Market Position Sean Gadd September 2016 Exhibit 99.5

Agenda 35/90 AND WHERE IT COMES FROM SINGLE FAMILY NEW CONSTRUCTION AGAINST VINYL SINGLE FAMILY REPAIR AND REMODEL AGAINST VINYL WINNING AGAINST OSB SIDING TOP OF MARKET STRATEGY

James Hardie us strategy To grow organically through a differentiated position in the building products industry. Grow Fiber Cement by substituting for both wood and vinyl based sidings and trim in the new construction, repair & remodel market and multifamily segments (35) Maintain our Fiber Cement category position by delivering differentiated value to supply chain participants, right through to the home owner (90)

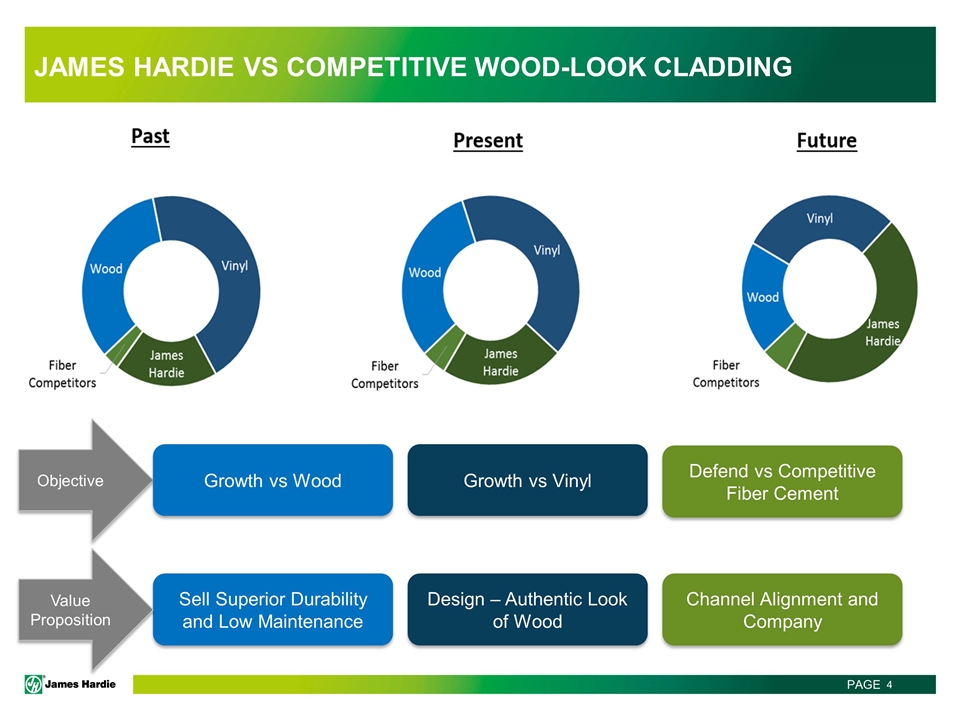

James Hardie vs competitive wood-look cladding Objective Sell Superior Durability and Low Maintenance Design – Authentic Look of Wood Channel Alignment and Company Growth vs Wood Defend vs Competitive Fiber Cement Growth vs Vinyl Value Proposition

Growth – terminal segment composition Market opportunity & growth will come from both metro and non-metro markets Multifamily Repair and Remodel Single Family 35%++ >35% <35%

Single family new construction - vinyl

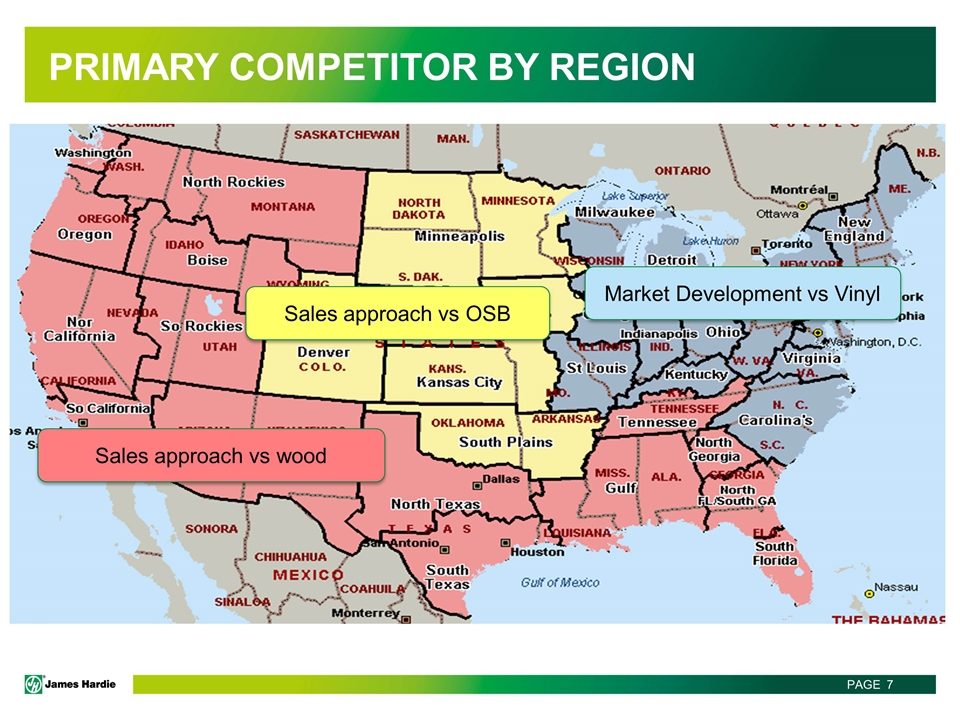

Primary competitor by region Market Development vs Vinyl Sales approach vs OSB Sales approach vs wood

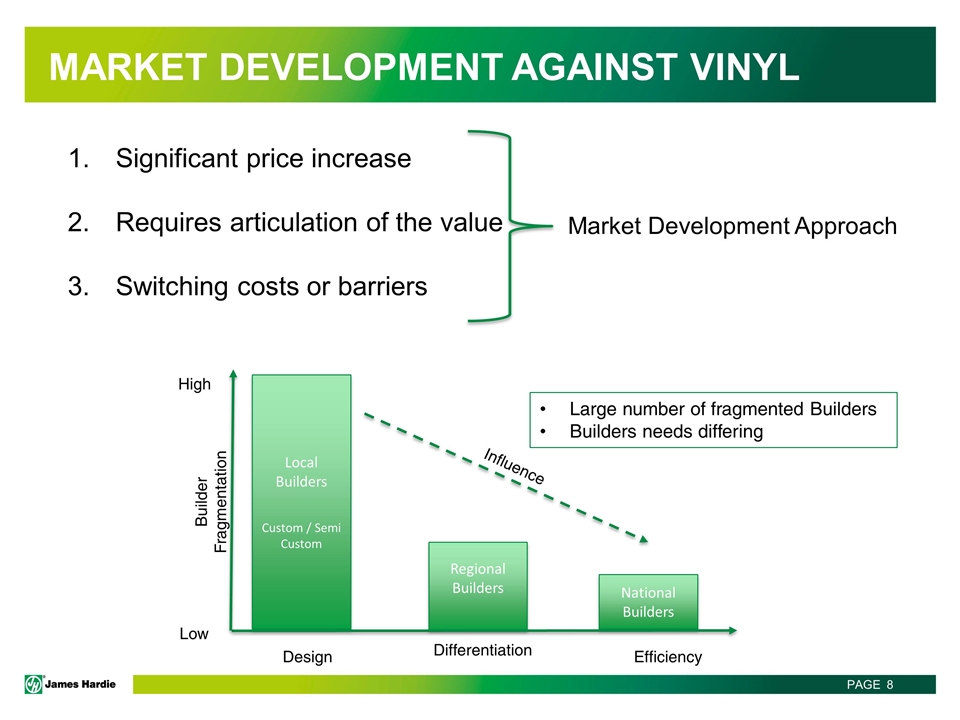

Market development against vinyl Significant price increase Requires articulation of the value Switching costs or barriers Market Development Approach Large number of fragmented Builders Builders needs differing Local Builders Custom / Semi Custom Regional Builders National Builders Influence Builder Fragmentation High Low Differentiation Design Efficiency

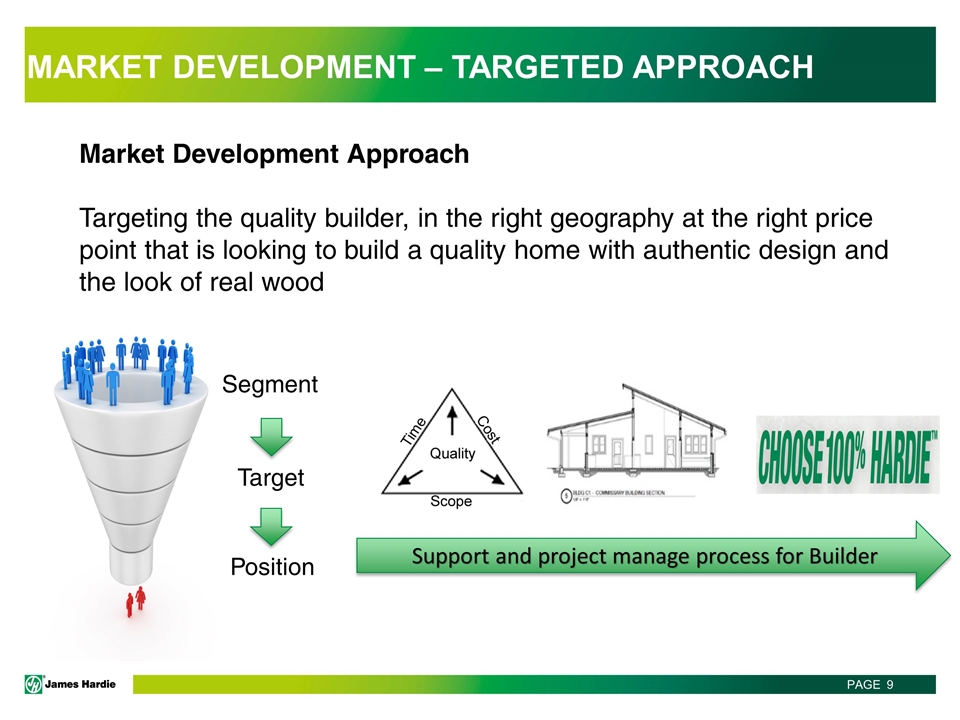

Market development – targeted approach Market Development Approach Targeting the quality builder, in the right geography at the right price point that is looking to build a quality home with authentic design and the look of real wood Segment Target Position Support and project manage process for Builder

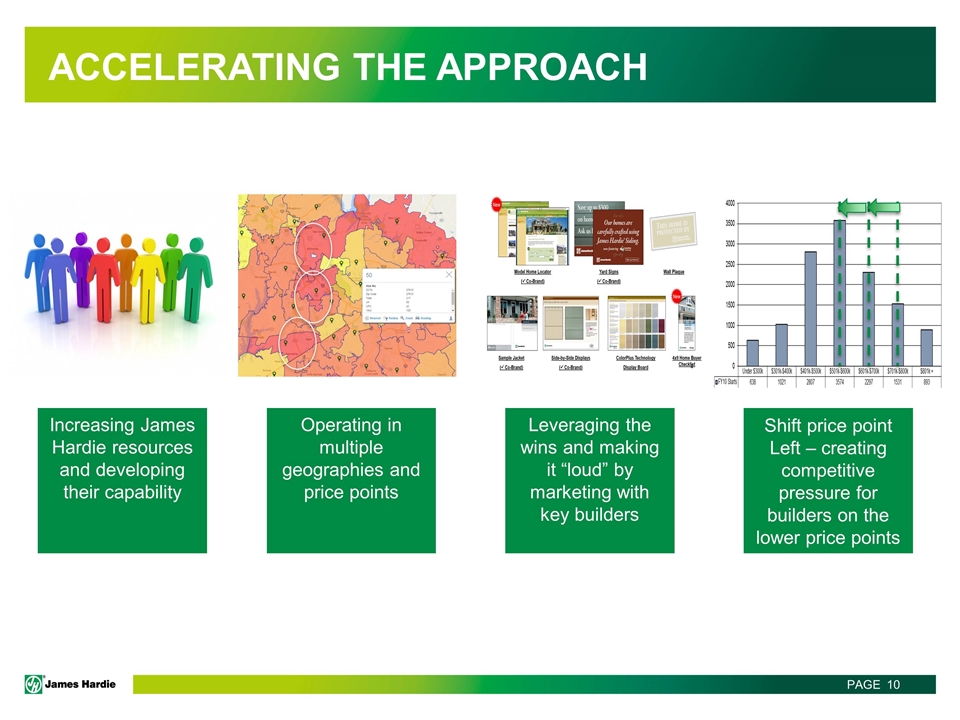

Accelerating the approach Increasing James Hardie resources and developing their capability Operating in multiple geographies and price points Leveraging the wins and making it “loud” by marketing with key builders Shift price point Left – creating competitive pressure for builders on the lower price points

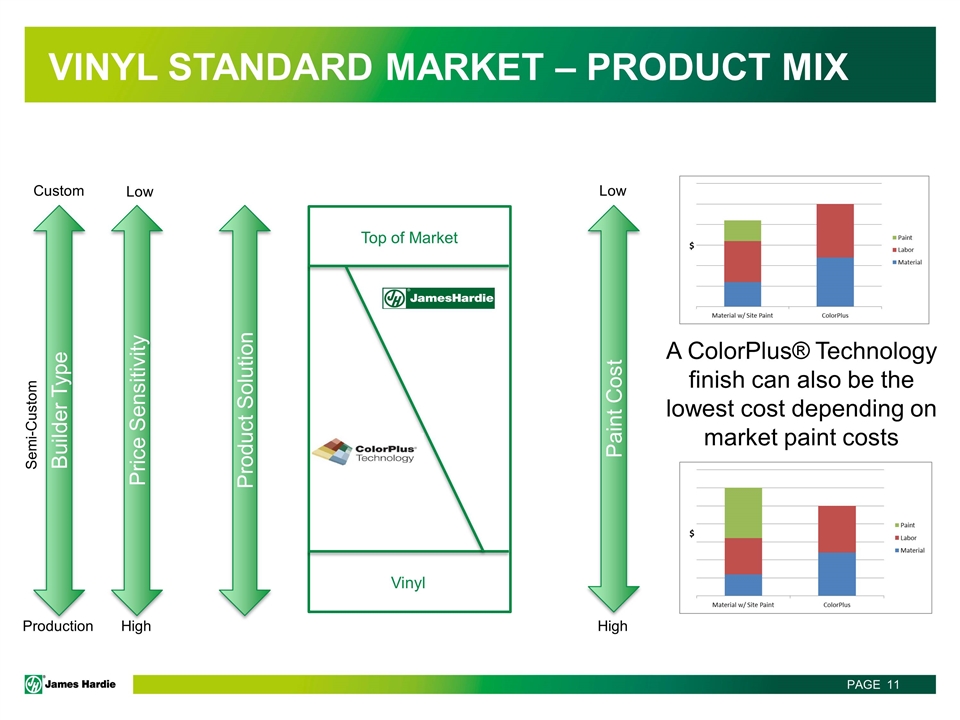

Vinyl standard market – product mix Production Custom Semi-Custom Builder Type High Low Price Sensitivity Product Solution Top of Market Vinyl Paint Cost Low High A ColorPlus® Technology finish can also be the lowest cost depending on market paint costs

Single family repair and remodel

Single family repair and remodel Raise Awareness with The Homeowner Develop an Aligned Group of Contractors Help the Contractor Sell in the Home Brand ONLY Homeowner Return On Investment A Trusting Contractor Renewing Homeowner’s Dream Home Durability, Low Maintenance, Design and Time Proven Product Decision Maker Key Considerations Key Decision Maker Go to Market Strategy

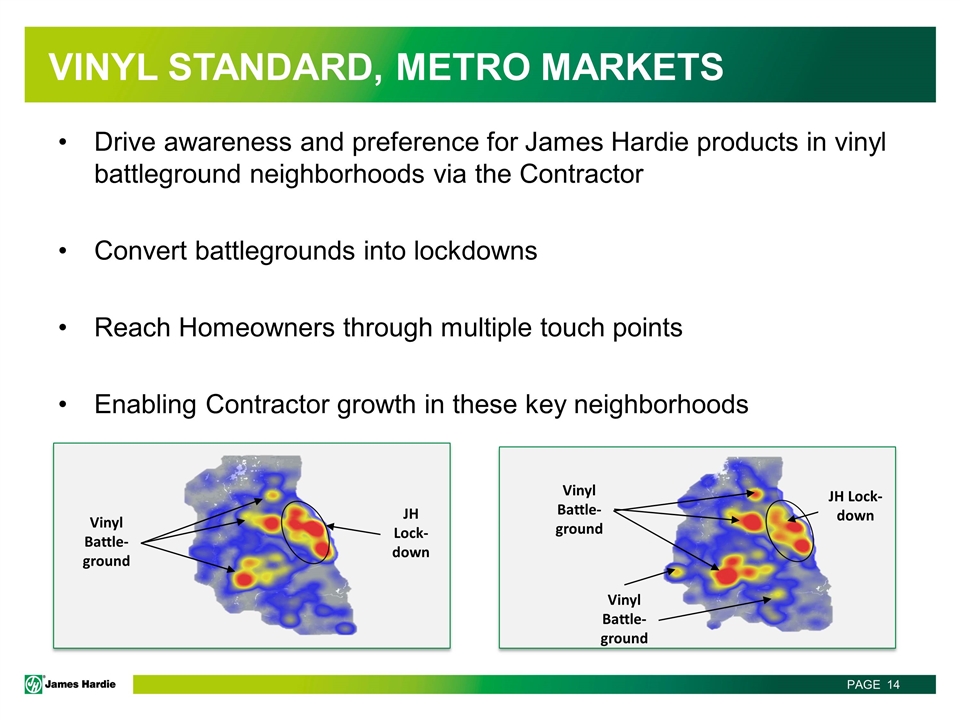

Vinyl standard, metro markets Drive awareness and preference for James Hardie products in vinyl battleground neighborhoods via the Contractor Convert battlegrounds into lockdowns Reach Homeowners through multiple touch points Enabling Contractor growth in these key neighborhoods JH Lock-down Vinyl Battle-ground Vinyl Battle- ground JH Lock-down Vinyl Battle-ground

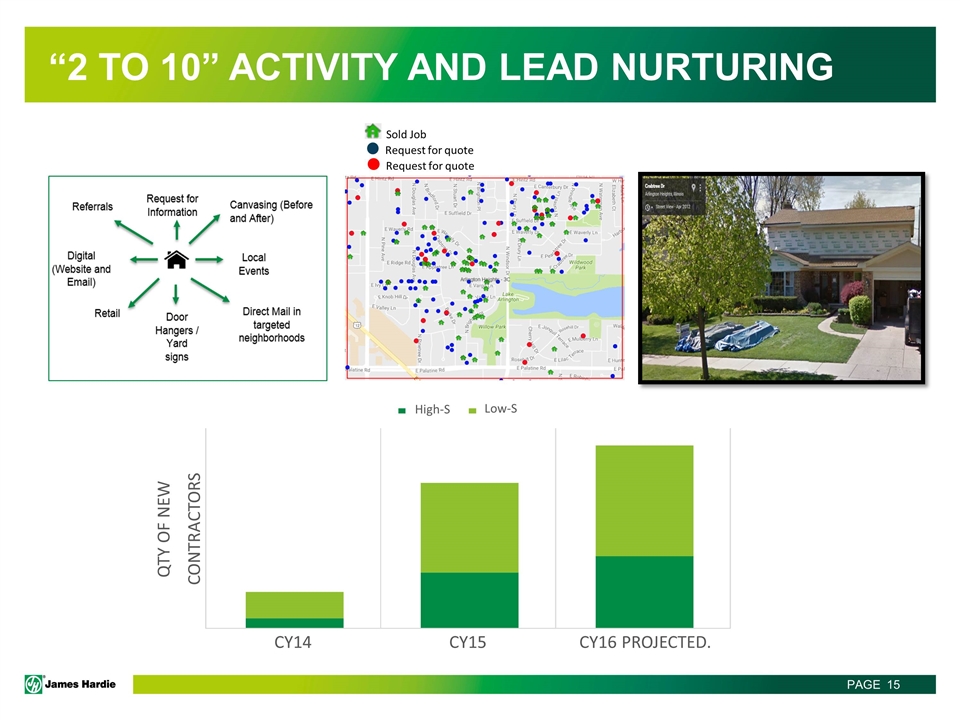

“2 to 10” activity and lead nurturing CY14 CY15 CY16 PROJECTED. QTY OF NEW CONTRACTORS High-S Low-S Request for quote Request for quote Sold Job

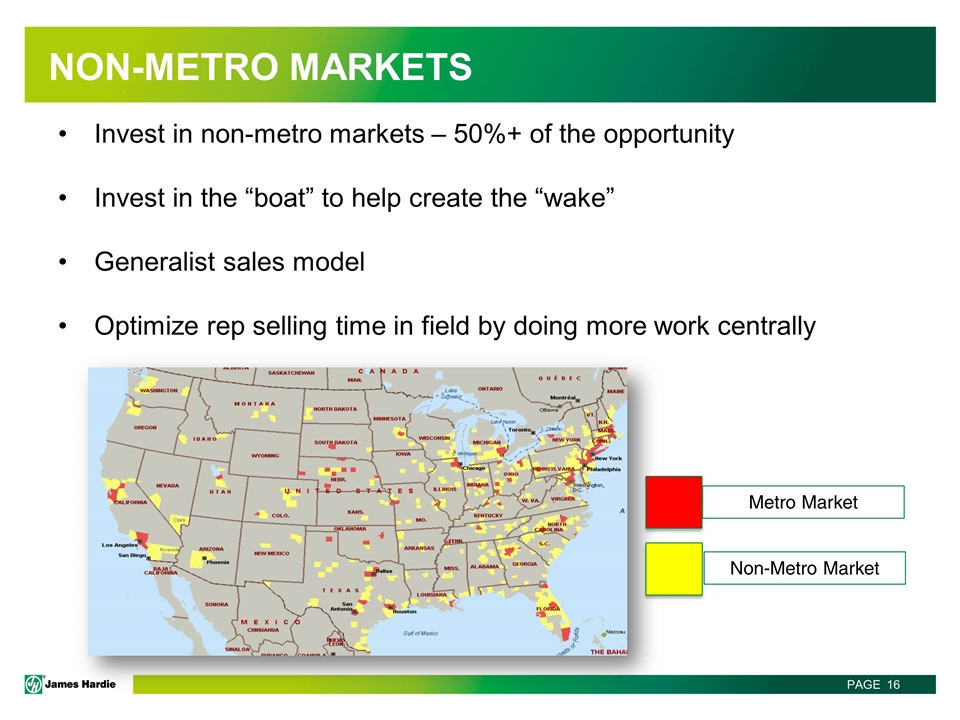

Non-metro markets Invest in non-metro markets – 50%+ of the opportunity Invest in the “boat” to help create the “wake” Generalist sales model Optimize rep selling time in field by doing more work centrally Metro Market Non-Metro Market

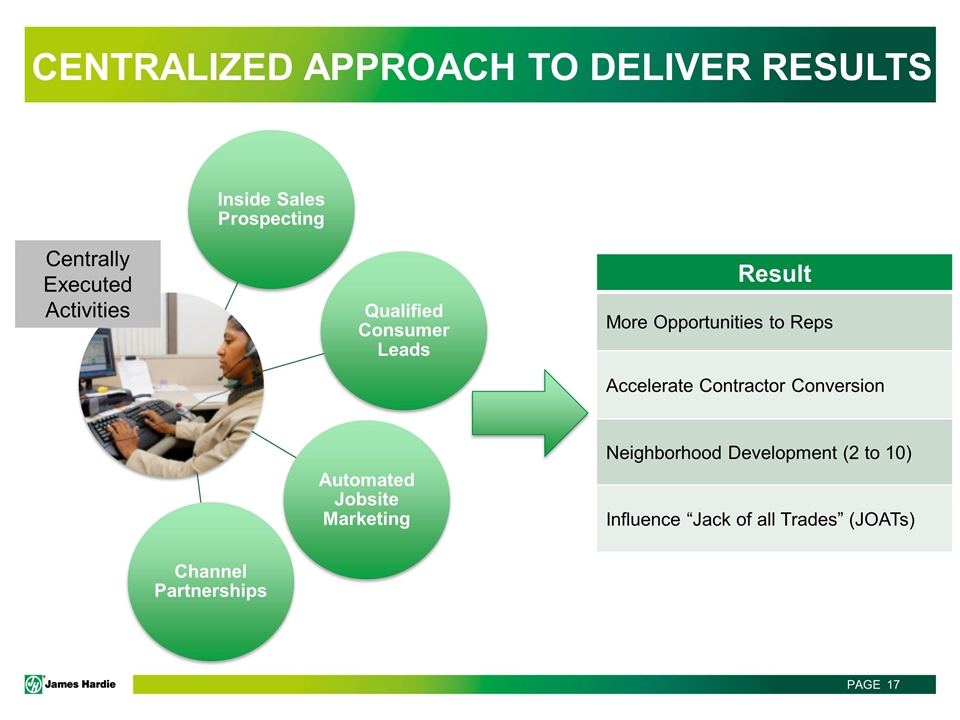

Centralized approach to deliver results Result More Opportunities to Reps Accelerate Contractor Conversion Neighborhood Development (2 to 10) Influence “Jack of all Trades” (JOATs) Centrally Executed Activities Inside Sales Prospecting Qualified Consumer Leads Automated Jobsite Marketing Channel Partnerships

winning against OSB siding

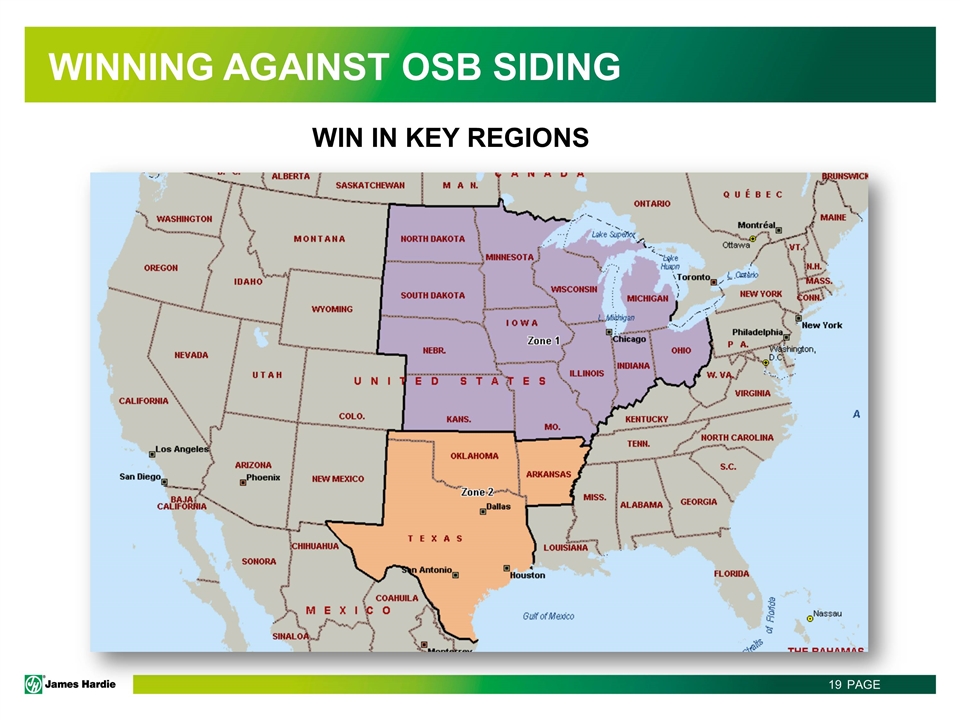

Winning against OSB siding WIN IN KEY REGIONS

Winning against OSB siding Company versus company (non-product value) OSB Siding Durability Non – Product Value Ease of Install, “Me too” positioning Low Maintenance Design Warranty Marketing Tools Value Economic Value Analysis $’s

Winning against OSB siding in Zone 1 To win against OSB siding products, James Hardie game plan was developed around key pillars: Resourcing Product portfolio changes Non-Product value programs Value chain engagement

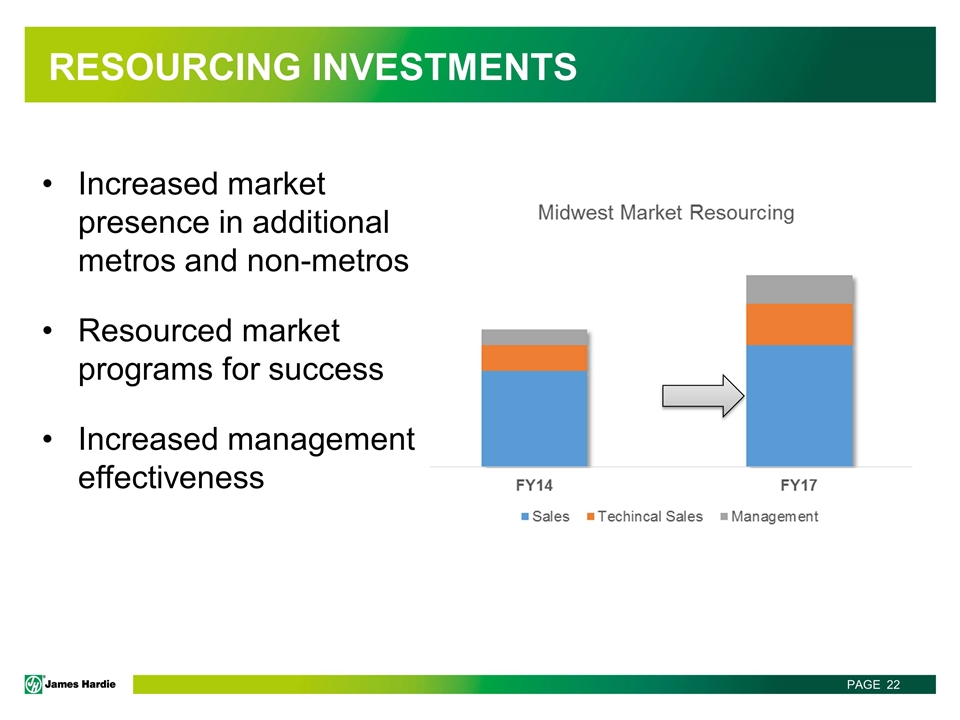

Resourcing Investments Increased market presence in additional metros and non-metros Resourced market programs for success Increased management effectiveness

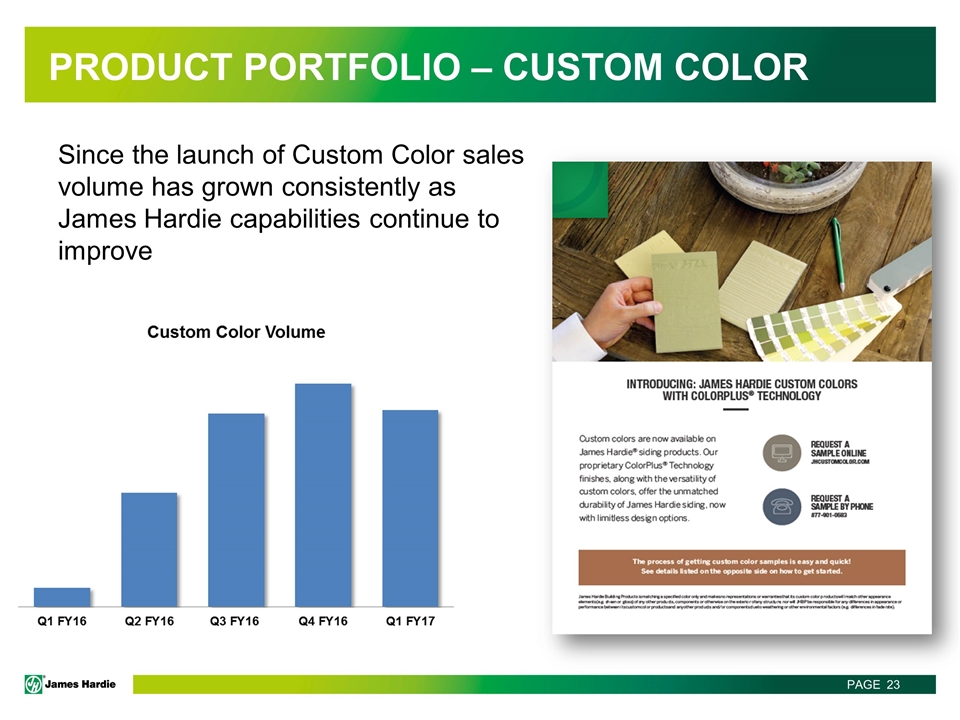

Product Portfolio – Custom Color Since the launch of Custom Color sales volume has grown consistently as James Hardie capabilities continue to improve

Product Portfolio – Roughsawn Trim HardieTrim is now attached to more Hardie homes following the launch of Roughsawn trim

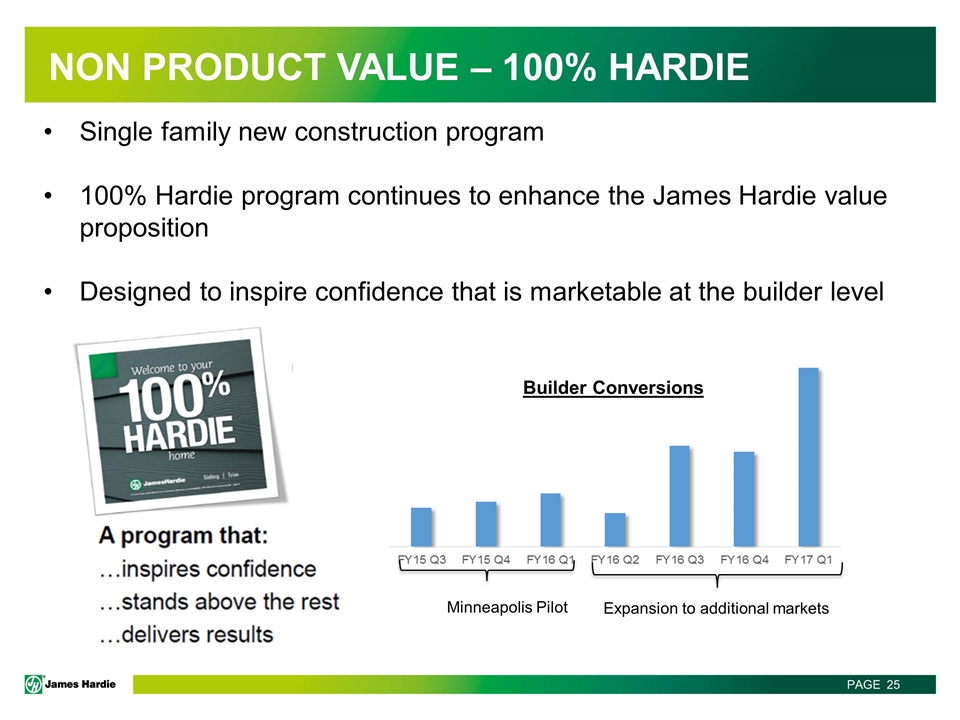

Non Product Value – 100% Hardie Single family new construction program 100% Hardie program continues to enhance the James Hardie value proposition Designed to inspire confidence that is marketable at the builder level Minneapolis Pilot Expansion to additional markets Builder Conversions

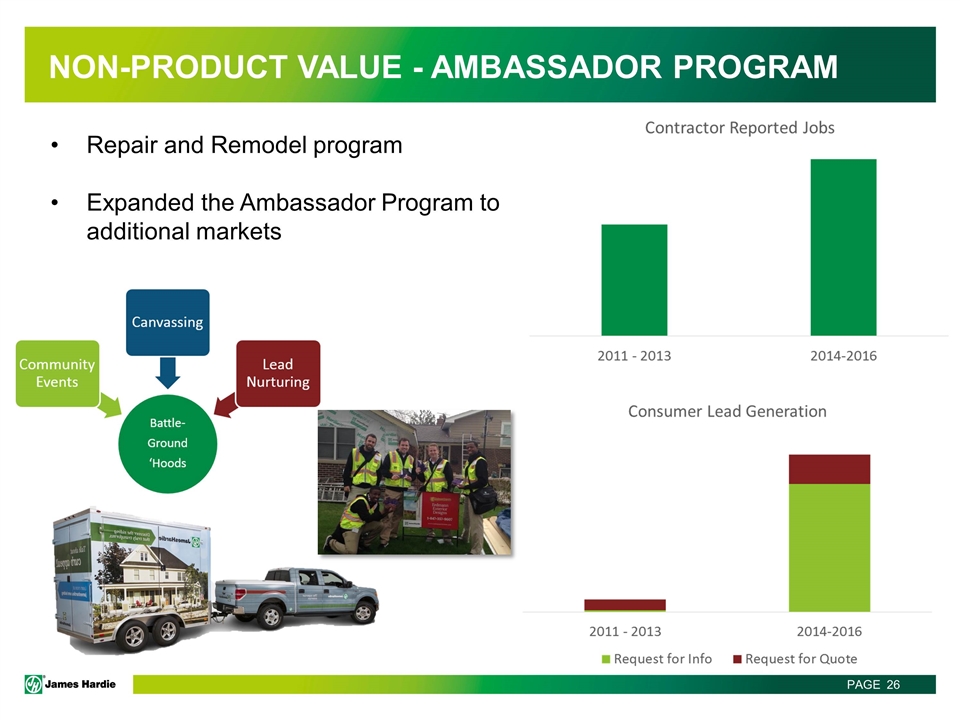

Non-Product Value - Ambassador Program Repair and Remodel program Expanded the Ambassador Program to additional markets

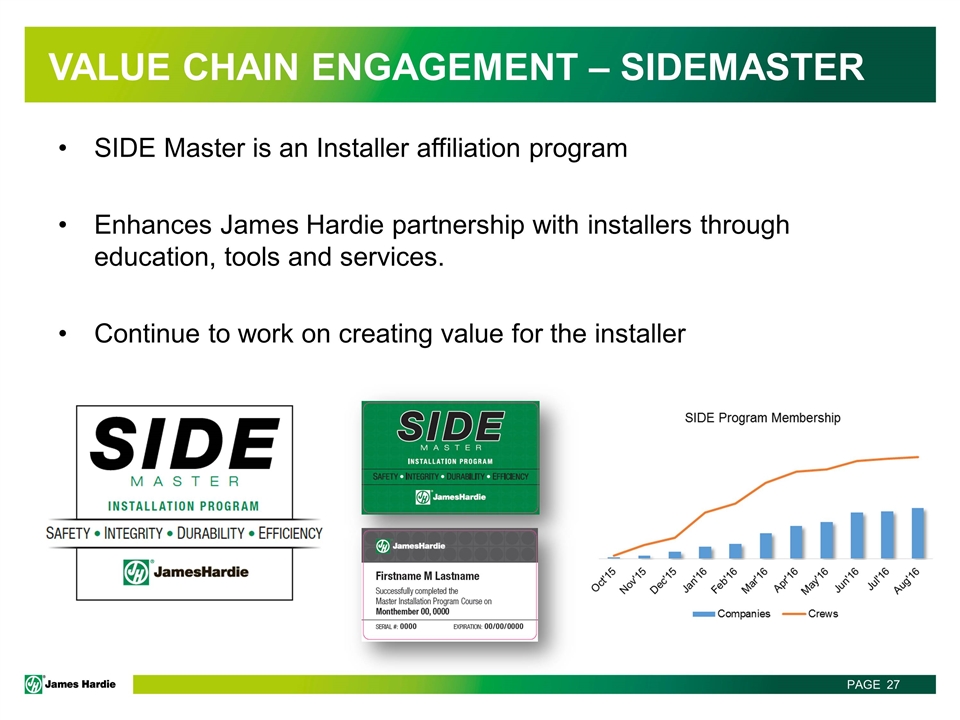

Value Chain Engagement – SIDEMaster SIDE Master is an Installer affiliation program Enhances James Hardie partnership with installers through education, tools and services. Continue to work on creating value for the installer

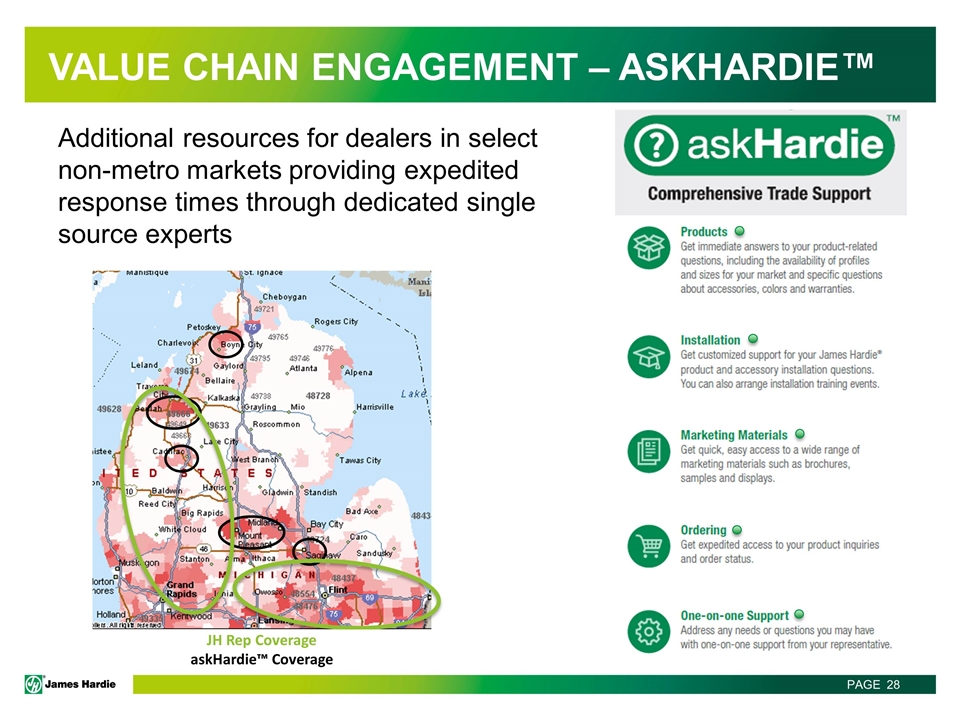

Value Chain Engagement – AskHardie™ Additional resources for dealers in select non-metro markets providing expedited response times through dedicated single source experts JH Rep Coverage askHardie™ Coverage

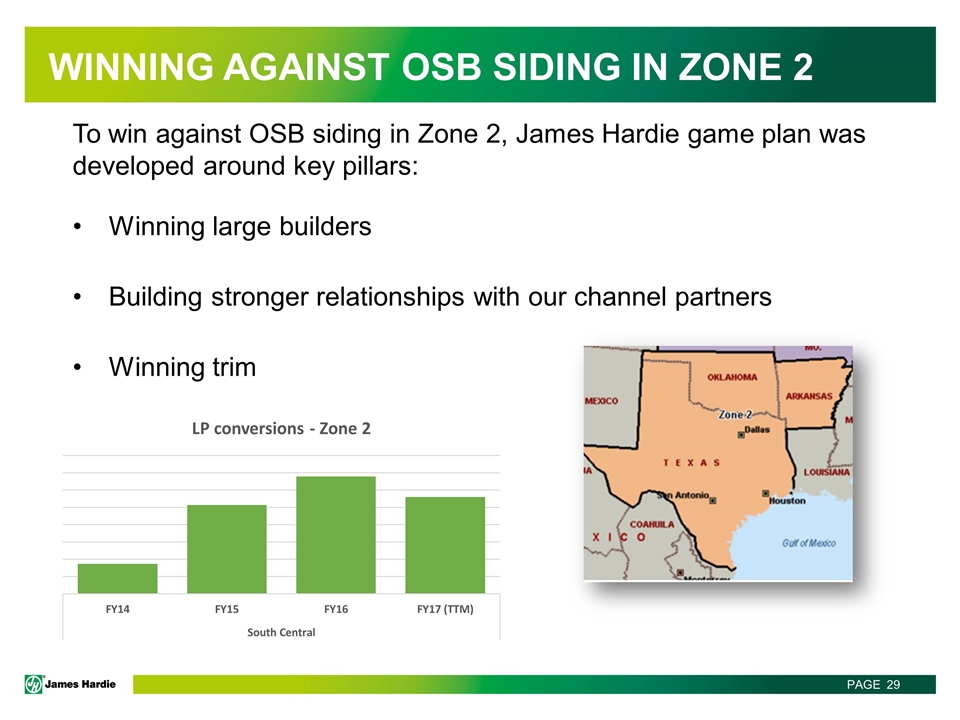

Winning against osb siding in Zone 2 To win against OSB siding in Zone 2, James Hardie game plan was developed around key pillars: Winning large builders Building stronger relationships with our channel partners Winning trim

Top of market

Top of market The goal in Top of Market is to establish a design leadership position for James Hardie on luxury and custom homes. Product development investments will deliver a suite of products designed to appeal to traditional, contemporary, or modern design preferences.

Top of market – James Hardie James Hardie is uniquely advantaged to win in the Top of Market… Trusted and respected brand with proven durability Product Leadership: Technologies to deliver improved product development capabilities Leverage process advantages Work though current aligned channel partners for quick entry Wood–replacement strategy against cedar Top of Market is aligned to the James Hardie strategy Delivers against the 35 and better defends the 90 Provides value that this customer group is looking for

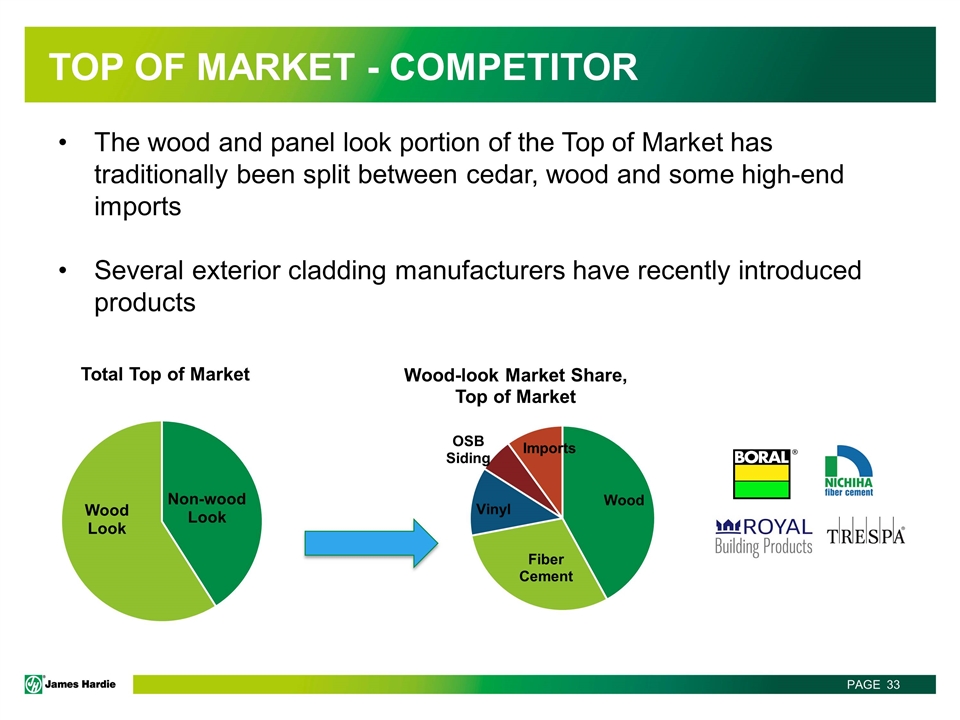

Top of market - competitor The wood and panel look portion of the Top of Market has traditionally been split between cedar, wood and some high-end imports Several exterior cladding manufacturers have recently introduced products

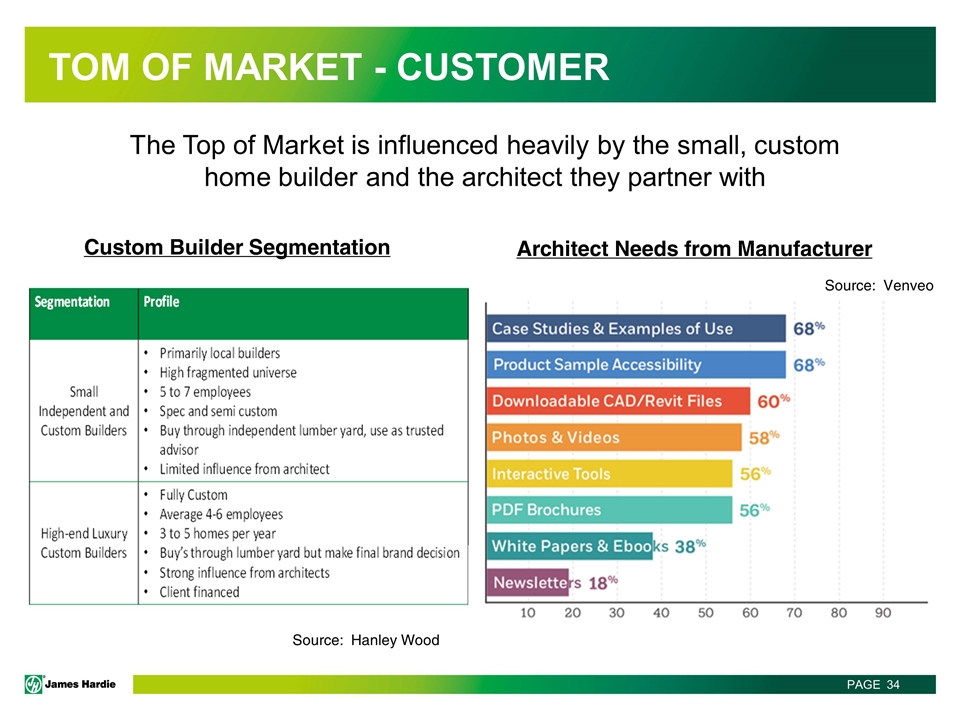

Tom of market - customer The Top of Market is influenced heavily by the small, custom home builder and the architect they partner with Custom Builder Segmentation Source: Hanley Wood Source: Venveo Architect Needs from Manufacturer

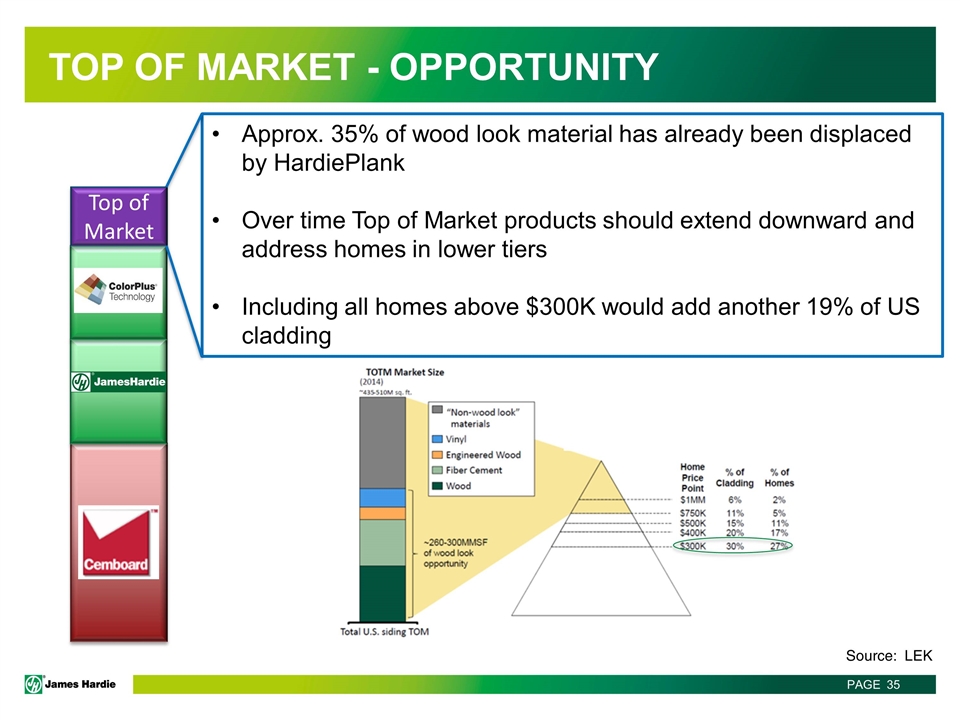

Top of market - opportunity Top of Market Approx. 35% of wood look material has already been displaced by HardiePlank Over time Top of Market products should extend downward and address homes in lower tiers Including all homes above $300K would add another 19% of US cladding Source: LEK

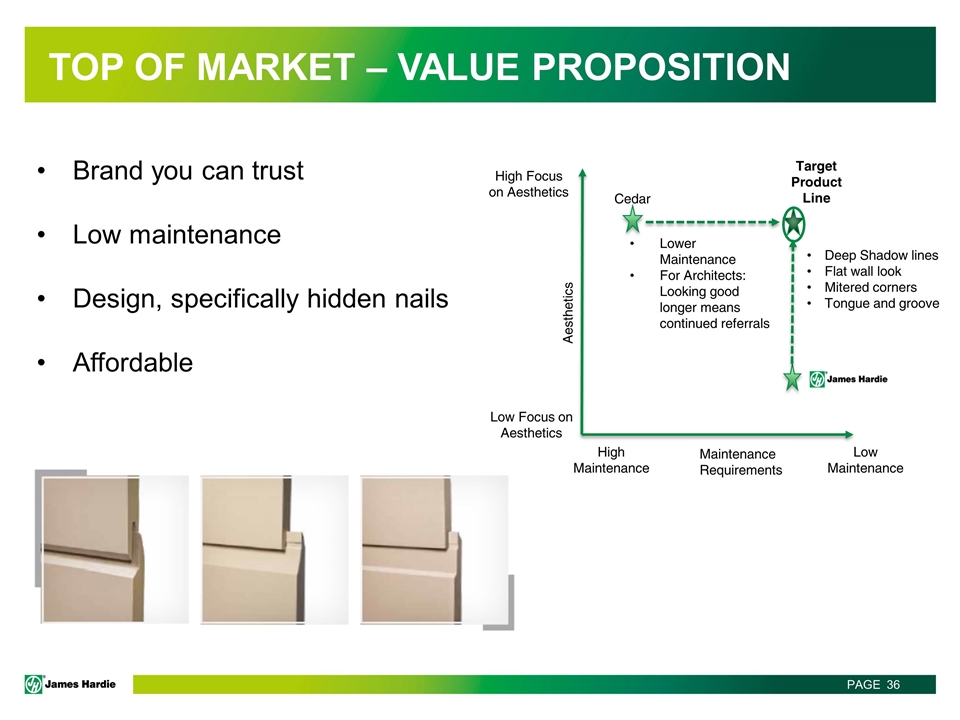

Top of market – value proposition Brand you can trust Low maintenance Design, specifically hidden nails Affordable Aesthetics Maintenance Requirements High Maintenance Low Maintenance Low Focus on Aesthetics High Focus on Aesthetics Lower Maintenance For Architects: Looking good longer means continued referrals Deep Shadow lines Flat wall look Mitered corners Tongue and groove Cedar Target Product Line

Top of market - product development Our product development programs leverage advances and investments in: Thick Products Low Density Machining Pressing Sanding Embossing

Top of market – sales and marketing High fragmentation of Top of Market customers drives the marketing mix to win the segment more heavily weighted to centralized investments vs field resources. Will supplement with field resources to partner with key builders, architects and independent lumber yards Architect Outreach Programs BIM & Technical Resources Content Marketing Central Lead Generation and Management Website & Digital

questions