INTERIORS OVERVIEW Bill Hogan September 2016 Exhibit 99.6

AGENDA INTERIORS OVERVIEW PATH TO 50% SHARE ACHIEVING “++” STRATEGY QUESTIONS

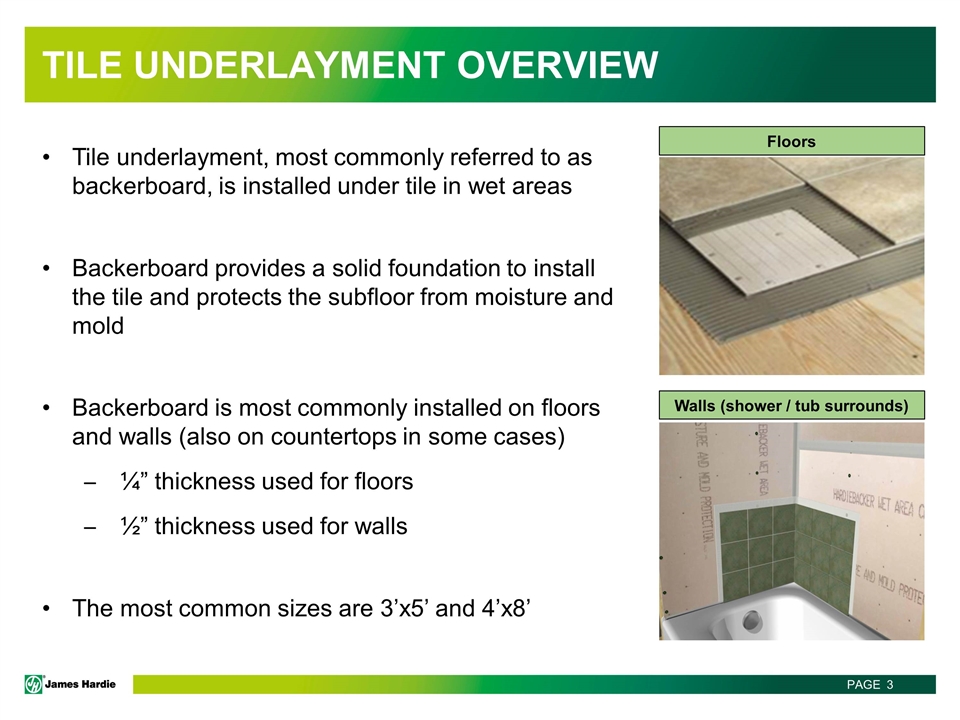

Tile underlayment, most commonly referred to as backerboard, is installed under tile in wet areas Backerboard provides a solid foundation to install the tile and protects the subfloor from moisture and mold Backerboard is most commonly installed on floors and walls (also on countertops in some cases) ¼” thickness used for floors ½” thickness used for walls The most common sizes are 3’x5’ and 4’x8’ TILE UNDERLAYMENT OVERVIEW Floors Walls (shower / tub surrounds)

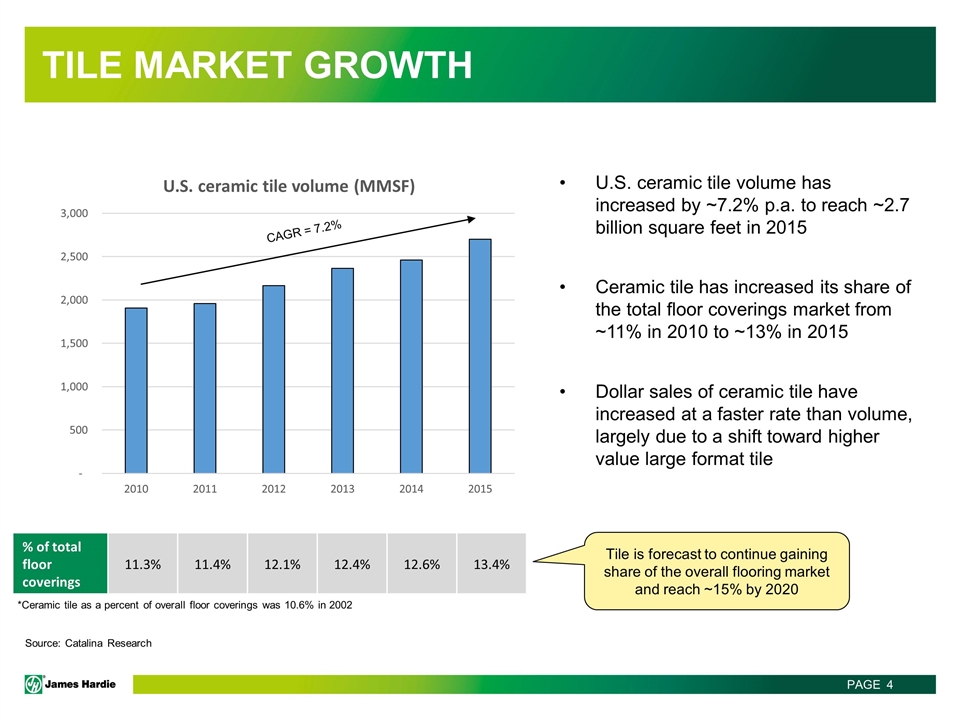

TILE MARKET GROWTH % of total floor coverings 11.3% 11.4% 12.1% 12.4% 12.6% 13.4% CAGR = 7.2% U.S. ceramic tile volume has increased by ~7.2% p.a. to reach ~2.7 billion square feet in 2015 Ceramic tile has increased its share of the total floor coverings market from ~11% in 2010 to ~13% in 2015 Dollar sales of ceramic tile have increased at a faster rate than volume, largely due to a shift toward higher value large format tile Tile is forecast to continue gaining share of the overall flooring market and reach ~15% by 2020 Source: Catalina Research *Ceramic tile as a percent of overall floor coverings was 10.6% in 2002

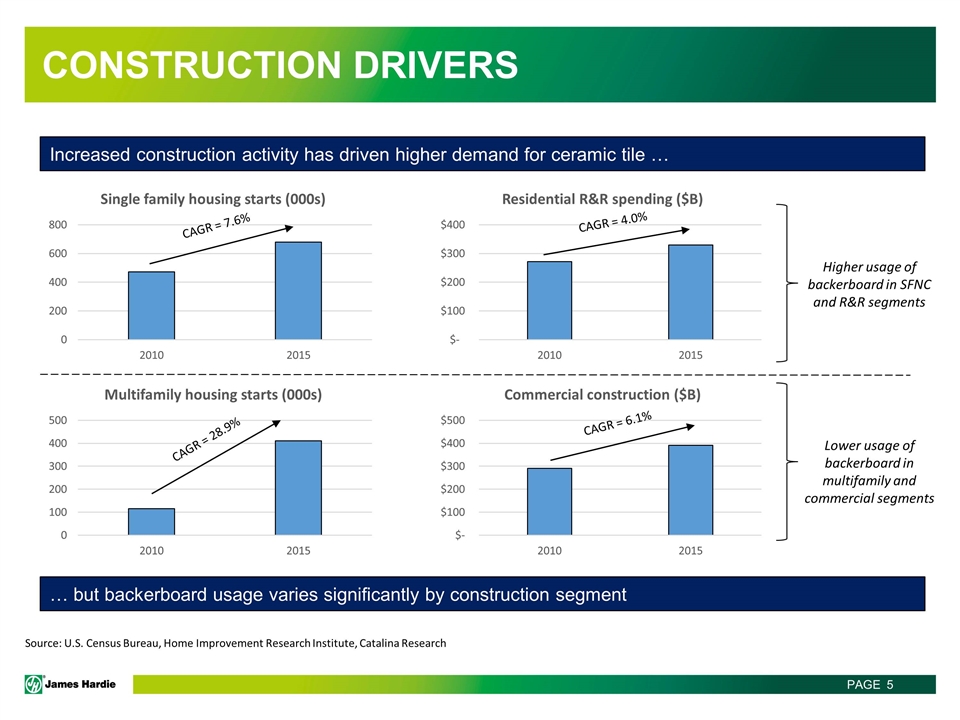

CONSTRUCTION DRIVERS Increased construction activity has driven higher demand for ceramic tile … … but backerboard usage varies significantly by construction segment Higher usage of backerboard in SFNC and R&R segments Lower usage of backerboard in multifamily and commercial segments CAGR = 7.6% CAGR = 28.9% CAGR = 4.0% CAGR = 6.1% Source: U.S. Census Bureau, Home Improvement Research Institute, Catalina Research

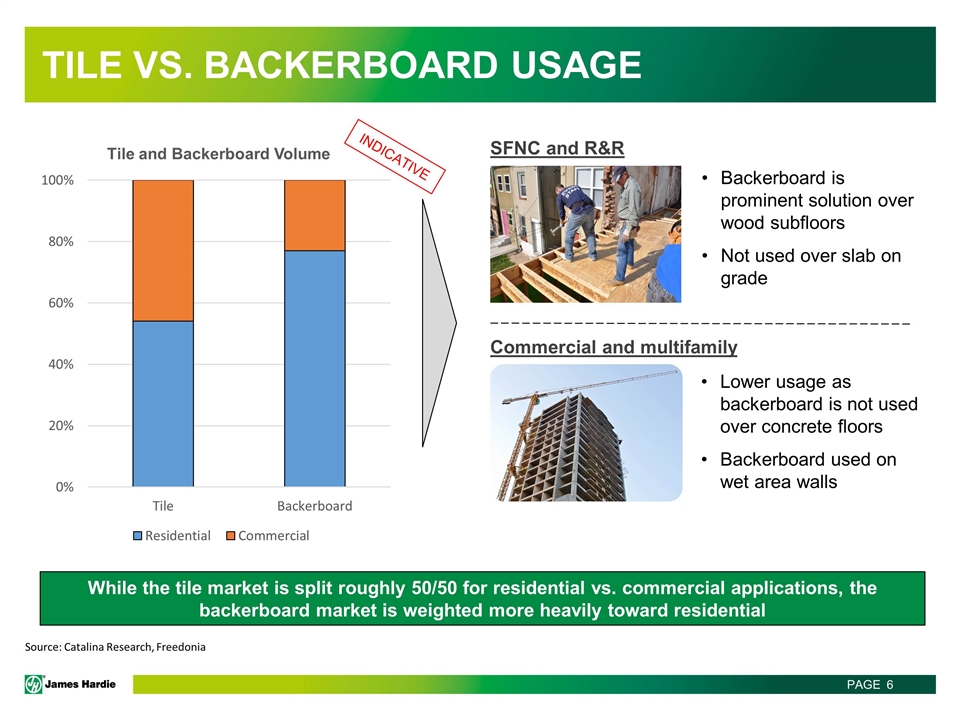

TILE VS. BACKERBOARD USAGE Backerboard is prominent solution over wood subfloors Not used over slab on grade SFNC and R&R Lower usage as backerboard is not used over concrete floors Backerboard used on wet area walls Commercial and multifamily While the tile market is split roughly 50/50 for residential vs. commercial applications, the backerboard market is weighted more heavily toward residential Source: Catalina Research, Freedonia INDICATIVE

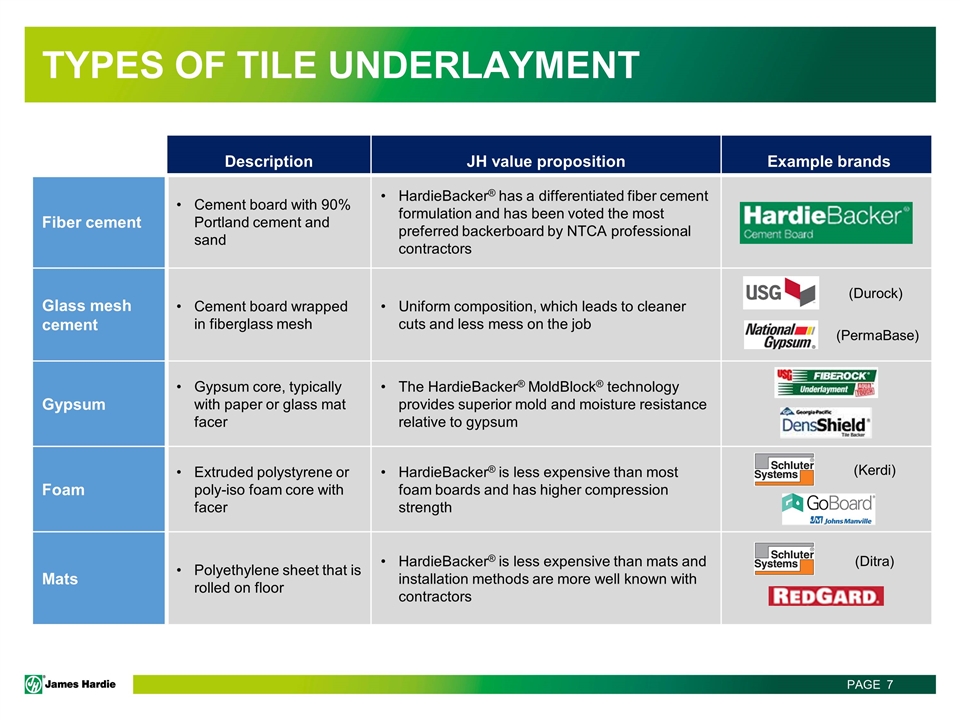

TYPES OF TILE UNDERLAYMENT Description JH value proposition Example brands Fiber cement Cement board with 90% Portland cement and sand HardieBacker® has a differentiated fiber cement formulation and has been voted the most preferred backerboard by NTCA professional contractors Glass mesh cement Cement board wrapped in fiberglass mesh Uniform composition, which leads to cleaner cuts and less mess on the job Gypsum Gypsum core, typically with paper or glass mat facer The HardieBacker® MoldBlock® technology provides superior mold and moisture resistance relative to gypsum Foam Extruded polystyrene or poly-iso foam core with facer HardieBacker® is less expensive than most foam boards and has higher compression strength Mats Polyethylene sheet that is rolled on floor HardieBacker® is less expensive than mats and installation methods are more well known with contractors (Durock) (PermaBase) (Kerdi) (Ditra)

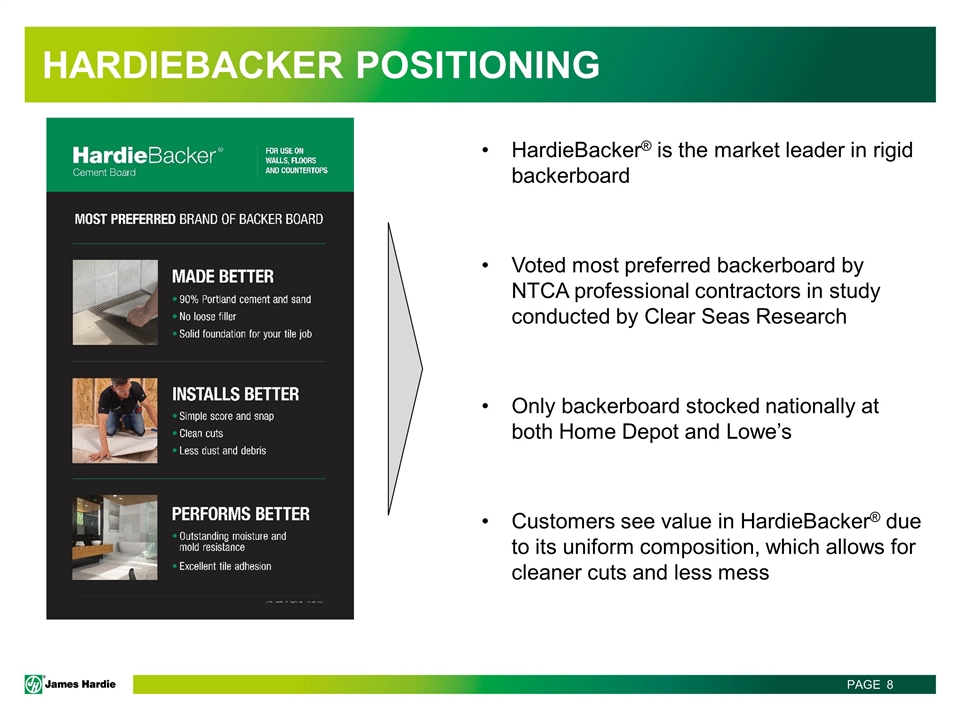

HARDIEBACKER POSITIONING HardieBacker® is the market leader in rigid backerboard Voted most preferred backerboard by NTCA professional contractors in study conducted by Clear Seas Research Only backerboard stocked nationally at both Home Depot and Lowe’s Customers see value in HardieBacker® due to its uniform composition, which allows for cleaner cuts and less mess

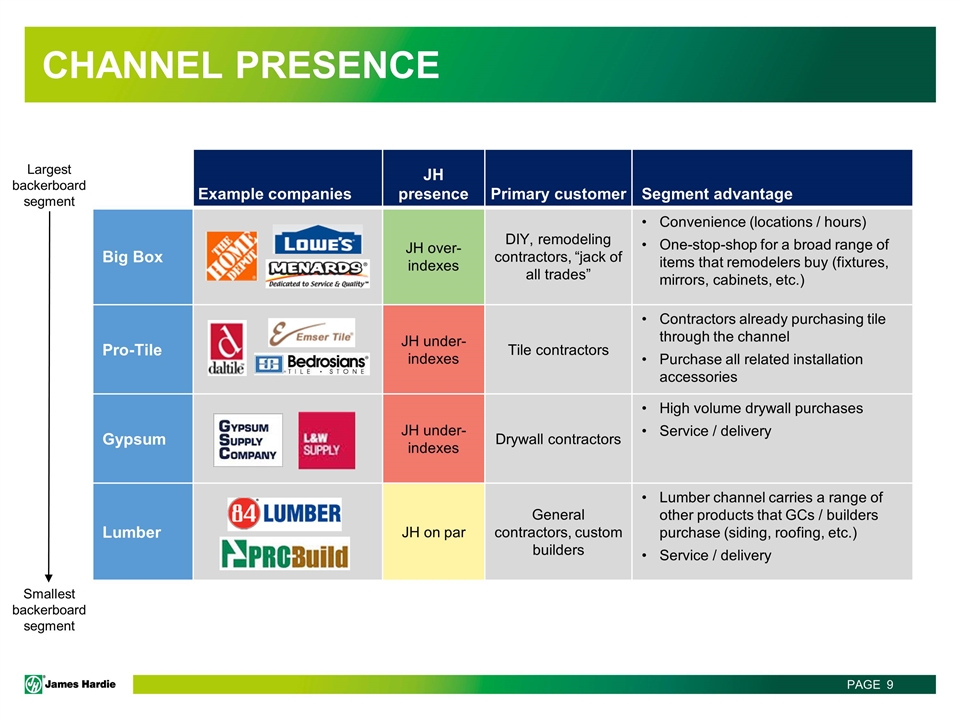

CHANNEL PRESENCE Example companies JH presence Primary customer Segment advantage Big Box JH over-indexes DIY, remodeling contractors, “jack of all trades” Convenience (locations / hours) One-stop-shop for a broad range of items that remodelers buy (fixtures, mirrors, cabinets, etc.) Pro-Tile JH under-indexes Tile contractors Contractors already purchasing tile through the channel Purchase all related installation accessories Gypsum JH under-indexes Drywall contractors High volume drywall purchases Service / delivery Lumber JH on par General contractors, custom builders Lumber channel carries a range of other products that GCs / builders purchase (siding, roofing, etc.) Service / delivery Largest backerboard segment Smallest backerboard segment

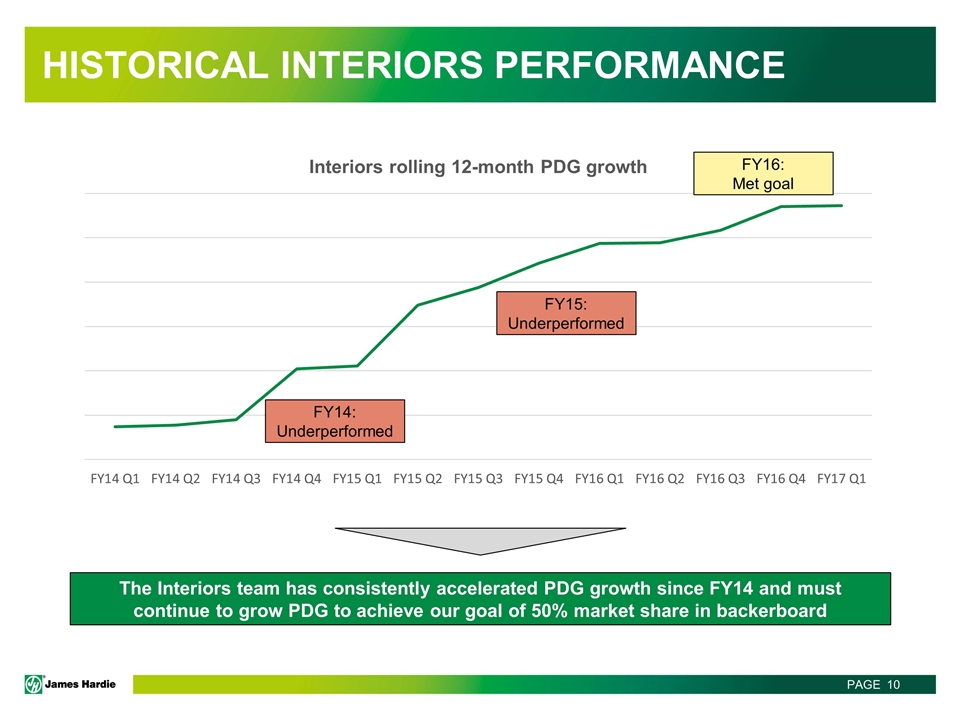

HISTORICAL INTERIORS PERFORMANCE The Interiors team has consistently accelerated PDG growth since FY14 and must continue to grow PDG to achieve our goal of 50% market share in backerboard FY14: Underperformed FY15: Underperformed FY16: Met goal

AGENDA INTERIORS OVERVIEW PATH TO 50% SHARE ACHIEVING “++” STRATEGY QUESTIONS

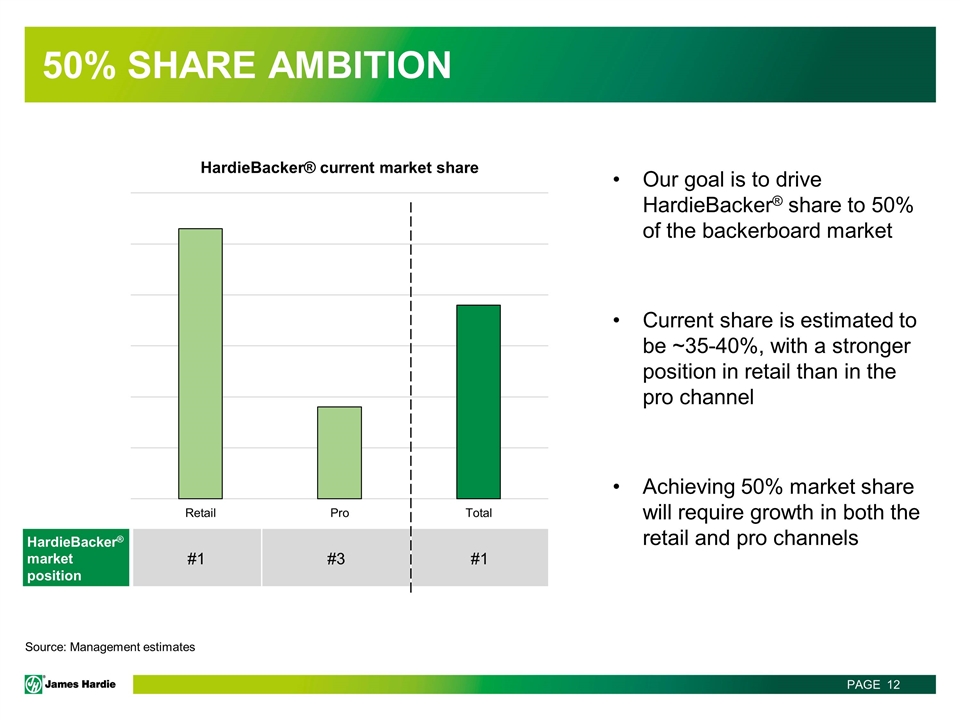

50% SHARE AMBITION Our goal is to drive HardieBacker® share to 50% of the backerboard market Current share is estimated to be ~35-40%, with a stronger position in retail than in the pro channel Achieving 50% market share will require growth in both the retail and pro channels HardieBacker® market position #1 #3 #1 Source: Management estimates

KEY INITIATIVES Channel Alignment 2 Maintain high level of engagement in retail channel Expand points of distribution and increase customer intimacy in pro channel Organizational Execution 3 Management focus Attract, develop and retain talent Educating contractors on the value proposition and points of differentiation Driving end user conversion to HardieBacker® from other technologies Driving Brand Preference 1

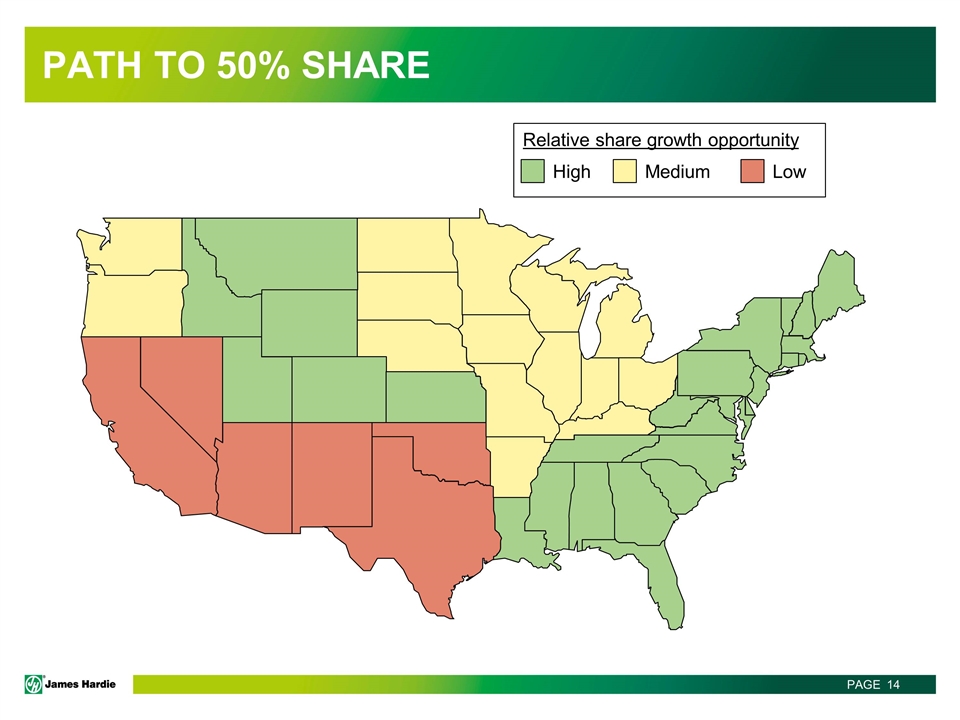

PATH TO 50% SHARE Relative share growth opportunity High Medium Low

INTERIORS OVERVIEW PATH TO 50% SHARE ACHIEVING “++” STRATEGY QUESTIONS AGENDA

Drive share of backerboard to 50% Growth required across channels, with most coming from pro VISION FOR INTERIORS 50 + + % share of rigid backer Win underlayments Add adjacencies Enter non-FC underlayment categories to achieve 50% share of total underlayments Develop JH into one of the top 3 companies in tile installation products with portfolio revenue > $500M

EXAMPLE CATEGORIES AND PRODUCTS Prep / underlayment Backerboard Mats Membranes Self-leveling Setting / grout Mortar Grout Accessories Sealants Fasteners Tapes Shower systems Pans / bases Shelves Kits Benches

INTERIORS OVERVIEW PATH TO 50% SHARE ACHIEVING “++” STRATEGY QUESTIONS AGENDA