Exhibit 99.5

james hardie industries plc remuneration report 2017

This Remuneration Report describes the executive remuneration philosophy, programs and objectives of the Remuneration

Committee and the Board of Directors (the “Board”), as well as the executive remuneration plans and programs implemented by James Hardie Industries plc. For purposes of this discussion, references to “James Hardie”, the

“Company”, “we”, “our” and “us” all refer to James Hardie Industries plc.

We are not required to produce a remuneration

report under applicable Irish, Australian or US rules or regulations. However, taking into consideration our significant Australian and US shareholder bases and our primary listing on the Australian Securities Exchange (“ASX”), we

have voluntarily produced a remuneration report consistent with those provided by similarly situated companies for non-binding shareholder approval since 2005.

This

Remuneration Report outlines the key remuneration plans and programs and share ownership information for our Board of Directors and certain of our senior executive officers (Chief Executive Officer (“CEO”), Chief Financial Officer

(“CFO”) and the other three highest paid executive officers based on total compensation that was earned or accrued for fiscal year 2017) (“Senior Executive Officers”) in fiscal year 2017, and also includes an

outline of the key changes for fiscal year 2018. Further details of these changes are set out in the 2017 Notice of Annual General Meeting (“AGM”).

We first provide a summary of our business performance and the key remuneration considerations and decisions made in fiscal year 2017. We then describe in detail our

remuneration philosophy, the individual elements of our remuneration program and the linkage between our remuneration programs and our pay-for-performance philosophy. For fiscal year 2017, our Senior Executive Officers are:

| ◾ |

|

Matthew Marsh, CFO and Executive Vice President – Corporate; |

| ◾ |

|

Sean Gadd, Executive Vice President – Markets and Segments; |

| ◾ |

|

Joseph Blasko, General Counsel and Chief Compliance Officer; and |

| ◾ |

|

Mark Fisher, former Executive Vice President – International. |

Mr Fisher is included in this Remuneration Report

based on his level of compensation and status as an executive officer as of 31 March 2017. Subsequent to 31 March 2017, Mr Fisher voluntarily terminated his employment with us as of 3 April 2017.

This Remuneration Report has been adopted by our Board on the recommendation of the Remuneration Committee.

FORWARD-LOOKING STATEMENTS

Certain statements in this Remuneration Report may constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995.

James Hardie Industries plc (James Hardie or the Company) uses such words as “believe”, “anticipate”, “plan”, “expect”, “intend”, “target”, “estimate”, “project”,

“predict”, “forecast”, “guideline”, “aim”, “will”, “should”, “likely”, “continue”, “may”, “objective”, “outlook”, and similar expressions

are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are

qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on James Hardie’s current expectations,

estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s

control. Many factors could cause the actual results, performance or achievements of James Hardie to be materially different from those expressed or implied in this Remuneration Report, including, among others, the risks and uncertainties set forth

in Section 3 “Risk Factors” in James Hardie’s Annual Report on Form 20-F for the year ended 31 March 2017; changes in general economic, political, governmental and business conditions globally and in the countries in which

James Hardie does business; changes in interest rates; changes in inflation rates; changes in exchange rates; the level of construction generally; changes in cement demand and prices; changes in raw material and energy prices; changes in business

strategy and various other factors. Should one or more of these risks or uncertainties materialise, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. These forward-looking statements

are made as of the date of this Remuneration Report and James Hardie does not assume any obligation to update them, except as required by law. Investors are encouraged to review James Hardie’s Annual Report on Form 20-F, and specifically the

risk factors discussed therein, as it contains important disclosures regarding the risks attendant to investing in our securities.

NON-GAAP

FINANCIAL INFORMATION

This Remuneration Report contains financial measures that are not considered a measure of financial performance under United States

generally accepted accounting principles (“US GAAP”) and should not be considered to be more meaningful than the equivalent US GAAP measure. Management has included such measures to provide investors with an alternative method

for assessing its operating results in a manner that is focused on the performance of its ongoing operations. Additionally, management uses such non-GAAP financial measures for the same purposes. However, these non-GAAP financial measures are not

prepared in accordance

2

with US GAAP, may not be reported by all of James Hardie’s competitors and may not be directly comparable to similarly titled measures of James Hardie’s competitors due to potential

differences in the exact method of calculation. For additional information regarding the non-GAAP financial measures presented in this Remuneration Report, including a reconciliation of each non-GAAP financial measure to the equivalent US GAAP

measure, see the sections titled “Definition and Other Terms” and “Non-US GAAP Financial Measures” included in James Hardie’s Management’s Analysis of Results for the fourth quarter and twelve months ended

31 March 2017.

EXECUTIVE SUMMARY

Fiscal Year 2017 Business Highlights

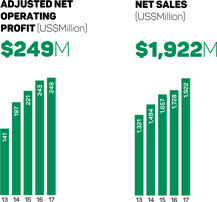

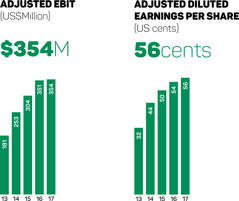

We delivered strong financial

performance in fiscal year 2017, highlighted by adjusted net operating profit of US$248.6 million, adjusted earnings before interest and taxes (“EBIT”) of US$354.3 million, and net sales of US$1.9 billion. In addition, we achieved a

12% increase in net cash provided by operating activities, compared to fiscal year 2016, and US$276.6 million of capital returned to shareholders through a combination of dividends and the previously announced share buyback program.

The following graphs show our performance for key financial measures during fiscal year 2017, with a comparison to prior corresponding periods:

Fiscal Year 2017 Compensation Highlights

Our fiscal year 2017 compensation continued to reflect and promote our pay-for-performance philosophy and our stated goal to position Senior Executive Officer fixed base

salary and benefits at the median and total target direct remuneration (comprising fixed and target variable remuneration) at the 75th percentile of our Peer Group (defined herein), if stretch short- and long-term target performance goals are met.

During May 2016, the Board, with the assistance of the Remuneration Committee and its independent remuneration advisers, undertook its annual review of our existing remuneration policies, programs and arrangements and determined the following for

fiscal year 2017 pay programs:

| ◾ |

|

There were no changes to Mr Gries’ fixed or variable compensation. Mr Gries’ base salary, target short-term incentive (“STI”), and target long-term incentive (“LTI”) remained

the same in fiscal year 2017 as they were for fiscal year 2016. |

| ◾ |

|

Base salary, target STI and target LTI increases for Mr Marsh were made to properly align his base salary with the increase in role scope and accountability that occurred for him during fiscal year 2016 as well as to

align his overall compensation package with (i) our CEO succession plan, (ii) our need to retain key senior executives through the eventual CEO transition process, (iii) our lean management structure, and (iv) the 75th percentile

of our Peer Group LTI values, consistent with our remuneration philosophy. |

| ◾ |

|

Base salary increases for Messrs Fisher and Blasko were made in line with our annual compensation review guidelines and were adjusted as required to maintain positioning relative to market merit increase levels. A small

increase to Mr Blasko’s target LTI was also made to better align his LTI target value with the 75th percentile of the market, consistent with our remuneration philosophy. There were no changes made to Mr Gadd’s fixed or variable

compensation components. |

| ◾ |

|

No changes were made to the operation or components of the company performance plan (“CP Plan”) or individual performance plan (“IP Plan”) for our annual STI program for fiscal year

2017 other than to establish new targets which align with our strategic initiatives as we do every year. A complete description of the performance hurdles applicable for fiscal year 2017 for the CP Plan is set out in the section titled

“Incentive Arrangements” later in this Remuneration Report. |

| ◾ |

|

No changes were made to the operation or components of our LTI program for fiscal year 2017 other than minor updates to the performance hurdles for the return on capital employed restricted stock unit (“ROCE

RSU”) and scorecard long-term incentive (“Scorecard LTI”) objectives. A complete description of the LTI program, including the applicable performance hurdles is set out in the section titled “Incentive

Arrangements” later in this Remuneration Report. |

3

JAMES HARDIE REMUNERATION REPORT

2017

REMUNERATION REPORT 2017 CONTINUED

Fiscal Year 2017 Total Target Compensation

Remuneration packages for Senior Executive Officers reflect our remuneration philosophy and comprise a mixture of fixed base salary and benefits and variable

performance-based incentives. The Remuneration Committee seeks to appropriately balance fixed and variable remuneration in order to align our total compensation structure with our pay-for-performance philosophy. The following chart summarises total

target compensation awarded to each Senior Executive Officer in fiscal year 2017:

Summary of Fiscal Year 2017 Senior Executive Officer Target Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SENIOR EXECUTIVE

OFFICER |

|

FY2017 ANNUAL

BASE SALARY

(US$)

|

|

|

FY2017 STI

TARGET VALUE

(US$)

|

|

|

FY2017

LTI

TARGET VALUE

(US$) |

|

|

FY2017 TOTAL TARGET

COMPENSATION

(US$)

|

|

| L Gries |

|

|

950,000 |

|

|

|

1,187,500 |

|

|

|

4,000,000 |

|

|

|

6,137,500 |

|

| M Marsh |

|

|

560,000 |

|

|

|

392,000 |

|

|

|

1,200,000 |

|

|

|

2,152,000 |

|

| M Fisher |

|

|

515,000 |

|

|

|

309,000 |

|

|

|

650,000 |

|

|

|

1,474,000 |

|

| S Gadd |

|

|

408,000 |

|

|

|

244,800 |

|

|

|

650,000 |

|

|

|

1,302,800 |

|

| J Blasko |

|

|

405,000 |

|

|

|

243,000 |

|

|

|

450,000 |

|

|

|

1,098,000 |

|

Results of 2017 Remuneration Report Vote

In

August 2016, our shareholders were asked to cast a non-binding advisory vote on our remuneration report for the fiscal year ended 31 March 2016. Although we are not required under applicable Irish, Australian or US laws or regulations to

provide a shareholder vote on our executive remuneration practices, the Board believes that it is important to engage shareholders on this important issue and we have voluntarily submitted our remuneration report for non-binding shareholder approval

on an annual basis since 2005 and currently intend to continue to do so. At our 2016 Annual General Meeting, our shareholders approved our remuneration report, with just over 78% of the votes cast in support of our remuneration program. The

Remuneration Committee considered the results of this advisory vote, together with investor feedback and other factors and data associated with strategic priorities discussed in this Remuneration Report, in determining our executive remuneration

policies, objectives and decisions and related shareholder engagement efforts for fiscal year 2017. The Remuneration Committee also considered these same factors in determining changes to our fiscal year 2018 executive remuneration programs,

resulting in a more evenly balanced focus between advancing critical operational and strategic objectives that position the Company for long-term success, and financial and shareholder return measures achieved. Among the adjustments it was also

decided to eliminate the retesting feature of our relative total shareholder return restricted stock unit (“Relative TSR RSU”) grants, which is understood to have been a factor of concern to a significant proportion of our

shareholders. A complete description of the changes to our fiscal year 2018 executive remuneration programs is set out in the section titled “Remuneration for Fiscal Year 2018” later in this Remuneration Report.

APPROACH TO SENIOR EXECUTIVE REMUNERATION

Remuneration Philosophy

As our main business and all of our Senior Executive

Officers are located in the US, our remuneration philosophy is to provide our Senior Executive Officers with an overall package that is competitive with Peer Group companies (defined herein) exposed to the US housing market. Within this philosophy,

the executive remuneration framework emphasises operational excellence and shareholder value creation through incentives which link executive remuneration with the interests of shareholders. Our remuneration plans and programs are structured to

enable us to: (i) attract and retain talented executives; (ii) reward outstanding individual and corporate performance; and (iii) align the interests of our executives to the interests of our shareholders, with the ultimate goal of

improving long-term value for our shareholders. This pay-for-performance system continues to serve as the framework for executive remuneration, aligning the remuneration received with the performance achieved.

Composition of Remuneration Packages

In line with our remuneration

philosophy, our goal is to position Senior Executive Officer fixed base salary and benefits at the median and total target direct remuneration (comprising fixed and target variable remuneration) at the 75th percentile of our Peer Group, if stretch

short and long-term target performance goals are met. Performance goals for target variable performance-based incentive remuneration are set with the expectation that we will deliver results in the top quartile of our Peer Group. Performance below

this level will result in variable remuneration payments below target (and potentially zero for poor performance). Performance above this level will result in variable remuneration payments above target.

4

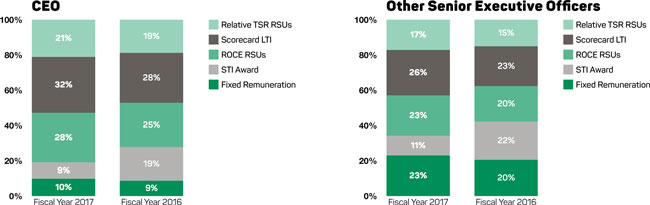

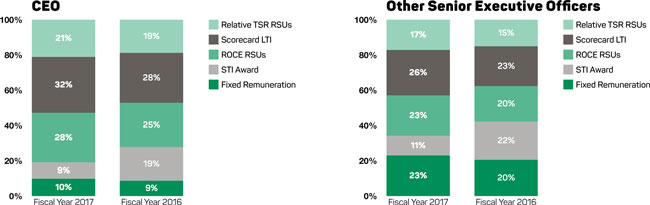

Relative Weightings of Fixed and Variable Remuneration

The charts below detail the relative weightings of fixed versus variable remuneration for the CEO and other Senior Executive Officers for fiscal years 2017 and 2016.

Fixed remuneration includes base salary and other fixed benefits. Variable remuneration is comprised of STI awards and the following three LTI components: (i) Relative TSR RSUs; (ii) ROCE RSUs; and (iii) Scorecard LTI, each of which

are discussed in more detail in this Remuneration Report. STI awards include amounts earned under the CP and IP plans for each fiscal year, paid in June of the following fiscal year, and LTI components are shown at total maximum grant value.

Setting Remuneration Packages

Remuneration decisions are based on the executive remuneration philosophy and framework described in this Remuneration Report. The Remuneration Committee reviews and the

Board approves this framework each year.

Remuneration packages for Senior Executive Officers are evaluated each year to make sure that they continue to align with

our compensation philosophy, are competitive with our Peer Group and developments in the market, and continue to support our business structure and objectives. In making decisions regarding individual Senior Executive Officers, the Remuneration

Committee takes into account both the results of an annual remuneration positioning review provided by the Remuneration Committee’s independent advisor and the Senior Executive Officer’s responsibilities and performance.

All aspects of the remuneration package for our CEO and CFO are determined by the Remuneration Committee and ratified by the Board. All aspects of the remuneration

package for the remaining Senior Executive Officers are determined by the Remuneration Committee on the recommendation of the CEO.

Remuneration Committee

Governance

The remuneration program for our Senior Executive Officers is overseen by our Remuneration Committee, the members of which are appointed by the Board.

As prescribed by the Remuneration Committee Charter, the duties of the Remuneration Committee include, among other things: (i) administering and making recommendations on our incentive compensation and equity-based remuneration plans;

(ii) reviewing the remuneration of directors; (iii) reviewing the remuneration framework for the Company; and (iv) making recommendations to the Board on our recruitment, retention and termination policies and procedures for senior

management. The current members of the Remuneration Committee are David Harrison (Chairman), Brian Anderson, Russell Chenu, Michael Hammes and Alison Littley, the majority of whom are independent non-executive directors. A more complete description

of these and other Remuneration Committee functions is contained in the Remuneration Committee’s Charter, a copy of which is available in the Corporate Governance section of the Investor Relations page on our website

(www.ir.jameshardie.com.au).

5

JAMES HARDIE REMUNERATION REPORT

2017

REMUNERATION REPORT 2017 CONTINUED

Summary of Executive Compensation Practices

The following table summarises certain of the key governance practices employed by the Remuneration Committee relative to our executive compensation practices, including

those practices which we believe are important drivers of both short- and long-term corporate performance and those practices which we believe are not aligned with the long-term interests of our shareholders:

|

|

|

| WHAT WE

DO |

|

WHAT WE DON’T DO |

|

|

| ✓ Retain independent compensation advisors reporting

directly to Remuneration Committee |

|

O

Prohibition on hedging of stock held by executives and directors |

|

|

| ✓ Pay for performance model, with approximately 85% of

our CEO’s total target compensation being performance-based “at risk” compensation and an average of approximately 68% total target compensation being performance-based “at risk” compensation for our other Senior Executive

Officers |

|

O

Limited employment agreements and severance arrangements |

|

|

| ✓ Circuit breaker on annual STI awards to ensure that

no annual incentive awards are paid unless minimum corporate performance levels are achieved |

|

O

Limited change-in-control benefits |

|

|

| ✓ Set robust share ownership requirements for all

directors and Senior Executive Officers |

|

O No

dividends paid on unvested equity awards |

|

|

| ✓ Broad clawback policy on performance-based

compensation |

|

O

Limited perquisites and other benefits |

|

|

| ✓ Set performance-based vesting conditions for all

equity grants to Senior Executive Officers |

|

O No

annual time-based LTI equity grants to Senior Executive Officers |

|

|

| ✓ Provide

the Remuneration Committee with ability to exercise “negative” discretion when determining the vesting and payout of our LTI programs |

|

O No excessive retirement or deferred compensation arrangements |

Remuneration Advisers

As permitted by the

Remuneration Committee Charter, the Remuneration Committee retained Aon Hewitt (in the US) and Guerdon Associates (in Australia) as its independent advisers for matters regarding remuneration for fiscal year 2017. The Remuneration Committee reviews

the appointment of its advisors each year. Both Aon Hewitt and Guerdon Associates provided the Remuneration Committee with written certification during fiscal year 2017 to support their re-appointment. In those certifications, the advisors:

(i) confirmed that their pay recommendations were made without undue influence from any member of our management; and (ii) provided detailed responses to the six independence factors a Remuneration Committee should consider under relevant

NYSE rules, and confirmed their independence based on these factors.

The Remuneration Committee reviewed these certifications before re-appointing each advisor for

fiscal year 2018.

Benchmarking Analysis

To assist the Remuneration

Committee in making remuneration decisions, the Remuneration Committee evaluates the remuneration of our Senior Executive Officers against a designated set of companies (the “Peer Group”). The Peer Group, which is reviewed by the

Remuneration Committee on an annual basis, consists of companies that are similar to us in terms of certain factors, including size, industry, and exposure to the US housing market. For fiscal year 2017, the Peer Group remained unchanged from fiscal

year 2016. The Remuneration Committee believes that US market focused companies are a more appropriate peer group than ASX-listed companies, as they are exposed to the same macroeconomic factors in the US housing market as those we face. The names

of the 24 companies comprising the Peer Group are set forth below.

|

|

|

|

|

| |

|

|

| Acuity Brands, Inc |

|

Louisiana-Pacific Corp |

|

Sherwin Williams Co |

|

|

|

| American Woodmark Corp |

|

Martin Marietta Materials, Inc |

|

Simpson Manufacturing Co., Inc |

|

|

|

| Apogee Enterprises, Inc |

|

Masco Corporation |

|

Trex Co., Inc |

|

|

|

| Armstrong World Industries Inc |

|

Mohawk Industries, Inc |

|

USG Corp |

|

|

|

| Eagle Materials, Inc |

|

Mueller Water Products, Inc |

|

Valmont Industries, Inc |

|

|

|

| Fortune Brands Home & Security |

|

NCI Building Systems, Inc |

|

Valspar Corporation |

|

|

|

| Headwaters, Inc |

|

Owens Corning |

|

Vulcan Materials Co |

|

|

|

| Lennox International, Inc

|

|

Quanex Building Products Corp |

|

Watsco, Inc |

The Peer Group was used to benchmark the remuneration of Messrs Gries, Marsh, and Fisher in fiscal year 2017. Supplemental remuneration

survey data of other manufacturing companies of similar size to James Hardie was used to define competitive pay levels for Messrs Gadd and Blasko.

6

Performance Linkage with Remuneration Policy

During its annual review, the Remuneration Committee assessed our performance in fiscal year 2017 against:

| ◾ |

|

our historical performance; |

| ◾ |

|

the goals in our STI and LTI variable remuneration plans; and |

| ◾ |

|

the key objectives and measures the Board expects to see achieved, which are referred to as the “Scorecard” and further discussed later in this Remuneration Report. |

Based on that review, the Board and the Remuneration Committee concluded that management’s performance in fiscal year 2017 was on the whole: (i) at target on

growth measures and slightly below target on earnings, resulting in STI variable remuneration outcomes being below target for fiscal year 2017; and (ii) when taken together with performance in fiscal years 2015 and 2016, at the 59th percentile

of our Peer Group on TSR performance, above expectations on ROCE performance, and above expectations on long-term strategic measures included in the Scorecard, resulting in LTI variable remuneration being above target for fiscal years 2015-2017.

More details about this assessment, including the percentage of the maximum variable remuneration awarded to or forfeited by Senior Executive Officers is set out on

pages 8 through 13 of this Remuneration Report.

DESCRIPTION OF 2017 REMUNERATION ELEMENTS

Base Salaries and Other Fixed

Remuneration Benefits

Base salary provides a guaranteed level of income that recognises the market value of the position and internal equities between roles, and the individual’s

capability, experience and performance. Annual base salary increases are not automatic. Base salaries for Senior Executive Officers are positioned around the market median for positions of similar responsibility and are reviewed by the Remuneration

Committee each year.

In addition, Senior Executive Officers may receive certain other limited fixed benefits, such as medical and life insurance benefits, car

allowances, participation in executive wellness programs and an annual financial planning allowance. For fiscal year 2017, the base salary and value of other fixed benefits for each of our Senior Executive Officers is provided in the Base Pay and

Other Benefits columns of the remuneration table in the section titled “Remuneration Paid to Senior Executive Officers”.

Retirement Plan

In every country in which we operate, we offer employees access to pension, superannuation or individual retirement savings plans consistent with the laws of the

respective country.

In the US, we sponsor a defined contribution plan, the James Hardie Retirement and Profit Sharing Plan (the “401(k) Plan”). The

401(k) Plan is a tax-qualified retirement and savings plan covering all US employees, including our Senior Executive Officers, subject to certain eligibility requirements. Participating employees were able to elect to reduce their current annual

compensation by up to US$18,000 in calendar year 2016 and have the amount of such reduction contributed to the 401(k) Plan, with a maximum eligible compensation limit of US$265,000. In addition, we match employee contributions dollar for dollar up

to a maximum of the first 6% of an employee’s eligible compensation.

Incentive Arrangements

In addition to the base salary and other fixed benefits provided to our Senior Executive Officers, the Remuneration Committee reviews and approves a combination of both

short-term and long- term variable incentive programs on an annual basis.

For fiscal year 2017, our variable incentive plans for Senior Executive Officers were as follows:

|

|

|

|

|

|

|

| DURATION

|

|

PLAN NAME

|

|

AMOUNT

|

|

FORM

INCENTIVE PAID |

|

|

|

|

| STI (1 year) |

|

IP Plan |

|

20% of

STI Target |

|

Cash |

|

|

|

|

| |

|

CP Plan |

|

80% of

STI Target |

|

Cash |

|

|

|

|

| LTI (3–4.5 years) |

|

Long Term

Incentive Plan

2006 (“LTIP”) |

|

40% of

LTI Target |

|

ROCE RSUs |

|

|

|

|

|

|

|

|

30% of

LTI Target |

|

Relative TSR

RSUs |

|

|

|

|

| |

|

|

|

30% of

LTI Target |

|

Cash

(Scorecard LTI)

|

STI Plans

On an annual basis, the

Remuneration Committee approves an STI target for all Senior Executive Officers, expressed as a percentage of base salary, which is allocated between individual goals and Company goals under the IP and CP Plans, respectively. For fiscal year 2017,

the STI target percentage for Mr Gries was 125% of base salary, 70% of base salary for Mr Marsh, and 60% of base salary for Messrs Fisher, Gadd and Blasko, with 80% allocated to the CP Plan and 20% allocated to the IP Plan for all Senior Executive

Officers.

Since fiscal year 2014, the Remuneration Committee has applied a ‘circuit breaker’ to the STI plans, which for Senior Executive Officers will

prevent payment of any STI under the CP and IP Plans unless our performance exceeds a level approved by the Remuneration Committee each year. For fiscal year 2017, the ‘circuit breaker’ was set at 60% of our fiscal year 2017 plan Adjusted

EBIT (indexed to housing starts) less any impairment costs the Remuneration Committee determines should be disregarded.

CP Plan

The CP Plan is based on a series of payout matrices for the US and Asia Pacific businesses, which provide a range of possible payouts depending on our performance against

hurdles which assess volume growth relative to, and above, market (“Growth Measure”), earnings (“Return Measure”), and for the US business, performance of the interiors business and performance against certain

“wood-look” competitors. Each Senior Executive Officer can receive between 0% and 300% of their STI target allocated to the CP Plan based on the results of the payout multiple the Senior Executive Officer is tied to. All Senior Executive

Officers are tied to either the US multiple (Mr Gadd) or a composite multiple derived from the metrics for the US (80%) and Asia Pacific (20%) businesses combined (Messrs Gries, Marsh, Fisher and Blasko).

Payout Matrices

We use both performance measures (Growth Measure and

Return Measure) in the payout matrices for our US and Asia Pacific businesses in order to ensure that as management increases its top line market growth focus, it does not do so at the expense of short- to medium-term earnings. Management is

encouraged to balance market growth and earnings returns since achievement of a higher reward requires management to generate both strong earnings and growth relative to and above market. Higher returns on one measure at the expense of the other

measure may result in a lower reward or no reward at all.

7

JAMES HARDIE REMUNERATION REPORT

2017

REMUNERATION REPORT 2017 CONTINUED

To ensure that the payout matrices represent genuinely challenging targets aligned with our executive remuneration

philosophy, the Growth Measure is indexed to take into account changes in new housing starts in both the US and Asia Pacific and the US repair and remodel market, while the Return Measure is indexed to take into account changes in pulp prices. The

targets for the Return Measure exclude costs related to legacy issues. The Remuneration Committee has reserved for itself discretion to change the STI paid. Examples of instances when the Remuneration Committee would consider exercising this

discretion include external factors outside of management’s control, and for the US CP Plan only, if the general shift toward smaller homes at each segment of the US market is considered sufficiently material. The Remuneration Committee will

disclose the reasons for any such exercise of its discretion.

The Remuneration Committee believes that the payout matrices are appropriate because they provide

management with an incentive to achieve overall corporate goals, balance growth with returns in our primary markets, recognise the need to flexibly respond to strategic opportunities, incorporate indexing relative to market growth to account for

factors beyond management’s control, and incorporate Remuneration Committee discretion to ensure appropriate outcomes. Payouts under the US matrix may range from 0% to 200% of target, while payouts under the Asia Pacific matrix may range from 0

to 300% of target.

We do not disclose the volume Growth Measure and earnings Return Measure targets for our US or Asia Pacific businesses since these are

commercial-in-confidence. However, achieving a target payment for the Return Measure under either the US or Asia Pacific payout matrix for fiscal year 2017 would have required performance equal to the average of performance for the previous three

years and the fiscal year 2017 plan. Achieving a target payout for the Growth Measure requires growth substantially above market growth.

Additional US

Performance Metrics

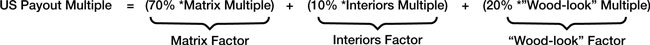

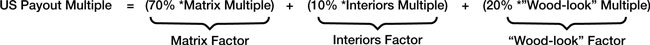

In order to better align and focus management’s performance on initiatives that are key to the success of the US business, the US

payout multiple for fiscal year 2017 is determined by performance against the matrix multiple (Growth and Return Measures for 70% of STI opportunity), the interiors product business multiple (for 10% of STI opportunity), and the

“Wood-look” multiple (for 20% of STI opportunity). The overarching formula for the US payout multiple is:

Each payout factor (Matrix Factor, Interiors Factor, and “Wood-look” Factor) is capped as follows to properly balance

management’s focus across volume growth, returns and key initiatives:

| ◾ |

|

Matrix Factor = capped at 2.0x |

| ◾ |

|

Matrix Factor plus Interiors Factor = capped at 2.3x |

| ◾ |

|

“Wood-look” Factor = capped at 1.25x |

The Interiors Multiple is measured as a function of the revenue growth of

our interiors business in fiscal year 2017. The “Wood-look” Multiple is measured as our growth against key “wood-look” competition.

We do not

disclose the interiors volume growth or “wood-look” targets since these are commercial-in-confidence. However, achieving a target payment for fiscal year 2017 requires interior volume performance above fiscal year 2016 interiors volume and

substantial growth against key “wood-look” competition.

IP Plan

Under the IP Plan, the Remuneration Committee approves a series of one-year individual performance goals which, along with goals on our core organisational values, are

used to assess the performance of our Senior Executive Officers. The IP Plan links financial rewards to the Senior Executive Officer’s achievement of specific objectives that have benefited us and contributed to shareholder value, but are not

captured directly by financial measures in the CP Plan. Each Senior Executive Officer can receive between 0% and 150% of their STI target allocated to the IP Plan based on achievement of individual performance and core organisational values goals.

STI Plan Performance for Fiscal Year 2017

Our CP Plan results

and the subsequent STI payouts for fiscal year 2017 were just below target as a result of:

| ◾ |

|

the US business performing slightly above target on the Growth Measure; |

| ◾ |

|

the US business performing slightly below target on the Return Measure due to an increase in manufacturing costs (caused by the accelerated commissioning of new capacity and overall performance of the network lagging

fiscal year 2016 performance) as well as increased investment in the marketing development program; |

| ◾ |

|

the US business performing above target on the Interiors Factor and below target on the “Wood-look” Factor; |

| ◾ |

|

Asia Pacific performing above target on the Return Measure due to higher returns in Australia, partially offset by performance in New Zealand and the Philippines; and |

| ◾ |

|

Asia Pacific performing below target on the Growth Measure. |

In regards to the IP Plan, the Senior Executive

Officers’ performance and the subsequent STI payouts for fiscal year 2017 were generally at or below target based on each Senior Executive Officer’s achievement of fiscal year 2017 one-year individual performance and core organisational

values goals.

For fiscal year 2017, the amount to be paid to each of our Senior Executive Officers under the STI Plans is provided in the STI Award column of the

remuneration table, in the section titled “Remuneration Paid to Senior Executive Officers”. The percentage of the maximum STI Variable Remuneration awarded to or forfeited by each Senior Executive Officer for (individual and company)

performance in fiscal year 2017 compared to fiscal year 2016 was:

8

|

|

|

|

|

|

|

|

|

| |

|

STI AWARD 1 |

|

| |

|

AWARDED

%

|

|

|

FORFEITED

%

|

|

| L Gries |

|

|

|

|

|

|

|

|

| Fiscal Year 2017 |

|

|

33 |

|

|

|

67 |

|

| Fiscal Year 2016 |

|

|

76 |

|

|

|

24 |

|

| M Marsh |

|

|

|

|

|

|

|

|

| Fiscal Year 2017 |

|

|

35 |

|

|

|

65 |

|

| Fiscal Year 2016 |

|

|

76 |

|

|

|

24 |

|

| M Fisher |

|

|

|

|

|

|

|

|

| Fiscal Year 2017 |

|

|

33 |

|

|

|

67 |

|

| Fiscal Year 2016 |

|

|

74 |

|

|

|

26 |

|

| S Gadd |

|

|

|

|

|

|

|

|

| Fiscal Year 2017 |

|

|

34 |

|

|

|

66 |

|

| Fiscal Year 2016 |

|

|

76 |

|

|

|

24 |

|

| J Blasko |

|

|

|

|

|

|

|

|

| Fiscal Year 2017 |

|

|

35 |

|

|

|

65 |

|

| Fiscal Year 2016 |

|

|

74 |

|

|

|

26 |

|

| 1 |

Awarded = % of STI Award maximum actually paid. Forfeited = % of STI Award maximum foregone. STI Award amounts are paid in cash under the CP and IP Plans. |

LTI Plans

Each year, the Remuneration Committee approves an LTI target

for all Senior Executive Officers. The approved target is allocated between three separate components to ensure that each Senior Executive Officer’s performance is assessed across factors considered important for sustainable long-term value

creation:

| ◾ |

ROCE RSUs are used as they are an indicator of high capital efficiency required over time; |

| ◾ |

Relative TSR RSUs are used as they are an indicator of our performance relative to our Peer Group; and |

| ◾ |

Scorecard LTI is an indicator of each Senior Executive Officer’s contribution to achieving our long-term strategic goals. |

Awards issued under the LTI Plans are issued pursuant to the terms of the LTIP. During fiscal year 2017, our Senior Executive Officers were granted the following awards

under the LTIP:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

ROCE RSUs

|

|

|

TSR RSUs

|

|

|

SCORECARD

LTI UNITS

|

|

| L Gries |

|

|

194,626 |

|

|

|

218,159 |

|

|

|

218,954 |

|

| M Marsh |

|

|

58,388

|

|

|

|

65,448

|

|

|

|

65,686

|

|

| M Fisher |

|

|

31,627 |

|

|

|

35,451 |

|

|

|

35,580 |

|

| S Gadd |

|

|

31,627

|

|

|

|

35,451

|

|

|

|

35,580

|

|

| J Blasko

|

|

|

21,895 |

|

|

|

24,543 |

|

|

|

24,632 |

|

RSUs issued under our LTI programs will be settled upon vesting in CUFS on a 1-to-1 basis. Unless the context indicates otherwise, in

this Remuneration Report when we refer to our common stock, we are referring to the shares of our common stock that are represented by CUFS.

ROCE RSUs (40% of target LTI)

The Remuneration Committee introduced ROCE RSUs in fiscal year 2013 because the US housing market had stabilised to an extent which permitted the setting of multi-year

financial metrics. The Remuneration Committee believes ROCE RSUs remain an appropriate component of the LTI Plan because they:

| ◾ |

tie the reward’s value to share price which provides alignment with shareholder interests; |

| ◾ |

promote that we earn appropriate returns on capital invested; |

| ◾ |

reward performance that is under management’s direct influence and control; and |

| ◾ |

focus management on capital efficiency as the necessary precondition for the creation of additional shareholder value. |

Consistent with fiscal years 2013 through 2016, the maximum payout for the ROCE RSUs is 200% of target LTI. ROCE is determined by dividing Adjusted EBIT by Adjusted

Capital Employed1. The ROCE hurdles will be indexed for changes to US and Asia Pacific addressable housing starts. The resulting Adjusted Capital Employed for each quarter of any fiscal year will

be averaged to better reflect Capital Employed through a year rather than at a certain point in time.

ROCE hurdles for the ROCE RSUs are based on historical results

and take into account the recovering US housing market and better optimisation of our manufacturing plants. The three-year average ROCE for fiscal years 2014, 2015 and 2016 was 27.6%.

The hurdles for ROCE RSUs granted in fiscal year 2017 (for performance in fiscal years 2017 to 2019) were changed from those granted in fiscal year 2016 as follows:

|

|

|

|

|

|

|

| FISCAL YEARS

2016-2018 ROCE

|

|

FISCAL YEARS

2017-2019 ROCE |

|

% OF ROCE

RSUs

GRANTED

TO

VEST |

|

| < 23.0% |

|

< 24.0% |

|

|

0% |

|

| > 23.0%, but < 25.0% |

|

> 24.0%, but < 26.0% |

|

|

25% |

|

| > 25.0%, but < 27.5% |

|

> 26.0%, but < 28.5% |

|

|

50% |

|

| > 27.5%, but < 28.5% |

|

> 28.5%, but < 29.5% |

|

|

75% |

|

| > 28.5%

|

|

> 29.5% |

|

|

100% |

|

At the conclusion of this three-year performance period, the Remuneration Committee will review management’s performance based on

the quality of the returns balanced against management’s delivery of market share growth and performance against the Scorecard. Following this review, the Remuneration Committee can exercise negative discretion to reduce the number of shares

received on vesting of the ROCE RSUs. This discretion can only be applied to reduce the number of shares which will vest.

| 1 |

For purposes of ROCE RSU vesting, “Adjusted EBIT” and “Adjusted Capital Employed” will be calculated as follows: “Adjusted EBIT” will be calculated as (i) EBIT as reported in our

financial results; adjusted by (ii) deducting the earnings impact of legacy issues (such as asbestos adjustments and New Zealand weathertightness); and (iii) adding back asset impairment charges in the relevant period, unless otherwise

determined by the Remuneration Committee. |

“Adjusted Capital Employed” will be calculated as Total Assets minus Current

Liabilities as reported in our financial results; adjusted by: (i) excluding balance sheet items related to legacy issues (such as asbestos adjustments), dividends payable and deferred taxes; (ii) adding back asset impairment charges in

the relevant period, unless otherwise determined by the Remuneration Committee; (iii) adding back leasehold assets for manufacturing facilities and other material leased assets; and (iv) deducting all greenfield construction-in-progress,

and any brownfield construction-in-progress projects involving capacity expansion that are individually greater than US$20 million, until such assets reach commercial production and are transferred to the fixed asset register.

9

JAMES HARDIE REMUNERATION REPORT

2017

REMUNERATION REPORT 2017 CONTINUED

ROCE RSUs Vesting in Fiscal Year 2017

(For Fiscal Years 2014-2016)

As a component of the fiscal year 2014

LTI Plan, we granted ROCE RSUs in September 2013. The ROCE RSUs comprised 40% of each Senior Executive Officer’s LTI target and were granted assuming maximum performance (200% of target). Vesting of the ROCE RSUs is dependent on the average

ROCE performance for fiscal years 2014-2016 and is subject to the Remuneration Committee’s negative discretion based on its judgment regarding the quality of returns balanced against management’s delivery of market share growth. The ROCE

performance hurdles for this grant were approved as follows:

|

|

|

|

|

| ROCE PERFORMANCE LEVEL |

|

% OF ROCE RSUs

GRANTED TO VEST |

|

| < 19.5% |

|

|

0% |

|

| ³

19.5%, but < 21.0% |

|

|

25% |

|

| ³

21.0%, but < 22.5% |

|

|

50% |

|

| ³

22.5%, but < 24.0% |

|

|

75% |

|

| ³ 24.0% |

|

|

100% |

|

Based solely on the average ROCE result for fiscal years 2014-2016 of 27.6%, 100% of the ROCE RSUs granted (or 200% of target) would have

vested. However, based on the Remuneration Committee’s assessment of the quality of returns balanced against management’s delivery of market share growth, the Remuneration Committee determined that it would apply negative discretion in the

amount of 35%. As such, 65% (or 130% of target) of the outstanding fiscal year 2014 ROCE RSUs vested on 16 September 2016. Unvested ROCE RSUs from this grant were forfeited.

ROCE RSUs Vesting for Fiscal Years 2015-2017

As a component of the

fiscal year 2015 LTI Plan, we granted ROCE RSUs in September 2014. The ROCE RSUs comprised 40% of each Senior Executive Officer’s LTI target and were granted assuming maximum performance (200% of target). Vesting of the ROCE RSUs is dependent

on the average ROCE performance for fiscal years 2015-2017 and is subject to the Remuneration Committee’s negative discretion based on its judgment regarding the quality of returns balanced against management’s delivery of market share

growth. The ROCE performance hurdles for this grant were approved as follows:

|

|

|

|

|

| ROCE PERFORMANCE LEVEL |

|

% OF ROCE RSUs

GRANTED TO VEST |

|

| < 22.0% |

|

|

0% |

|

| ³

22.0%, but < 24.5% |

|

|

25% |

|

| ³

24.5%, but < 27.0% |

|

|

50% |

|

| ³

27.0%, but < 28.5% |

|

|

75% |

|

| ³ 28.5% |

|

|

100% |

|

Based solely on the average ROCE result for fiscal years 2015-2017 of 29.9%, 100% of the ROCE RSUs granted (or 200% of target) would have

vested. However, based on the Remuneration Committee’s assessment of the quality of returns balanced against management’s delivery of market share growth, the Remuneration Committee determined that it would apply negative discretion in the

amount of 40%. As such, 60% (or 120% of target) of the outstanding fiscal year 2015 ROCE RSUs will vest on 16 September 2017. Unvested ROCE RSUs from this grant will be forfeited.

Relative TSR RSUs (30% of target LTI)

The Remuneration Committee believes that Relative TSR RSUs continue to be an appropriate component of the LTI Plan because they provide alignment with shareholders. Even

if macro-economic conditions create substantial shareholder value, Senior Executive Officers will only receive payouts if the TSR of our shares exceeds a specified percentage of our Peer Group over a performance period.

We have used Relative TSR RSUs in our LTI Plan since fiscal year 2009. Consistent with fiscal years 2013 through 2016, the maximum payout for Relative TSR RSUs granted in

fiscal year 2017 is 200% of target LTI.

Relative TSR measures changes in our share price and the share prices of our Peer Group; and assumes all dividends and

capital returns are reinvested when paid. For fiscal year 2017, our relative TSR performance will be measured against the Peer Group over a 36 to 54 month period from grant date, with testing at the 36th month, 48th month and at the end of the 54

month period. To eliminate the impact of short-term share price changes, the starting point and each test date are measured using a 20 trading-day average closing price. Relative TSR RSUs will vest based on the following straight-line schedule:

|

|

|

|

|

| PERFORMANCE AGAINST

PEER GROUP |

|

% OF RELATIVE TSR RSUs

GRANTED TO VEST |

|

| < 40th Percentile |

|

|

0% |

|

| 40th Percentile |

|

|

25% |

|

| > 40th, but < 60th Percentile |

|

|

Sliding Scale |

|

| 60th Percentile |

|

|

50% |

|

| > 60th, but < 80th Percentile |

|

|

Sliding Scale |

|

| ³ 80th Percentile |

|

|

100% |

|

For the fiscal year 2018 Relative TSR RSU component, the Remuneration Committee has determined that relative TSR performance will be

measured against the Peer Group over a 36 month period only. A complete description of the changes to our fiscal year 2018 LTI program is set out in the section titled “Changes to LTI Variable Compensation for Fiscal Year 2018” later in

this Remuneration Report. The Remuneration Committee will continue to monitor the design of the Relative TSR RSU component of the LTI Plan for Senior Executive Officers with the aim of balancing investor preferences with the ability to motivate and

retain Senior Executive Officers.

TSR RSUs Vesting in Fiscal Year 2017

As part of the fiscal year 2012 LTI Plan, in September 2011 we granted five year Relative TSR RSUs to senior executives. Vesting of these Relative TSR RSUs was dependent

on our TSR performance relative to a set peer group, based on the following schedule:

|

|

|

|

|

| PERFORMANCE AGAINST

PEER GROUP |

|

% OF RELATIVE TSR RSUs

GRANTED TO VEST |

|

| < 50th Percentile |

|

|

0% |

|

| 50th Percentile |

|

|

33% |

|

| ³

51st, but < 75th Percentile |

|

|

Sliding Scale |

|

| ³ 75th Percentile |

|

|

100% |

|

In September 2016, the final test of relative TSR performance was completed, resulting in our TSR performance at just over the 65th

percentile of the peer group. This brought the total vesting percentage for these grants over the five-year performance period to 74% of the Relative TSR RSUs granted (or 222% of target). The remaining unvested Relative TSR RSUs from this grant were

forfeited.

10

As part of the fiscal year 2013 LTI Plan, in September 2012 we granted five year Relative TSR RSUs to senior executives.

Vesting of these Relative TSR RSUs was dependent on our TSR performance relative to a set peer group, based on the following schedule:

|

|

|

|

|

| PERFORMANCE AGAINST

PEER GROUP |

|

% OF RELATIVE TSR RSUs

GRANTED TO VEST |

|

| < 40th Percentile |

|

|

0% |

|

| ³

40th, but < 60th Percentile |

|

|

Sliding Scale |

|

| 60th Percentile |

|

|

50% |

|

| > 60th, but < 80th Percentile |

|

|

Sliding Scale |

|

| ³ 80th Percentile |

|

|

100% |

|

In September 2016, the third test of relative TSR performance was completed, resulting in our TSR performance at just above the 83rd

percentile of the peer group. This brought the total vesting percentage for these grants to 100% of the Relative TSR RSUs granted (or 200% of target).

As part of

the fiscal year 2014 LTI Plan, in September 2013 we granted four and a half year Relative TSR RSUs to Senior Executive Officers. Vesting of these Relative TSR RSUs was dependent on our TSR performance relative to a set peer group, based on the

following schedule:

|

|

|

|

|

| PERFORMANCE AGAINST

PEER GROUP |

|

% OF RELATIVE TSR RSUs

GRANTED TO VEST |

|

| < 40th Percentile |

|

|

0% |

|

| 40th Percentile |

|

|

25% |

|

| > 40th, but < 60th Percentile |

|

|

Sliding Scale |

|

| 60th Percentile |

|

|

50% |

|

| > 60th, but < 80th Percentile |

|

|

Sliding Scale |

|

| ³ 80th Percentile |

|

|

100% |

|

In September 2016, the first test of relative TSR performance was completed, resulting in our TSR performance at just above the 91st

percentile of the peer group. As a result, 100% of the outstanding Relative TSR RSUs (or 200% of target) vested.

Scorecard LTI (30% of target LTI)

Scorecard LTI have been a component of our LTI Plan since fiscal year 2010. Each year, the Remuneration Committee approves a number of key management

objectives and the measures it expects to see achieved in relation to these objectives. These objectives are incorporated into that year’s grant of Scorecard LTI. At the end of the three-year performance period, the Remuneration Committee

assesses our Senior Executive Officers’ collective performance on each key objective and each individual Senior Executive Officer’s contribution to those achievements (with scores between 0 and 100) and the Board reviews this assessment.

Senior Executive Officers may receive different ratings depending on the contribution they have made during the three-year performance period. Although most of the objectives in the Scorecard have quantitative targets, we consider some of the

targets to be commercial-in-confidence. Consistent from fiscal year 2010, the maximum payout for Scorecard LTI is 300% of target LTI.

The Remuneration Committee believes that the Scorecard LTI continues to be an appropriate component of its LTI Plan because

it:

| ◾ |

allows the Remuneration Committee to set targets for and reward executives on a balance of longer-term financial, strategic, business, customer and organisational development goals which it believes are important

contributors to long-term creation of shareholder value; |

| ◾ |

ties the reward’s value to our share price over the medium-term; and |

| ◾ |

allows flexibility to apply rewards across different countries, while providing Senior Executive Officers with liquidity to pay tax or other material commitments at a time that coincides with vesting of shares (via the

other components of the LTI Plan) as payment is in cash. |

No specific weighting is applied to any single objective and the final Scorecard assessment

reflects an element of judgment by the Board. The Board may only exercise negative discretion (i.e., to reduce the amount of Scorecard LTI that will ultimately vest). It cannot enhance the maximum reward that can be received.

The amount received by Senior Executive Officers is based on both our share price performance over the three years from the grant date and the Senior Executive

Officer’s Scorecard rating. At the start of the three-year performance period, we calculate the number of shares each Senior Executive Officer could have acquired if they received a maximum payout on the Scorecard LTI at that time (based on a

20 trading-day average closing price). Depending on the Senior Executive Officer’s rating (between 0 and 100), between 0% and 100% of the Senior Executive Officer’s Scorecard LTI awards will vest at the end of the three-year performance

period. Each Senior Executive Officer will receive a cash payment based on our share price at the end of the period (based on a 20 trading-day average closing price) multiplied by the number of shares they could have acquired at the start of the

performance period, adjusted downward in accordance with their Scorecard rating.

Further details related to the Scorecard for fiscal year 2017, including the method

of measurement, historical performance against the proposed measures and the Board of Director’s expectations, were previously set out in our Remuneration Report for fiscal year 2016. An assessment of our Scorecard performance for fiscal years

2015-2017 is set out below. We will provide an explanation of the final assessment of performance under the Scorecard for fiscal years 2017-2019 at the conclusion of fiscal year 2019.

11

JAMES HARDIE REMUNERATION REPORT

2017

REMUNERATION REPORT 2017 CONTINUED

Scorecard LTI for Fiscal Years 2015-2017

After fiscal year 2017, the Remuneration Committee reviewed our performance over fiscal years 2015-2017 against the Scorecard objectives set forth in fiscal year 2015,

and the contribution of individual Senior Executive Officers towards the achievement of such objectives. As a result of this evaluation, the Remuneration Committee determined that Senior Executive Officers would receive a weighted average Scorecard

rating of 53.4% (with a range of 33% to 58%).

|

|

|

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE MEASURE/RATIONALE |

|

PERFORMANCE METRIC/RESULTS

|

|

|

BOARD ASSESSMENT FOR

THE

THREE-YEAR PERIOD |

|

|

|

| Grow exterior cladding market share and maintain category share in the US

business A key strategy for the Company is to maximise its market share

growth/ retention of the exterior cladding market for new housing starts and for repair & remodel markets. |

|

Goal: PDG above market.

Outperformance against ‘wood-look’ competition.

Result: PDG performance at the Board requirement. Growth above key competition and an increase in exterior cladding market share above the Board requirement.

|

|

|

Performance exceeded expectations |

|

|

|

| Build US organisational and leadership capability in support of the 35/90 growth

target The amount of growth that 35/90 entails requires lower turnover

levels and an increase in management depth and organisational capability. |

|

Goal: Satisfactory progress on turnover, engagement initiatives and programs to build

organisational capability demonstrated by greater bench strength of high performing managers.

Result: Increase in total turnover over the three year period, however have seen a positive trend on turnover for salaried employees. Some progress made on

developing bench strength, although additional recruiting, mentoring career development and leadership programs are required to further build bench strength and overall organisational capability.

|

|

|

Performance below expectations |

|

|

|

| Manufacturing effectiveness and sourcing efficiency

The Company operates a national US network of manufacturing facilities. |

|

Goal: Commercial-in-confidence metrics for product and process efficiency and material

yield used to confirm manufacturing performance and progress as well as service levels is effectively supporting our product leadership strategy.

Result: Product and process efficiency above Board expectations for the three year period and material yield slightly below Board expectations. Service levels

above Board expectations for two of three fiscal years, however this was offset by a drop off in service levels during fiscal year 2017 due to supply/ capacity constraints.

|

|

|

Performance met expectations |

|

|

|

| Safety

The safety of our employees is an essential objective of the Company. |

|

Goal: No fatalities, 2.0 or below incident rate (“IR”) and 20.0 or below severity rate (“SR”).

|

|

|

Performance met expectations |

| |

|

Result: |

|

IR |

|

|

SR |

|

|

|

|

|

FY2017 |

|

|

1.4 |

|

|

|

20.5 |

|

|

|

|

|

FY2016 |

|

|

1.8 |

|

|

|

42.4 |

|

|

|

|

|

FY2015 |

|

|

1.3 |

|

|

|

11.0 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

12

|

|

|

|

|

|

|

|

|

| PERFORMANCE MEASURE/RATIONALE

|

|

PERFORMANCE METRIC/RESULTS

|

|

BOARD ASSESSMENT FOR

THE

THREE-YEAR PERIOD |

|

|

|

| Maintain market position on core products in Australian and NZ Markets and grow Scyon

to greater proportion of Australian business Value creating

opportunity. |

|

Goal: Grow category share on core Australian and New Zealand products, grow PDG in

Australia and New Zealand, and achieve growth of Scyon as a percentage of the Australian business.

Result: APAC business has maintained and grown market position in Australia and NZ markets over the period driven by a new management focus on new products and

segments, and a substantial investment in management capability and marketing programs. Scyon grew as a percentage of the Australian business over the three-year period. |

|

Performance met expectations |

|

|

|

| Global capacity expansion

Expansion to support expected growth over the next 20 years. |

|

Goal: Completion of building construction, equipment installation and start up at

identified sites. Result: The Company expanded global nameplate capacity by ~20%

during the three year period. The Company added four brownfield sheet machines in North America and a new sheet machine and new finishing lines in Carole Park over the three year period. The Company’s returns will significantly benefit from

identification of brownfield capacity versus adding more expensive greenfield capacity. |

|

Performance met expectations |

|

|

|

| Strategic positioning

Developing sustainable growth beyond the Company’s traditional markets may

create shareholder value through increased profits and diversification for lower risk. |

|

Goal: This measure is subjective and achievement can take many different forms, including

developing new technologies, expanding into new product categories, or expanding geographically.

Result: Plans in place to move forward with additional product offerings which show great potential in terms of market acceptance and profitability. Additionally,

the Europe business grew volume and expanded market position during the period, including expanding into Germany. |

|

Performance exceeded expectations |

|

|

|

| Customer experience

Necessary to support the Company’s 35/90 strategy. |

|

Goal: Demonstrated improvement in the customer experience based on measures set in fiscal

year 2015. Result: Customer experience initiatives met expectations. The Customer

Experience team was disbanded and the initiatives distributed within operations. Operations has had success in continuing to execute on the customer experience strategy. |

|

Performance met expectations |

|

|

|

| Defend market share position against key wood-look competitor

Necessary to support the Company’s 35/90 strategy. |

|

Goal: Outgrow key wood-look competitors in specific markets in the aggregate measured on a

calendar year basis. Result: By the end of the three-year period, the Company

outgrew key wood-look competition in the relevant market. |

|

Performance met expectations |

|

|

|

| Trim market strategy implementation

Developing sustainable growth beyond the Company’s traditional

products. |

|

Goal: Commercial-in-confidence targets will be reviewed to confirm progress is supporting

the Company’s trim market strategy. Result: Some progress made. Performance

for the three-year period is above the prior three-year period. |

|

Performance met expectations |

13

JAMES HARDIE REMUNERATION REPORT

2017

REMUNERATION REPORT 2017 CONTINUED

CHANGES TO REMUNERATION FOR FISCAL YEAR 2018

Remuneration for Fiscal Year 2018

During May 2017, the Board, with the

assistance of the Remuneration Committee and its independent remuneration advisers, undertook its annual review of our existing remuneration policies, programs and arrangements and determined to implement certain changes for fiscal year 2018.

CEO Compensation

For fiscal year 2018, there will be no

changes to the CEO’s base salary, target STI or target LTI.

Other Senior Executive Officer Compensation

Base pay, and target LTI increases in fiscal year 2018 for other Senior Executive Officers, excluding Mr Fisher who resigned from James Hardie effective 3 April 2017

and did not receive any pay adjustments, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

BASE SALARY |

|

|

TARGET LTI |

|

| NAME |

|

FISCAL

YEAR 2017

(US$) |

|

|

FISCAL

YEAR 2018

(US$) |

|

|

FISCAL

YEAR 2017

(US$) |

|

|

FISCAL

YEAR 2018

(US$) |

|

| M Marsh |

|

|

560,000 |

|

|

|

600,000 |

|

|

|

1,200,000 |

|

|

|

No change |

|

| S Gadd |

|

|

408,000 |

|

|

|

500,000 |

|

|

|

650,000 |

|

|

|

800,000 |

|

| J Blasko |

|

|

405,000 |

|

|

|

425,000 |

|

|

|

450,000 |

|

|

|

500,000 |

|

There are no changes to target STI for other Senior Executive Officers for fiscal year 2018. The base salary increase for Mr Marsh was

made to continue to align his compensation package with our CEO succession plan and our need to retain key senior executives through the eventual CEO transition process. Base salary and LTI target increases for Mr Gadd were made to properly align

his overall compensation package with the increase in role scope and accountability that occurred for Mr Gadd during fiscal year 2017. The base salary increase for Mr Blasko was made in line with our annual compensation review guidelines and were

adjusted as required to maintain positioning relative to market merit increase levels. The small increase to Mr Blasko’s LTI target was made to better align his LTI target value with the 75th percentile of the market, consistent with our

remuneration philosophy.

STI Plans

There will be

no changes to the operation of the IP or CP Plans for fiscal year 2018 other than to establish new commercial-in-confidence targets aligned with our strategic initiatives as we do every year.

LTI Plan

The Remuneration Committee believes the three

components of the LTI Plan continue to (i) align management objectives with shareholder interests (Relative TSR RSU component), (ii) promote the appropriate internal management behaviours related to operating efficiency and the

profitability of JHIplc’s assets (ROCE RSU component), and (iii) emphasise strategic long-term priorities (Scorecard LTI component). As such, the fiscal year 2018 LTI Plan will continue to be comprised of these three components. However,

after careful consideration of strategic priorities, as well as investor feedback and LTI Plan design alternatives, the Remuneration Committee has made the following changes to the design of the LTI Plan for fiscal year 2018:

| ◾ |

shifted the allocation of LTI target amongst the three components of the LTI plan as follows: |

|

|

|

|

|

|

|

|

|

| LTI COMPONENT |

|

FY2017 |

|

|

FY2018 |

|

| ROCE RSUs |

|

|

40% |

|

|

|

25% |

|

| Relative TSR RSUs |

|

|

30% |

|

|

|

25% |

|

| Scorecard LTI |

|

|

30% |

|

|

|

50% |

|

| ◾ |

increased the ROCE performance hurdles; and |

| ◾ |

removed the re-testing feature from the Relative TSR RSU awards such that there is only one test of relative TSR performance on the third anniversary of the grant date and no re-tests. |

The Remuneration Committee made these changes to strike a balance of strategic and operational performance with financial and share price performance metrics within the

LTI Plan (re-allocation of the LTI target amongst the three components), reflect the Board’s requirement for improved ROCE, and address shareholder concerns (removal of the re-testing feature).

The Board and Remuneration Committee feel the LTI Plan for fiscal year 2018 will continue to have the desired effect of balancing the short-term focus of base salaries

and the STI program by tying equity-based rewards to performance achieved over multi-year periods and aligning equity incentives with long-term shareholder interests.

The 2017 Notice of AGM contains further details on the Relative TSR RSU and ROCE RSU grants for fiscal year 2018. Changes to ROCE performance hurdles and Scorecard

objectives for fiscal year 2018 are set forth below.

Changes to LTI Variable Compensation for Fiscal Year 2018

ROCE RSUs

To reflect the Board’s requirement

for improved and sustainable operational efficiencies, the Remuneration Committee increased the hurdles for fiscal year 2018 ROCE RSUs (for performance in fiscal years 2018 to 2020) from the hurdles for fiscal year 2017 ROCE RSUs, thereby making it

more difficult to achieve minimum, at target and maximum vesting:

|

|

|

|

|

|

|

| FISCAL YEARS

2018-2020 ROCE |

|

FISCAL YEARS

2017-2019 ROCE |

|

% OF ROCE RSUs

GRANTED TO VEST |

|

| < 25.0% |

|

< 24.0% |

|

|

0% |

|

| > 25.0%, but < 27.0% |

|

> 24.0%, but < 26.0% |

|

|

25% |

|

| > 27.0%, but < 29.5% |

|

> 26.0%, but < 28.5% |

|

|

50% |

|

| > 29.5%, but < 30.5% |

|

> 28.5%, but < 29.5% |

|

|

75% |

|

| > 30.5% |

|

> 29.5% |

|

|

100% |

|

Relative TSR RSUs

The Remuneration Committee has removed the re-testing feature such that relative TSR performance for fiscal year 2018 Relative TSR RSUs is tested once on the third

anniversary of the grant date. Any awards which do not vest based on this performance test will be forfeited.

14

Scorecard LTI

The Remuneration Committee has set the following six fiscal year 2018 Scorecard goals (for performance in fiscal years 2018 to 2020) to ensure alignment with our

strategic priorities:

|

|

|

|

|

|

|

|

|

| PERFORMANCE GOAL/RATIONALE |

|

PERFORMANCE METRIC |

|

BOARD EXPECTATION |

|

|

|

| Market Position: Growing market share in all our businesses and geographies.

A key strategy for the Company is to maximise market share of the exterior

cladding market for new housing starts and for repair & remodel markets in North America, while maintaining 90% category share. |

|

Our PDG performance for exterior cladding compared to the underlying market (in standard feet) and outperformance of key competition. |

|

PDG growth above market and outperformance against key competition. |

|

|

|

| People: Continue to invest in the development and promotion of our people.

The ability for the Company to realise its growth potential and deliver results

in line with shareholder expectations requires lower turnover, an increase in management depth, and greater organisational capability. |

|

A range of factors including the rate of salaried turnover, execution of programs to build organisational capability and bench strength for key roles, and succession

planning. |

|

Continued focus on turnover and engagement initiatives, success in external recruitment, onboarding of key positions and programs to build organisational capability, and development

of/successful execution on a management team succession plan. |

|

|

|

| Safety

The safety of our employees is an essential objective of the Company. |

|

Incident Rate (IR): Recordable incidents per 200,000 hours worked.

Severity Rate (SR): Days lost per 200,000 hours worked. |

|

Zero fatalities.

IR: 2.0 or below.

SR: 20.0 or below. |

|

|

|

| Deliver on Brand Promise: An unrivalled commitment to research and development;

maintaining our manufacturing cost advantage; delivering industry leading quality and service levels; investing in future manufacturing capability and capacity; utilising technology to better improve our customers’ experiences with us; and

ensuring we meet our financial returns objective. Adequate capacity, and

effective machine utilisation, product quality, and service are critical to delivering future growth and optimising returns through a more efficient manufacturing network. |

|

Completion of capacity projects on budget and schedule. First pass quality and service, as well

as sheet machine product and process efficiency metrics. Manufacturing performance data is

commercial-in-confidence. |

|

Commercial-in-confidence targets will be reviewed to confirm progress is supporting the Company’s product leadership strategy. |

|

|

|

| International: Pursue organic growth in all International markets. Value

creating opportunity. |

|

Category share and PDG.

Continued growth of Scyon and introduction and growth of new products in Asia Pacific. |

|

Grow category share on core Australian and New Zealand products.

Grow PDG in Australia and New Zealand.

Achieve growth in Scyon as well as the introduction of new products in Asia Pacific. |

|

|

|

| Non-fiber Cement Business Development: Develop other streams of growth

beyond fiber cement. Long-term growth of James Hardie in part requires growth

businesses beyond core fiber cement. |

|

This measure is subjective and achievement can take many different forms, including developing a vision or business development framework, new technologies, or expanding into

new product categories. |

|