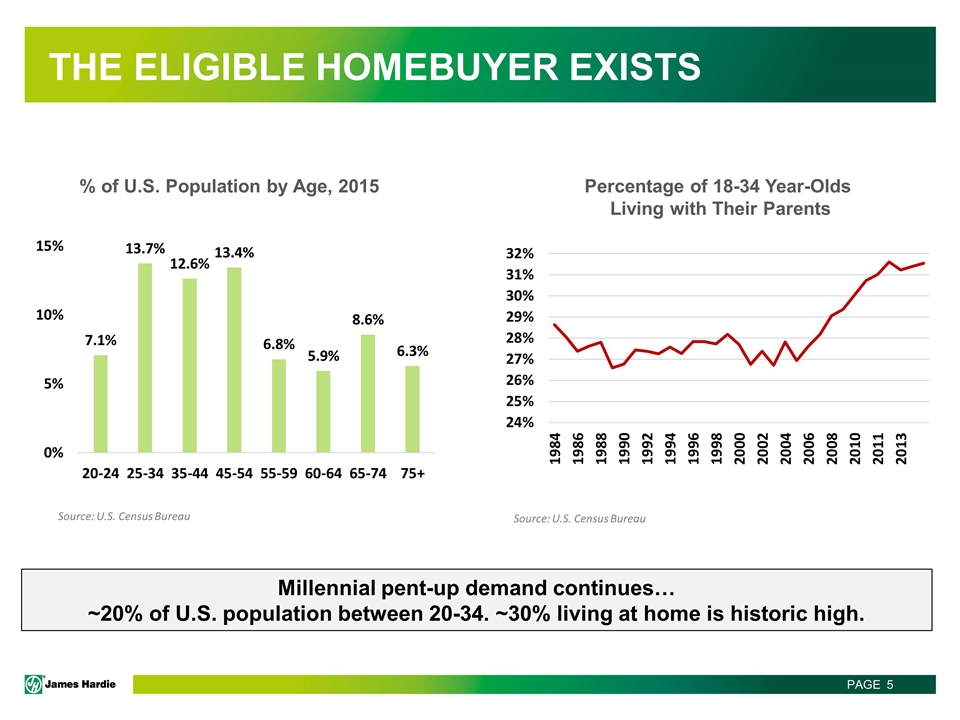

The eligible homebuyer exists Source: U.S. Census Bureau Source: U.S. Census Bureau % of U.S. Population by Age, 2015 Percentage of 18-34 Year-Olds Living with Their Parents Millennial pent-up demand continues… ~20% of U.S. population between 20-34. ~30% living at home is historic high.

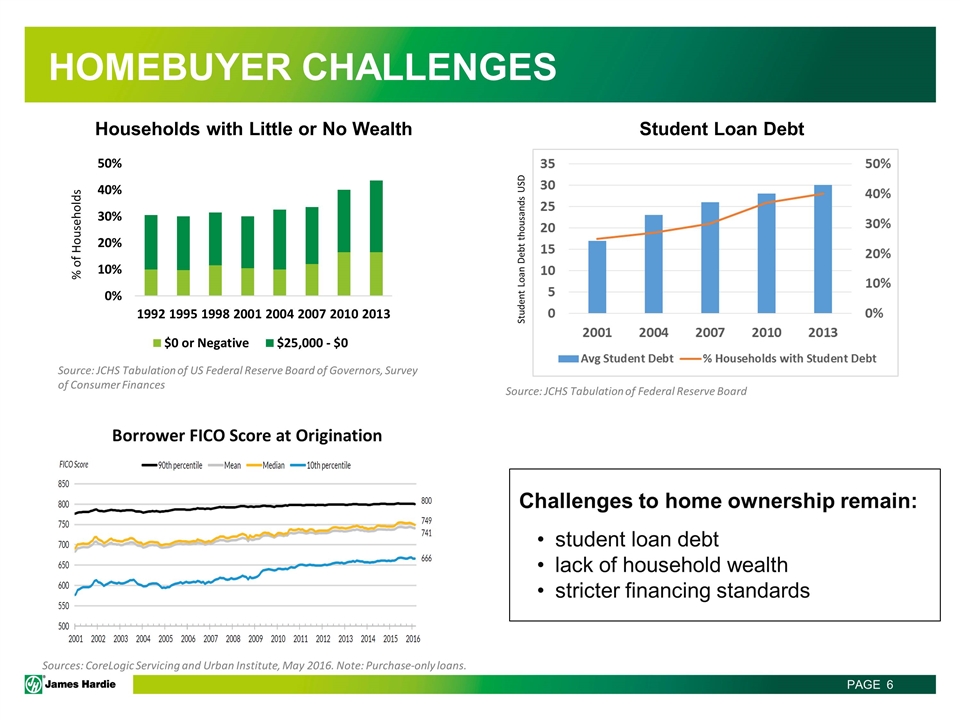

Homebuyer challenges Households with Little or No Wealth Source: JCHS Tabulation of US Federal Reserve Board of Governors, Survey of Consumer Finances Borrower FICO Score at Origination Sources: CoreLogic Servicing and Urban Institute, May 2016. Note: Purchase-only loans. % of Households Challenges to home ownership remain: student loan debt lack of household wealth stricter financing standards Student Loan Debt Source: JCHS Tabulation of Federal Reserve Board Student Loan Debt thousands USD

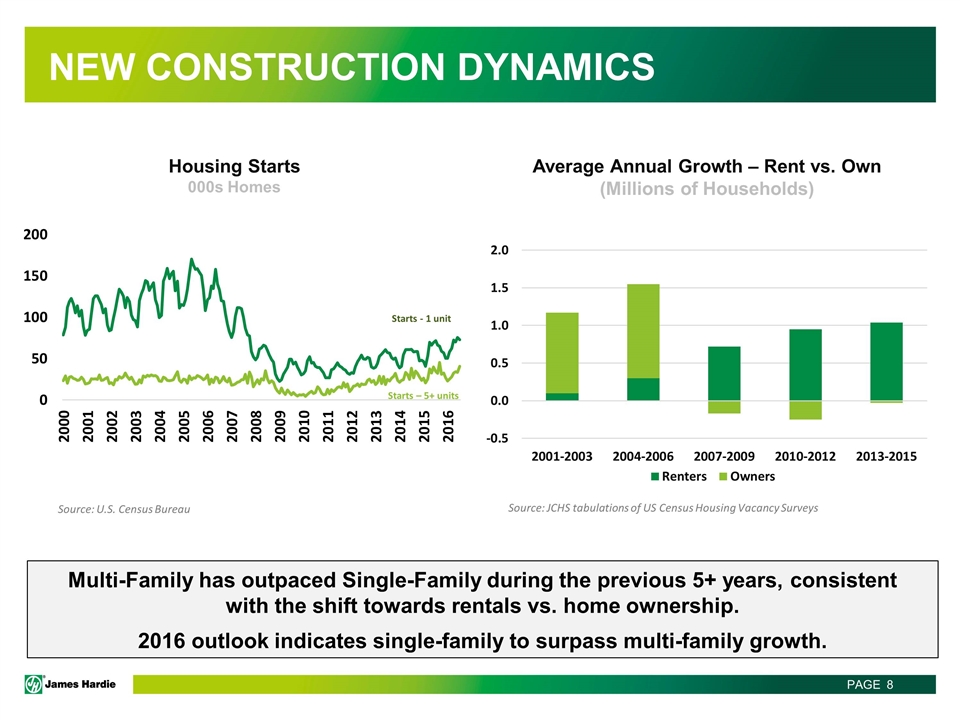

New construction dynamics Source: U.S. Census Bureau Housing Starts 000s Homes Average Annual Growth – Rent vs. Own (Millions of Households) Source: JCHS tabulations of US Census Housing Vacancy Surveys Multi-Family has outpaced Single-Family during the previous 5+ years, consistent with the shift towards rentals vs. home ownership. 2016 outlook indicates single-family to surpass multi-family growth.

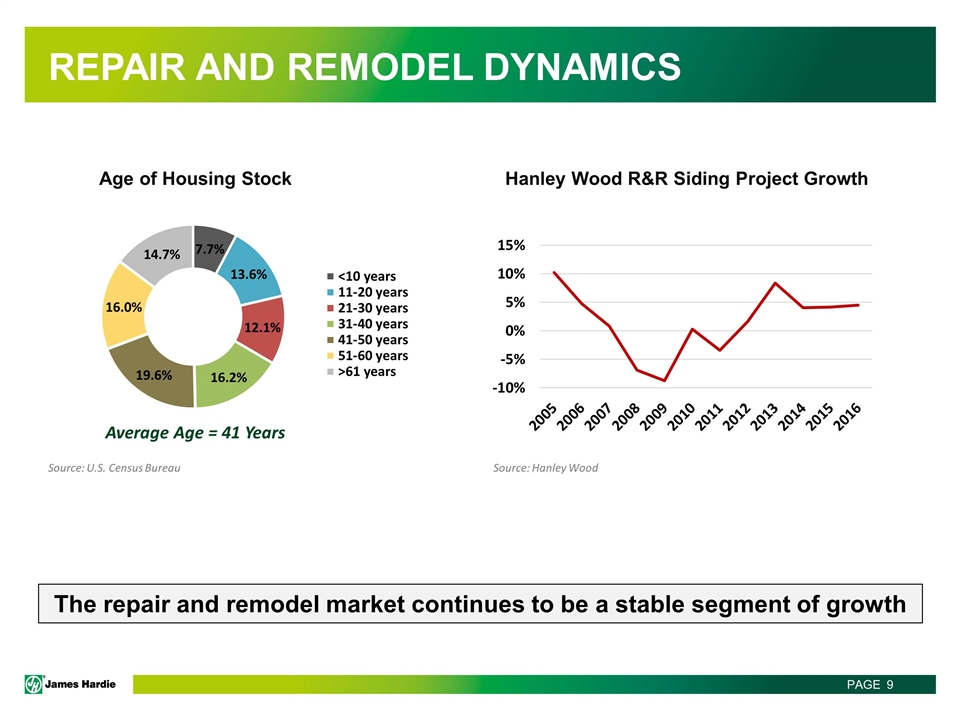

Repair and remodel dynamics Source: U.S. Census Bureau Age of Housing Stock Source: Hanley Wood Hanley Wood R&R Siding Project Growth The repair and remodel market continues to be a stable segment of growth Average Age = 41 Years

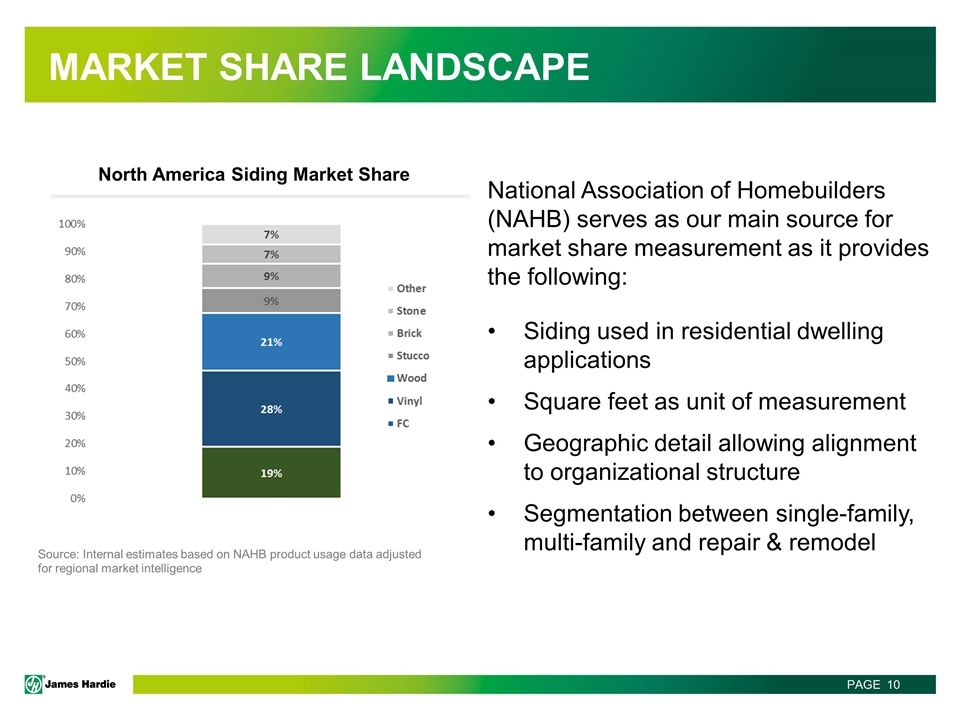

Market share landscape North America Siding Market Share Source: Internal estimates based on NAHB product usage data adjusted for regional market intelligence National Association of Homebuilders (NAHB) serves as our main source for market share measurement as it provides the following: Siding used in residential dwelling applications Square feet as unit of measurement Geographic detail allowing alignment to organizational structure Segmentation between single-family, multi-family and repair & remodel

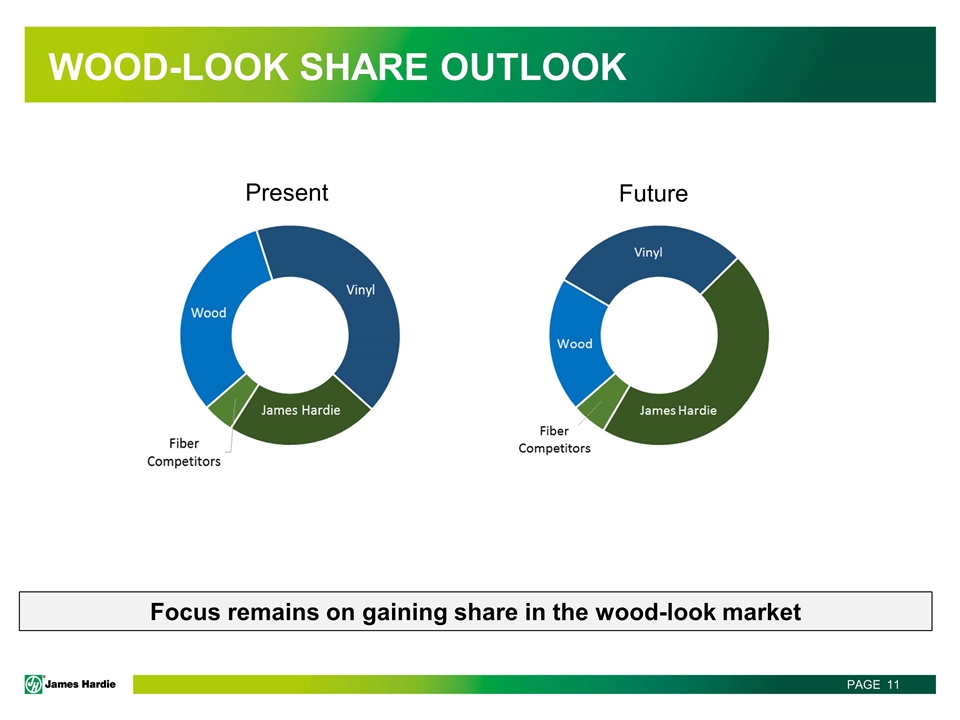

Wood-look share outlook Present Future Focus remains on gaining share in the wood-look market

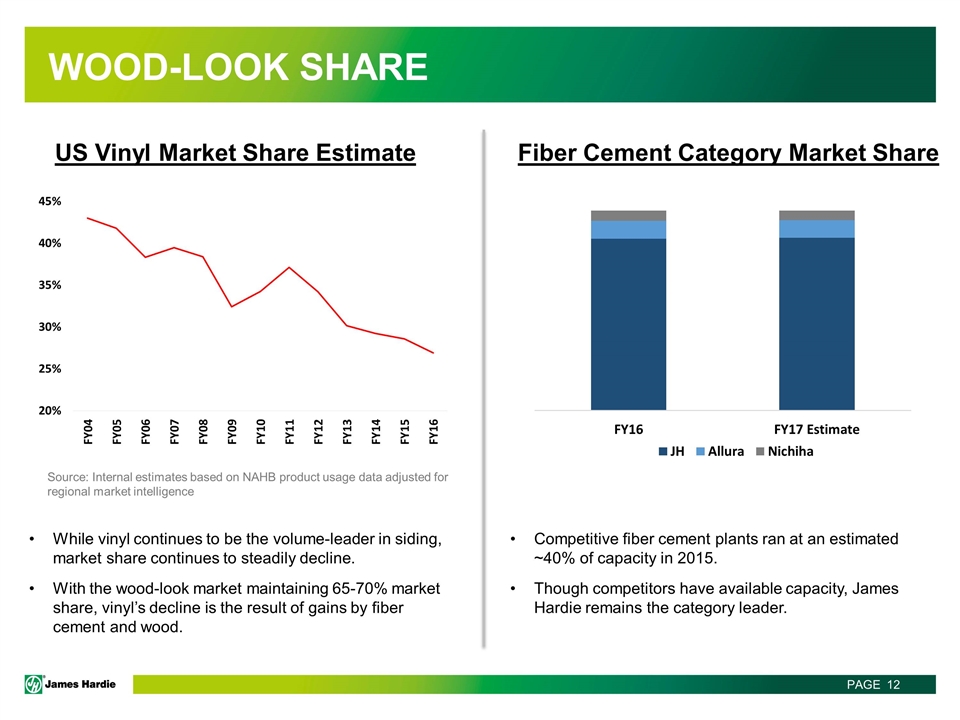

Wood-look share Source: Internal estimates based on NAHB product usage data adjusted for regional market intelligence US Vinyl Market Share Estimate While vinyl continues to be the volume-leader in siding, market share continues to steadily decline. With the wood-look market maintaining 65-70% market share, vinyl’s decline is the result of gains by fiber cement and wood. Fiber Cement Category Market Share Competitive fiber cement plants ran at an estimated ~40% of capacity in 2015. Though competitors have available capacity, James Hardie remains the category leader.

Capacity

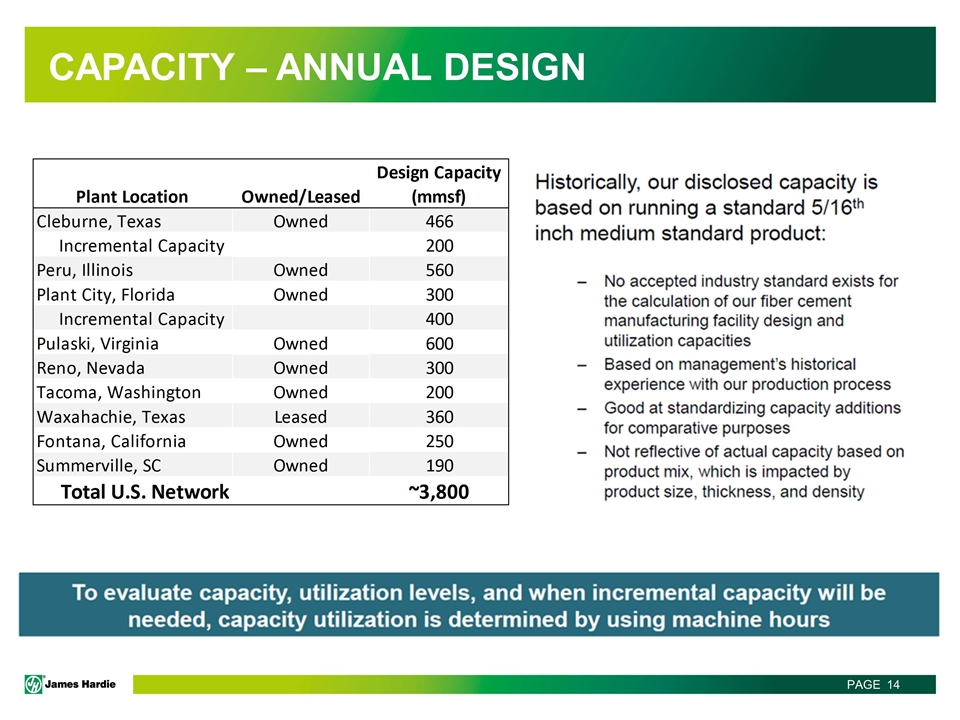

Capacity – annual design

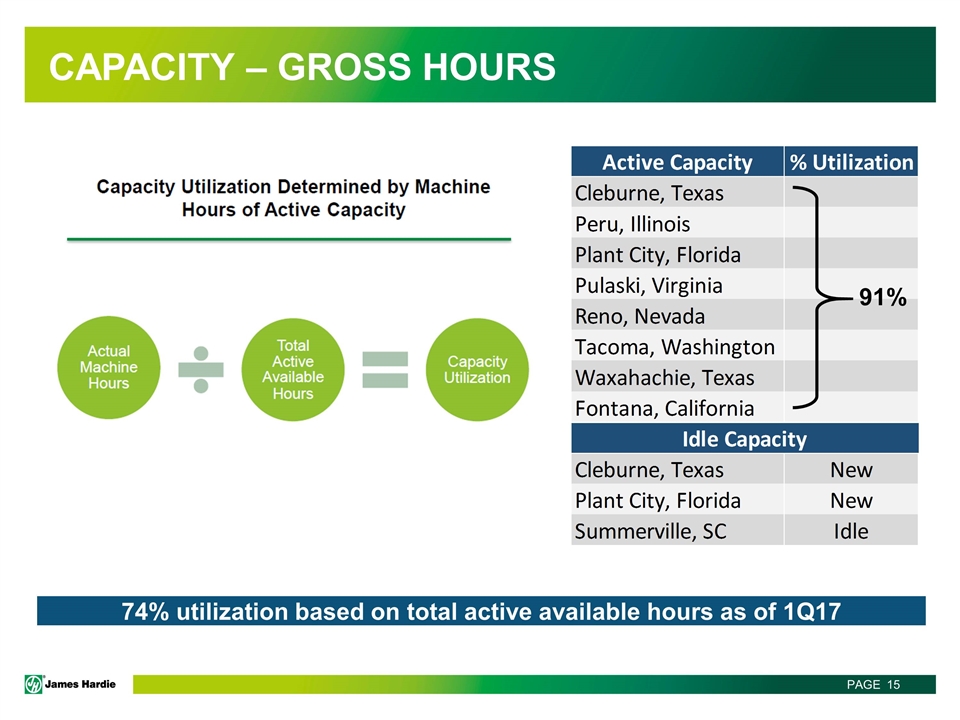

Capacity – gross hours 74% utilization based on total active available hours as of 1Q17 91%

Capacity core concepts Enable 35/90 by ensuring market supply ahead of demand Commission new capacity to optimize network costs Invest in capacity that maximizes value creation Use triggers to serve as leading indicators for capacity expansion CORE CONCEPTS OF MANUFACTURING CAPACITY

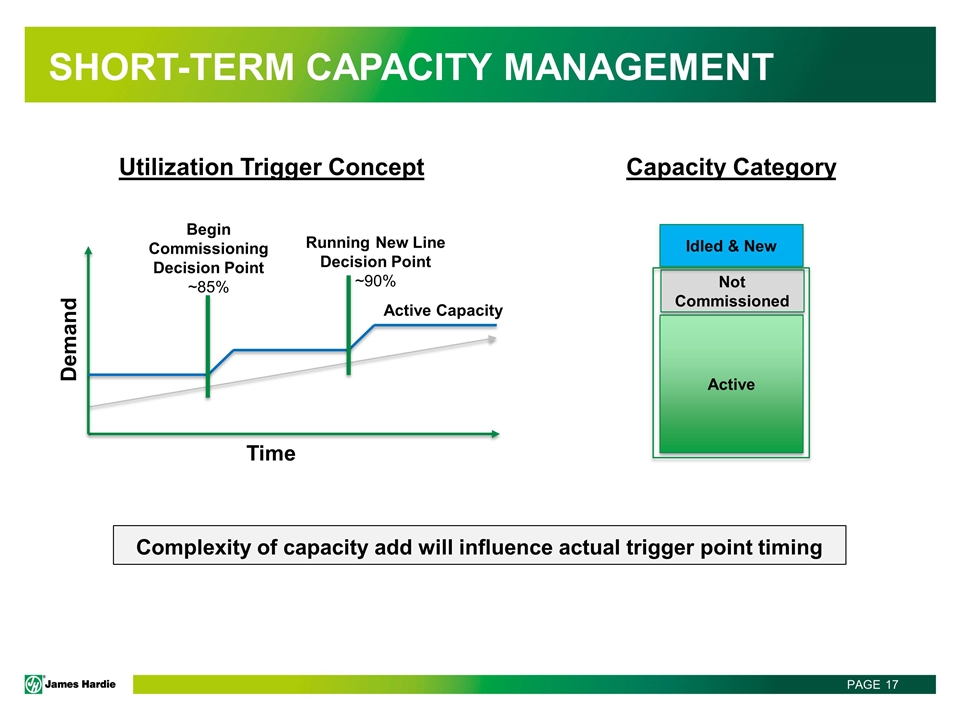

Short-term capacity management Active Capacity Running New Line Decision Point ~90% Begin Commissioning Decision Point ~85% Time Demand Capacity Category Utilization Trigger Concept Complexity of capacity add will influence actual trigger point timing Active Not Commissioned Idled & New

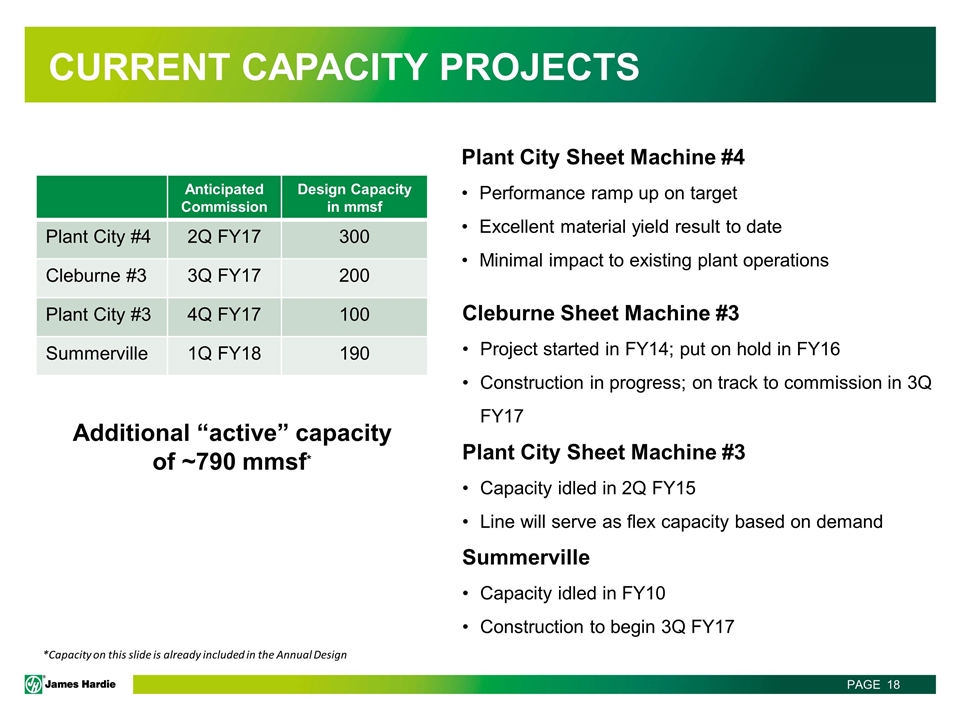

Current capacity projects Anticipated Commission Design Capacity in mmsf Plant City #4 2Q FY17 300 Cleburne #3 3Q FY17 200 Plant City #3 4Q FY17 100 Summerville 1Q FY18 190 Additional “active” capacity of ~790 mmsf* Plant City Sheet Machine #4 Performance ramp up on target Excellent material yield result to date Minimal impact to existing plant operations Cleburne Sheet Machine #3 Project started in FY14; put on hold in FY16 Construction in progress; on track to commission in 3Q FY17 Plant City Sheet Machine #3 Capacity idled in 2Q FY15 Line will serve as flex capacity based on demand *Capacity on this slide is already included in the Annual Design Summerville Capacity idled in FY10 Construction to begin 3Q FY17

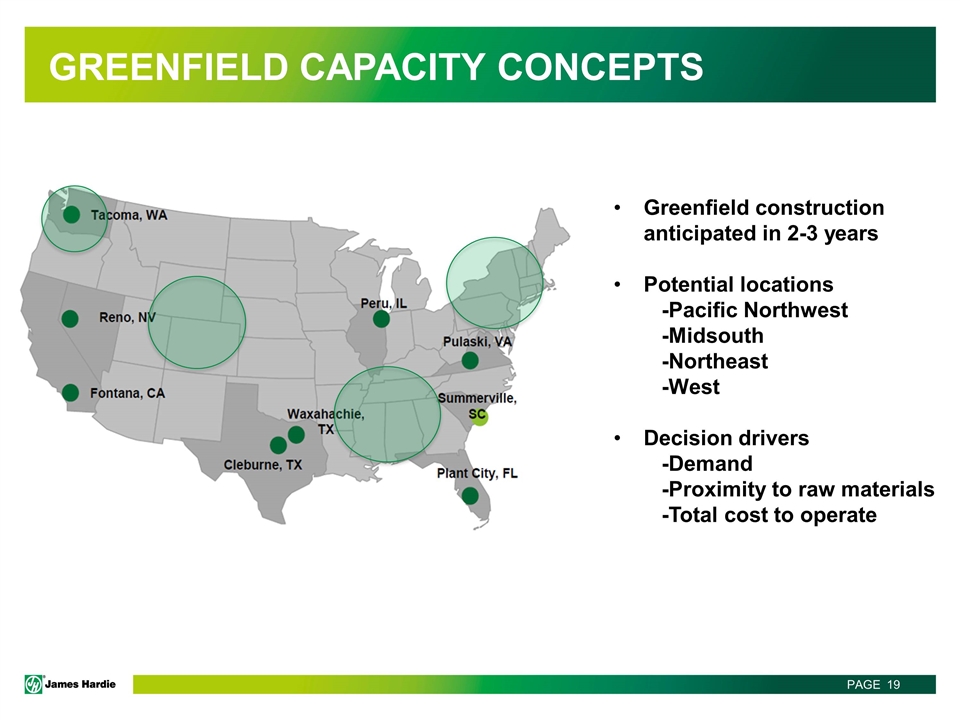

Greenfield capacity concepts Greenfield construction anticipated in 2-3 years Potential locations -Pacific Northwest -Midsouth -Northeast -West Decision drivers -Demand -Proximity to raw materials -Total cost to operate

Greenfield capacity concepts Design new capacity that optimizes returns of the entire network Line location and size determination Product & process capability selection Value engineering and line optimization Current cost estimates for next greenfield site range between $70MM-$120MM Cost to build increasing faster than margin growth, dampening returns Assessing opportunities to reduce construction costs through value engineering

summary US housing market continues down path of recovery, though at a slower than historical rate. James Hardie remains focused on market position, including share growth in the wood-look category. Capacity core concepts remain guiding principles of investment decision-making.